Get the free Business Online Banking Authorization Agreement

Get, Create, Make and Sign business online banking authorization

How to edit business online banking authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business online banking authorization

How to fill out business online banking authorization

Who needs business online banking authorization?

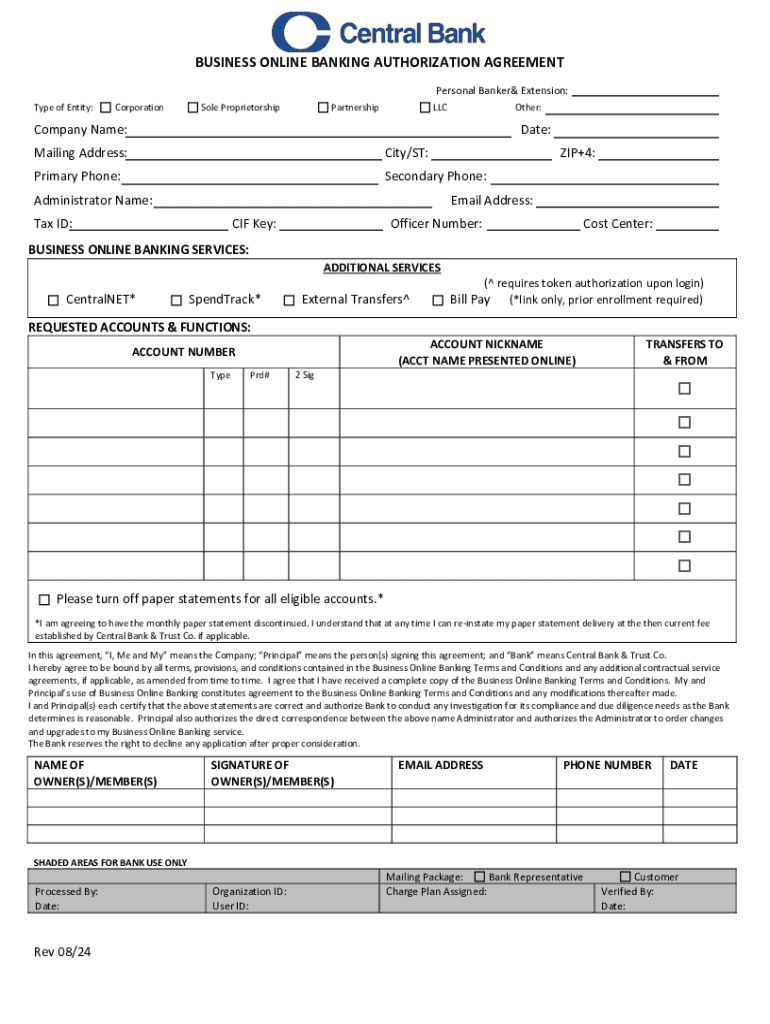

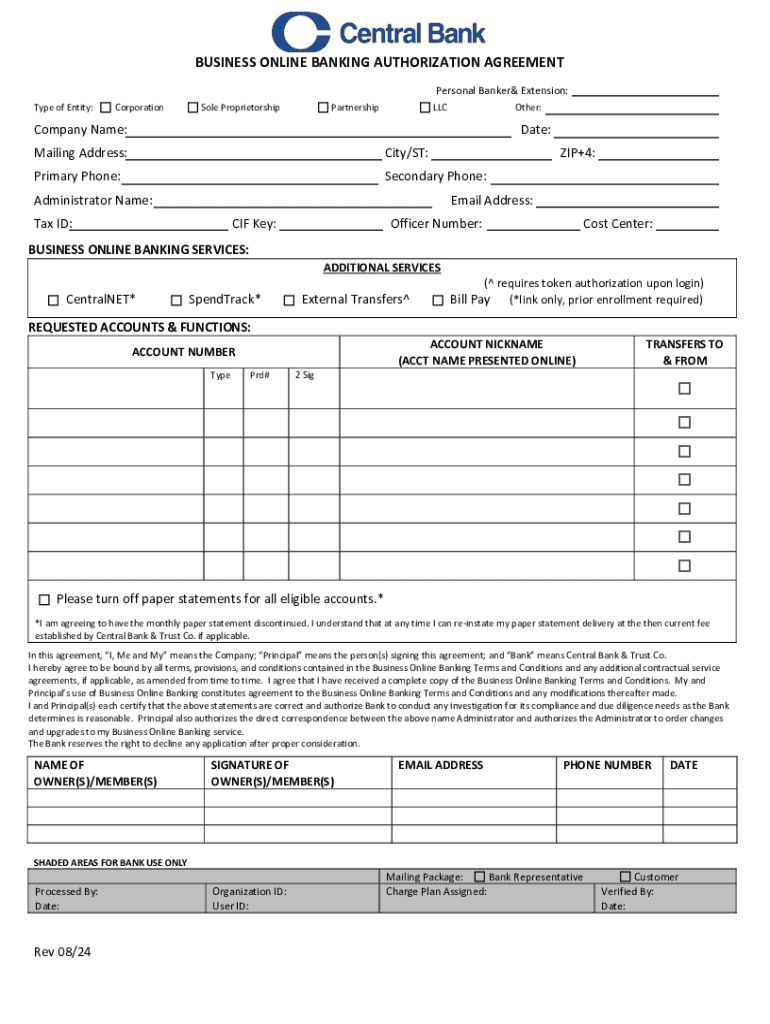

Comprehensive Guide to the Business Online Banking Authorization Form

Understanding the business online banking authorization form

A business online banking authorization form is a critical document enabling organizations to designate individuals who can execute financial transactions on behalf of the business. This form serves as an official request to the bank, outlining who is allowed to access online banking services, manage accounts, and conduct transactions.

Authorization is crucial in online banking as it safeguards against unauthorized access. Without clear authorization protocols, businesses risk financial exposure and may suffer from fraudulent activities. The significance of this form extends across various organizational types, including small businesses, corporations, non-profits, and partnerships, all of which require precise authorizations to mitigate risks.

Key features of the business online banking authorization form

The business online banking authorization form is designed to encompass several key features that facilitate effective management of online banking access.

Preparing to fill out the authorization form

Filling out the business online banking authorization form requires meticulous preparation. Gathering the necessary information and documentation ensures a smooth process.

Furthermore, understanding the roles and responsibilities associated with the authorization form is vital. Key terms include signatories, who are legally allowed to sign for transactions; payment approvers, designated individuals who must authorize payments; and administrators, responsible for managing user access and ensuring compliance.

Step-by-step guide to filling out the form

Navigating the business online banking authorization form can be straightforward if approached methodically. Here’s a detailed step-by-step guide.

