Get the free Registered Student Organization Banking Account Information Request

Get, Create, Make and Sign registered student organization banking

Editing registered student organization banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registered student organization banking

How to fill out registered student organization banking

Who needs registered student organization banking?

A comprehensive guide to the registered student organization banking form

Overview of registered student organization banking

Registered student organizations (RSOs) play a vital role in fostering community and providing students with leadership opportunities, social experiences, and networking prospects. Banking is an essential aspect of managing these organizations, as it allows them to handle finances efficiently while complying with university regulations. Having a clear and systematic approach to financial management can lead to successful events, projects, or initiatives that benefit the entire student body.

Proper financial management is crucial for RSOs, as it not only helps maintain transparency and accountability but also ensures the sustainability of the organization. Effectively managing funds enables organizations to allocate resources appropriately, ensuring they meet the needs of their members while adhering to budgetary constraints. By utilizing the registered student organization banking system, students can streamline their banking processes, simplify reporting, and enhance overall organizational performance.

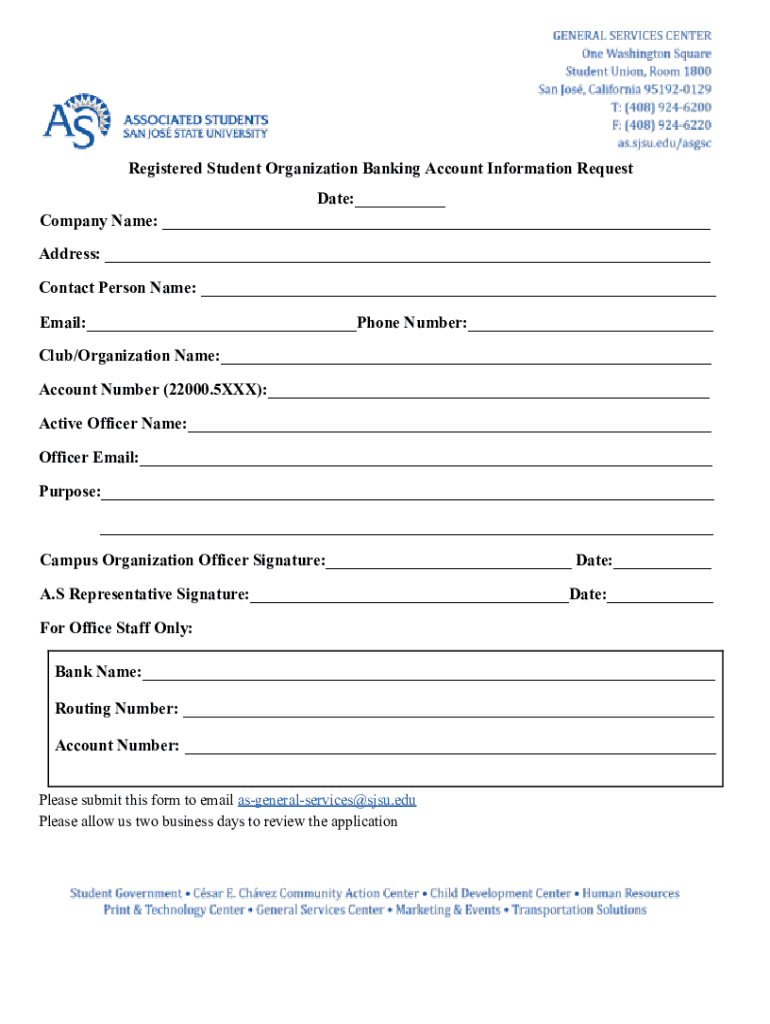

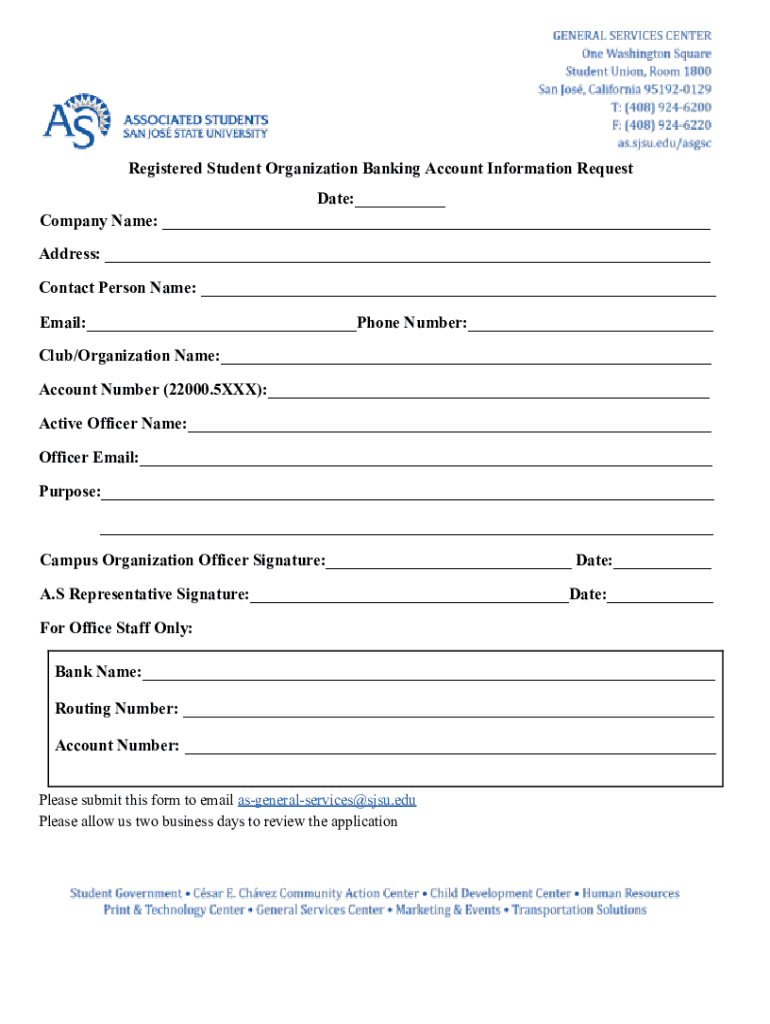

Understanding the banking form

The registered student organization banking form is a crucial document for any student organization aiming to establish a banking account. This form serves as an official request to set up an account at a designated financial institution, allowing RSOs to manage their funds responsibly. By filling out and submitting this form, organizations can access essential banking services that will facilitate their day-to-day operations.

Key information required on the form includes specific organization details, authorized signatories who will have access to the account, and pertinent financial institution information. Accurately completing this form is essential to avoid delays in account approval and to ensure that organizations have access to the funds needed for their activities.

