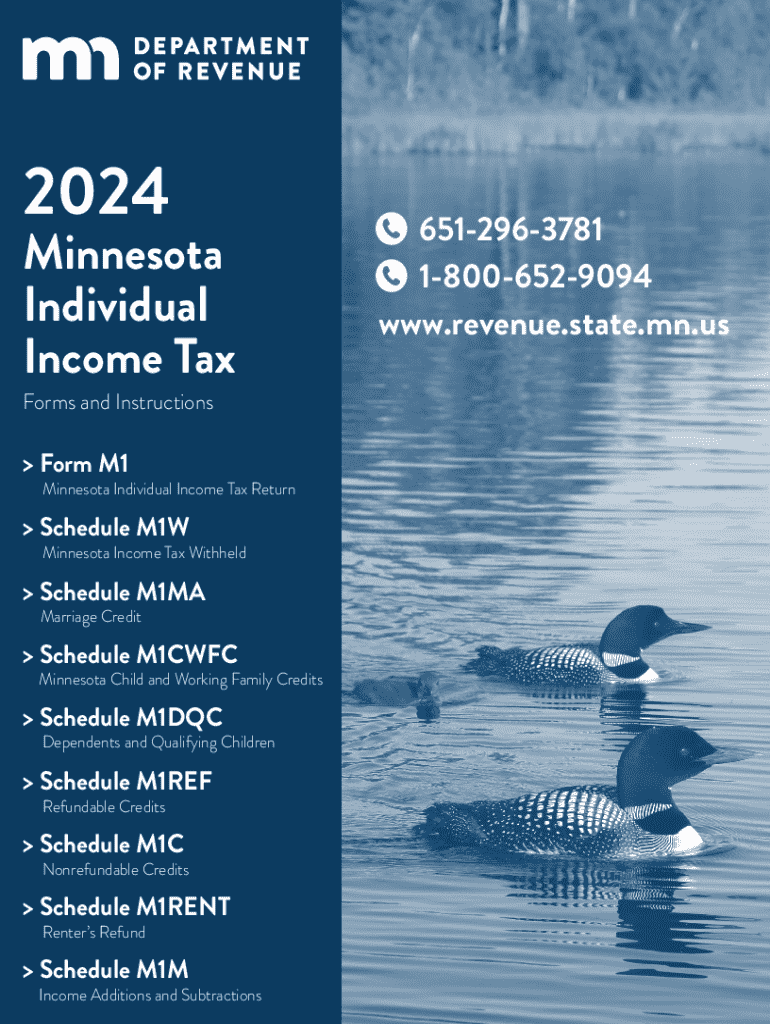

MN Individual Income Tax Forms and Instructions 2024-2026 free printable template

Get, Create, Make and Sign MN Individual Income Tax Forms and

Editing MN Individual Income Tax Forms and online

Uncompromising security for your PDF editing and eSignature needs

MN Individual Income Tax Forms and Instructions Form Versions

How to fill out MN Individual Income Tax Forms and

How to fill out 2024 minnesota individual income

Who needs 2024 minnesota individual income?

A Complete Guide to the 2024 Minnesota Individual Income Form

Overview of the 2024 Minnesota Individual Income Form

The Minnesota Individual Income Form, also known as Form M1, is the official document used by residents of Minnesota to report their income and calculate their state tax obligation for the year. Filing this form ensures compliance with state regulations and helps you maintain your eligibility for potential tax credits and refunds.

Filing the 2024 Minnesota Individual Income Form is particularly important as it reflects changes in income, tax credits, and deductions that may have occurred in the previous year. The form's accurate completion directly influences any tax refund or balance owed to the state.

For the 2024 tax year, several key updates have been introduced. These include increased income thresholds for tax brackets, adjustments to deductions, and additional credits aimed at supporting low-income households. Keeping abreast of these updates is essential for accurate filing.

Eligibility for Filing the Minnesota Individual Income Form

Not every resident is required to file Form M1. Individuals need to consider their income levels and specific circumstances before proceeding. Primarily, residents who have a gross income exceeding the minimum filing thresholds set by the Minnesota Department of Revenue are obligated to file.

In certain situations, special exemptions apply. For instance, part-year residents need to file based only on the income earned while residing in Minnesota. Additionally, dependents can also file Form M1 if they have sufficient earned income, which may offer them a refund opportunity or fulfill personal tax obligations.

Gathering necessary documents

To accurately fill out the 2024 Minnesota Individual Income Form, you will need various documents submitted to prove your income and support your deductions. The primary documents include.

Organizing these documents systematically can streamline the process and enhance accuracy, preventing delays in filing or potential errors in information.

Step-by-step instructions for completing the form

Completing the Minnesota Individual Income Form can be manageable when approached methodically. Here’s a breakdown of the sections.

Following this structured approach will help ensure thoroughness and accuracy while completing your tax form.

Filing methods for the 2024 Minnesota Individual Income Form

There are multiple avenues for submitting your completed Form M1, providing flexibility based on your preferences.

Be mindful of filing deadlines to avoid any penalties or missed opportunities for refunds.

Common mistakes to avoid when filing

Even seasoned taxpayers can overlook common errors on Form M1, which can lead to tax liability issues or delays in refunds. Common mistakes include incorrectly recording income amounts, failing to include all necessary forms, or miscalculating deductions.

To enhance the accuracy of your filing, integrate these tips:

Taking the time to review your form can significantly reduce the chance of errors, making the filing process smoother.

After filing: what to expect

Once Form M1 has been submitted, it’s natural to wonder what happens next. You can check the status of your Minnesota tax return online through the Minnesota Department of Revenue’s website. Most refunds are processed within a few weeks if filed electronically, but delays may occur during peak filing periods.

Should you receive any notices or correspondence from the Minnesota Department of Revenue, it’s crucial to respond promptly to avoid penalties or further complications regarding your tax situation.

Additional considerations

As you prepare your taxes, consider how federal and state tax changes for 2024 may impact your filing process. Familiarize yourself with new legislation that could affect taxable income or available credits, especially concerning healthcare or investment revenue.

If you anticipate owing taxes throughout the year, remember to review estimated payments to avoid underpayment penalties. The Minnesota Department of Revenue provides guidelines on how to calculate and make these payments effectively.

Interactive tools and resources

pdfFiller offers an array of interactive tools designed to simplify the process of filling out and managing your tax forms. Access templates and guidance within the platform to streamline your experience.

Frequently asked questions (FAQ)

As taxpayers navigate the complexities of the 2024 Minnesota Individual Income Form, several common queries arise. Understanding these frequently asked questions can provide clarity as you prepare your taxes.

Why choose pdfFiller for your tax filing needs?

pdfFiller’s cloud-based platform affords users streamlined functionality for managing tax forms, including Form M1. The platform empowers users to edit PDFs, eSign documents, and collaborate seamlessly from anywhere, making it easier to handle tax paperwork.

Customer testimonials highlight the convenience of pdfFiller for tax filing, emphasizing the platform's efficiency in saving time and minimizing the complexity typically associated with tax seasons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MN Individual Income Tax Forms and in Gmail?

How do I edit MN Individual Income Tax Forms and on an iOS device?

How do I complete MN Individual Income Tax Forms and on an iOS device?

What is 2024 minnesota individual income?

Who is required to file 2024 minnesota individual income?

How to fill out 2024 minnesota individual income?

What is the purpose of 2024 minnesota individual income?

What information must be reported on 2024 minnesota individual income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.