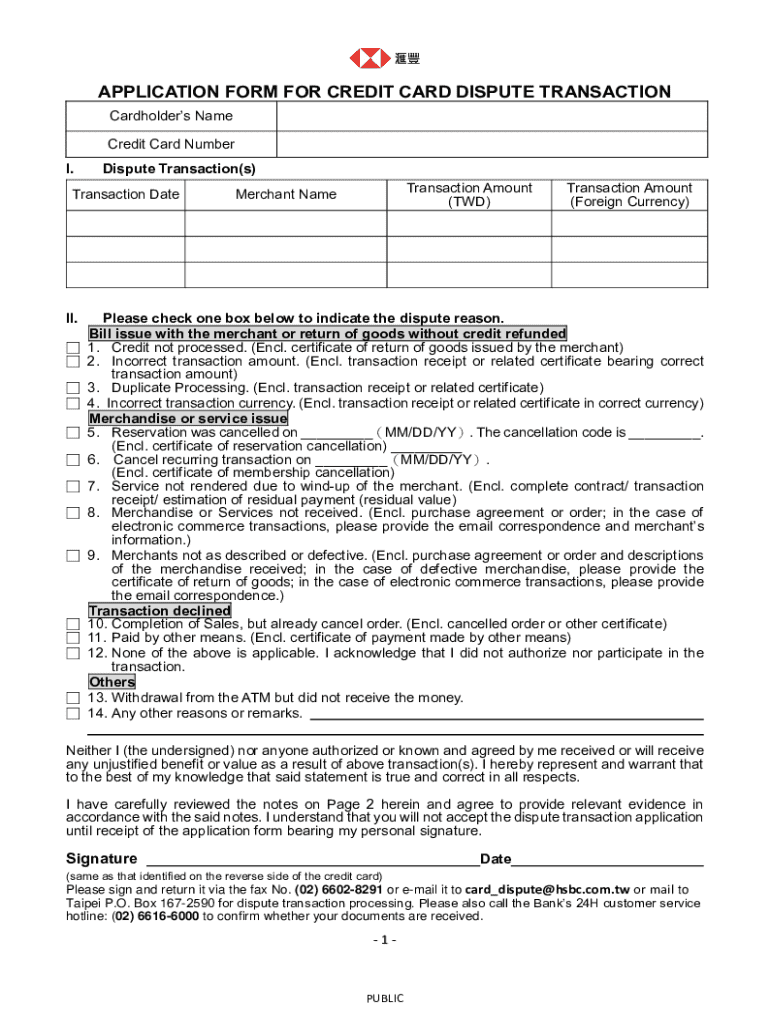

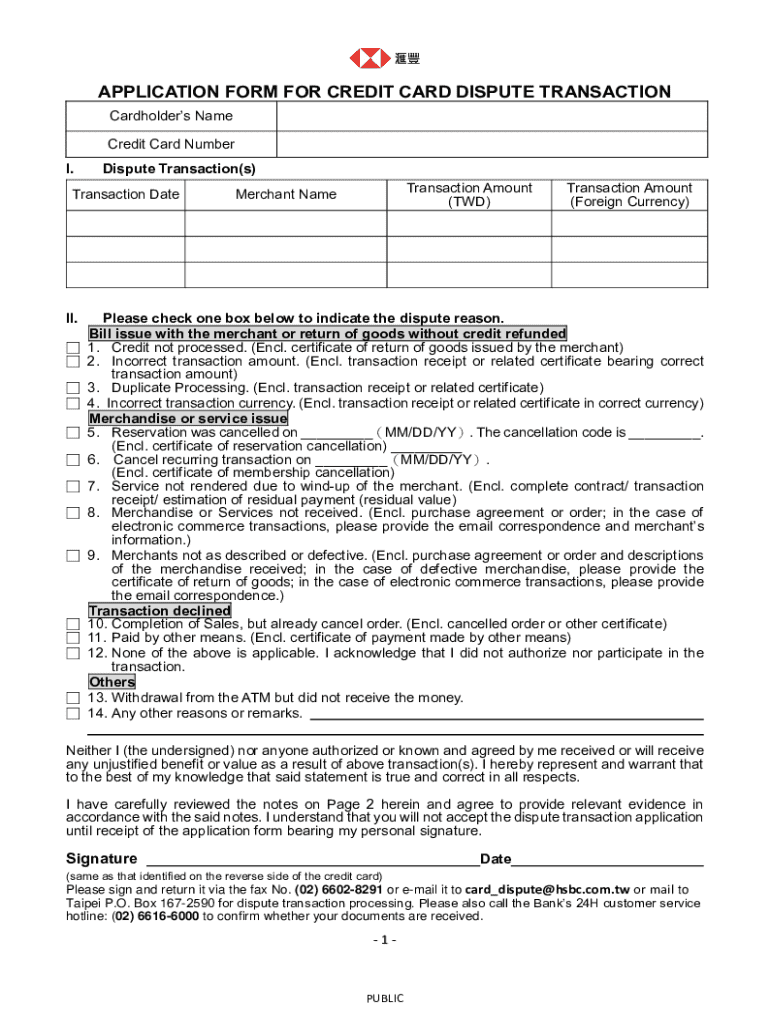

Get the free Application Form for Credit Card Dispute Transaction

Get, Create, Make and Sign application form for credit

How to edit application form for credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for credit

How to fill out application form for credit

Who needs application form for credit?

Your Comprehensive Guide to the Application Form for Credit Form

Understanding the application form for credit

An application form for credit is a document that potential borrowers fill out when seeking credit from a lender. This form is essential as it serves as a structured way for lenders to collect crucial information about the applicant’s identity, financial situation, and creditworthiness. It is used in various financial scenarios including loans, credit cards, and mortgages. Having a complete and accurate credit application is necessary to facilitate a smooth evaluation process.

