Get the free Mobile Banking Application Form

Get, Create, Make and Sign mobile banking application form

Editing mobile banking application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mobile banking application form

How to fill out mobile banking application form

Who needs mobile banking application form?

Your Comprehensive Guide to the Mobile Banking Application Form

Understanding the mobile banking application form

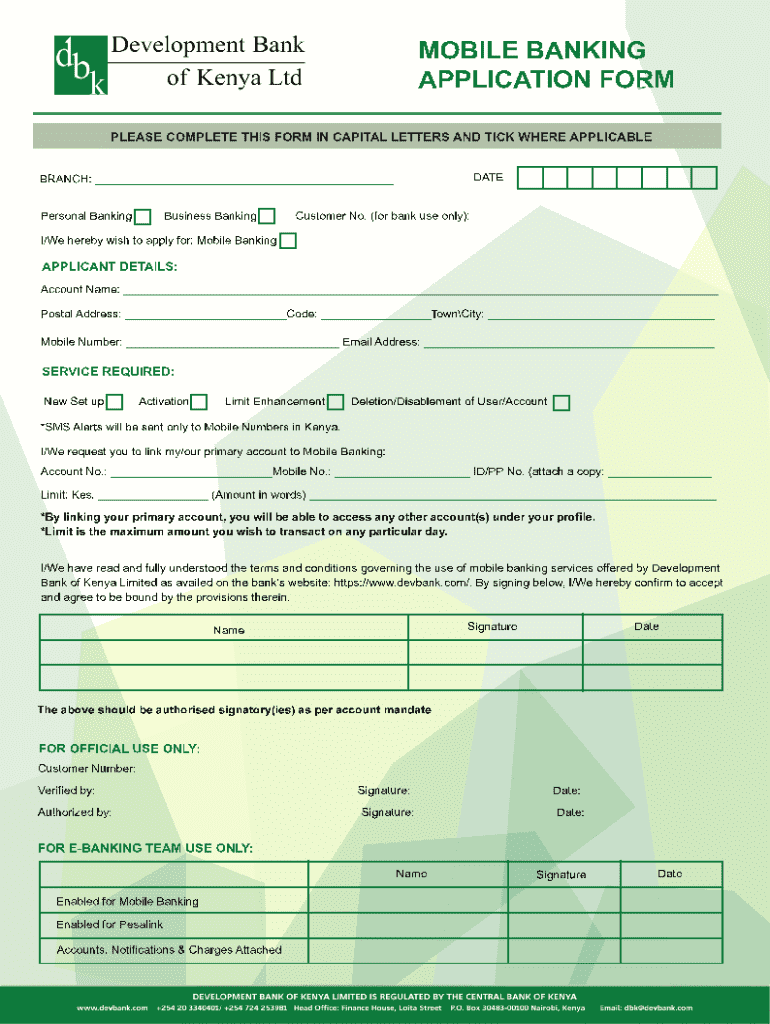

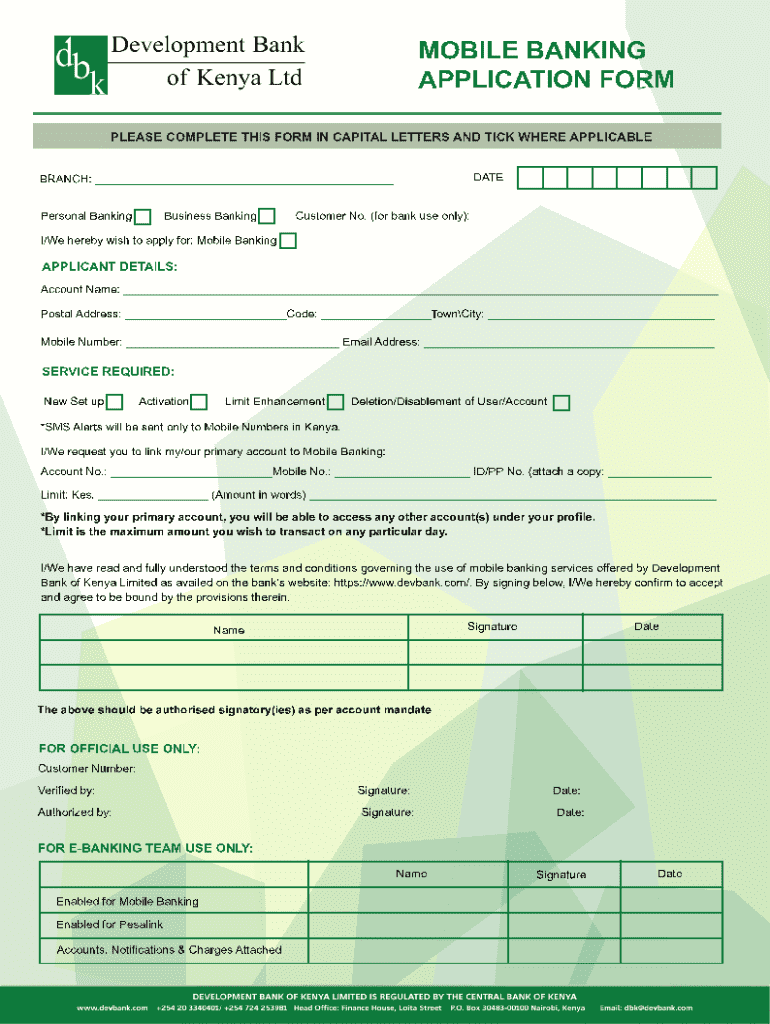

A mobile banking application form is a crucial document that allows individuals to apply for banking services through their mobile devices. Its primary purpose is to collect essential information about the applicant to facilitate account creation, enabling users to access a range of banking services online, from checking balances to transferring funds. With the rapid growth of digital transactions, the mobile banking application form plays an essential role, providing a seamless entry point into the banking world.

The importance of mobile banking in today's digital economy cannot be overstated. As more consumers prefer the convenience of handling their finances on-the-go, mobile banking has evolved to meet these needs. It offers users the ability to manage their finances without visiting a physical bank, significantly enhancing financial accessibility and personal empowerment.

Benefits of using a mobile banking application

Utilizing a mobile banking application can significantly enhance your banking experience. Here are some of the key benefits:

Key components of the mobile banking application form

When filling out a mobile banking application form, you'll be required to provide various pieces of information. Understanding these components is key to completing your application successfully.

Personal information section

This section typically requires you to provide your name, address, and contact information. Accuracy is vital here, as incorrect details can lead to delays or issues in account setup.

Identification and verification documentation

Most banks will require a government-issued ID and proof of address, such as a utility bill. Make sure to have these documents ready, and double-check them against bank requirements to avoid complications.

Financial information section

You'll need to disclose details about your income and employment status. If you're a new client, previous banking history may also be requested to assess your financial background.

Account preferences

This includes selecting the type of accounts you wish to open, whether checking, savings, or others. When choosing, consider your banking needs and the features each type of account offers.

Step-by-step guide to filling out the mobile banking application form

Filling out your mobile banking application form can be straightforward if you follow these steps:

Step 1: Accessing the application form

Begin by navigating to pdfFiller, where you can find the mobile banking application form. Look for the specific templates provided by your bank to ensure you're using the correct form.

Step 2: Completing the personal information section

Carefully fill out the personal details section. Avoid common pitfalls such as typos or outdated addresses as these mistakes could delay your application's processing.

Step 3: Uploading required identification

Using pdfFiller's tools, scan and upload your identification documents. Remember to check the bank's specific requirements for acceptable file formats and size limits.

