Get the free Transfer of Assets

Get, Create, Make and Sign transfer of assets

Editing transfer of assets online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer of assets

How to fill out transfer of assets

Who needs transfer of assets?

A Comprehensive Guide to the Transfer of Assets Form

Understanding the transfer of assets form

A transfer of assets form is a crucial document used to legally record the transfer of ownership of various assets from one party to another. This form serves multiple purposes, whether it’s for selling property, bequeathing assets through inheritance, or for business transactions where ownership stakes or physical assets are exchanged. Understanding the definition and purpose of this document is the first step toward seamless asset management.

There are several reasons for utilizing a transfer of assets form. For instance, in real estate transactions, it ensures that property ownership is accurately reflected in legal records. Similarly, during estate planning, it helps beneficiaries receive their rightful inheritances without any legal hiccups. Regardless of the reason, proper documentation is essential, as it protects the interests of all parties involved.

Types of assets commonly transferred

Various types of assets can be transferred, each requiring a specific approach and documentation. Understanding these asset types is crucial for effective management and compliance with legal requirements.

Real estate is one of the most significant assets people transfer. Typically, it involves property deeds and detailed transfer documentation that must be filed with local authorities. Financial assets, including stocks, bonds, and mutual funds, also necessitate formal transfer processes to ensure ownership rights are respected. Personal property, from vehicles to jewelry, requires similar attention, while intangible assets like intellectual property and patents may need unique forms due to their specialized nature.

Who needs a transfer of assets form?

Individuals often need a transfer of assets form for various purposes, particularly in private transactions. For example, homeowners may want to transfer property ownership to family members, especially through gifts or inheritance procedures. Beneficiaries dealing with estate planning must also complete such forms to claim assets for which they are entitled.

Businesses similarly require these forms when transferring ownership stakes or physical assets during mergers and acquisitions. Legal representatives such as executors and trustees must manage asset transfers as outlined in wills, ensuring compliance with legal requirements and smoothing out the settlement process.

