Get the free Business Loan Application Form

Get, Create, Make and Sign business loan application form

Editing business loan application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application form

How to fill out business loan application form

Who needs business loan application form?

Business Loan Application Form: How-to Guide

Understanding the business loan application process

A business loan application form is a critical tool for any entrepreneur or business owner seeking financial assistance. It serves as the first impression of your financial standing and business viability to potential lenders. The importance of this form cannot be overstated; it's not just a formality, but a vital part of acquiring the funding necessary for business operations and expansion.

A well-prepared application can significantly impact your chances of securing a loan. Lenders use these forms to assess your qualifications and gauge the level of risk involved in lending you money. Moreover, securing a loan can dramatically affect the trajectory of your business by providing the capital needed for growth, such as expanding operations, hiring employees, or increasing inventory.

Types of business loans requiring applications

Key components of a business loan application form

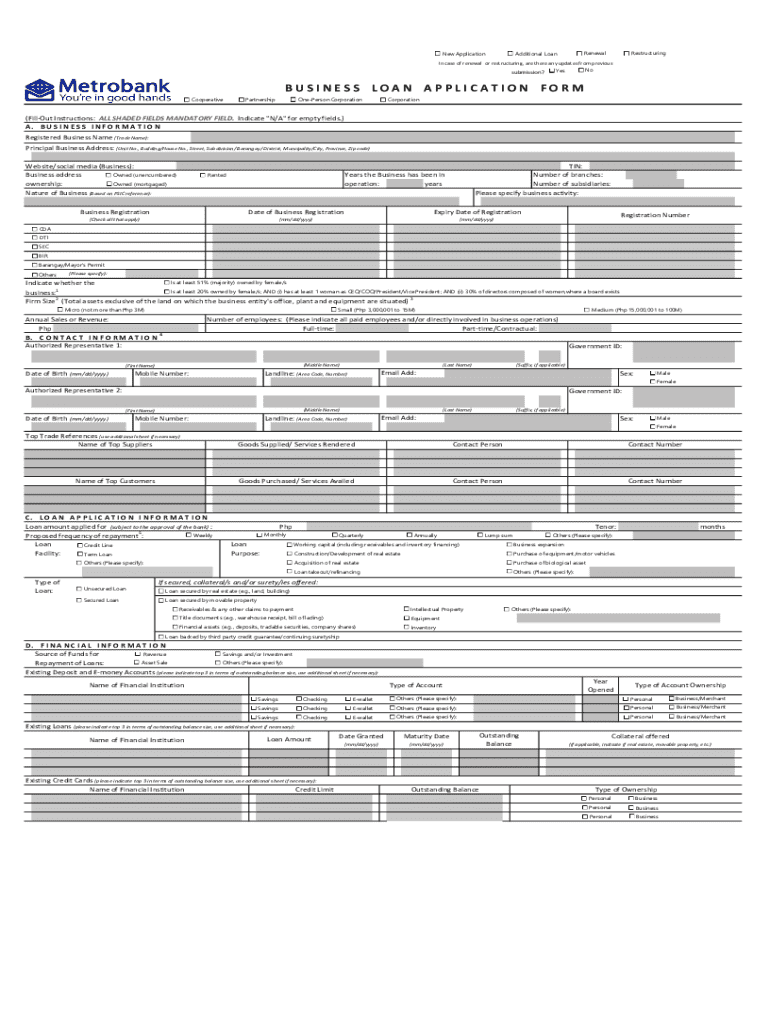

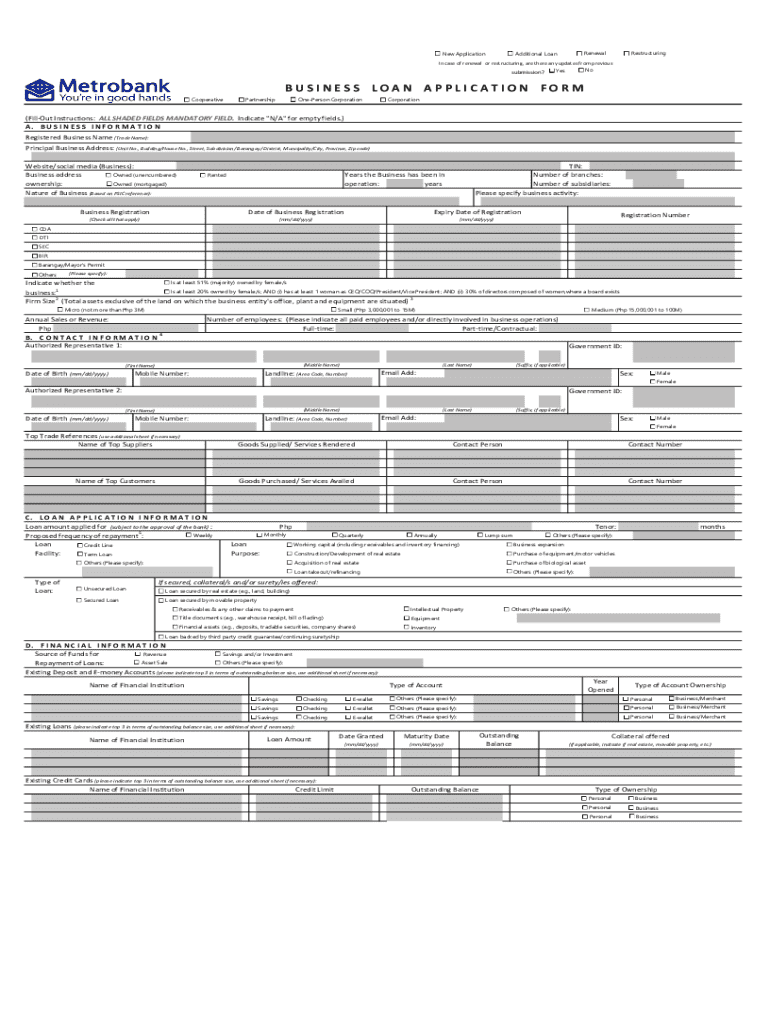

When filling out a business loan application form, certain key components are necessary to ensure a comprehensive submission. First, you will need to provide personal and business information, including your business name, address, and the applicant's personal information. This establishes the basic identity of your enterprise and its owners.

Financial information is also crucial; lenders will require a profit and loss statement, a balance sheet, and a cash flow analysis to assess the business's financial health. Moreover, clearly stating your loan details, including the amount requested and intended use of funds, is vital for lenders to understand how the capital will support your business objectives.

Supporting documentation

Step-by-step guide to filling out the application form

Filling out a business loan application accurately is paramount to your success. Start by gathering all necessary information to streamline the process. Creating a checklist of required documents—such as financial statements, personal identification, and summary of business operations—can help ensure you do not miss anything crucial.

Next, focus on completing the application fields accurately. Pay special attention to the personal vs. business information sections; they should clearly reflect both your identity and that of your business. Include specific metrics, such as annual revenue and expenses, as these will provide lenders with a comprehensive view of your financial situation.

Common pitfalls to avoid

Editing and finalizing your business loan application

Once you've filled out your business loan application form, the next step is to edit and finalize your submission. Utilizing pdfFiller's editing tools can greatly enhance your application. Import your completed form into the platform and make any real-time edits or corrections needed to improve clarity and accuracy. This feature ensures your submission is polished before it reaches lenders.

Beyond merely correcting errors, it's essential to focus on formatting and overall presentation. A visually appealing application is easier to read and can convey professionalism. Ensure that all sections are clearly labeled, using consistent fonts, and adequately spaced paragraphs for improved readability.

