Get the free Apply for RS Credit Account Form

Get, Create, Make and Sign apply for rs credit

How to edit apply for rs credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out apply for rs credit

How to fill out apply for rs credit

Who needs apply for rs credit?

Apply for RS Credit Form: Your Comprehensive Guide

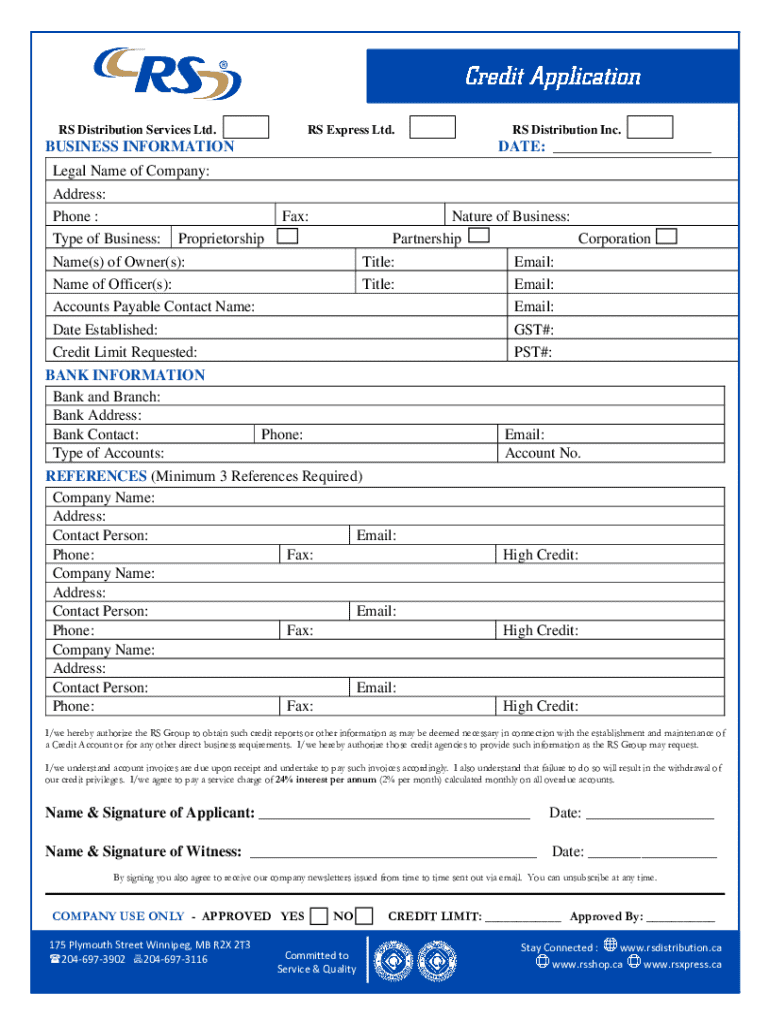

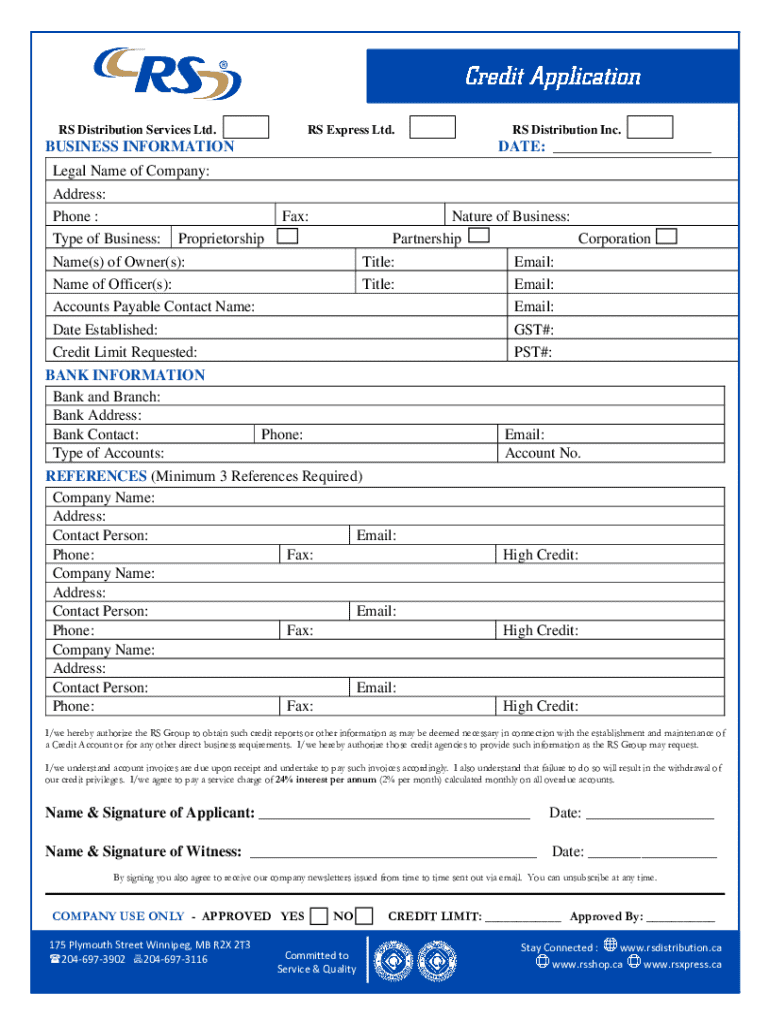

Understanding the RS Credit Form

An RS Credit Form is integral for individuals looking to establish a line of credit through RS Credit Accounts. These accounts offer various benefits, such as flexible repayment options, competitive interest rates, and the ability to build credit over time. Anyone over the age of 18 with a stable financial background can apply for the RS Credit Form, making it accessible to a wide range of applicants.

The importance of the RS Credit Form cannot be overstated. By filling out and submitting this form, you gain access to additional financial resources that can aid in personal projects, emergencies, or larger purchases. Moreover, timely payments on the resultant account can positively impact your credit score, enhancing your overall financial standing and future borrowing potential.

Preparing to apply for the RS Credit Form

Preparation is key when applying for the RS Credit Form. Before you start, gather essential documents like identification, proof of income, and bank statements. A complete list includes your social security number, a valid government-issued ID, recent pay stubs, and tax returns. Organizing these documents beforehand will help streamline the application process, ensuring that you’re not scrambling for information at the last minute.

Understanding eligibility criteria is crucial as well. Generally, you must have a minimum income threshold, a stable employment record, and a reasonable credit history. Common pitfalls include applying with outdated financial statements or incomplete information, which can lead to delays or denials.

Step-by-step guide to completing the RS Credit Form

Accessing the RS Credit Form on pdfFiller is straightforward. You can find the form easily by searching for 'RS Credit Form' on the pdfFiller platform or visiting their templates section. The interactive tools available allow you to fill out the form electronically, making the process more efficient and user-friendly.

Filling out the RS Credit Form involves several critical sections. Start with personal information, where you'll provide your name, address, and contact information. Next, include financial information such as your annual income and existing debts, and finally, list your employment details to verify your job stability. It’s wise to double-check each section for accuracy, as mistakes can delay the approval process.

Once your form is complete, utilize pdfFiller's editing tools to review content. Check for typographical errors and ensure all required fields are filled. This attention to detail can prevent unnecessary complications.

Signing and submitting the RS Credit Form

After finalizing your RS Credit Form, the next step is to sign it electronically. On pdfFiller, this process is simple. Navigate to the signature field and follow the prompts to eSign your document. The platform ensures stringent security measures to protect your signature, including verification steps to confirm your identity.

