A comprehensive guide to the Minnesota independent contractor agreement form

Understanding independent contractor agreements

An independent contractor is an individual or business that provides services to another entity under terms specified in a contract or agreement. Unlike employees, independent contractors maintain more control over how and when they perform their work, which can lead to greater flexibility and job satisfaction. However, this independence comes with significant responsibilities, particularly regarding legal and tax obligations.

A written agreement is crucial for both parties. It clarifies expectations and responsibilities, mitigates misunderstandings, and provides a legal reference in case of disputes. In Minnesota, independent contractor relationships are governed by various laws, necessitating well-drafted agreements to facilitate compliance and protect the interests of all involved.

Defines the working relationship and sets clear terms.

Reduces risks and liabilities for both parties.

Creates a legal framework for dispute resolution.

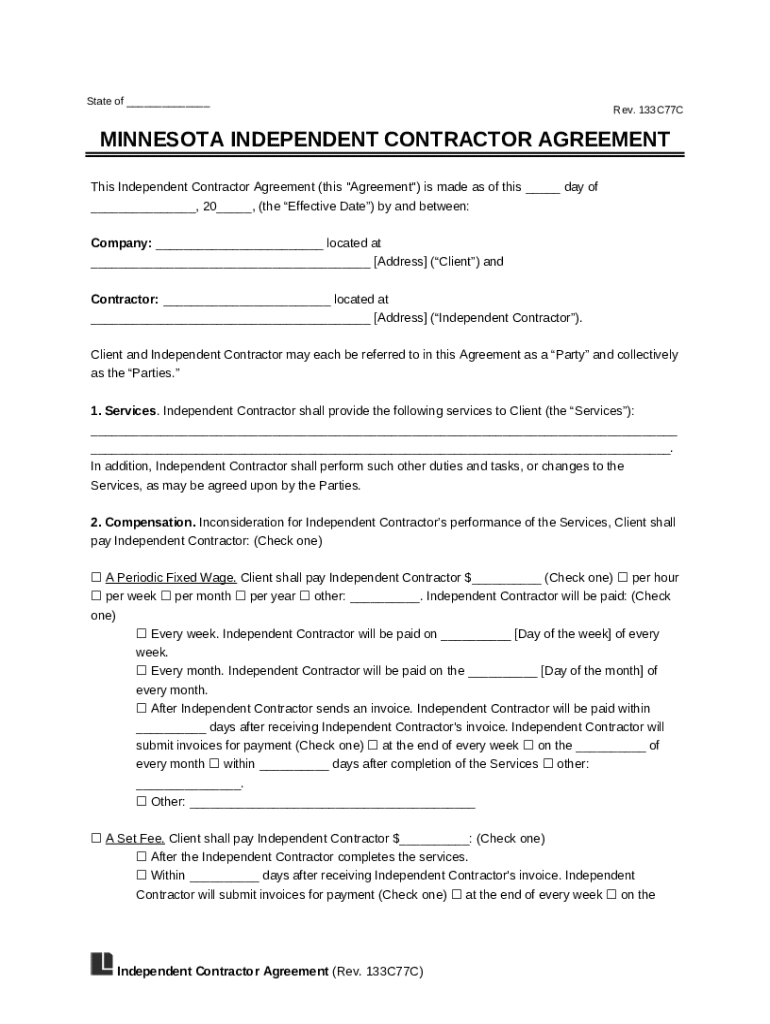

Overview of Minnesota independent contractor agreement form

The Minnesota independent contractor agreement form serves multiple purposes: it formally outlines the arrangement between the contractor and the hiring entity, providing clarity on the terms of employment. Such an agreement not only helps in establishing a professional relationship but also protects both parties by clearly defining the rights, obligations, and expectations.

Key components of the agreement typically include:

Names and contact information of both the contractor and the hiring entity.

Detailed description of the services to be provided by the contractor.

Specifications on how and when the contractor will be compensated.

Start and end dates of the contractor's engagement, along with termination clauses.

Provisions protecting sensitive information shared during the contract.

Circumstances under which either party may terminate the agreement.

