Get the free Ct-227

Get, Create, Make and Sign ct-227

Editing ct-227 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-227

How to fill out ct-227

Who needs ct-227?

Your Complete Guide to the CT-227 Form

Overview of the CT-227 Form

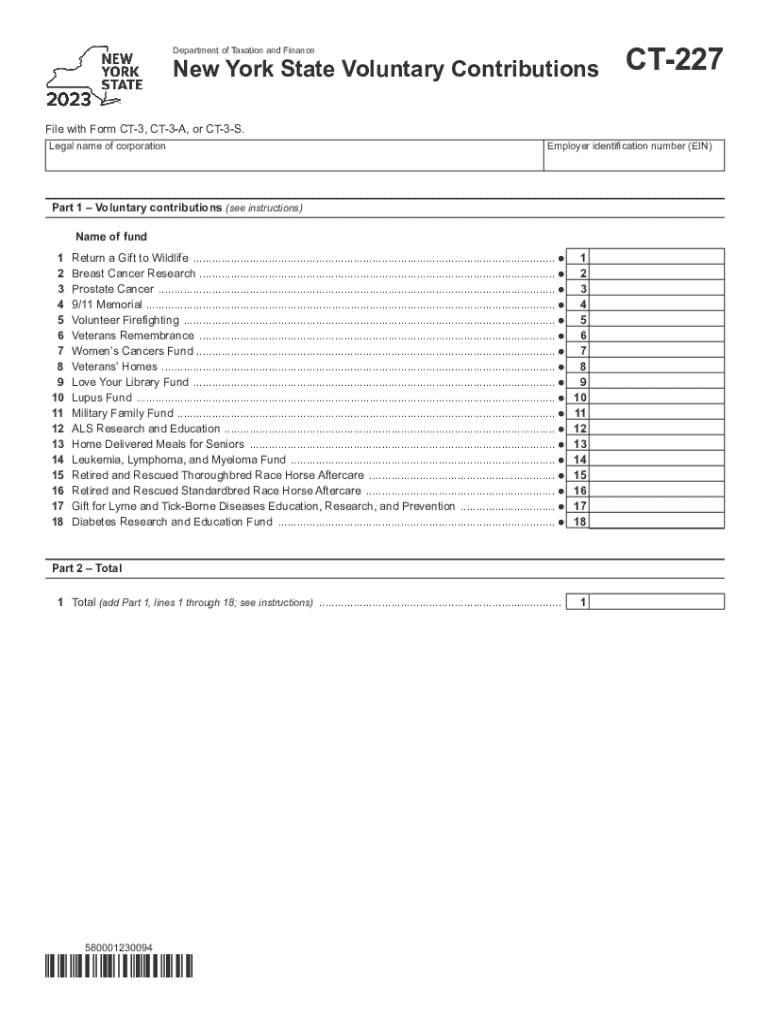

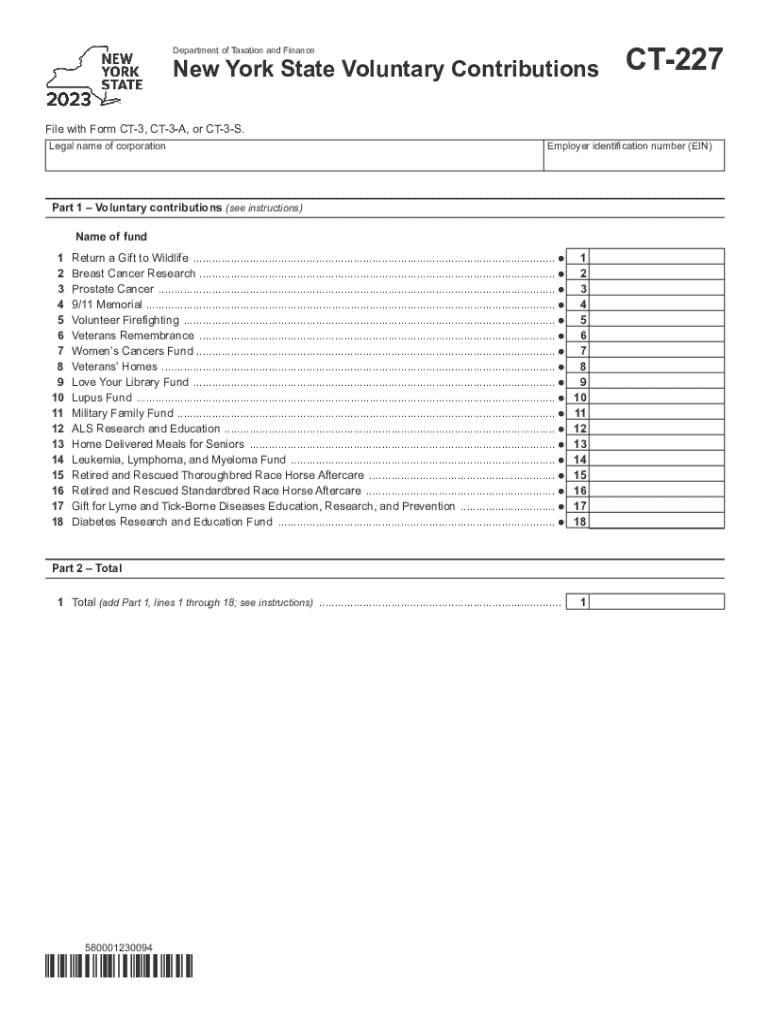

The CT-227 Form, officially known as the Voluntary Contribution Form, is a crucial document for taxpayers in New York State. Its primary purpose is to allow individuals to make voluntary contributions to designated funds directly through their New York state income tax returns. This form stands out as an opportunity for taxpayers not just to fulfill their tax obligations but also to support vital community initiatives and services, effectively engaging them in the betterment of local society.

For taxpayers in New York, the CT-227 Form serves not only as a tool for making contributions but also represents a streamlined way to allocate a portion of their tax commitment towards causes that resonate with their values. It supports various initiatives, such as environmental conservation, education, and health services, fundamentally reflecting the collective ethos of the state.

Key benefits of using the CT-227 Form

Using the CT-227 Form comes with a range of benefits that can significantly enhance your tax filing experience. One of the most prominent benefits is the streamlined process of contributing to projects and funds that you care about. With just a few selections made on this form, taxpayers can direct contributions toward various community initiatives, reducing the complexities typically associated with charitable donations.

Additionally, using this form allows taxpayers to track their contributions efficiently. Not only does it help in documenting any monetary allocation for tax purposes, but it also provides clarity on how these contributions impact supporting funds within the state. Furthermore, making voluntary contributions can also lead to potential tax benefits, as certain contributions may be eligible for tax deductions, providing added financial incentives.