Submission of the RS Credit Form can be done through online methods, such as direct upload to the lender’s portal, or by email. Always take note of any confirmation messages to ensure your application has been successfully received. Following up after submission is essential; tracking your application status allows you to stay informed and address any issues proactively.

Managing your application

Once you’ve submitted the RS Credit Form, staying informed about your application status is vital. pdfFiller provides tools that allow you to check your application’s progress. Typically, you can expect feedback on your application within a couple of weeks, but be aware that peak seasons could cause delays.

Common questions that applicants have typically include inquiries about approval timelines or what to do if additional documentation is requested. For any specific concerns or if you encounter issues, pdfFiller has customer support readily available to assist you.

Additional information and services

Beyond the RS Credit Form, pdfFiller offers various related forms and templates that assist users in managing their financial documentation. These could include loan applications, credit agreements, and more, often customized to meet specific needs. Exploring these options can equip you with additional resources that complement your credit journey.

It’s crucial to be aware of the legal considerations surrounding RS Credit Accounts. When applying, ensure that you protect your personal information and are familiar with any terms and conditions that apply. Clear understanding helps avoid surprises later on, particularly regarding fees or obligations.

Community and engagement

Success stories from individuals who have successfully applied for the RS Credit Form highlight the effectiveness of using pdfFiller. Many users share how easy it was to navigate the platform, complete their forms accurately, and receive fast approvals. These testimonials serve as valuable insight into the user experience and emphasize the reliability of pdfFiller.

Encouraging community feedback can also illuminate areas of improvement. Sharing your journey not only contributes to the community but also helps pdfFiller enhance their services to better meet user needs.

Conclusion of the application process

After applying for the RS Credit Form, understanding your next steps is vital. You may receive a request for additional documentation or be called for an interview. Being prepared for these scenarios can set you apart as a well-organized and committed applicant.

Once you’ve been approved, the focus shifts to managing your newly opened credit account effectively. Implementing strategies like making payments on time and keeping your credit utilization low can foster financial health. Resources for financial literacy can also provide guidance as you manage your credit relationship.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the apply for rs credit in Chrome?

How can I edit apply for rs credit on a smartphone?

How do I edit apply for rs credit on an iOS device?

What is apply for rs credit?

Who is required to file apply for rs credit?

How to fill out apply for rs credit?

What is the purpose of apply for rs credit?

What information must be reported on apply for rs credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.