Get the free 403(b)(7) Account Application and Agreement

Get, Create, Make and Sign 403b7 account application and

How to edit 403b7 account application and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 403b7 account application and

How to fill out 403b7 account application and

Who needs 403b7 account application and?

A Comprehensive Guide to 403b7 Account Application and Form

Understanding the 403b7 account

A 403b7 account is a specialized retirement savings plan designed for employees of tax-exempt organizations such as public schools, hospitals, and certain non-profit entities. This account allows eligible employees to defer portions of their salary into tax-advantaged investments, promoting long-term savings for retirement.

Unlike traditional 401(k) accounts, which are primarily for profit-driven companies, 403b7 accounts cater specifically to the needs of public sector employees. In contrast to Individual Retirement Accounts (IRAs), which have lower contribution limits, 403b7 accounts typically allow for larger deferrals, making them attractive for retirement savings.

Who should consider a 403b7 account?

Eligibility for a 403b7 account is primarily limited to employees of qualified tax-exempt organizations, often including teachers, healthcare workers, and nonprofit staff. These individuals can take advantage of the unique benefits offered by this retirement plan, which can result in significant growth of their retirement savings.

Furthermore, employees in these organizations often face unique retirement savings challenges, making the tax advantages and investment flexibility of a 403b7 account especially valuable. This account serves not just to encourage savings but also to facilitate a secure financial future.

Benefits of a 403b7 account

403b7 accounts offer various tax advantages for employees. Contributions made to these accounts are often pre-tax, allowing individuals to reduce their taxable income in the present while enabling their investments to grow tax-deferred until withdrawal in retirement. This feature is crucial as it can lead to compounding growth over the years, amplifying savings significantly.

The investment flexibility offered by a 403b7 account includes options like mutual funds and annuities, helping individuals align their investments with personal financial strategies. Unique features like loan provisions enable account holders to borrow against their retirement savings during emergencies, while hardship withdrawals provide an avenue for accessing funds during critical situations.

Preparing to apply for a 403b7 account

Before submitting a 403b7 account application, gather all necessary documentation, including identification and employment verification. Understanding the current IRS contribution limits and any available catch-up provisions is also key. As of now, the IRS allows contributions up to $20,500 annually for employees under 50, with higher limits for those age 50 and older.

Consider your investment preferences and future retirement goals. Evaluate whether you prefer higher-risk investments that may offer larger returns or more stable options for consistent growth. Take time to reflect on your financial landscape, as these decisions will shape the success of your retirement planning.

