Get the free Financial Application

Get, Create, Make and Sign financial application

How to edit financial application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial application

How to fill out financial application

Who needs financial application?

Understanding the Financial Application Form: A Comprehensive Guide

Understanding financial application forms

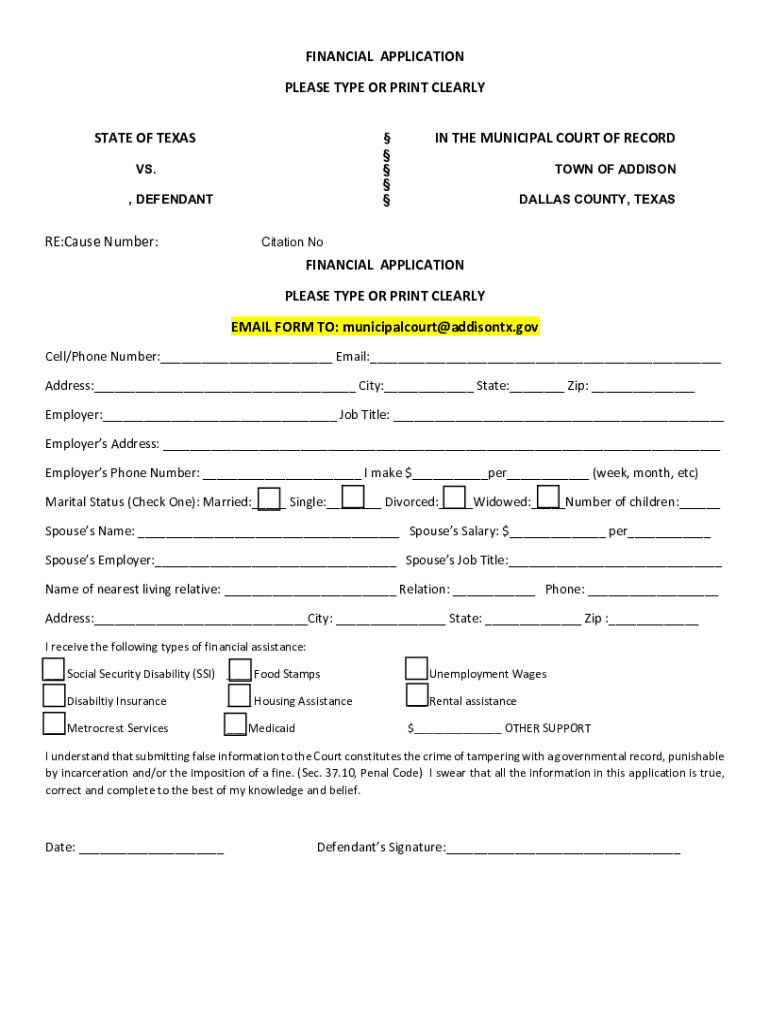

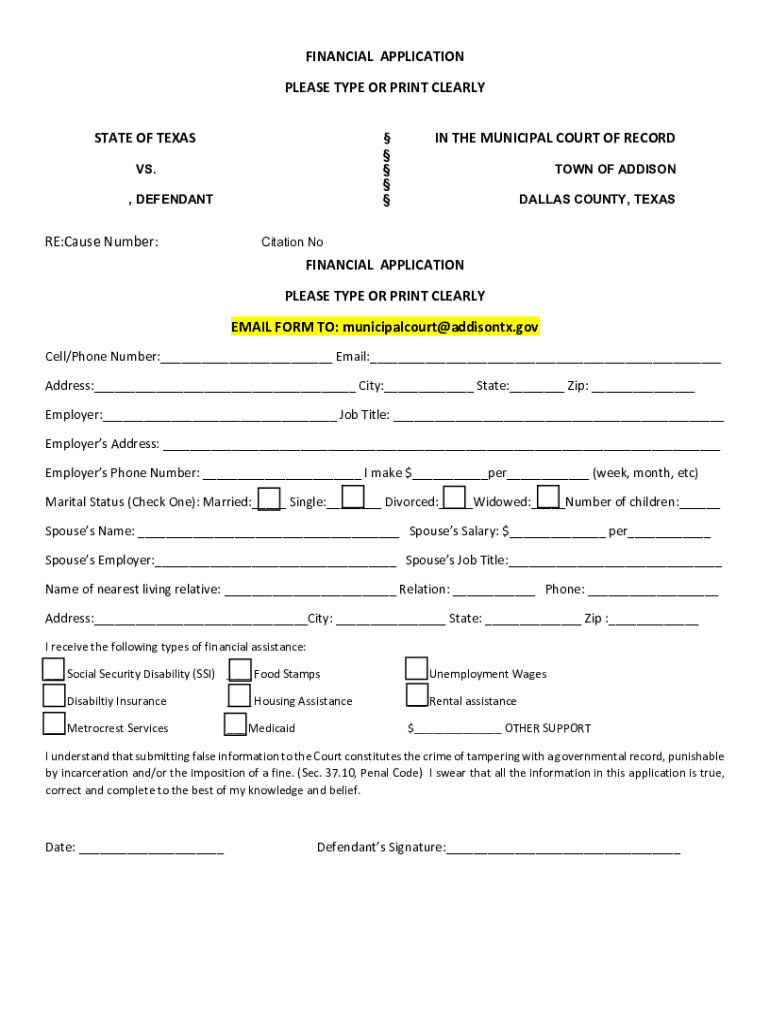

A financial application form is a critical document used to gather necessary information to assess an individual's or organization's financial status. The primary purpose of these forms is to evaluate eligibility for financial assistance, loans, scholarships, and other funding opportunities. They serve as a transparent means for entities to determine how much financial support a potential applicant qualifies for based on their documented financial circumstances.

These forms are of paramount importance for both individuals seeking aid and organizations reviewing applications. For individuals, a well-completed financial application form can mean the difference between securing funds or missing out on vital financial resources. For organizations, the forms allow for a systematic approach to narrow down candidates and ensure funds are allocated effectively.

Financial application forms are often required in various scenarios. They may be necessary for educational funding programs, government loans, personal finance applications, or even grants provided by non-profit organizations. Understanding the context in which these forms are required can streamline the application process and enhance the chances of approval.

Types of financial application forms

There are several types of financial application forms tailored for different needs, each with its own set of requirements and recipients. Here are four key categories:

Essential components of a financial application form

A well-constructed financial application form includes several critical components that help outline an accurate picture of the applicant's financial status. Understanding each section can significantly improve the chances of securing financial assistance.

