Get the free Notice of Terminated Trustee or Attorney

Get, Create, Make and Sign notice of terminated trustee

How to edit notice of terminated trustee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of terminated trustee

How to fill out notice of terminated trustee

Who needs notice of terminated trustee?

Comprehensive Guide to the Notice of Terminated Trustee Form

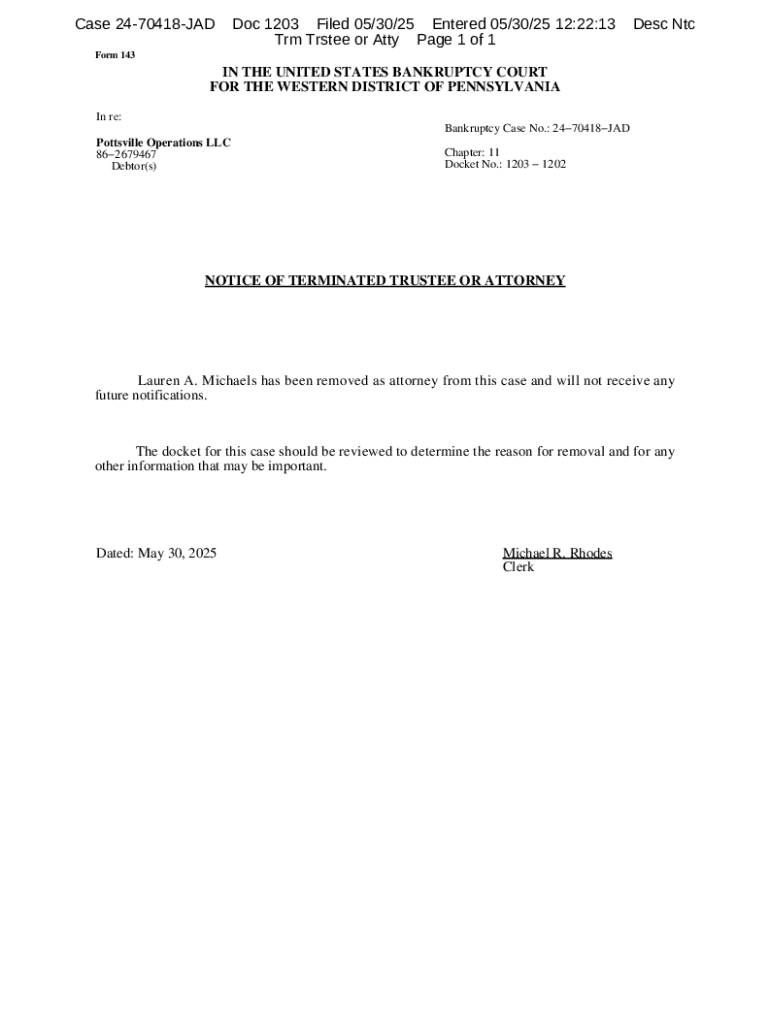

Understanding the Notice of Terminated Trustee Form

A Notice of Terminated Trustee Form is an official document used to notify relevant parties about the termination of a trustee's authority over a trust. This form is crucial in legal and financial contexts, as it helps ensure that all parties are aware of a change in the management of trust assets.

The importance of this form cannot be overstated. It functions as a formal declaration that eliminates the trustee’s decision-making powers and outlines the transition to a new trustee if applicable. Proper execution of this form is essential for maintaining the integrity of the trust and complying with relevant laws.

Types of trusteeship that require termination

Various types of trusts may require a termination of trusteeship. Common types include revocable trusts, irrevocable trusts, and charitable trusts. Each type has distinct characteristics and can have different implications when a trustee is terminated. Scenarios that necessitate termination can include failure to act in the best interest of beneficiaries, mismanagement of trust assets, or even personal issues that impact the trustee’s ability to fulfill their role.

Eligibility criteria for terminating a trustee

Not everyone can initiate the termination of a trustee. Primarily, trust beneficiaries—the individuals or entities entitled to the benefits of the trust—can typically take action to terminate a trustee’s authority. Additionally, co-trustees often hold the power to collectively decide to remove another trustee if stipulated by the trust document.

For a termination to be valid, certain conditions must be met. These may include misconduct by the trustee, incapacity, failure to perform duties effectively, or breaches of fiduciary duty. It is important that any termination adheres to the trust’s governing document, applicable state laws, and any specific legal requirements.