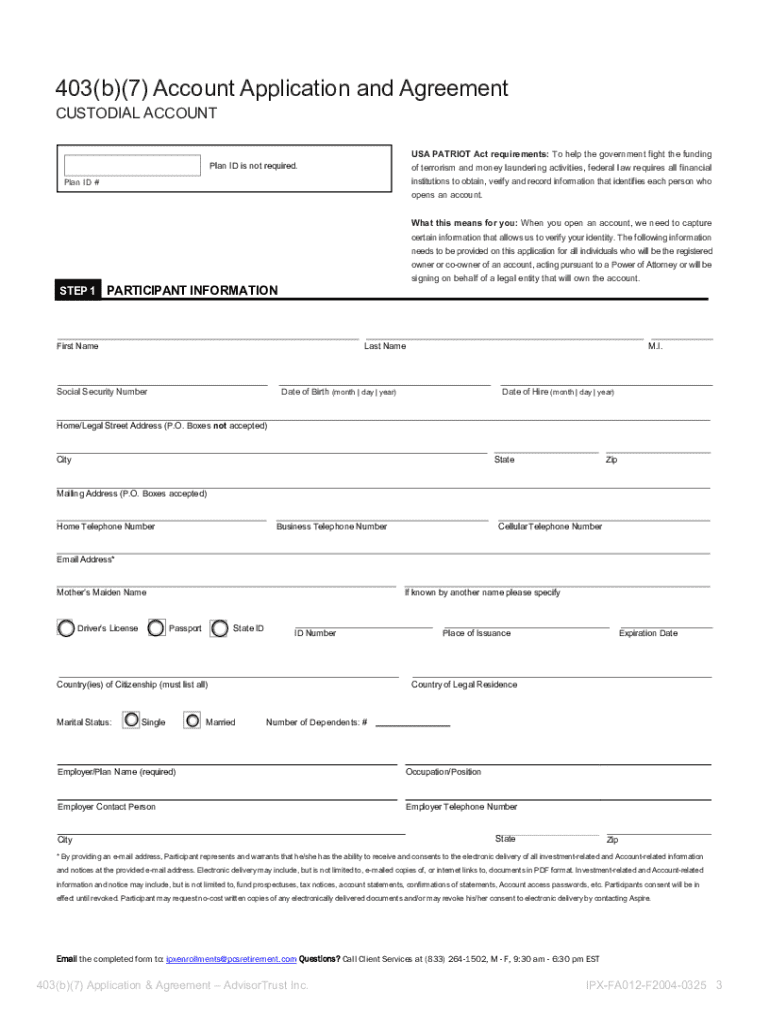

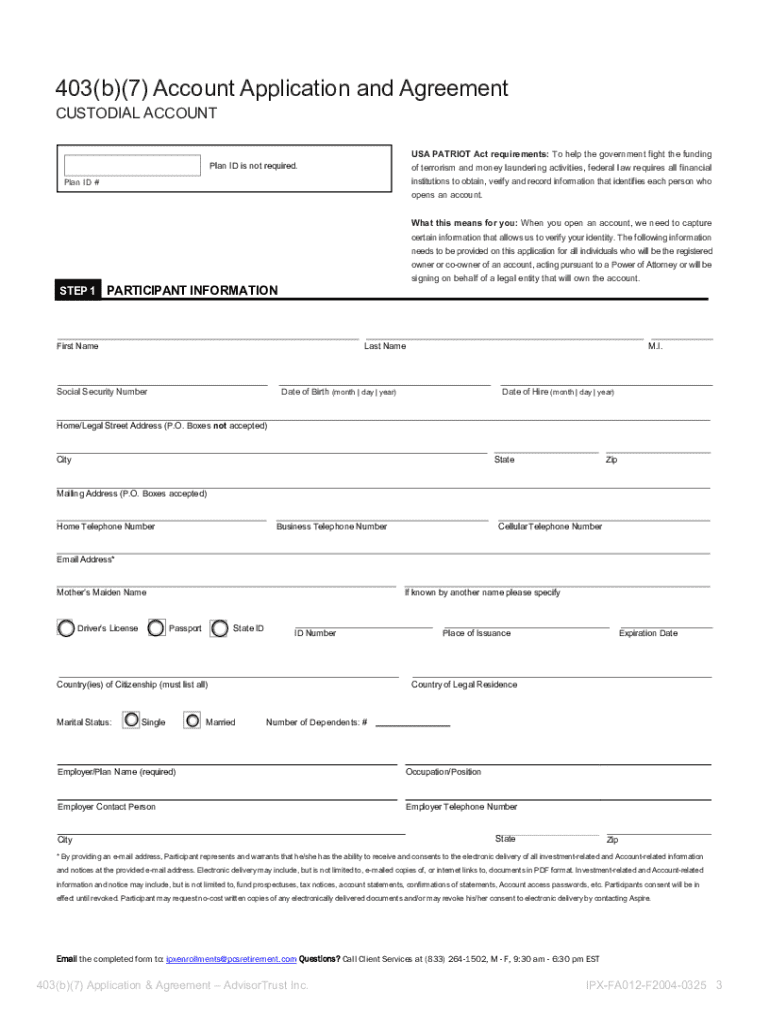

Step-by-step guide to complete the 403b7 account application form

Access the 403b7 application form on pdfFiller's website. You can choose between an online form or a downloadable paper application. Ensure you have all your details at hand to ease the form-filling process.

The application will usually contain several sections, including personal information, employment details, beneficiary designations, and investment preferences. Taking your time to fill out each section thoroughly will help prevent common mistakes and delays in processing.

Editing and customizing your application form

Using pdfFiller's tools allows you to effectively edit and customize your application form. Upload your incomplete application to the platform, where you can use various editing features to add custom fields or electronic signatures as necessary.

For teams applying collaboratively, pdfFiller also allows for inviting colleagues to review the application. This feature ensures that all necessary input is considered before submission while also maintaining a version history of changes made.

Finalizing your 403b7 account application

Once the application has been filled out, take time to review it for completeness and accuracy. Each detail matters, as inaccuracies can delay the processing of your application or even lead to rejection.

Understanding the terms and conditions associated with your new account is also essential. Different financial institutions may have varying terms for account maintenance, access, and investment options. After final review, submit your application via your chosen method, whether online or paper, and note the typical processing timelines.

Managing your 403b7 account post-application

Once your account is established, you can access it online through the portal provided by your financial institution. This platform typically features a user-friendly dashboard that allows for the effective management of your investments, tracking changes, contributions, and overall performance.

Monitoring your contributions regularly helps to ensure you are on track with your retirement goals. Should your financial situation change, pdfFiller simplifies the process of updating account information, such as beneficiary details and investment choices, ensuring your 403b7 account remains aligned with your changing needs.

Common questions about the 403b7 account

Many individuals considering a 403b7 account might wonder how it differs from a traditional 403b. The main difference is that a 403b7 account is specifically designed for certain investment types, such as mutual funds, while traditional 403b accounts often include both mutual funds and annuities.

Another common question is whether funds from other retirement accounts can be rolled over into a 403b7. Generally, yes; as long as the funds originate from another qualified retirement account or 403b plan. Transitioning accounts smoothly is crucial for maintaining retirement savings integrity.

Using interactive tools for 403b7 management

pdfFiller provides a variety of interactive tools designed to streamline document management throughout the 403b7 application process. From editing capabilities to enabling collaborative input from team members, these features enhance the effectiveness of your application and promote accuracy.

Additional resources for effective retirement planning, including calculators and budget planners may be available. Being able to combine document creation with comprehensive planning tools fosters a more holistic approach towards financial readiness.

Contacting support for 403b7 account inquiry

For any queries regarding your application process or account management, pdfFiller offers customer service options to assist you. Whether through phone, email, or live chat, support is readily available to address your concerns and provide guidance.

It's crucial to keep essential contact information handy for prompt assistance, especially during urgent inquiries. Maintaining clear communication channels will lead to a smoother experience while navigating the complexities surrounding your 403b7 account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 403b7 account application and online?

How do I edit 403b7 account application and in Chrome?

How do I edit 403b7 account application and on an Android device?

What is 403b7 account application?

Who is required to file 403b7 account application?

How to fill out 403b7 account application?

What is the purpose of 403b7 account application?

What information must be reported on 403b7 account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.