Understanding the components of the CT-227 Form

The CT-227 Form is structured to gather essential information along with clearly indicating the options available for voluntary contributions. The 'Personal Information Section' requires vital details such as your name, address, Social Security Number, and filing status. Accuracy in this section is crucial, as any mistakes could lead to complications in processing your form.

The 'Contribution Selection' area is the heart of the CT-227 Form. Here, taxpayers can select from a variety of funds, including educational scholarships, environmental protection funds, and health service improvements. Understanding what each fund supports can help you make informed decisions that align with your values. Visual aids in the form can guide you through these options more effortlessly.

Step-by-step instructions for filling out the CT-227 Form

Filling out the CT-227 Form can be streamlined by following these key steps. First, gather all necessary documentation, including your prior year’s taxable income and contributions to ensure accurate reporting and selection. This foundational step reduces the risk of errors and helps you complete the form efficiently.

Next, fill out your personal details accurately, ensuring that your name, address, and Social Security Number are correct. This information is vital for the tax processing system to link your contributions accurately. Afterward, you can make your contribution selections. Review each fund’s purpose—this is your chance to support causes that are personally meaningful to you.

Before submission, review your completed form thoroughly using a checklist. Common pitfalls include overlooking personal information or incorrectly summarizing contributions. Lastly, submit your form. You can opt for electronic submission through e-file systems or print and mail it. Ensure that you’re aware of submission deadlines to avoid penalties.