Step-by-step guide to filling out the Minnesota independent contractor agreement form

Filling out the Minnesota independent contractor agreement form may seem daunting, but following these steps can streamline the process and ensure all necessary information is captured.

Step 1: Gather necessary information. Before you begin, collect all personal information required, such as full names, addresses, and contact details of both parties, as well as specifics regarding the work to be performed.

Step 2: Specify payment terms carefully. Decide whether you will charge an hourly rate or a flat fee for the project and establish a payment schedule that meets both parties' expectations.

Step 3: Outline rights and responsibilities in the agreement. Clearly state the rights of the contractor regarding their work and highlight the responsibilities of the hiring party, such as providing necessary resources.

Step 4: Include legal clauses that cover important issues such as non-disclosure agreements and indemnification. These provisions can help safeguard both parties against potential liabilities.

Common mistakes to avoid when creating an independent contractor agreement

While drafting an independent contractor agreement, it’s essential to be meticulous. Here are some common pitfalls to watch out for:

Ensure all required fields are filled out to avoid confusion.

Use clear, concise language to prevent misinterpretation.

Research state-specific regulations to ensure compliance.

Consider reporting requirements and tax responsibilities for both parties.

A legal professional can help identify potential issues before finalizing the document.

Editing and signing the form in pdfFiller

pdfFiller provides a seamless experience for those looking to fill out and manage the Minnesota independent contractor agreement form. To access the form, simply navigate to the pdfFiller website and search for the template.

The platform boasts various features for editing PDFs, allowing you to input information easily and efficiently. Once the form is filled out, you can follow the straightforward instructions for eSigning the agreement electronically, making the process quick and convenient.

Collaboration tools within pdfFiller enable team reviews, fostering communication between parties to ensure all elements of the agreement are satisfactory. Additionally, the version management feature helps track document changes and maintain an organized history of edits.

Managing and storing your contracts

Once your Minnesota independent contractor agreement is finalized, effective document management is crucial. Best practices for managing these important agreements include organizing them in a way that makes retrieval easy.

Using pdfFiller, you can easily organize and store your agreements in designated folders, enhancing accessibility. The platform’s cloud storage features provide added convenience, allowing you to access documents from anywhere at any time.

Security is another critical aspect; implementing strong password protections and monitoring access can safeguard your sensitive information against unauthorized use.

Navigating tax and legal considerations in Minnesota

Independent contractors in Minnesota must be aware of their responsibilities in regard to both state and federal tax obligations. Worker classification is pivotal in defining your tax status; proper classification can influence tax treatment, benefits, and eligibility.

Being informed about state versus federal tax implications is vital. For instance, contractors may need to file taxes quarterly and provide a 1099 form, detailing earnings to the IRS. Familiarizing yourself with these requirements ensures legal compliance and prevents potential penalties.

Meeting these obligations also involves keeping meticulous records of income and expenses, which can aid in accurately filing taxes as an independent contractor.

Additional templates and related forms

In addition to the Minnesota independent contractor agreement form, various other common contract templates may be relevant for individuals and businesses operating in Minnesota. These include:

Agreements that outline terms between employers and employees.

Contracts designed to protect confidential information.

Documents detailing the terms under which services are provided.

You can easily access these templates along with the Minnesota independent contractor agreement form on pdfFiller, ensuring you have all the necessary resources at your fingertips.

Learning opportunities around independent contractor agreements

To further enhance your understanding of independent contractor agreements, consider taking advantage of learning opportunities such as webinars on contract law and online courses tailored for independent contractors. These resources can provide valuable insights into creating effective agreements and knowing your rights and responsibilities.

Additionally, exploring tips for effective contract negotiation and staying updated on industry best practices can make a significant difference in how you approach independent contractor relationships.

Frequently asked questions (FAQs)

Navigating independent contractor agreements raises several common questions among professionals. Some key FAQs include:

Refer to the terms of your contract; try mediation before escalating to legal action.

Yes, independent contractors have the freedom to work simultaneously for various clients.

Employees work under the direction of an employer while independent contractors determine their working process.

Review your current contract, assess legal requirements, and draft a new independent contractor agreement.