Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Campaign Finance Receipts Expenditures Form - How-to Guide

Understanding campaign finance: A primer

Campaign finance refers to the funding of political campaigns, encompassing both individual and organization contributions aimed at influencing elections. This financial framework is crucial because it underpins the operational capability of campaigns, affecting their outreach and effectiveness. Tracking receipts and expenditures is not just about maintaining good practices; it's also legally mandated to ensure transparency and accountability. Ethical considerations further emphasize the importance of clear financial reporting, offering voters insights into who supports candidates and campaigns.

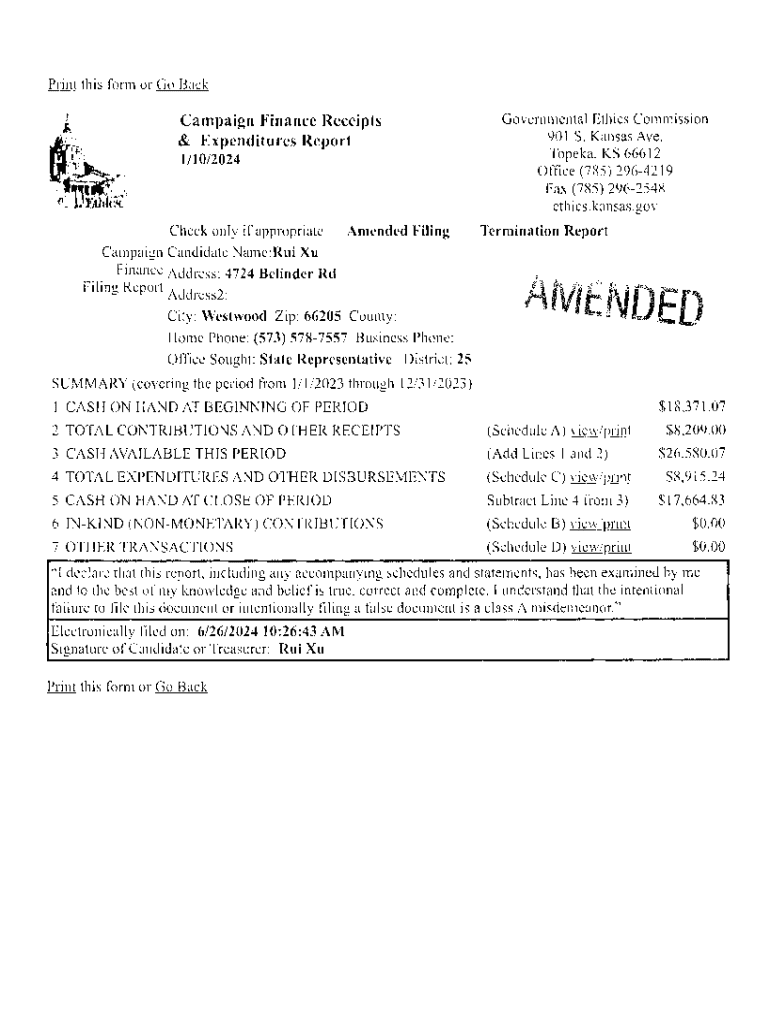

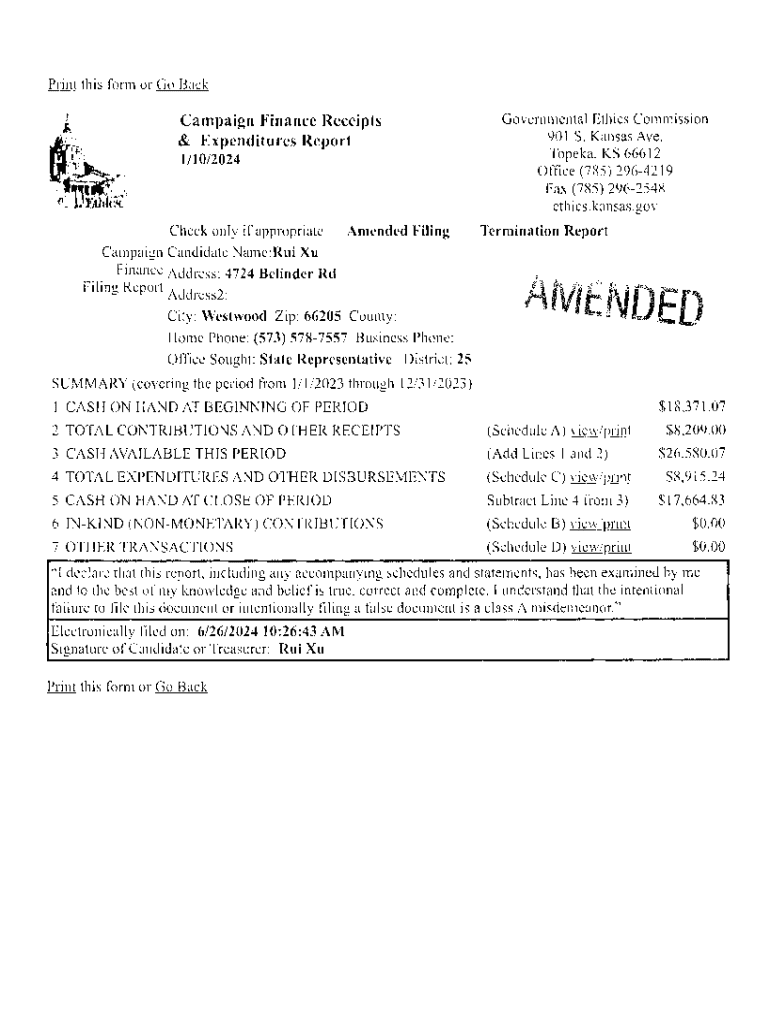

Overview of the campaign finance receipts and expenditures form

The campaign finance receipts and expenditures form is a vital tool for political candidates and committees to report their financial activities. This form serves several purposes, including tracking contributions received and expenditures made during a campaign. Its significance lies not only in compliance with legal mandates but also in fostering transparency within the electoral process. Each component of the form, ranging from donor information to expenditure categories, plays a critical role in accurately reflecting the financial state of a campaign.

Key components of the form include the identification of receipts, detailing sources of income, and a comprehensive breakdown of expenditures, listing various costs associated with campaign activities. This meticulous documentation is essential for maintaining compliance with both federal and state regulations.

Preparing to fill out the form

Before diving into filling out the campaign finance receipts and expenditures form, it’s vital to gather all necessary documentation. This includes detailed records of receipts such as contributions, donations, and other forms of income, including in-kind contributions. On the expenditure side, you'll need to document every expense, from advertising costs to office supplies and payments to staff.

Step-by-step instructions for filling out the form

When it comes to reporting receipts, Section 1 of the form is particularly critical. Required fields include donor information such as name, address, and the donation amount. It’s essential to categorize donations accurately, distinguishing between individual contributions, corporate donations, and other types to maintain compliance with guidelines.

For expenditures, Section 2 requires a detailed breakdown of each cost incurred. This section should not only provide various types of expenditures, such as advertising and fundraising costs, but also include documentation required for verification, like receipts and contracts.

Common mistakes to avoid when completing the form