Step 4: Providing financial information

When detailing your financial information, be transparent and accurate about your income. This not only builds trust but also aids in the approval process.

Step 5: Revising and editing the form

Utilize pdfFiller’s editing tools to review your application for errors. A thorough revision before submission can save time and ensure accuracy.

Step 6: Signing the application form

You can legally sign your application electronically using pdfFiller. Understand the legal implications of eSigning, which is equivalent to signing a physical document.

Step 7: Submitting the form

Once you've completed all sections of the form, you can submit your application straightforwardly through pdfFiller. Be sure to monitor the status of your application for updates.

Frequently asked questions about mobile banking application forms

Having questions during this process is normal, and several common inquiries frequently arise:

Managing your mobile banking account post-application

Once your application is approved, you can begin managing your mobile banking account effectively. Follow these steps for a smooth experience:

Accessing your mobile banking account

To set up online access, follow the bank's instructions for creating a profile. Ensure your password is unique and regularly updated for security purposes.

Common features and services offered

Mobile banking allows you to check account balances, make transfers, pay bills, and even deposit checks through your mobile device. Familiarize yourself with these features to maximize your banking experience.

Security considerations for mobile banking users

With the convenience of mobile banking comes the responsibility of keeping your information secure. Here are best practices to follow:

If you suspect any unauthorized activity, it's crucial to report it immediately to your bank's customer support team for prompt assistance.

Policies, terms, and compliance information

Understanding the policies surrounding mobile banking is essential for a transparent relationship with your bank. Key policies include how your information is used, privacy concerns, and regulations that protect your rights as a customer.

Compliance with regulations is vital not only for your security but also to ensure that your bank operates within established laws. Familiarize yourself with these regulations to better understand the protection systems in place that govern your usage of mobile banking.

Other relevant resources

For further assistance, refer to links provided on your bank’s website for important forms and documents. You can also find useful tools within pdfFiller for effective document management.

If you face any issues while navigating your mobile banking account or filling out forms, don’t hesitate to contact customer support for help.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mobile banking application form on a smartphone?

How do I edit mobile banking application form on an iOS device?

How do I complete mobile banking application form on an iOS device?

What is mobile banking application form?

Who is required to file mobile banking application form?

How to fill out mobile banking application form?

What is the purpose of mobile banking application form?

What information must be reported on mobile banking application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.