Signing the business loan application form

Signing the application is a vital part of the submission process. The legality of an eSigned document is recognized by many lenders, making the electronic signature just as binding as a handwritten one. Thus, validating your application submission is crucial to ensure that you are fully accountable for the information provided.

Using pdfFiller, you can easily add your eSignature to the document. There are various e-signature options available, allowing you to customize your signature to fit your personal style or corporate branding. Additionally, pdfFiller provides tracking for signature requests, so you can monitor when your application has been completed and submitted.

Submitting the application: Best practices

Understanding the submission methods for your business loan application form is crucial. Most lenders offer options for online submissions, which are often quicker and more efficient compared to traditional paper submissions. Each method can come with specific requirements; make sure you follow these closely to avoid delays or complications in processing your application.

After submitting your application, it’s important to maintain communication with the lender. Establish a follow-up schedule to check on the status of your application, understanding that response times can vary. Familiarizing yourself with what to expect after submission can help you manage your own business plans and operations effectively while waiting for a decision.

Managing your application with pdfFiller

pdfFiller empowers users with cloud-based document management, allowing you to access your business loan application from anywhere. This feature is particularly valuable for business owners who may be on the go or working remotely. You can also collaborate with team members, sharing the document as needed to ensure everyone is on the same page regarding the loan application process.

Additionally, pdfFiller's organizational features facilitate storing and retrieving your documents. The platform offers version history and document tracking, allowing you to keep tabs on any changes made to the application over time. This capability ensures that you always have access to the most updated version of your application.

Preparing for potential outcomes

Understanding the criteria lenders use to approve business loan applications is essential. Factors such as your credit score, business history, cash flow, and overall financial stability will heavily influence their decision. By familiarizing yourself with these aspects beforehand, you can better prepare your application to meet lenders' expectations.

In the unfortunate event that your application is denied, don't lose hope. It's important to analyze the reasons behind the rejection and take necessary steps to improve future applications. Consider seeking alternative funding options, such as crowdfunding, personal loans, or grant opportunities. Each route presents different benefits and challenges, so choose one that aligns with your business goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business loan application form in Chrome?

How do I complete business loan application form on an iOS device?

Can I edit business loan application form on an Android device?

What is business loan application form?

Who is required to file business loan application form?

How to fill out business loan application form?

What is the purpose of business loan application form?

What information must be reported on business loan application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.