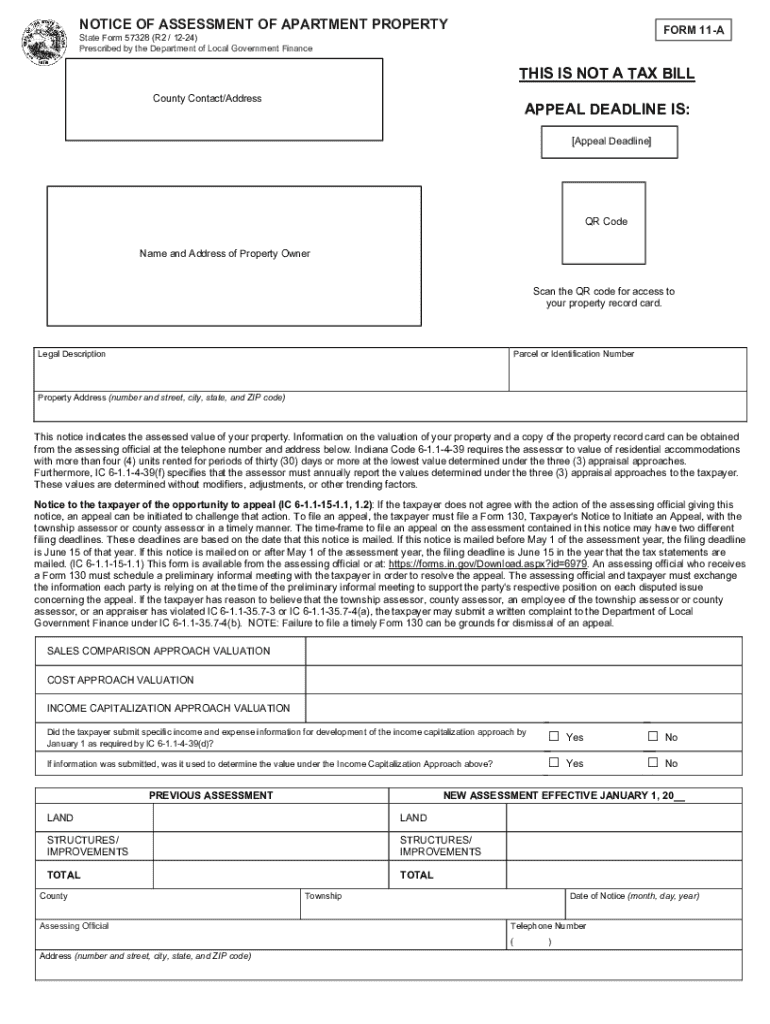

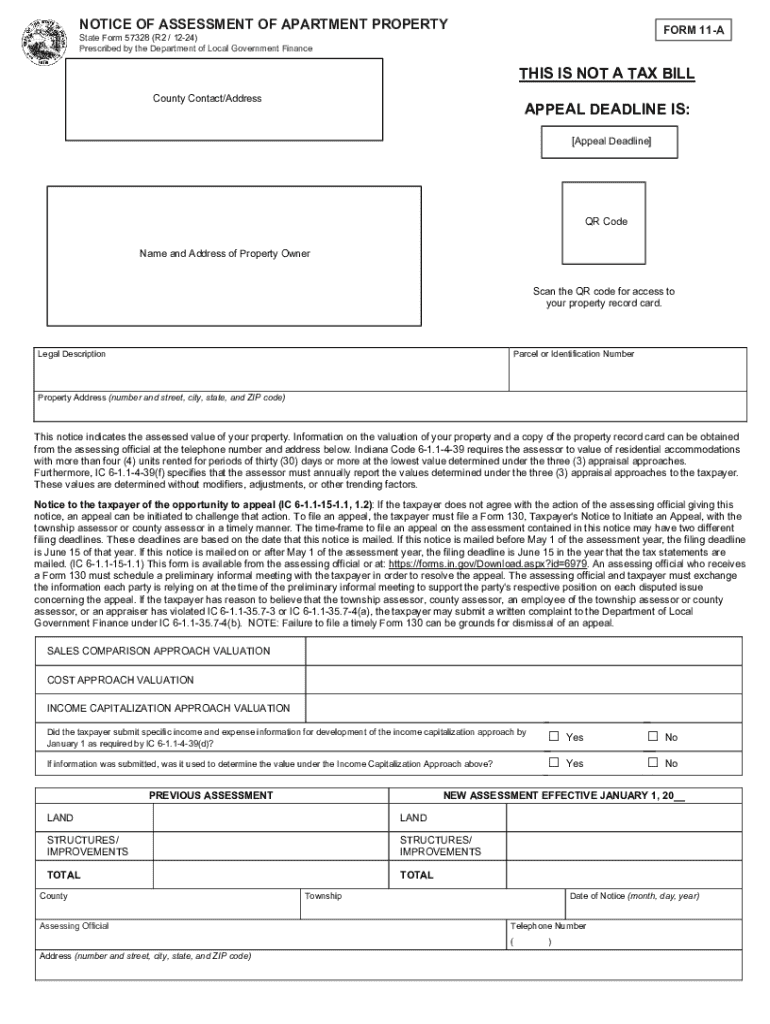

Get the free Notice of Assessment of Apartment Property

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Notice of Assessment of Form: A Comprehensive How-to Guide

Overview of the notice of assessment (NOA)

A Notice of Assessment (NOA) is an official document issued by the Canada Revenue Agency (CRA) after processing your tax return. It outlines the details of your taxable income, deductions, and the amount of tax you owe or the refund you're entitled to. The NOA is a critical part of the tax process as it serves as an official communication regarding your tax status, informing you of the CRA's evaluation of your tax return.

