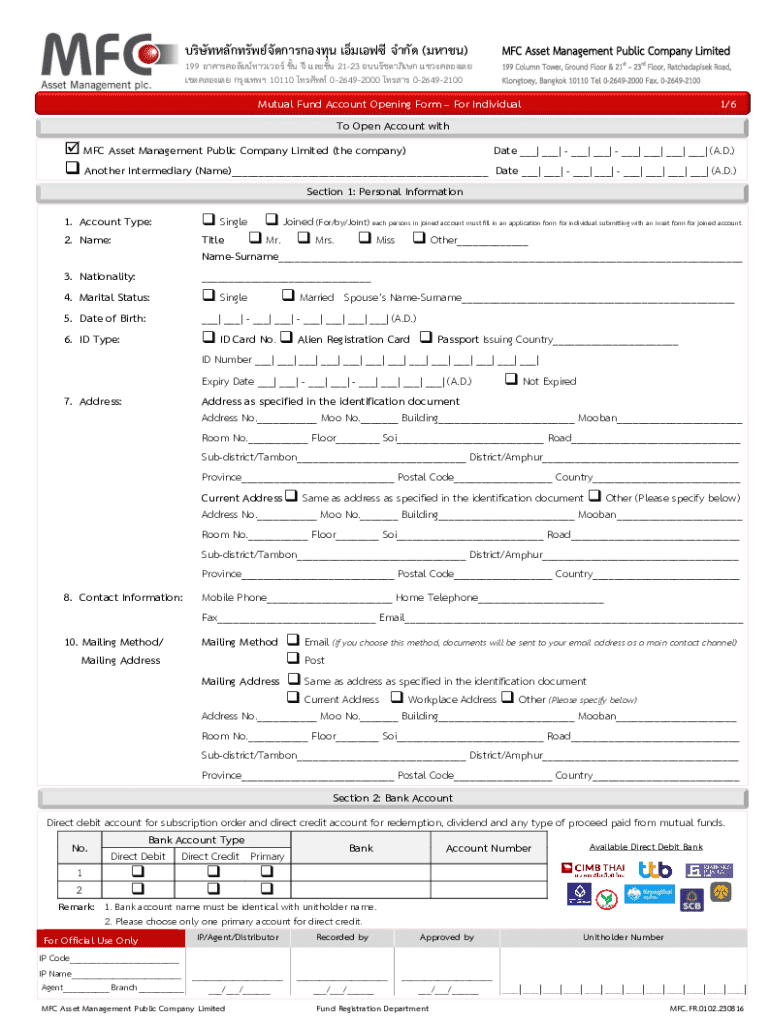

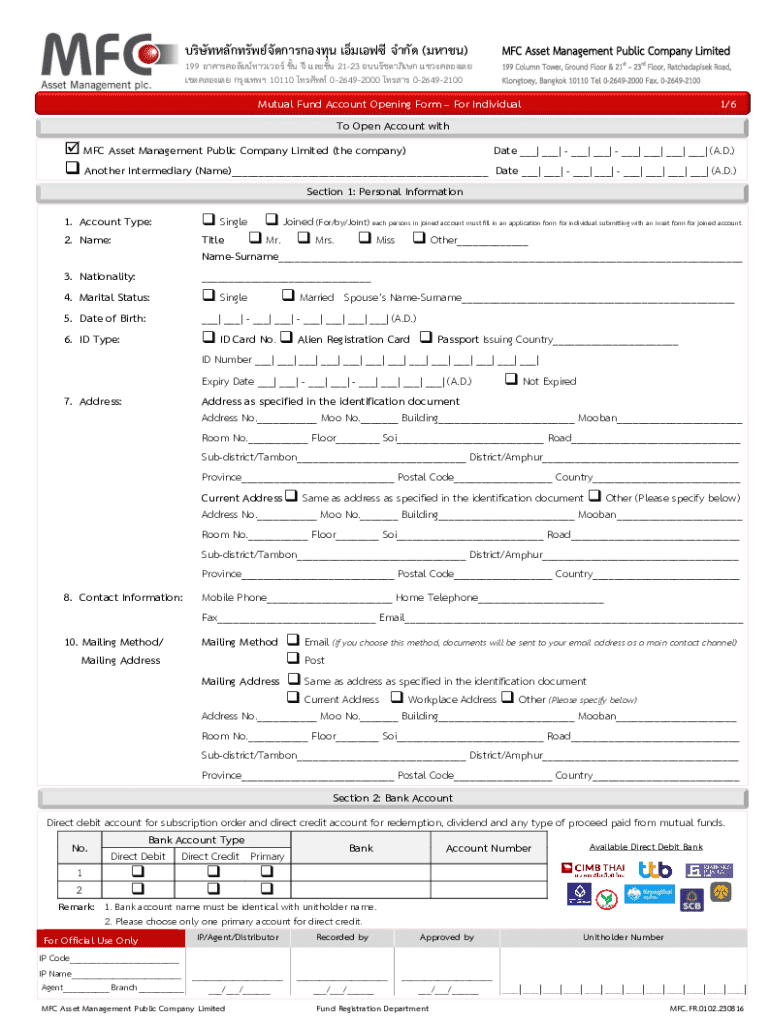

Get the free Mutual Fund Account Opening Form – for Individual

Get, Create, Make and Sign mutual fund account opening

Editing mutual fund account opening online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund account opening

How to fill out mutual fund account opening

Who needs mutual fund account opening?

Mutual fund account opening form how-to guide

Overview of mutual fund investing

Mutual funds serve as a popular investment vehicle, bringing together the money of multiple investors to purchase a diverse portfolio of stocks, bonds, or other securities. Understanding what a mutual fund is and how it operates can empower investors to leverage this tool effectively. Investing in mutual funds allows individuals to benefit from professional management and diversification, reducing the risk associated with investing directly in individual assets.

The benefits of investing in mutual funds are abundant. They offer liquidity, as investors can redeem shares at any time. Additionally, mutual funds provide an opportunity for investors with varying levels of capital to participate in the market, as they usually have low initial investment requirements. There are several types of mutual funds including equity funds, debt funds, hybrid funds, and index funds, each catering to different investment goals and risk preferences.

Importance of the account opening form

The mutual fund account opening form is a crucial document in the investment process. It establishes the legal foundation for your investment and ensures that your identity and financial details are properly verified. Without this form, investors cannot set up their investment accounts, making it a key step towards accessing the world of mutual funds.

Preparing to fill out the mutual fund account opening form

Before diving into filling out the mutual fund account opening form, gathering the necessary information is essential to ensure a smooth process. This includes important personal and financial details that the fund provider will require to evaluate your eligibility and to comply with regulatory guidelines.

Step-by-step guide to completing the mutual fund account opening form

Completing the mutual fund account opening form requires careful attention to detail, as each section has specific requirements that help fund houses assess your application.

