Get the Tax Free Cash & Income - Application form

Get, Create, Make and Sign tax cash amp income

Editing tax cash amp income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax cash amp income

How to fill out tax cash amp income

Who needs tax cash amp income?

Tax Cash Amp Income Form: A Comprehensive How-To Guide

Understanding the tax cash and income form

The Tax Cash and Income Form serves as a crucial document for individuals and businesses alike, providing a structured means to report earnings and related financial activities to tax authorities. Its primary purpose is to ensure compliance with tax laws while accurately reflecting income derived from various sources, particularly cash transactions. Accurate reporting is essential; failure to do so can lead to audits, penalties, and in some cases, criminal charges.

There are several scenarios where you might need this form. Freelancers and independent contractors, for example, often report cash income that may otherwise go unrecorded. Additionally, small business owners who receive payments in cash ought to complete this form to ensure their tax obligations are met. Understanding when and how to utilize this form is integral to maintaining proper financial practices.

Getting started with the tax cash and income form

Before diving into the specifics of filling out the Tax Cash and Income Form, you need to determine your eligibility. Eligibility generally depends on your income level, filing status, and whether you have multiple income sources. Familiarizing yourself with the necessary documentation is also important.

Be mindful of the deadlines associated with submitting the Tax Cash and Income Form, typically due on the 15th of April annually, unless extended for certain conditions. Being aware of these dates can save you from costly penalties and interest.