Understanding the components of a typical NOA is essential for taxpayers. Important elements include the tax year, which indicates the specific period your taxation reflects; the total taxable income that highlights your earnings; and the assessment amount, detailing what you owe or what will be refunded. These details are crucial for future tax preparations and financial planning.

Understanding your notice of assessment

A thorough understanding of your NOA can empower you to manage your tax obligations effectively. The NOA includes sections for personal information, which confirms your name and address, ensuring that all communication is accurate and directed to you. Another critical part details your income, which includes all sources, as well as any deductions you have claimed. Familiarizing yourself with these sections can help you identify any discrepancies or areas for review.

Common terminology found on the NOA may include "net tax owing," referring to the amount you must pay the CRA, and "refund," which indicates what you are entitled to receive if overpaid. Additionally, you'll find terms like "carryover amounts," which pertain to future tax years where unused deductions can be applied. Understanding these terms is vital for making informed financial decisions.

Steps to access and manage your NOA

Accessing your NOA has become increasingly convenient, especially through the CRA's My Account portal. To retrieve your NOA online, you first need to register for a My Account profile, where you can securely view your NOA, tax returns, and other important documents. This digital approach streamlines the process of keeping track of your tax obligations.

Alternatively, third-party services like pdfFiller can prove useful in managing your NOA. The platform offers tools for saving and organizing your document. Once you have your NOA, you can easily upload it to your pdfFiller account, allowing for secure cloud storage and easy access whenever needed. If discrepancies are found in your NOA, pdfFiller also provides straightforward options to edit the document.

Filing procedures based on your NOA

When it's time to file your taxes, your NOA can be an invaluable resource. It contains key figures that will help you prepare your return, including your previous income, which can indicate trends in your earnings. It’s essential to gather all necessary documents, including W-2s, T4 slips, and other income records, before starting the filing process.

Once you have all your documents, begin by filling out the appropriate tax forms. You may elect to e-file using platforms such as pdfFiller, which provides an efficient and secure method for submitting your tax return online. Their user-friendly interface allows for quick data entry and the ability to save your progress, which can significantly alleviate filing stress.

Frequently asked questions about the NOA

Taxpayers often have common concerns regarding their NOA. If you find discrepancies or disagree with the assessment indicated on your NOA, you can initiate a reassessment. It’s critical to gather supporting documents that clarify your stance and submit a request within the designated deadlines, usually within 90 days of receiving your NOA.

Additionally, understanding the impact of your NOA on future filings is crucial. Previous assessments can influence potential audits or financial trends, so keeping your files organized and your records up-to-date minimizes the chances of errors in future tax years.

Interactive tools and features offered by pdfFiller

pdfFiller enhances the way users manage their NOA through various interactive features. Users can engage in a live demo that showcases how to edit and sign your NOA securely, ensuring that you can make adjustments while maintaining the integrity of the document. This demonstration can be especially valuable for individuals unfamiliar with digital document management.

Moreover, pdfFiller’s collaboration features allow you to share your NOA with your tax professional directly through the platform. This not only speeds up the process of seeking advice but also enables secure communication surrounding sensitive tax data. The cloud storage advantage means you can access your NOA anywhere, at any time, providing unparalleled convenience in document management.

Best practices for record-keeping

Effective record-keeping is foundational in tax management. The CRA recommends that you retain your NOA and other tax documents for at least six years after the end of the tax year they relate to. Establishing an organized filing system—whether digital or physical—ensures you can locate essential documents swiftly, particularly if you ever face an audit.

A digital filing system has advantages such as easy access from multiple devices, reduced physical clutter, and automated backups. Remember to label your files clearly and consider categorizing them by year or type (e.g., income statements, deductions) to streamline your organization.

Navigating complex scenarios related to NOA

Complex tax situations arise, especially if your income fluctuates throughout the year. Changes in your earnings can affect your taxable income and potentially your assessments. It’s wise to consistently track your income changes so you can accurately report them, thereby minimizing the risk of discrepancies in your NOA.

Handling special deductions, such as those related to passive income or retirement contributions, requires careful documentation. For instance, if you encounter an unexpected tax obligation due to a passive income stream, it is vital to seek clarification on how these elements may alter your overall tax liability and future assessments.

Consider a case study where a taxpayer disputed an incorrect assessment with the CRA. By gathering supporting documentation and proactively communicating with the CRA, the individual successfully rectified the error, demonstrating the importance of being proactive and informed.

Conclusion: Empower yourself with knowledge

Staying informed about your Notice of Assessment is crucial for effective tax management. Understanding this document not only empowers you as a taxpayer but also enhances your financial literacy. By utilizing innovative tools like pdfFiller, you can simplify document management, ensuring your tax preparation process is smooth and efficient.

Embracing this knowledge and leveraging resources available to you can minimize tax-related stress, allowing you to focus on what matters most in your financial journey. Continue to educate yourself with further resources tailored specifically for tax management, and ensure that organizing your NOA is a priority during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice of assessment of in Gmail?

How can I get notice of assessment of?

How do I edit notice of assessment of straight from my smartphone?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.