Step-by-step guide to filling out financial application forms

Completing a financial application form can be daunting, but a systematic approach can simplify the process. Here’s a step-by-step guide to ensure comprehensiveness and accuracy.

Tips for enhancing your application's success rate

To increase the likelihood of your financial application form being approved, consider these tips that can make your submission stand out.

Common pitfalls to avoid

When filling out a financial application form, being mindful of potential pitfalls can prevent unnecessary setbacks. Here are some common issues to avoid:

Frequently asked questions about financial application forms

When navigating financial application forms, prospective applicants often have questions. Here are answers to some commonly asked queries:

Tools and resources for creating financial application forms

Leveraging cloud-based solutions can enhance the efficiency of creating and managing financial application forms. This approach not only promotes accessibility but also simplifies the submission process.

Related templates and examples

To assist applicants in their journey, it is useful to reference existing templates and examples of financial application forms. These resources can provide clarity and inspiration.

How to make financial application forms accessible

Accessibility in financial application forms is essential for all individuals, particularly those with disabilities. Ensuring that forms are available in formats that everyone can use will enhance inclusivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial application without leaving Google Drive?

How do I execute financial application online?

How do I edit financial application online?

What is financial application?

Who is required to file financial application?

How to fill out financial application?

What is the purpose of financial application?

What information must be reported on financial application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.