New Mexico Independent Contractor Form: A How-to Guide

Understanding independent contractors in New Mexico

Independent contractors play a critical role in New Mexico's economy, providing flexible labor solutions across various industries. By definition, independent contractors are self-employed individuals who offer services to clients under terms specified in a contract. Unlike employees, independent contractors maintain a substantial degree of control over how they perform their work.

Correctly classifying independent contractors is essential for compliance with state and federal tax laws. Misclassification can lead to significant penalties, making it vital for businesses to understand the definitions and criteria that delineate employees from independent contractors in New Mexico. The state has specific regulations governing independent contractors, aimed at ensuring fair practices and safeguarding workers’ rights.

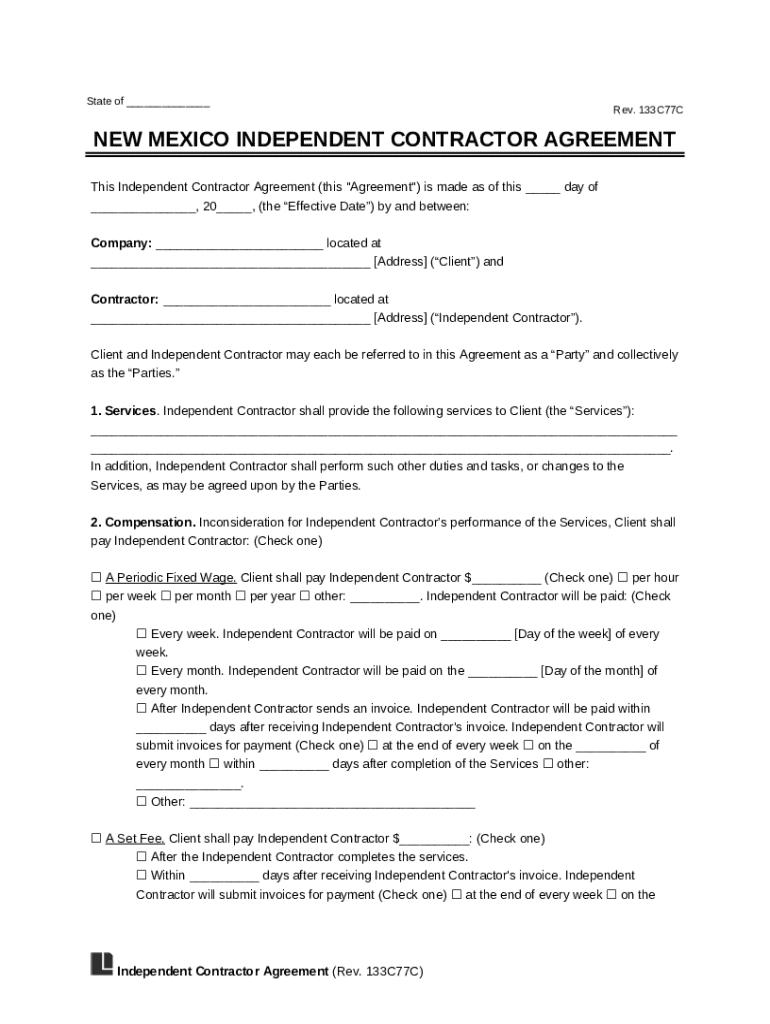

The New Mexico independent contractor form explained

The New Mexico independent contractor form serves as a formal agreement between businesses and independent contractors. This form is crucial not only for legal compliance but also to clarify the terms of the working relationship, protecting both parties involved. By having a written agreement, businesses can avoid miscommunications and set clear expectations.

Key differences between independent contractor forms and employee agreements lie in the nature of control, benefits, and obligations. While employee agreements often mention benefits like health insurance and paid time off, independent contractor forms detail specific project scopes, deadlines, and payment arrangements.

Clearly outlines the scope of work.

Defines payment terms, including rates and invoicing.

Specifies project duration.

Contains confidentiality clauses if applicable.

Essential criteria for independent contractor status in New Mexico

Determining the classification of a worker as an independent contractor hinges on several factors that assess the level of control and Independence they possess while performing their tasks. It’s important for both employers and contractors to understand how these criteria apply.

