Get the free 2023 Individual Taxpayer Organizer

Get, Create, Make and Sign 2023 individual taxpayer organizer

How to edit 2023 individual taxpayer organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 individual taxpayer organizer

How to fill out 2023 individual taxpayer organizer

Who needs 2023 individual taxpayer organizer?

Your complete guide to the 2023 individual taxpayer organizer form

Overview of the 2023 individual taxpayer organizer form

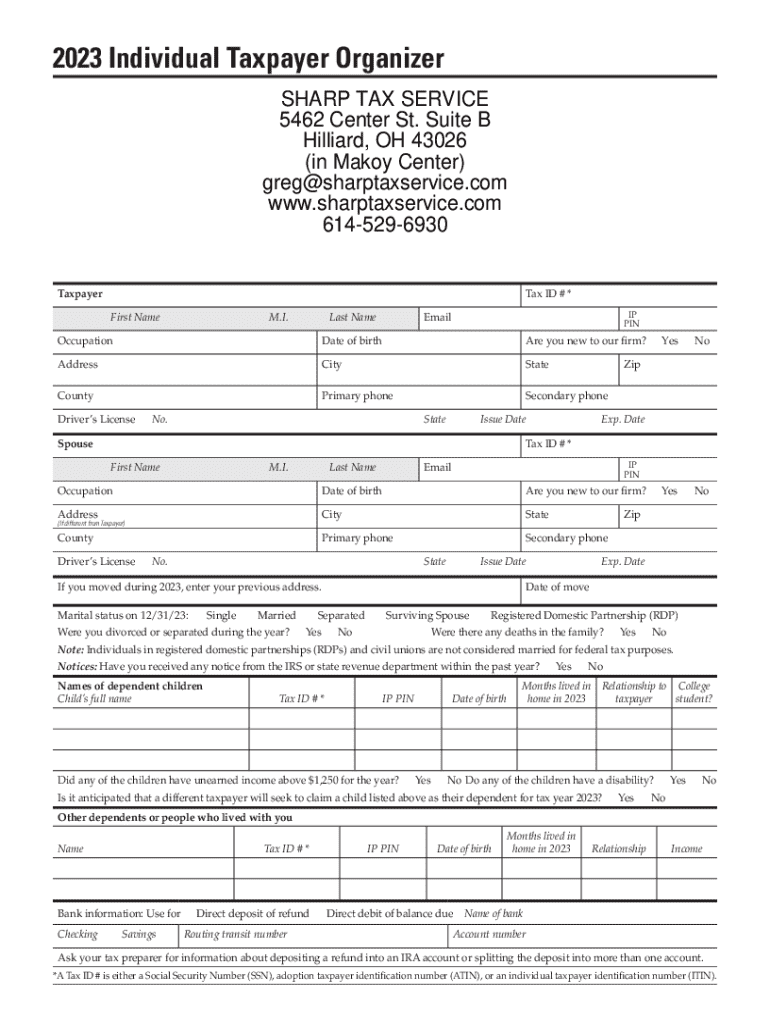

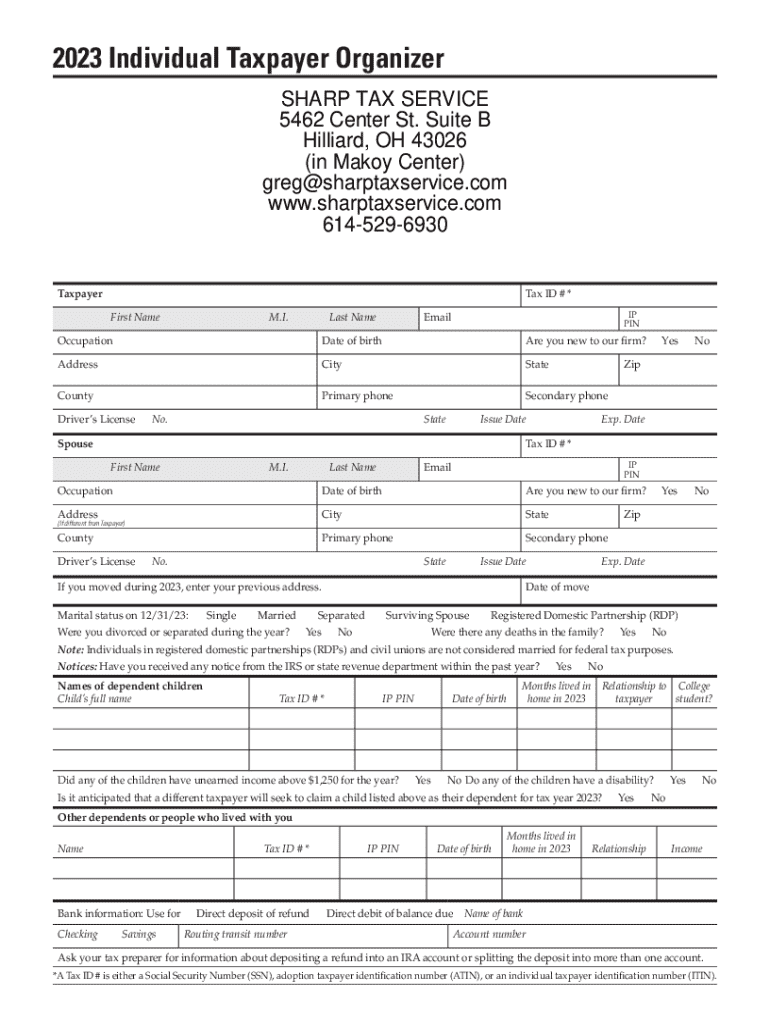

The 2023 individual taxpayer organizer form is an essential document designed to assist taxpayers in compiling necessary personal and financial information for tax filing. It streamlines the process by providing a structured format to gather income, deductions, and credits, making tax season less daunting.

This form is particularly important for individuals who wish to stay organized, ensuring that they do not overlook any income sources or potential deductions. Compared to the previous years, the 2023 form introduces minor updates tailored to reflect changes in tax laws and deductions, helping users maintain compliance and optimize their tax returns.

Key information required for completion

Completing the 2023 individual taxpayer organizer form requires specific personal and financial information. This includes:

Step-by-step instructions for filling out the tax organizer

Filling out the 2023 individual taxpayer organizer requires a systematic approach. Start by gathering all necessary documents based on a checklist, ensuring that everything is at your fingertips.

Here’s a section-by-section breakdown:

To boost accuracy, avoid common mistakes such as entering incorrect Social Security numbers or omitting a W-2. It’s critical to double-check all entries before proceeding.

Interactive tools for enhanced filing experience

Utilizing pdfFiller’s online PDF editing tools can greatly simplify the process of filling out the 2023 individual taxpayer organizer form. These tools allow for easy editing and filling online, letting you seamlessly complete your forms without the hassle of printing.

With features for eSigning, collaborating with tax professionals is simplified. You can share your completed documents for review and signature without the delays of traditional mail. Additionally, pdfFiller offers cloud storage capabilities, enabling you to manage your documents efficiently and always access them from anywhere.

Best practices for organizing tax-related documents

An organized approach to tax-related documents can save time and reduce stress during the filing process. Here are some best practices:

Submitting your completed tax organizer

The final step in the process is submitting your completed tax organizer form. You have options: mailing or electronic submissions. Many taxpayers prefer e-filing due to its convenience and quicker processing times.