How to establish an on-campus bank account

Setting up an on-campus bank account for your registered student organization can be a straightforward process when approached systematically. Here’s a step-by-step guide to help you navigate this essential task.

Making deposits: procedures and best practices

Once your on-campus bank account is set up, knowing how to make deposits is critical for maintaining a healthy financial status. In-person deposits require certain documentation to ensure transparency and record-keeping. When visiting the bank, be prepared with your organization's account number, identification of authorized signatories, and any deposit slips if required.

To improve your deposit experience, consider these tips: always double-check the amounts being deposited, ensure documentation is complete, and keep a copy of the receipt for your records. Alternatively, electronic deposits can offer a convenient way to manage funds through online banking options sanctioned by the financial institution, but always be aware of security considerations, such as using strong passwords and monitoring your account for unauthorized transactions.

Managing your organization's finances

Effective financial management requires regular monitoring and reconciliation of bank statements. Organizations should reconcile their accounts frequently, ideally monthly, to ensure financial integrity. This involves comparing the recorded transactions against bank statements to identify discrepancies, resolve any errors, and adjust for missed entries.

Creating a realistic budget is another critical component of managing finances effectively. This includes setting realistic income expectations, estimating expenses, and adjusting for potential fluctuations. To help with tracking expenses, organizations can use budgeting software or spreadsheets to log expenditures and categorize them, allowing for clearer visibility into financial health. Ultimately, a proactive approach to budgeting will empower organizations to make informed decisions and plan for upcoming events more effectively.