Editing and managing the CT-227 Form

Editing your CT-227 Form is straightforward with tools available on pdfFiller. Whether you need to correct a minor error or revise contribution options, pdfFiller’s editing capabilities make it simple and efficient. You can upload your original PDF and utilize various tools to modify text, insert images, or add additional notes.

To edit your CT-227 form using pdfFiller, open the document on their platform, and navigate to the specific sections you need to correct. The intuitive interface allows users to make changes conveniently without compromising the integrity of the original document. Once your forms are updated, you can save, print, or share them as needed, ensuring your team or advisors have access to the latest version.

Signing the CT-227 Form

When it comes to signing your CT-227 Form, pdfFiller offers electronic signature options that align with New York State’s legal requirements. Electronic signatures not only expedite the submission process but also maintain a high level of security. The e-signature tool integrated into pdfFiller allows you to sign documents swiftly and ensures your records are securely stored and easily accessible.

In New York State, the legality of electronic signatures is robust, making it a trustworthy option for taxpayers. By utilizing pdfFiller, you ensure that your CT-227 Form carries a valid signature that confers upon the document the same legal weight as a handwritten one, enhancing your confidence in the submission process.

Tracking your contributions and donations

After submitting your CT-227 Form, tracking your contributions becomes essential to ensure that everything has been processed accurately. PdfFiller provides tools that allow users to monitor their submitted forms, sending notifications and updates directly regarding their status. This feature enables taxpayers to keep an organized record of their contributions without sifting through pages of paperwork.

Understanding refund and amendment processes is equally critical. If any discrepancies arise, you can utilize pdfFiller to amend your submitted form efficiently. This digital platform facilitates an easy amendment process, ensuring that your contributions reflect accurately on your tax records.

Frequently Asked Questions about the CT-227 Form

Taxpayers often have queries about the CT-227 process. Common questions include eligibility requirements for funds and how to correctly fill out contribution choices. It's important to check whether you meet the contributions requirements stated by each fund before proceeding.

Specific questions relevant to pdfFiller users often pertain to document editing ease, submission methods, and how to ensure compliance with all guidelines that the state mandates. PdfFiller's customer support can provide timely responses to any detailed inquiries you might have, making it a valuable resource in managing your CT-227 Form.

Related topics and additional resources

As you navigate the complexities of the CT-227 Form, various related forms and documents can complement your understanding. Voluntary contribution forms available in New York State include those targeting different sectors such as education and healthcare. For taxpayers interested in maximizing their contributions, understanding the broader context of voluntary giving in the state is essential.

Resources available through the New York State Department of Taxation and Finance provide in-depth guidelines, eligibility requirements, and updated information about supported funds. For further assistance, contacting local tax assistance offices can enhance your clarity on contribution strategies and options.

Contact information for tax support

For inquiries related to the CT-227 Form and your tax contributions, the New York State Department of Taxation and Finance offers various contact options. You can reach them via phone, email, or through their official website. They provide assistance to taxpayers to ensure accurate reporting and understanding of tax obligations.

In addition, if you have specific questions related to form editing and management on pdfFiller, their customer support team is available to assist you. You can contact them through their support page, where you can find FAQs, tutorials, and other resources dedicated to enhancing your experience on their platform.

Interactive tools available on pdfFiller

PdfFiller not only offers the necessary tools for editing and managing the CT-227 Form but also provides a suite of interactive tools that enhance document management. Users can tap into templates for various forms, facilitating a smooth experience when drafting and submitting forms. These templates are essential for both new users and seasoned taxpayers alike.

Maximizing the use of pdfFiller involves utilizing its collaborative features, allowing teams to work simultaneously on document revisions. This capability is particularly beneficial for organizations processing multiple contributions. By leveraging pdfFiller's resources, users can ensure their document management is efficient, accessible, and secure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct-227 for eSignature?

How can I edit ct-227 on a smartphone?

How do I complete ct-227 on an iOS device?

What is ct-227?

Who is required to file ct-227?

How to fill out ct-227?

What is the purpose of ct-227?

What information must be reported on ct-227?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.