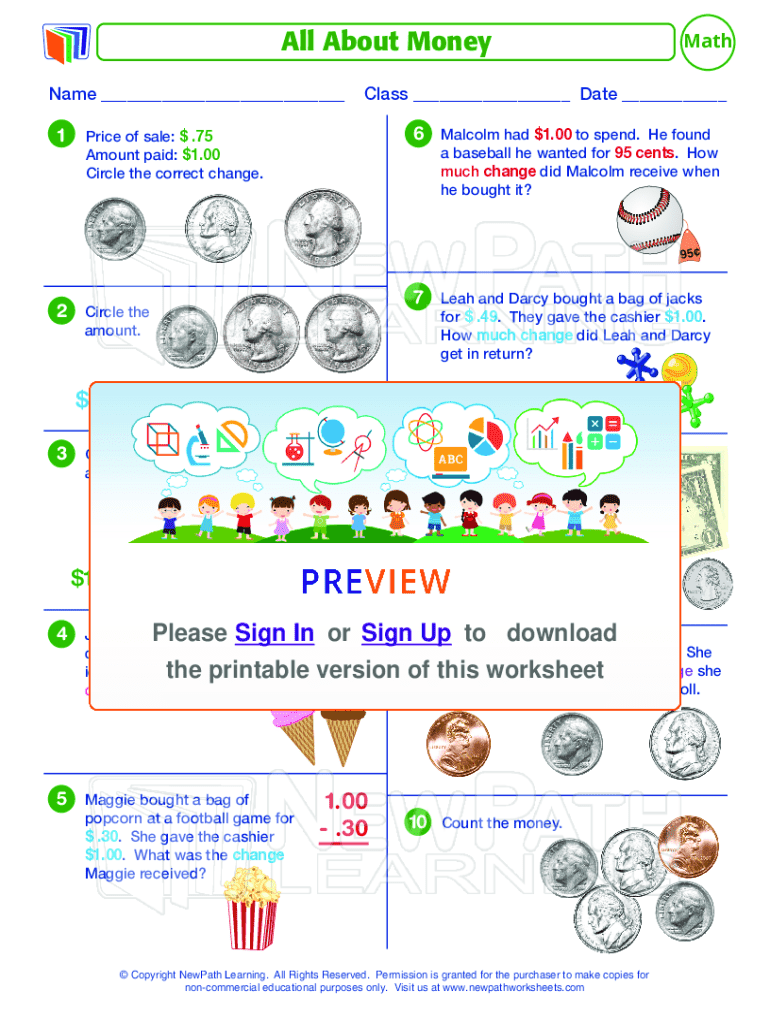

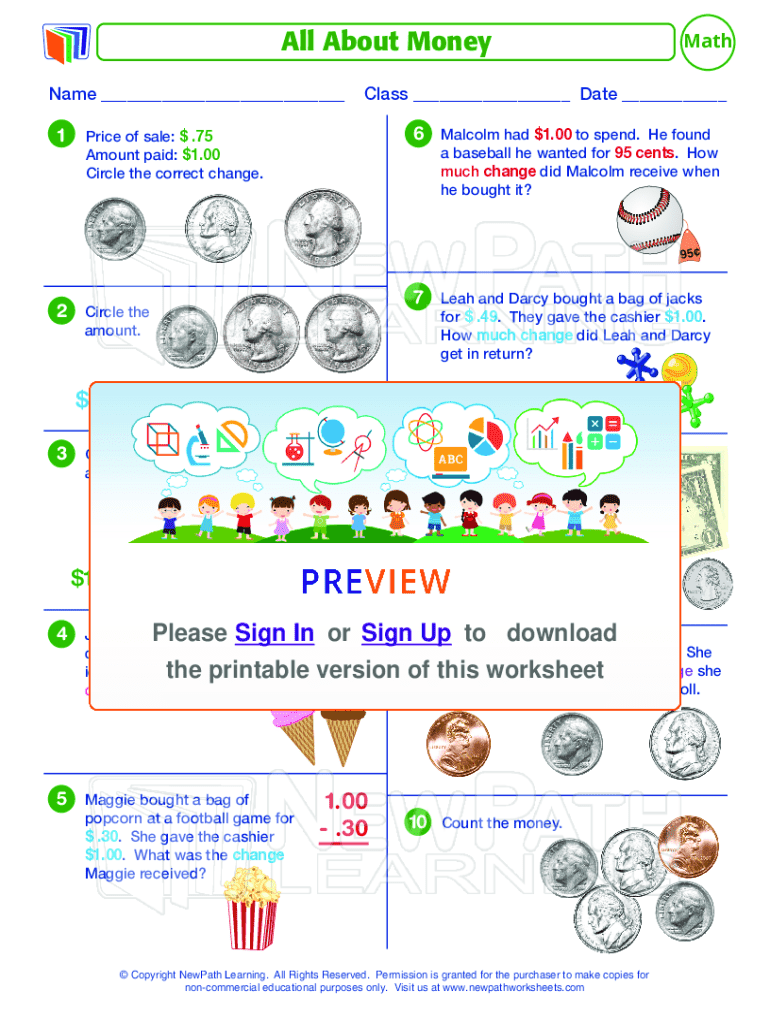

Get the free All About Money

Get, Create, Make and Sign all about money

Editing all about money online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all about money

How to fill out all about money

Who needs all about money?

All About Money Form

Overview of money forms

Money forms refer to the various formats that money can take, encompassing physical, digital, and representative forms. Each type of money serves as a medium through which people conduct transactions, save value, and measure worth in economic exchanges. Understanding the importance of these forms is essential in today’s rapidly changing financial systems, as they underpin how we manage, invest, and spend resources.

In financial systems, money forms play a crucial role in facilitating transactions. They streamline the exchange process, providing stability and efficiency in economic activities. The movement from traditional physical forms to modern digital currencies showcases the evolution of money and the ongoing adaptation to technological advancements.

Types of money forms

Money comes in various forms, and understanding these can help in effectively managing and utilizing financial resources. Below are the primary categories of money forms:

The role of money forms in the economy

The different money forms serve three primary functions in the economy. Understanding these functions provides insight into their importance in everyday transactions and broader financial systems.

Creating and managing money forms

The creation of money is an intricate process primarily governed by central banking systems, with commercial banks playing a significant role in the money supply. Here's a closer look at these mechanisms.

On an individual level, managing money forms effectively involves using various tools and techniques for secure transactions. This includes utilizing digital wallets for safety and tracking expenses with budgeting apps.

Innovations in money forms

Technological advancements drive significant innovations in money forms, enhancing efficiency and accessibility. Mobile payment solutions and fintech applications are particularly noteworthy.

Filling out money forms

Completing various money forms accurately is critical for financial transactions and budgeting. Here are detailed steps for successful completion.