Completing the campaign finance receipts and expenditures form can be intricate, and there are several common pitfalls to be wary of. One major error is failing to provide complete or accurate reporting, which can lead to compliance issues down the road. Misclassification of donations or expenses can also result in complications during audits or reviews. It’s crucial to be conscious of deadline oversights as well, understanding that federal timelines may differ from state requirements.

Tools for managing campaign finance documentation

Managing campaign finances can be simplified and streamlined using interactive resources available on pdfFiller. The platform offers cloud-based solutions, allowing campaign teams to access, fill out, and manage the campaign finance receipts expenditures form from anywhere. Additionally, pdfFiller includes eSign tools that enable easy collaboration among team members, ensuring all necessary parties can contribute without geographical limitations.

Submitting the campaign finance receipts and expenditures form

Once the form has been completed, it’s essential to understand how and where to submit it. Submissions can generally be filed online or via paper forms, depending on local regulations. It’s crucial to check for state-specific submission portals where required, as these procedures can vary significantly.

Understanding the compliance checks that follow submission is also vital. Prepare your campaign for potential audits by maintaining organized records and verifying that all reported information aligns with submitted data.

After submission: Monitoring and reporting changes

The work does not end with the submission of the campaign finance receipts expenditures form. Continuous monitoring and updating of campaign records are crucial to ensure ongoing compliance. If there are changes to previously reported data, knowing how to amend submitted forms is essential. Utilizing pdfFiller’s tools allows for real-time updates and collaborative reviews, making it easier for campaign teams to stay informed and aligned.

FAQs about the campaign finance receipts and expenditures form

Navigating the campaign finance receipts expenditures form can raise several questions among candidates and committees. For instance, what happens if the form is filed late? Generally, late filings may incur penalties or sanctions. Similarly, handling disputed donations or expenditures entails providing clear documentation and, if necessary, seeking resolution from governing bodies. Clarifications on the different types of contributions can also play a significant role in how finances are managed.

Best practices for future campaign financing

Engaging in effective fundraising strategies and maintaining rigorous expense tracking is key to successful campaign financing. Candidates and their teams should focus on creating a culture of compliance, ensuring that transparency and adherence to legal standards are prioritized. Building a reliable team dedicated to financial management not only alleviates the burden on candidates but also establishes a streamlined process for handling campaign finances moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send campaign finance receipts expenditures for eSignature?

How can I fill out campaign finance receipts expenditures on an iOS device?

Can I edit campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.