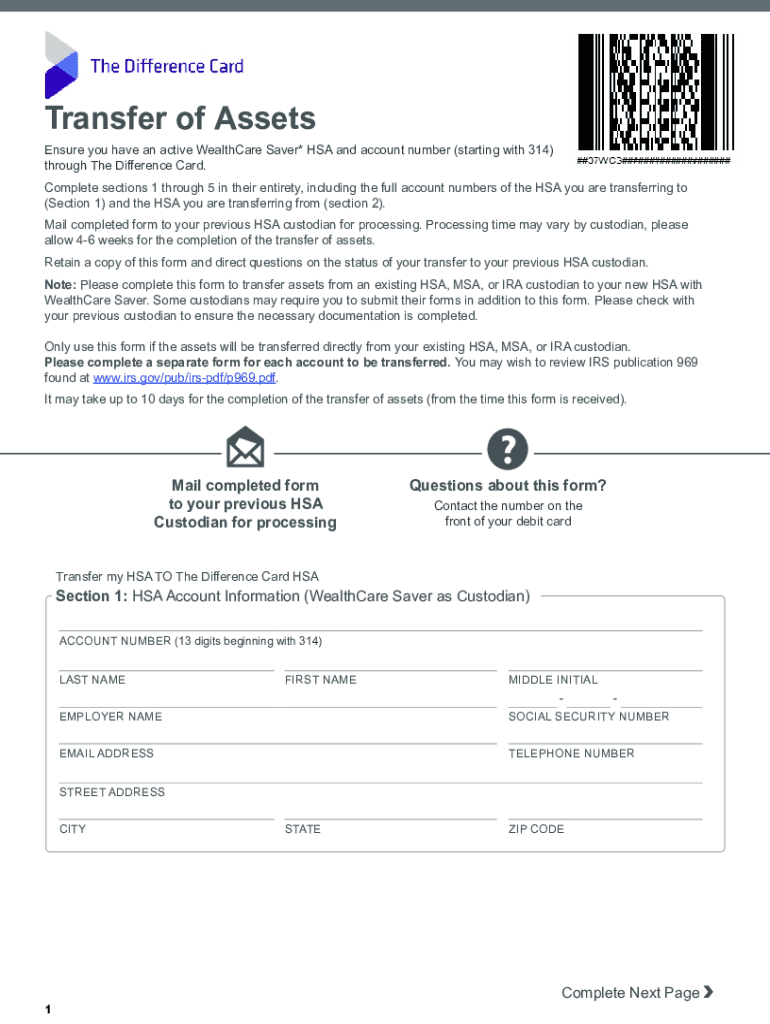

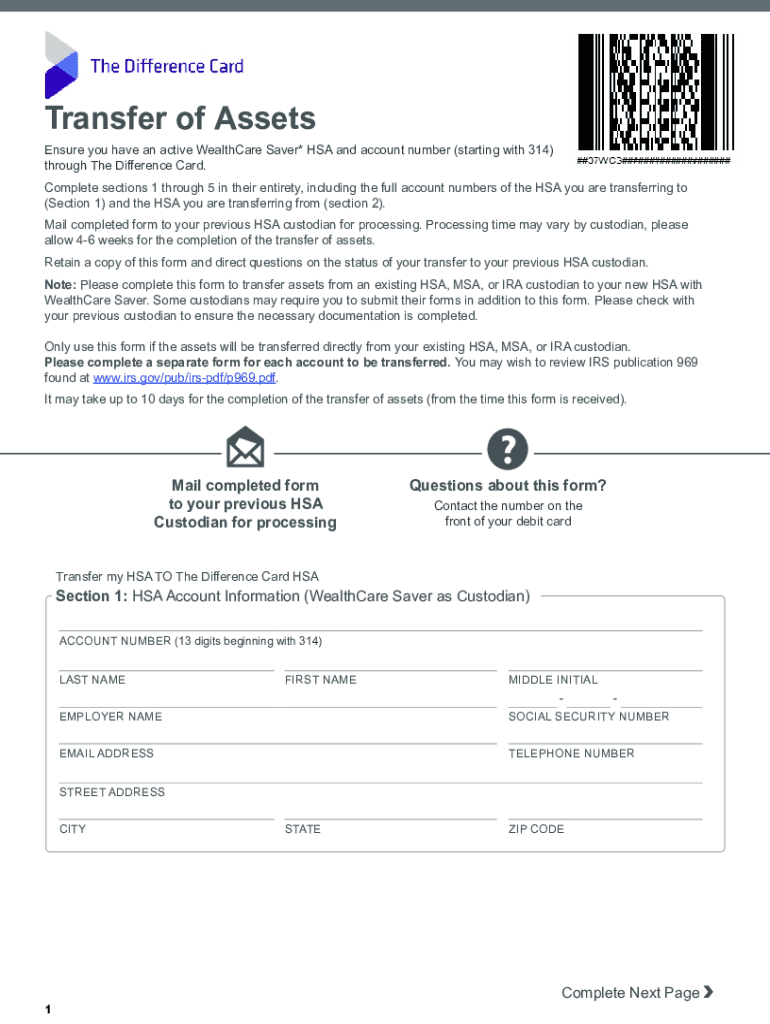

Step-by-step guide to completing the transfer of assets form

Completing a transfer of assets form can seem daunting, but breaking down the process into manageable steps makes it straightforward. Here’s a detailed guide.

Interactive tools for managing your transfer of assets

Utilizing digital tools can enhance the experience of managing transfer of assets forms. Platforms like pdfFiller provide a comprehensive suite of document creation, editing, and managing utilities designed to simplify this process. The platform allows users to seamlessly edit PDFs, eSign documents, and collaborate with others regardless of their geographical locations.

Real-time collaboration features enable teams to work together on asset transfers, facilitating transparency and efficiency. Moreover, the eSignature capabilities streamline the signing process, making it easier than ever to finalize the transfer without being physically present.

Frequently asked questions (FAQs)

Many individuals have questions when dealing with the transfer of assets form. Whether it’s about completion errors or the process to track asset status, clarity is essential.

Troubleshooting common issues

Navigating the intricacies of a transfer of assets form can lead to common errors. Identifying and rectifying these issues promptly is crucial for smooth transactions.

Common errors include missing signatures or required documentation, leading to delayed processes. If disputes arise, it’s essential to approach resolutions calmly. Engage in discussions with the involved parties and, if necessary, seek legal assistance to navigate through any conflicts.

Future implications of asset transfer

Transferring assets is not just a current concern but has future implications, especially in terms of taxation and estate planning. Understanding these factors can significantly influence decision-making.

For instance, potential capital gains tax may arise from asset transfers, depending on the market value and ownership duration. Additionally, proper asset transfer during estate planning can affect future inheritance processes, ensuring that loved ones receive their intended legacies without complications.

Enhancing your document management strategy with pdfFiller

Effective document management is essential for successful asset transfers, and pdfFiller offers robust tools to enhance this strategy. Users benefit from features such as comprehensive document creation and editing, facilitating smooth form completion.

The cloud-based platform allows for easy access from anywhere, enabling teams to collaborate seamlessly on transfer processes. Importantly, pdfFiller emphasizes security and compliance, safeguarding sensitive information throughout the asset transfer journey.

User experiences and testimonials

The experiences of users who have navigated the transfer of assets form using pdfFiller reveal the platform's effectiveness. Testimonials highlight how seamless document management has transformed their transaction processes.

Many users appreciate the ease with which they can edit and sign documents, eliminating traditional hassles such as printing, scanning, and mailing. Feedback indicates a higher level of satisfaction with asset transfer processes, thanks to the organization and accessibility provided by pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transfer of assets for eSignature?

How do I make changes in transfer of assets?

How do I edit transfer of assets straight from my smartphone?

What is transfer of assets?

Who is required to file transfer of assets?

How to fill out transfer of assets?

What is the purpose of transfer of assets?

What information must be reported on transfer of assets?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.