Get the free Credit Card Usage Request

Get, Create, Make and Sign credit card usage request

Editing credit card usage request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card usage request

How to fill out credit card usage request

Who needs credit card usage request?

Understanding the Credit Card Usage Request Form: A Complete Guide

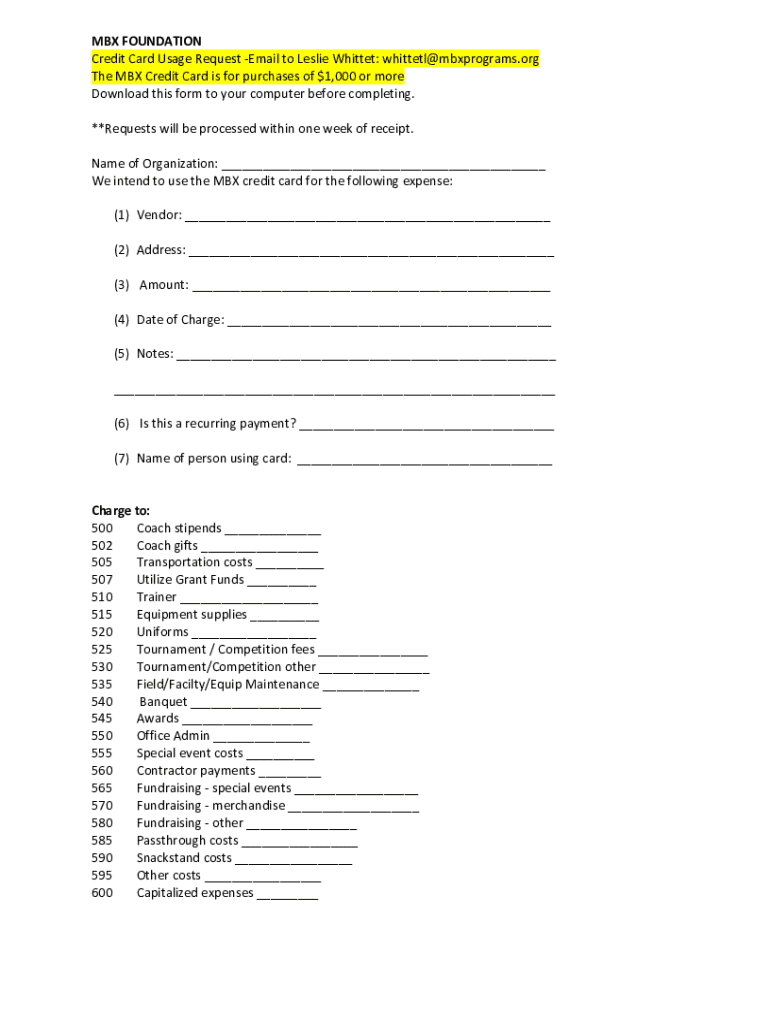

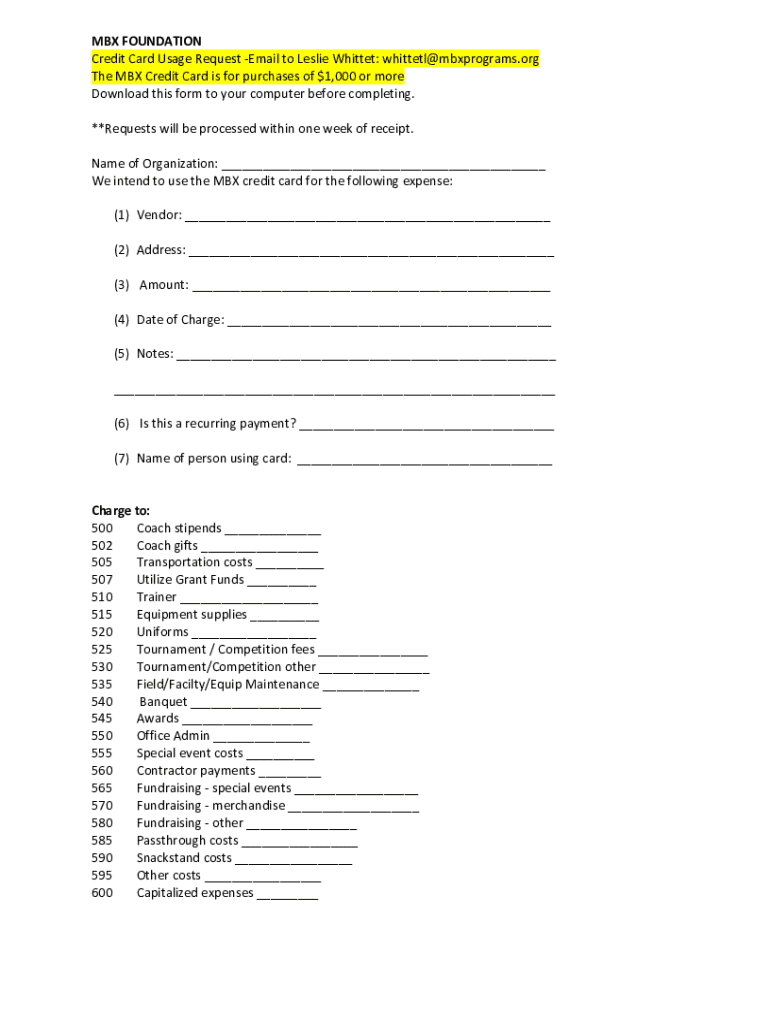

Overview of credit card usage

Credit cards are essential tools for both personal and business transactions. Many organizations adopt a standardized credit card usage request form to manage spending effectively and maintain accountability. These forms are critical in documenting requests for credit card usage, especially in scenarios that involve high-value transactions or expenditures that need oversight.

Common situations requiring these forms include travel expenses, procurement of supplies, and client-related expenses. Using a standardized form simplifies the payment process and ensures that all necessary information is collected uniformly, making it easier to track and manage.

What is a credit card usage request form?

A credit card usage request form is a document that facilitates the authorization of expenditures charged to a company credit card. Its main purpose is to provide a clear, structured way for employees to request permission to make purchases using company funds. This form not only streamlines the request process but also serves as a record of all credit card transactions.

Key components of the form typically include:

Advantages of using a credit card usage request form

Utilizing a credit card usage request form offers numerous advantages that can significantly enhance financial management within organizations. Security is paramount; these forms help to verify that purchases are legitimate and authorized, thus reducing the risk of fraudulent transactions.

Moreover, they help maintain compliance with PCI standards, which necessitate careful handling of credit card information. This compliance not only protects the organization from potential data breaches but also instills confidence among clients and vendors regarding the safety of their transactions.

How to complete a credit card usage request form

Completing a credit card usage request form accurately is crucial. Here’s a step-by-step guide to effectively filling out the form:

Best practices for managing credit card usage request forms

Managing credit card usage request forms effectively is essential for compliance and financial integrity. Organizations should establish clear sample storage procedures that align with legal and industry regulations. This includes retaining copies of all submitted forms in a secure digital format to make tracking easier and to facilitate audits.

Regular reviews and updates of these forms ensure they remain relevant and compliant with current banking regulations and organizational policies. It’s also crucial that sensitive information is retrieved and handled securely to prevent data breaches.

Common mistakes to avoid

Completing a credit card usage request form is straightforward, but there are common pitfalls to avoid. One frequent mistake is failing to include all required information, which can lead to delays in processing the request. Ensure that all sections are filled out, and that the authorization statement is signed properly.

