Get the free Buyer Qualification Form

Get, Create, Make and Sign buyer qualification form

How to edit buyer qualification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buyer qualification form

How to fill out buyer qualification form

Who needs buyer qualification form?

Buyer Qualification Form: How-to Guide

Understanding the buyer qualification form

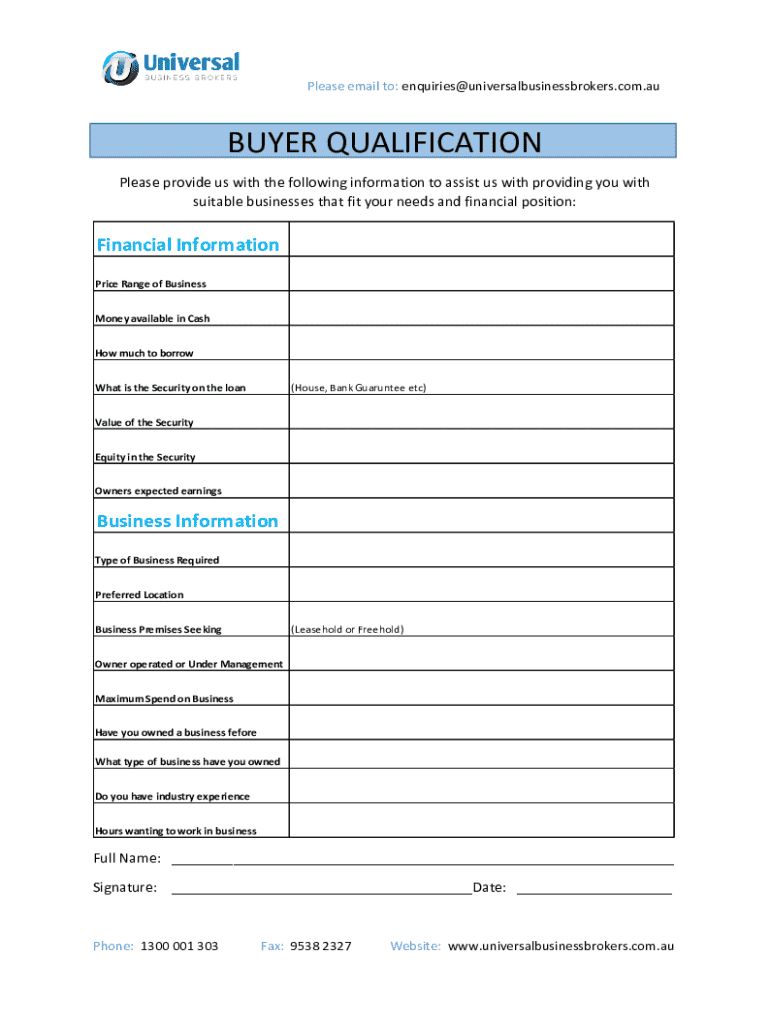

A buyer qualification form is a document that collects essential information from individuals looking to purchase property, allowing agents and brokers to assess buyer viability effectively. This form plays a crucial role in the real estate process, ensuring that relevant details about the buyer's finances, preferences, and requirements are organized and communicated. By understanding the nuances of the buyer qualification process, prospective homeowners can expedite their property search and make informed decisions.

The importance of the buyer qualification process cannot be understated. It helps filter serious buyers from those who may be more casual in their home search. Understanding financial qualifications upfront saves time and energy for both buyers and agents. Moreover, having a clear outline of buyer needs and preferences allows for a more streamlined property search, ensuring each candidate can receive tailored recommendations that align with their goals.

Key components of the buyer qualification form

Essential information typically required on a buyer qualification form covers various aspects related to a buyer's identity and financial standing. Collecting personal information such as the buyer's name, contact details, and current living situation is essential for effective communication. This initial data setup helps real estate agents in profiling potential buyers and reaching out for follow-up discussions.

Financial information is equally crucial. Prospective buyers must detail their budget, mortgage status, and any relevant existing debts. Understanding potential buyers' financial positions helps agents determine realistic property matches, easing the process of finding suitable homes within their economic means.

Alongside financial details, buyers should specify their property preferences and requirements. This section empowers buyers to articulate what they are looking for in a new home, including property type, size, styles, or specific features such as a garden or garage. Moreover, specifying location preferences—like neighborhoods, school districts, and proximity to work—can further streamline the property search process.