The primary factors include:

Control over work: Independent contractors typically have more freedom in deciding how to perform their work compared to employees.

Financial independence: Independent contractors usually bear the costs associated with their work, including equipment and supplies.

Relationship nature: The working relationship is often limited to specific projects without ongoing obligations on either side.

Misclassification can have serious legal implications, including liability for unpaid taxes, penalties, and back payments for unemployment insurance and workers' compensation.

Step-by-step guide to filling out the New Mexico independent contractor form

Filling out the New Mexico independent contractor form requires thorough preparation and an understanding of its sections. Before you begin, gather all necessary information to ensure accuracy.

Key information includes:

Personal information: Names, addresses, and contact details of both parties.

Scope of work: A clear description of the services to be provided.

Payment terms: Details on compensation, including rate and payment schedule.

Duration of agreement: Start and end dates of the contract.

When filling out the form, ensure that each section is completed with precision. Follow these detailed instructions for each segment to avoid any discrepancies. Once you've filled out the form, take a moment to review for accuracy and compliance with state guidelines.

Editing and managing your form with pdfFiller

pdfFiller provides a robust online platform that enables users to efficiently edit and manage the New Mexico independent contractor form. With its user-friendly interface, you can make necessary changes to your document seamlessly.

Collaborating with other parties on the form is straightforward. You can invite them to view or edit the document directly on the platform, thus streamlining communication and reducing the potential for errors. Moreover, pdfFiller supports digital signatures, allowing you to eSign your form effortlessly without the hassles of paper.

Common challenges and solutions when working with independent contractor forms

Filling out and managing independent contractor forms can come with several challenges, such as unclear terms, miscommunications, or incomplete information. Addressing these issues promptly is essential for maintaining a professional working relationship.

Some common challenges include:

Insufficient clarity on scope of work, leading to expectations that are not met.

Misunderstandings regarding payment terms.

Issues with contract duration or termination procedures.

To address these challenges effectively, consider seeking legal advice to interpret contractual obligations. Utilizing resources and tools, including the capabilities of pdfFiller, can facilitate better compliance and ease the process of form management.

Best practices for engaging independent contractors

Establishing a healthy working relationship with independent contractors requires clear expectations. Start by clearly outlining project requirements and paying attention to the contractor's input to foster collaboration.

While drafting the independent contractor form, always ensure compliance with New Mexico labor laws to protect both parties. Maintaining detailed records of conversations, agreements, and payments can help in case of disagreements or misunderstandings.

Define the project scope clearly.

Discuss payment terms upfront.

Encourage open communication throughout the project.

Keep a written record of agreements and communications.

Frequently asked questions (FAQs) about the New Mexico independent contractor form

Addressing common queries about the New Mexico independent contractor form can clear up uncertainties and foster confidence among contractors and businesses alike.

What should be included in the independent contractor form? Typical components include personal details, scope of work, payment terms, and duration.

Is the independent contractor form legally binding? Yes, once signed, it acts as a binding agreement between the involved parties.

How do you amend an existing independent contractor agreement? Amendments should be documented in writing and signed by all parties.

What happens if there’s a dispute? Disputes should ideally be addressed through clear communication, but in some cases, legal intervention may be necessary.

Resources for independent contractors in New Mexico

Independent contractors in New Mexico can leverage various resources for assistance and support. The state provides guidelines and regulations to help navigate the landscape effectively.

Useful resources include state websites that outline contractor rights and responsibilities, as well as services that offer educational materials to enhance understanding.

Links to New Mexico State Resources for Independent Contractors.

Access to tools offered by pdfFiller for document management.

Opportunities for attending educational workshops focused on compliance and best practices.

Next steps after completing the New Mexico independent contractor form

After completing your New Mexico independent contractor form, the next steps include submitting your form according to the specifics agreed upon with your client or business partner. Ensuring all parties are informed about the terms of the agreement is crucial.

It's essential to keep track of the terms and compliance requirements outlined in the agreement and to follow up with clients or agencies for acknowledgments. Doing so helps keep communication lines open and fosters a professional relationship.