Filling out the tax cash and income form step-by-step

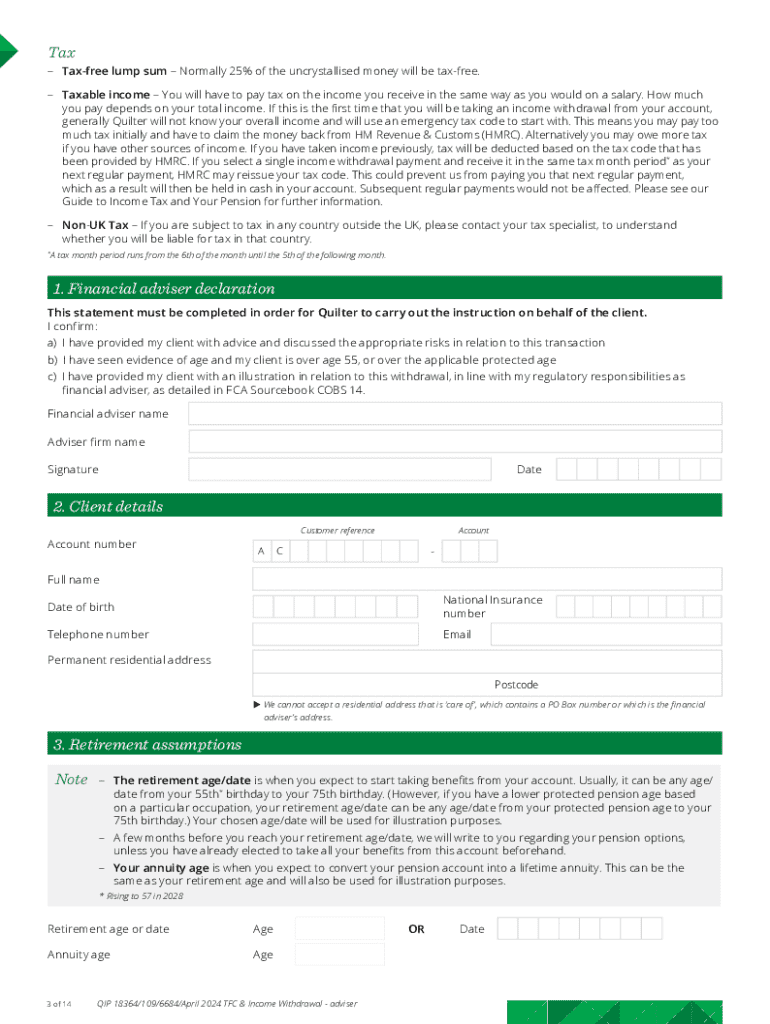

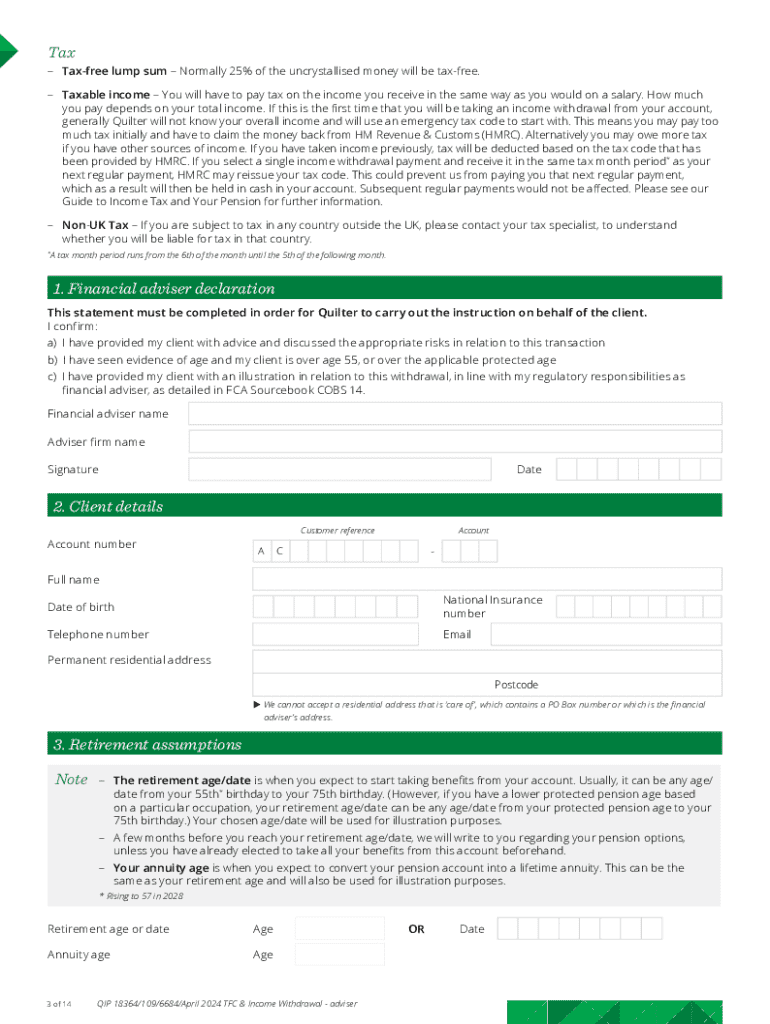

Filling out the Tax Cash and Income Form requires careful attention to detail. Start with Section 1, which gathers your personal information. You will need to provide your full name, your address, Social Security number, and any relevant identification information. Ensuring that this data is accurate is crucial. Any discrepancies can delay processing or trigger audits.

Moving on to Section 2, focus on income reporting. This is where you’ll classify all sources of income. Include cash income from freelancing, tips, or any sideline businesses. If you have multiple income streams, it’s a good idea to maintain separate records to simplify this process. Itemizing these income sources can help prevent errors.

Section 3 delves into deductible expenses. These are costs you’ve incurred that can be subtracted from your total income, reducing your taxable earnings. Common deductible expenses may include business travel costs, material purchases for freelance projects, and home office deductions. Make sure you categorize these correctly and keep receipts for verification.

In Section 4, consider additional items or claims such as tax credits for which you may be eligible. This may include credits related to educational expenses or deductions for losses carried forward from previous years. Understanding these nuances can help maximize your tax return.

Utilizing interactive tools for accuracy

One effective way to ensure your Tax Cash and Income Form is filled out correctly is using interactive tools provided by pdfFiller. Their platform allows for easy editing and provides templates that take the guesswork out of form selection. With pdfFiller, you can also input your information directly into the digital form.

After filling out your form, pdfFiller also provides options for securely eSigning and sharing your document. This is particularly beneficial for freelancers who need to send forms directly to clients or tax authorities in a timely fashion.

Common mistakes to avoid when filling out the tax cash and income form

When handling tax forms, common pitfalls can lead to complications during the filing process. The first mistake is misreporting income, which can arise from forgetting any cash transactions or underreporting earnings. Such oversights can attract unwanted scrutiny from tax authorities.

By being aware of these common errors, you can take proactive measures to ensure your form is submitted without issues.

Reviewing and submitting your completed form

Once your Tax Cash and Income Form is filled out, it’s vital to review it thoroughly. Double-check each section to ensure all information is accurate and complete. A systematic approach works well here—verify personal information first, followed by income details and then deductible expenses.

After ensuring accuracy, you can submit your form electronically via pdfFiller. This platform not only simplifies the submission process but also allows you to receive a confirmation of submission, giving you peace of mind knowing your form was filed correctly.

Managing your tax documents post-submission

After your Tax Cash and Income Form has been submitted, organizing your tax records is crucial for future reference. Keep comprehensive records of all filings to ensure clarity in case you are audited or need to revisit any past claims.

Furthermore, keeping track of any refunds or additional payments due will help in managing personal finances effectively throughout the year. Regularly reviewing your records can help identify any discrepancies or adjustments needed before the next filing period.

FAQs about the tax cash and income form

Addressing common concerns regarding the Tax Cash and Income Form can help alleviate anxiety and confusion surrounding tax season. One frequent question is how to correct errors after submission. If you discover mistakes on your form post-filing, you should file an amended return as soon as possible to avoid penalties.

These FAQs highlight the importance of remaining informed about your filing status and know-how to act in various situations.

Additional insights related to the tax cash and income form

Tax laws continually evolve, impacting how individuals and businesses report their income. Staying updated on tax law changes is essential. These changes can affect allowable deductions, income classifications, and filing requirements, emphasizing the importance of thorough tax reporting.

Looking ahead, trends in tax filing suggest a significant shift towards digital solutions. Platforms like pdfFiller not only streamline the filing experience but ensure accuracy and security in handling sensitive information. Adapting to these trends will facilitate more efficient tax management.

Conclusion: Embracing efficient tax management

In conclusion, completing the Tax Cash and Income Form correctly is vital for ensuring compliance with tax regulations and optimizing your financial situation. Utilizing tools like pdfFiller enhances your document management process, making it easier to track income, report accurately, and store pertinent documents securely. By investing time in understanding your tax obligations, you can embrace a more efficient approach to tax management and minimize future complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax cash amp income to be eSigned by others?

How can I get tax cash amp income?

How do I fill out the tax cash amp income form on my smartphone?

What is tax cash amp income?

Who is required to file tax cash amp income?

How to fill out tax cash amp income?

What is the purpose of tax cash amp income?

What information must be reported on tax cash amp income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.