Procedures for completing the Notice of Terminated Trustee Form

Completing the Notice of Terminated Trustee Form requires careful attention to detail. Essential information to include encompasses the trustee's details, trust identification, and the reasons for termination. Clarity and accuracy are critical as they ensure the document's effectiveness and compliance with legal standards.

Follow these steps to fill out the form properly: First, gather all necessary documentation related to the trust and the trustee in question. Next, ensure you accurately complete each section, providing all required details. Verify the information for completeness and accuracy before proceeding to obtain the required signatures from relevant parties. Finally, include the date to formalize the document.

Submitting the form

Once the Notice of Terminated Trustee Form is completed, the next step is submitting it to the relevant parties. Depending on the state or jurisdiction, this may include local courts, financial institutions managing the trust assets, or other co-trustees. Adhering to compliance regulations is essential for the form's acceptance.

Maintaining thorough records during this process is essential. Keep copies of the submitted form and any documentation related to the termination for personal records, as these may be needed for future reference or potential disputes. Tracking submission dates and responses can also aid in managing the timeline of the transition.

Post-submission actions

After submitting the Notice of Terminated Trustee Form, it is essential to inform all affected parties. This includes beneficiaries of the trust and any relevant institutions involved with the trust’s assets. Effective communication not only ensures transparency but also helps mitigate potential conflicts arising from the change in trusteeship.

You should consider the best methods to notify these parties. Written communication, such as a formal letter, is recommended, along with confirming receipt by phone or email. After the termination, be prepared for possible reactions from both trustees and beneficiaries, including legal disputes or requests for additional information.

Common mistakes to avoid

Completing the Notice of Terminated Trustee Form can be straightforward, but there are common pitfalls to watch out for. Frequently, individuals may neglect to include crucial details or misunderstand the legal language contained in the trust documents. This can lead to invalid submissions or conflicts down the line.

To avoid these issues, ensure you read the instructions carefully, confirm all information prior to submission, and seek legal advice when necessary. Common mistakes include failing to gather appropriate signatures, leaving sections incomplete, and not keeping thorough records of the form's submission and any corresponding communications.

Utilizing pdfFiller for Notice of Terminated Trustee creation

Using pdfFiller to create and manage your Notice of Terminated Trustee Form offers numerous advantages. The platform allows users to edit and sign forms online seamlessly, making the document creation process more efficient and less prone to error. Given that trust management often involves multiple parties, the collaborative features in pdfFiller ensure that everyone can contribute to the document management process.

To use pdfFiller effectively, follow this simple guide: First, access the provided template within pdfFiller's library. Next, edit and customize the form according to your specific needs. Once finalized, the platform allows for secure storage of completed documents, permitting easy retrieval whenever necessary.

Frequently asked questions (FAQ)

Understanding nuances around the Notice of Terminated Trustee Form often raises questions. A common concern is: What happens if a trustee refuses to acknowledge the termination? In most instances, a refusal may necessitate legal intervention or further negotiation within the trust framework.

Another frequent question is whether multiple trustees can be terminated simultaneously. While it is possible, the procedure must be clearly outlined in the trust document to avoid potential legality issues. Lastly, if amendments to a submitted notice are necessary, consulting with a legal expert is advisable to understand the proper protocols.

Conclusion on the importance of proper form usage

Proper execution of the Notice of Terminated Trustee Form is pivotal in managing a trust effectively. By ensuring all steps are meticulously followed—from completion to submission—you uphold the integrity of the trust and protect the interests of the beneficiaries involved. As trust management is inherently complex, proactive handling and understanding of procedural steps can mitigate potential conflicts and support smooth transitions.

Ultimately, while navigating trustee terminations may seem daunting, having access to tools like pdfFiller ensures that you can manage these critical documents with confidence and ease. Utilizing such digital solutions not only streamlines the administrative burden but also enhances collaboration among all parties involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get notice of terminated trustee?

Can I create an eSignature for the notice of terminated trustee in Gmail?

How do I fill out notice of terminated trustee on an Android device?

What is notice of terminated trustee?

Who is required to file notice of terminated trustee?

How to fill out notice of terminated trustee?

What is the purpose of notice of terminated trustee?

What information must be reported on notice of terminated trustee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.