Editing and managing your form with pdfFiller

pdfFiller revolutionizes how you manage your mutual fund account opening form. With its user-friendly interface, investors can easily navigate the form editing process. Whether you need to fill in missing information, correct an error, or simply update your details, pdfFiller facilitates these changes swiftly.

Common mistakes to avoid

Filling out the mutual fund account opening form may seem straightforward, but certain pitfalls can emerge. Avoiding these mistakes can save you time and ensure a smooth application process.

Submitting your mutual fund account opening form

After completing the mutual fund account opening form, understanding the submission process is vital to ensure that your application is processed without issues. You’ve essentially two options: online and offline submission.

Tracking your application status

Once you’ve submitted your mutual fund account opening form, keeping track of your application status is essential. Many fund providers offer convenient online tracking tools that allow you to check your application’s progress without the need for contacting customer service.

Frequently asked questions (FAQs)

As with any financial process, questions may arise when filling out the mutual fund account opening form. Below are some of the most commonly asked questions to help clarify the process.

Additional services related to mutual fund investments

Beyond the mutual fund account opening form, a range of additional services exists to facilitate your investment journey. Understanding these can augment your investment strategy and management.

pdfFiller's unique value proposition

pdfFiller equips investors with tools that simplify document management throughout the mutual fund account opening process. The platform's cloud-based features allow users to access and edit their mutual fund account opening forms from anywhere, making it ideal for on-the-go investors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mutual fund account opening?

How do I edit mutual fund account opening on an iOS device?

How can I fill out mutual fund account opening on an iOS device?

What is mutual fund account opening?

Who is required to file mutual fund account opening?

How to fill out mutual fund account opening?

What is the purpose of mutual fund account opening?

What information must be reported on mutual fund account opening?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.