Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out 2024 property tax statement

Who needs 2024 property tax statement?

2024 Property Tax Statement Form - How-to Guide

Overview of the 2024 property tax statement form

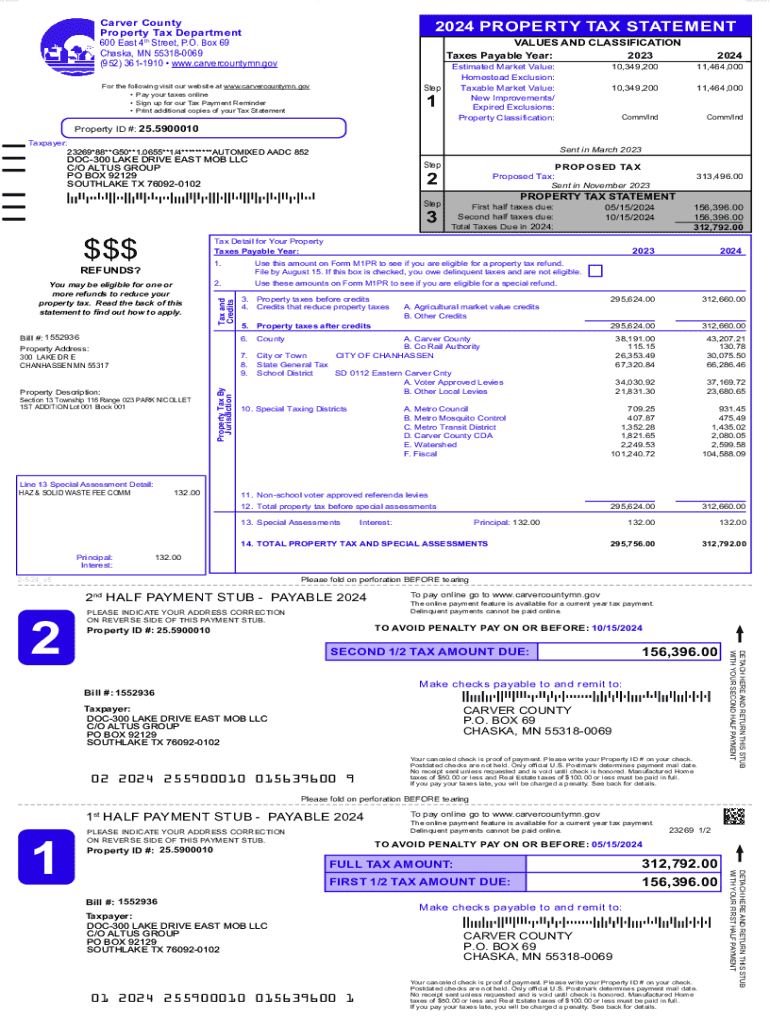

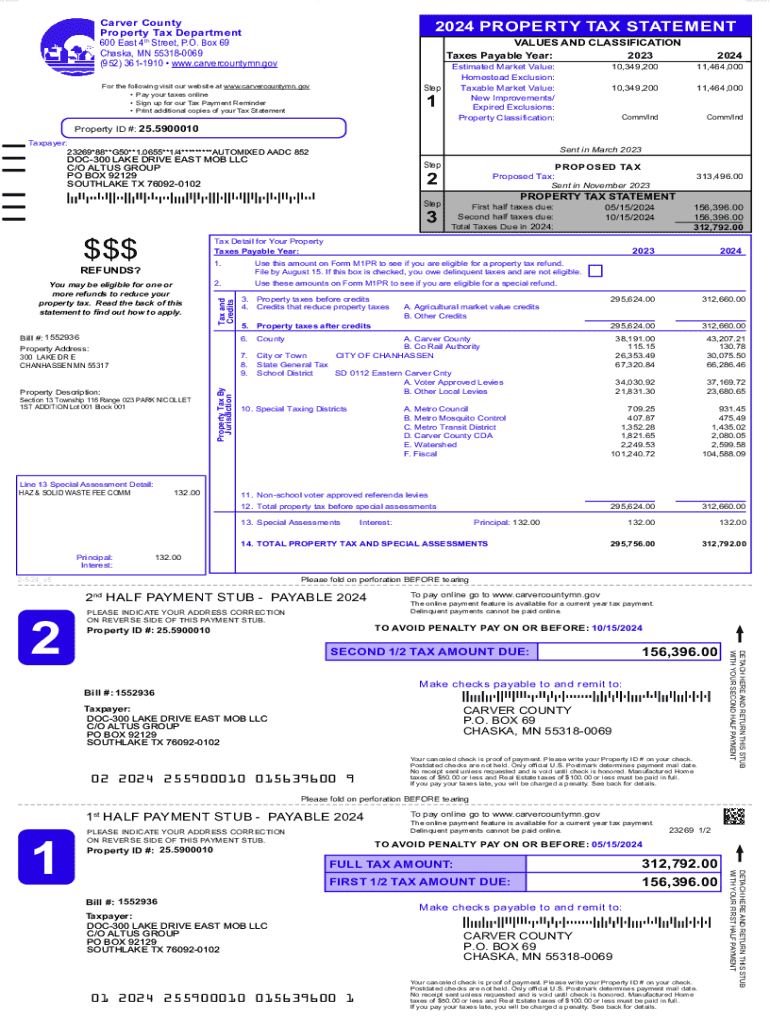

The 2024 property tax statement form serves as an essential document that outlines the taxes owed on a property for the fiscal year. Its primary purpose is to inform property owners of their tax obligations, including assessments of property value and due dates for payment. The form, typically mailed or made available online by local tax authorities, is crucial for ensuring that property owners are aware of their financial responsibilities concerning real estate. Understanding this document is vital, as it impacts financial planning, budgeting, and long-term property investment strategies.

Key updates for 2024 include adjustments in assessment methods and potential changes in tax rates due to shifts in local governance or policy updates. Being aware of these updates can help property owners anticipate changes in their tax bills and take proactive measures to address them.

Gaining a comprehensive understanding of your tax statement ensures you are well-prepared for payment and appeals, should discrepancies arise in valuations or assessments. This awareness can empower you to engage with local taxation authorities effectively.

Accessing your 2024 property tax statement

Accessing your 2024 property tax statement is easier than ever, with numerous options for both online and paper copies. Most counties provide digital access; therefore, property owners should start by checking their local tax authority's website. This often entails entering specific information, such as your property address or parcel number, to locate your statement quickly.

If you prefer a traditional route, you can request a paper copy by contacting your local assessor's office directly. Make sure to provide your personal information and property details to expedite the process.