Interactive tools, such as digital templates and document editing software like pdfFiller, can enhance the completion process, making it efficient and user-friendly.

Collaborative management of money forms

Managing money forms collaboratively, especially in team contexts, requires clear role assignments and effective tools. This aids in maintaining accountability and enhancing productivity.

Furthermore, using electronic signatures for completing money forms provides additional security. This method not only speeds up approval processes but also diminishes the risk of forgery.

Legal implications of money forms

Understanding local and international regulations surrounding money forms is vital to maintain compliance and avoid potential legal issues.

Historical context of money forms

The evolution of money is fascinating, transitioning from barter systems to the complex monetary systems of today. This history provides insight into why certain money forms have become prevalent.

Case studies and real-world applications

Examining specific cases where money forms have been effectively utilized can provide learning opportunities for individuals and businesses alike. Successful applications showcase the adaptability of money forms.

Trends shaping the future of money forms

The future of money is poised for significant changes, driven by technological advancements and evolving consumer behavior. Observing trends can help anticipate how money forms will operate moving forward.

Frequently asked questions (FAQs)

Addressing common questions about money forms can help eliminate confusion and promote better understanding among users.

Tools and resources for money management

Utilizing the right tools for money management can make all the difference in managing forms effectively. Key resources can provide significant benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send all about money for eSignature?

Can I sign the all about money electronically in Chrome?

How do I complete all about money on an Android device?

What is all about money?

Who is required to file all about money?

How to fill out all about money?

What is the purpose of all about money?

What information must be reported on all about money?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.