Common use cases include personal loans for purchasing a car or home, while benefits extend to quick access to credit and favorable loan terms if your application is strong. Essentially, this paperwork starts the borrowing process and informs lending decisions.

Components of a typical credit application form

Preparing to fill out the application form

Before you start filling out the application form for credit, it's crucial to gather necessary documents that validate your information and stability. A well-prepared application often leads to faster processing and approval rates.

Gather required documents

Assessing your financial situation

Understanding your credit score before applying can give you insight into your financial health. A score above 700 is generally considered good, while anything below 600 may lead to challenges in obtaining credit. This knowledge can help you make informed decisions regarding potential lenders and the types of credit you may qualify for.

Step-by-step guide to completing the application form

With your documents gathered and an understanding of your financial situation, it’s time to fill out the application. Each part of the application form serves a purpose. Below is a guide to accurately complete your credit application.

Filling out personal information

Start with the personal information section, providing your legal name, current address, and phone number. Ensure all names and addresses match the identification provided to avoid discrepancies during verification.

Disclosing financial information

Next, enter your financial details. This includes your monthly income, which can be stated as a gross figure along with any additional income you may receive. Be honest about your monthly expenses such as rent/mortgage payments and other debts as this informs the lender of your ability to repay.

Including additional information

If you're self-employed or have unique circumstances, consider sharing additional details. This can include information about your business operations or any additional assets you may have. The more relevant information you provide, the better the lender can understand your financial picture.

Common pitfalls in filling out credit applications

Avoiding mistakes on your application can save time and enhance your creditworthiness. Review your application carefully before submission, as even minor errors can lead to delays or denials. Mistakes in your personal information such as misspellings in your name or incorrect addresses can arise from a lack of attention to detail.

Mistakes to avoid

How to address common issues

If you discover an error after submission, immediately contact the lender to rectify it. Explain the mistake, and provide the correct details or updated documentation as needed. Timely communication can mitigate the negative impact of these oversights.

After submission: what to expect

Once you submit your application, it enters a review process that generally takes anywhere from a few hours to several days. Understand that various factors can affect this timeline, including the lender's processing capacity and the completeness of your documentation.

Timeline for processing applications

Understanding the evaluation process

Lenders evaluate applications by conducting thorough checks on credit scores, income levels, and existing debts. They often use risk assessment models to establish whether they consider you a good candidate for credit. Your credit score plays a significant role in this evaluation, alongside your financial history and employment stability.

Managing your credit application status

Staying informed about your credit application status will help you manage expectations. Many lenders provide online portals or customer service options for this purpose.

How to track your application

Contacting lenders for updates

If you haven’t heard back within the expected timeframe, reaching out to your lender can provide clarity. Be polite when asking for updates and have your application reference information handy to streamline the conversation. This demonstrates professionalism and shows you are proactive.

Handling loan rejections

Receiving a loan denial can be disheartening, but it’s crucial to understand the possible reasons behind the rejection. Often, lenders view red flags in an applicant’s credit history or income stability.

Possible reasons for denial

Steps to take after being denied

After a denial, take time to reassess your financial standing. It's a good time to improve your credit score by paying down debts and ensuring all bills are paid on time. You may also inquire from the lender about rehabilitation options or the possibility of reapplying once you've addressed the reasons for denial, which can often create a more favorable outcome in the future.

Using pdfFiller for your credit application needs

pdfFiller offers a seamless solution for managing your credit application form. It empowers users to edit, sign, and collaboratively work on their documents online, making the application process more efficient.

Editing and customizing your application form

With pdfFiller, you can easily edit PDFs by adding or modifying text and fields, allowing you to personalize your credit application according to your needs. This flexibility ensures that your application is accurately completed before submission.

eSigning your application securely

The platform also provides advanced electronic signature capabilities, making it easy to sign your application securely. Signing electronically can speed up the process, ensuring that your application is submitted on time.

Collaborating with others on your application

pdfFiller allows for seamless collaboration should you need feedback or assistance from family members or financial advisors as you prepare your credit application. This drives efficiency and increases the chances of a well-prepared submission.

Managing your documents with ease

Beyond editing and signing, pdfFiller provides cloud storage, ensuring you’ll have easy access to your credit application and any other documents you might need for future reference. This means you can manage everything from a single, online location.

FAQs about credit application forms

When it comes to the application form for credit, many individuals have common questions. Understanding these can help demystify many aspects of the credit process.

Common questions people ask

Myths vs. facts about credit applications

Many myths surround the credit application process, such as the belief that checking your credit report harms your score. In reality, checking your own report is a 'soft inquiry' and does not affect your score. Understanding these facts can empower you during the process and help you make educated decisions.

Interactive tools for enhanced application experience

Utilizing various interactive tools can enrich your experience. Resources like credit score calculators and budgeting worksheets can help you enhance your application's strength and clarity.

Credit score calculators

Online credit score calculators can help individuals evaluate their credit positions before applying for credit. Understanding where you currently stand can help strategize improvements for better terms and conditions.

Budgeting worksheets

Before applying, organizing your finances with budgeting worksheets allows you to identify your income, expenditures, and outstanding debts effortlessly. A well-prepared financial summary can significantly boost your application’s success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application form for credit in Gmail?

How can I edit application form for credit on a smartphone?

How can I fill out application form for credit on an iOS device?

What is application form for credit?

Who is required to file application form for credit?

How to fill out application form for credit?

What is the purpose of application form for credit?

What information must be reported on application form for credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.