Step-by-step guide to completing the buyer qualification form

Completing a buyer qualification form doesn't have to be daunting. Start with these essential steps to ensure you capture all necessary details effectively.

Understanding your financial position

A thorough understanding of your financial position is essential for navigating the property market successfully. One key element is obtaining a mortgage in principle (MIP). This document indicates the amount a lender is willing to lend you based on your financial assessment, facilitating the buying process by providing credibility to your home search.

Having a deposit readily available is crucial. Most lenders require at least a 10% to 20% down payment of the property's value, so securing this amount early in the process can dramatically expedite your home purchase. In addition, working with mortgage brokers can be beneficial as they often possess market insights and access to various lenders, potentially unlocking preferential rates and support tailored to your financial standing.

The role of the buyer qualification form in property search

The buyer qualification form plays a pivotal role in facilitating your property journey. By submitting accurate and comprehensive details on this form, you provide real estate agents with the necessary tools to match you with properties that meet your requirements. This targeted approach means you can focus on viewing homes that truly fit your criteria, leading to a more efficient search process.

When both agents and you have a solid understanding of your needs, the likelihood of finding suitable properties increases significantly. Accurate information enables agents to search broader databases with confidence, knowing they can suggest homes aligned with your financial parameters and preferred specifications. Additionally, a well-completed buyer qualification form fosters better communication with agents, allowing for effective discussions on market conditions and property availability.

Frequently asked questions about the buyer qualification form

Many potential buyers have questions and concerns about the buyer qualification process, leading to some common misconceptions. One prevalent concern is whether it's necessary to complete this form if you are already selling a property. In reality, selling a home offers a different perspective. It usually indicates you are financially capable but establishing your new purchase qualifications is essential.

Addressing specific situations can clarify uncertainties. For instance, if you’re buying without selling a property, having a clear budget and financial standing can enhance your competitiveness in the market. Additionally, managing financing challenges is possible. Speaking with a professional financial advisor who can guide you through various options may also alleviate stress regarding home purchasing.

Best practices for submitting your buyer qualification form

Submitting your buyer qualification form with accuracy and completeness is vital for seamless processing. Start by ensuring all required information is filled out correctly. Missing or incorrect details may lead to delays that could deter your property search.

Consider utilizing recommended tools for document submission, especially digital platforms like pdfFiller that offer an efficient and organized way to manage forms. Submit your form as early as possible to give agents ample time to understand your needs and prepare property insights that align with your aspirations. Early submission also facilitates quick adjustments in case further clarifications are necessary.

After submission: what to expect next

After submitting your buyer qualification form, expect a follow-up from your real estate agent or broker. They typically reach out within a few days to discuss your form, clarify any queries, and set the stage for your consultation. Staying available for these communications can significantly enhance the onboarding process.

Preparing for your consultation with real estate experts will ensure you get the most out of the meeting. Bring relevant documentation that supports your financial situation, such as income statements or primary credit evaluations—this preparation outlines a transparent picture of your qualifications. Asking questions during your first meeting can also pave the way for a more meaningful relationship, opening doors to useful insights about the market.

Exploring additional resources for buyers

Aside from the buyer qualification form, you may encounter additional forms that can aid your buying process, such as a buyer referral acknowledgment form, which helps confirm your connection with your agent. Understanding these documents can solidify your engagement in the property buying process and ensure all protocols are correctly followed.

Combining these forms with useful tools and calculators, like property valuation tools and mortgage calculators, can help you get a more accurate understanding of your potential investments. By leveraging these resources, buyers gain confidence in navigating complex financial decisions associated with property transactions while also streamlining their search efforts.

Connect with us for personalized assistance

For individuals and teams seeking tailored support during their property search or document management, the team at pdfFiller is here to help. Our platform is designed to make the document creation and signing process as seamless as possible, ensuring you have access to professional-grade tools at your fingertips.

Don’t hesitate to reach out for further inquiries regarding the buyer qualification form or any associated services. Our representatives are available during regular business hours, committed to addressing your needs and providing effective solutions for your property journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute buyer qualification form online?

Can I create an electronic signature for the buyer qualification form in Chrome?

How do I edit buyer qualification form on an iOS device?

What is buyer qualification form?

Who is required to file buyer qualification form?

How to fill out buyer qualification form?

What is the purpose of buyer qualification form?

What information must be reported on buyer qualification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.