Be mindful of important deadlines to avoid penalties. Ensure you have accounted for all attachments and documents needed before submission. Review the IRS guidelines for the latest information on submission methods.

Understanding additional tax responsibilities

For freelancers or individuals in the gig economy, understanding additional tax responsibilities is crucial. These include self-employment taxes and ensuring that all sources of income, including foreign income, are reported accurately.

Moreover, be aware of local and state tax requirements, as they can vary significantly depending on where you live. Keeping track of your obligations ensures compliance and helps in avoiding unforeseen penalties.

Recent changes and updates affecting 2023 individual tax filers

Tax laws are subject to frequent changes, and as of 2023, several key legislative updates have impacted individual taxpayers. It's essential to stay informed about these changes to take advantage of new deductions and tax benefits.

The IRS continuously updates guidelines, and notably, deadlines have become stricter, with potential penalties for late submissions being a focus. Understanding these rules can help you navigate the tax filing landscape effectively.

FAQs about the 2023 individual taxpayer organizer form

Taxpayers often have questions when navigating their obligations. Here are some frequently asked questions that may resonate with your experience:

For additional resources and assistance, consider consulting a tax professional to guide you through complex tax situations.

Client reviews and success stories

Users of pdfFiller have shared positive experiences, citing how the platform significantly improved their tax filing endeavors. Many highlighted how the ease of editing and collaborating translated into a smoother experience.

Success stories include individuals who, by utilizing the 2023 individual taxpayer organizer form, maximized their eligible deductions, showcasing how effective organization can lead to tangible financial benefits.

Related articles and resources for further exploration

Navigating tax season can be enhanced by further learning. Here are some articles and resources to explore:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2023 individual taxpayer organizer online?

How do I make edits in 2023 individual taxpayer organizer without leaving Chrome?

How do I fill out the 2023 individual taxpayer organizer form on my smartphone?

What is 2023 individual taxpayer organizer?

Who is required to file 2023 individual taxpayer organizer?

How to fill out 2023 individual taxpayer organizer?

What is the purpose of 2023 individual taxpayer organizer?

What information must be reported on 2023 individual taxpayer organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.