Editing and customizing your authorization form

Once the initial form is filled out, pdfFiller offers robust editing tools allowing for modifications as needed. Users can customize the authorization form easily to ensure it meets all specific business needs.

Signing the authorization form

The completion of the authorization form also necessitates proper signatures. pdfFiller accommodates various eSigning options that ensure both speed and legal validity.

Managing and storing the authorization form

After completion, effective document management becomes paramount. Employing best practices ensures that the authorization form can be easily retrieved when necessary.

Common issues and troubleshooting

When filling out the business online banking authorization form, users may encounter various challenges. Understanding these common issues can streamline the process, making completion less daunting.

Security features in pdfFiller for business banking forms

Security should be a principal concern when handling online banking documents. pdfFiller implements several robust security measures to protect sensitive data involved with the business online banking authorization form.

Additional tools and resources for business banking

Navigating the business landscape often requires integrating various tools for effective financial management. The right resources can enhance the overall banking experience.

Staying informed: Banking regulations and compliance

Understanding and adhering to banking regulations is essential for any business involved in online banking. Staying up to date on compliance requirements not only protects the business but also upholds its reputation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business online banking authorization in Gmail?

How can I modify business online banking authorization without leaving Google Drive?

How can I edit business online banking authorization on a smartphone?

What is business online banking authorization?

Who is required to file business online banking authorization?

How to fill out business online banking authorization?

What is the purpose of business online banking authorization?

What information must be reported on business online banking authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.