Understanding the components of the property tax statement

Navigating the 2024 property tax statement requires familiarity with its various components. Each section furnishes critical information necessary for understanding your tax obligation fully. The first component is taxpayer information, which includes your name, addresses, and, sometimes, identification numbers. This section is crucial for ensuring that the statement is correctly associated with the right individual or entity.

Next, you will find a property description, detailing your property's characteristics such as size, location, and category. The assessment information will reveal the assessed value of your property, which is often updated annually and serves as the base for calculating your taxes. Finally, the statement outlines the total tax amounts due and associated payment due dates, ensuring you know when to remit payments to avoid penalties.

Understanding key terms like assessed value, which refers to the valuation assigned to your property for tax purposes, and millage rate, which determines the amount of tax per $1,000 of assessed value, further enhances your comprehension of the statement.

How to fill out your 2024 property tax statement form

Filling out the 2024 property tax statement form can seem intimidating, but by following a structured approach, you can navigate this process smoothly. Start by gathering required information, including your personal details like name, address, and property identification number, if necessary. Ensuring all details are up-to-date can prevent complications down the line.

Next, fill in the specific details of your property, including its assessed value and other relevant characteristics outlined in your statement. It’s essential to double-check these numbers for accuracy, as mistakes can lead to either overpayment or underpayment of taxes.

Using a calculator can be helpful to ensure accuracy when calculating your total tax owed. Lastly, reviewing your completed form thoroughly helps ensure there are no errors, setting you up to move forward confidently.

