Get the free Personal Online Banking Application / Maintenance Request

Get, Create, Make and Sign personal online banking application

Editing personal online banking application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal online banking application

How to fill out personal online banking application

Who needs personal online banking application?

A Comprehensive Guide to the Personal Online Banking Application Form

Understanding personal online banking

Personal online banking refers to the digital means of managing your bank accounts via the internet. It allows users to access their bank accounts and perform various transactions using their computers or mobile devices. This service has completely transformed how we interact with our finances, offering an efficient and convenient alternative to traditional banking.

With a personal online banking application, users can carry out a variety of functions such as checking account balances, transferring funds, and paying bills, all from the comfort of their homes. Major benefits of this service include 24/7 accessibility, enhanced security measures, and a streamlined banking experience.

Getting started with personal online banking

Before you can enjoy the features of personal online banking, it's essential to understand the eligibility criteria associated with these services. Generally, any individual aged 18 or over with a valid identification can apply. However, it's important to check with your specific bank as requirements may vary.

To initiate the application process, various documents will be needed. At a minimum, you typically need a government-issued ID, such as a passport or driver’s license, and some financial information, including a Social Security number and income details, is usually required.

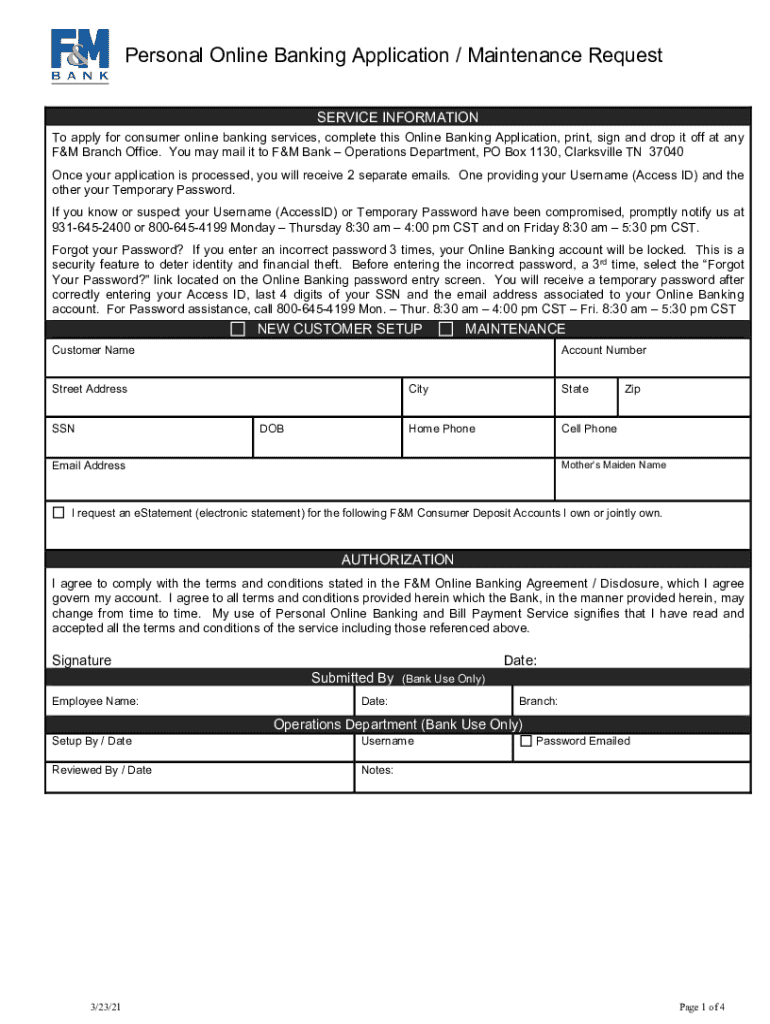

Step-by-step guide to filling out the personal online banking application form

To reap the benefits of personal online banking, starting with the application form is crucial. Begin by navigating to your bank's website where the online application is located. Ensure that you’re using a supported and up-to-date browser, and ideally a mobile-friendly device if you prefer applying on the go.

Once you locate the application form, filling it out correctly is imperative. The form generally comprises sections for personal information, financial details, and security setup.

Detailed instructions for completing each section

In the personal information section, enter your full name, address, and contact details. Accuracy is vital, as any discrepancy could delay processing or lead to complications in accessing your account.

Moving to the financial information section, provide insights into your income sources and amounts, as well as any preferences regarding your accounts. Being transparent in this area helps banks tailor services to your needs.

In the security information section, choose a strong password and set up security questions that are difficult for others to guess. This layer of security is essential to protect your financial information.

Finally, review your application form thoroughly before submission to ensure all details are correct. Once satisfied, follow the submission process, which can usually be done with just a click.

Features of personal online banking applications

After your application is approved, personal online banking applications unlock numerous features. You will be able to manage your accounts, monitor balances, pay bills, and transfer funds easily. These applications are designed to make your banking experience as seamless as possible.

Moreover, many of these applications come equipped with innovative tools such as budgeting planners and financial management resources. These tools can help you keep track of your expenses and savings effectively.

Managing your personal online banking account

Accessing your personal online banking account is straightforward. Logging in typically requires your username and password. Following this, you’ll be directed to a user-friendly dashboard that helps streamline navigation through various features.

Making transactions follows a similar casual approach. Whether transferring money between your accounts or paying bills, the process is made intuitive. If you ever run into trouble, common issues like forgetting your password or being locked out of your account are usually rectified quickly with the guidance of customer support.

Frequently asked questions about personal online banking

When it comes to applying for personal online banking, many questions arise. A common one is whether you need to be an existing customer to apply online. While some banks allow anyone to apply, others may require you to hold a pre-existing account with them.

Another frequent inquiry pertains to the security measures in place. Banks generally implement a range of security protocols such as encryption, firewalls, and continuous monitoring of your transactions for any suspicious activity. If you notice anything odd, reporting this promptly can help safeguard your account.

Important information to keep in mind

As you embark on utilizing personal online banking, be aware of the fees associated with different services. Many online banks provide fee-free banking, but others may charge for statements, overdrafts, or wire transfers. Knowing these fees upfront can help you avoid unnecessary charges.

Also, banks often update their online banking policies. It's crucial to keep an eye out for these updates and review any changes that may affect how you manage your accounts and transactions.

Conclusion: Empowering your banking experience

Choosing pdfFiller for your online banking forms provides a user-friendly interface that streamlines the process of form editing and completion. With cloud-based access, you can manage your documents anytime, anywhere—a crucial feature for those navigating their personal online banking applications.

Embracing personal online banking is more than just a trend; it is the future of banking. As technology advances, taking advantage of these digital services will enable you to handle your finances efficiently and conveniently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in personal online banking application without leaving Chrome?

Can I create an electronic signature for signing my personal online banking application in Gmail?

How do I fill out the personal online banking application form on my smartphone?

What is personal online banking application?

Who is required to file personal online banking application?

How to fill out personal online banking application?

What is the purpose of personal online banking application?

What information must be reported on personal online banking application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.