Accessing funds: requests and reimbursements

Accessing funds from your organization's account typically requires submitting a fund request form. This form should be filled out carefully, ensuring all information is accurate and complete. The verification process may include approval from designated signatories, which establishes accountability and security.

For organizations seeking reimbursements for purchases made on behalf of the group, specific documentation will be required, such as receipts and proof of payment. Understanding the timeframe for processing such requests is vital, as delays can impact financial planning and project execution. Keeping open communication with the university's financial office can help expedite these requests when necessary.

Understanding organization financial policies

Registered student organizations are subject to specific financial policies that govern their banking practices. Comprehensive knowledge of these policies is essential to ensure compliance and avoid penalties. For instance, spending limits may be imposed on certain activities, with exemptions for essential operational expenses.

Additionally, many universities offer tax exemptions for registered organizations, allowing them to optimize funding opportunities. Organizations should familiarize themselves with these policies not only to enhance their financial strategies but also to ensure that they remain compliant with university and state regulations. This involves periodically reviewing policy updates and attending mandatory trainings or informational meetings organized by the Office of Student Involvement.

Common situations: troubleshooting and solutions

Even with proper planning and management, issues may arise when dealing with your organization's bank account. It's important to know how to troubleshoot common account-related issues efficiently. For example, if a check is lost or an unauthorized transaction is detected, immediate contact with the bank and your university's financial office is critical. They can guide you through the process of freezing the account and investigating the issue.

Changing authorized signatories is another common situation that may occur, especially when leadership changes within the organization. This process typically involves filling out a specific form and providing necessary documentation. When dealing with reimbursement delays, it’s advisable to track your requests and follow up with the relevant department to resolve any hold-ups. Lastly, if the situation arises that leads to your account being closed, understanding the steps to reopen or re-establish an account is necessary for continuity.

Training resources and support

Universities often provide a wealth of resources to assist student organizations with their financial management. Workshops focused on financial literacy, budgeting, and compliance are invaluable for successful organization leaders. These workshops present not only practical information but also tools to adapt financial strategies effectively.

Connecting with financial advisors or peer mentors within the university can also prove beneficial. They can offer tailored advice, share experiences, and assist with navigating the complexities of student organization finances. Additionally, organizations may access online resources through the university's website that contain vital information about managing banking transactions and utilizing financial tools efficiently.

Frequently asked questions (FAQs)

When planning to open a banking account for your registered student organization, several questions commonly arise. A frequently asked question is what documentation is necessary for the account opening process. You'll typically need the Registered Student Organization Banking Form, IRS documentation if applicable, and identification for authorized signatories.

Another common inquiry deals with the timeline for establishing the account. Organizations can expect a processing timeframe that varies, often ranging from a few days to several weeks, depending on internal reviews. Some individuals may wonder if personal accounts could be used for organization expenses; generally, this practice is discouraged due to liability and transparency issues. Lastly, understanding what happens if an organization disbands is critical. In such cases, any remaining funds would usually need to be returned to the university or allocated according to university policies.

Contact information for further assistance

For further inquiries or assistance regarding the registered student organization banking form and related processes, reaching out to the Office of Student Involvement is the best course of action. They can provide specific guidance tailored to your organization's needs and facilitate a smoother experience managing your finances. Contacting them via email or phone can help clarify any pressing questions you may have.

Scheduling appointments for in-person assistance can also be valuable for addressing complex issues that may arise. Always check their operational hours and consider setting up a meeting to discuss your organization’s financial strategies and needs.

Useful links

Providing easy access to important resources can empower registered student organizations in their financial endeavors. Look for direct links to the registered student organization banking form, university financial guidelines, and other relevant documentation. These links are invaluable for ensuring that organizations have all the necessary resources to manage their finances effectively.

Additionally, consider exploring partnerships and resources that offer further funding opportunities, both internally and externally. Engaging with these resources can facilitate additional support for your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit registered student organization banking from Google Drive?

How can I send registered student organization banking for eSignature?

How do I make edits in registered student organization banking without leaving Chrome?

What is registered student organization banking?

Who is required to file registered student organization banking?

How to fill out registered student organization banking?

What is the purpose of registered student organization banking?

What information must be reported on registered student organization banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.