Editing and managing your property tax statement

Managing your 2024 property tax statement form becomes hassle-free when using pdfFiller. This platform offers intuitive tools for editing your PDF document, allowing you to make updates to your tax information with ease. Utilizing its user-friendly interface, property owners can enter changes directly on the form, ensuring accuracy and reducing the chances of returning to the local tax office with incorrect data.

Moreover, pdfFiller’s collaborative features facilitate teamwork for individuals who may need assistance or wish to review the statement with other stakeholders. You can easily share your document with team members, enabling efficient discussions and changes.

Signing and submitting your 2024 property tax statement

Once your 2024 property tax statement form is complete, it’s time to sign and submit it. Forums like pdfFiller make this process efficient, offering options for e-signing directly within the platform. This feature is particularly convenient, allowing you to sign documents electronically without the need for physical printing or scanning.

When it comes to submission, you can choose between online filing or mailing a paper form. Online submissions are often instantaneous and can help expedite the processing time compared to traditional mailing methods. Upon submission, you will receive a confirmation that you can save for your records.

Common mistakes and troubleshooting

Despite best efforts, errors can occasionally occur when filling out the 2024 property tax statement form. Common mistakes include missing information or miscalculations, both of which can lead to delays or issues with your tax filing. To avoid such pitfalls, be thorough in your review process.

If you do discover errors, don’t hesitate to reach out to your local tax authority promptly. They can guide you on the necessary steps to correct any mistakes. Additionally, keeping copies of previous tax statements can help ensure that the information you are providing is consistent year over year.

Understanding payment options for your property taxes

Understanding your payment options is vital for managing your 2024 property tax statement efficiently. Most tax authorities offer multiple payment methods to accommodate various preferences. Online payment has become increasingly popular, as it offers convenience and immediate confirmation of payment. Residents can utilize pdfFiller to guide them through this process seamlessly.

For those who prefer traditional methods, options include payment by phone, cash, or check. Make sure to review any potential fees associated with each method as they can vary. Setting up payment reminders and alerts is an excellent strategy for ensuring you do not miss critical deadlines.

Resources for property tax questions and support

If you have questions or need assistance regarding your 2024 property tax statement, numerous resources are available. If you are using pdfFiller, help is literally just a click away, with integrated customer support features provided within the platform. Whether you have questions about features or issues using the service, you can find guided assistance that caters to your exact needs.

For broader property tax inquiries, consider contacting your local tax authority directly. Keeping a list of key numbers or email addresses handy is effective for quick communication. Online communities and forums can also serve as valuable resources, connecting you with fellow property owners who might share insights or personal experiences.

Future considerations for property tax management

As you navigate through your 2024 property tax statement, think about future considerations for ongoing management. Platforms like pdfFiller offer numerous tools and features that can simplify managing property tax documents annually. Utilizing these resources can help you keep accurate records and prepare for future tax seasons.

Consider planning for changes in property taxes by staying informed on local government regulations and community developments that may affect property values. You may also look into educational opportunities or webinars to enhance your understanding of tax management and assessments. This proactive approach will equip you to handle your property taxes with confidence and clarity.

Conclusion

In summary, the 2024 property tax statement form is a critical document for property owners, outlining their financial responsibilities for the year. Having a thorough understanding of each component of your statement and utilizing tools like pdfFiller will simplify the tax management process, allowing you to focus on what matters most. Always ensure to check for updates, stay informed about your tax obligations, and maintain organization for a smoother experience each tax year.

By leveraging the capabilities of pdfFiller, you will empower yourself to manage all your tax-related documents efficiently, ensuring accuracy and timely submission. Utilize the resources and features available to you, and approach your property taxes with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form in Chrome?

How do I fill out pdffiller form using my mobile device?

How do I complete pdffiller form on an iOS device?

What is 2024 property tax statement?

Who is required to file 2024 property tax statement?

How to fill out 2024 property tax statement?

What is the purpose of 2024 property tax statement?

What information must be reported on 2024 property tax statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.