Misunderstanding transaction limits is another issue—knowing the allowable spending limits set by your organization is critical. Additionally, keeping updated records of submitted forms helps prevent confusion over whether a request has already been approved or processed.

Frequently asked questions (FAQs)

Understanding the intricacies of the credit card usage request form can lead to a variety of questions. Here are some commonly asked queries:

Interactive tools and templates from pdfFiller

pdfFiller provides users with a comprehensive platform for managing credit card usage request forms. From downloadable templates to customizable options, users can easily tailor forms to suit their organizational needs.

Additionally, pdfFiller offers tools for electronic signatures and real-time collaborations, ensuring that the process from request to approval is seamless and efficient.

Protecting against fraud with credit card usage request forms

Fraud prevention should always be a priority when dealing with credit card expenditures. Establishing procedures to identify potential fraud risks, such as reviewing unusual transaction patterns, can significantly enhance security measures.

To further protect against fraud, organizations can utilize smart forms that incorporate features aimed at verifying the identity of the cardholder and reducing errors in data entry. It’s equally important to conduct regular employee training on fraud awareness to know the signs and how to act in the event of suspected fraudulent activity.

Real-world application of credit card usage request forms

In practical settings, the implementation of credit card usage request forms can lead to notable improvements in expense management. For instance, a small business using these forms found that they could track spending more effectively and prevent unauthorized purchases.

Feedback from users highlights that using a structured process for request approvals reduced the time spent on managing finances and improved accountability among employees. Adapting forms for different business needs and scenarios allows for flexibility and efficiency in financial operations.

Related topics and further readings

Deepening your understanding of credit card management can also include exploring related topics such as:

Conclusion: Streamlining your payment processes with pdfFiller

The credit card usage request form is an invaluable tool for any organization looking to maintain financial integrity and enhance operational efficiency. Leveraging pdfFiller's robust document management features, users can manage these forms with ease, ensuring compliance and security.

Exploring the many tools and features offered by pdfFiller can further streamline processes, reduce operational friction, and foster a collaborative environment where document management is simplified.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card usage request online?

Can I create an eSignature for the credit card usage request in Gmail?

Can I edit credit card usage request on an Android device?

What is credit card usage request?

Who is required to file credit card usage request?

How to fill out credit card usage request?

What is the purpose of credit card usage request?

What information must be reported on credit card usage request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.