Get the free Annual Report

Get, Create, Make and Sign annual report

Editing annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual report

How to fill out annual report

Who needs annual report?

Comprehensive Guide to Completing Your Annual Report Form

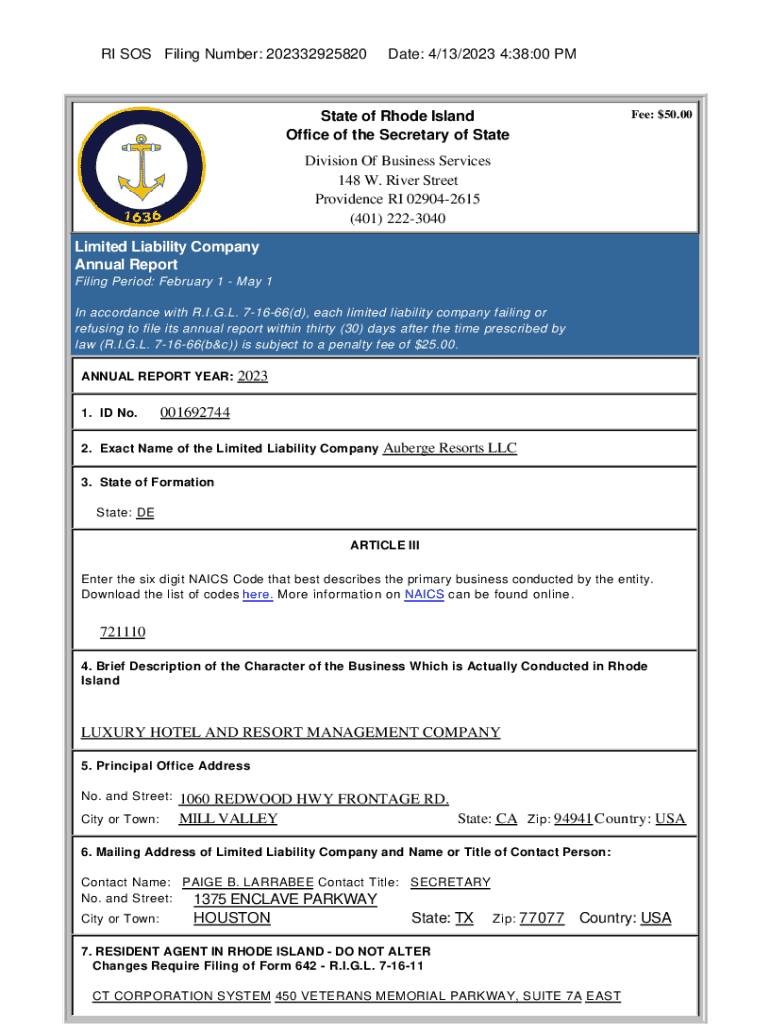

Overview of the annual report form

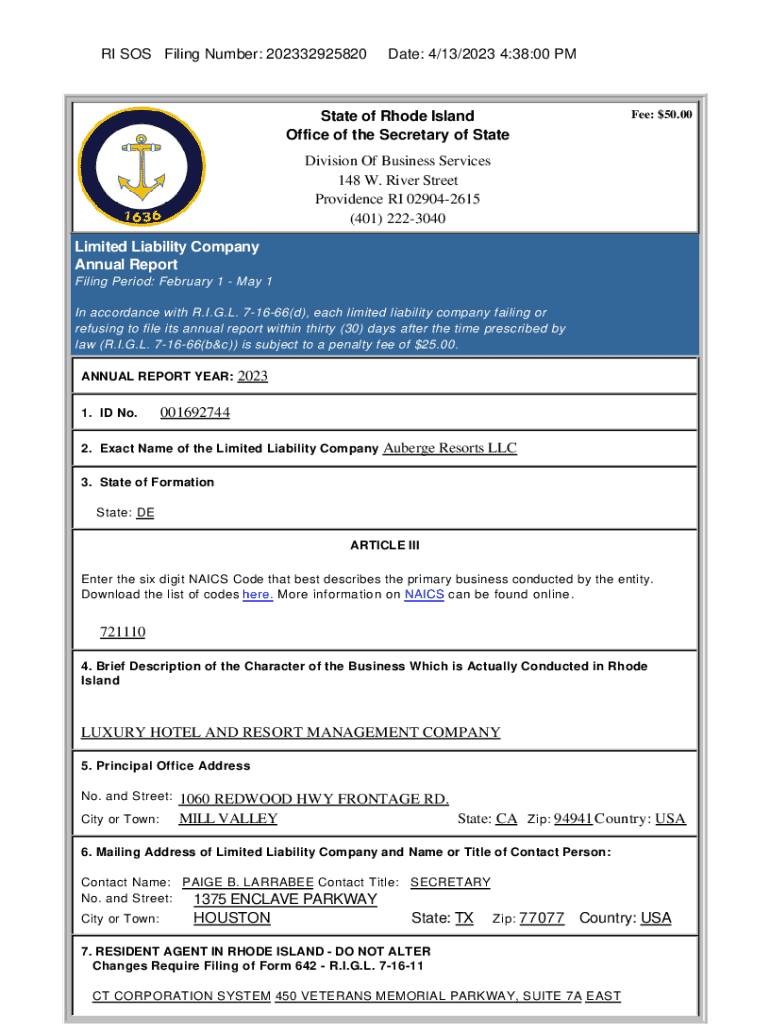

An annual report form is a crucial document that summarizes a company's financial performance and activities over the preceding year. It serves multiple purposes, from providing stakeholders with essential insights about the organization to ensuring compliance with legal regulations. Depending on the type of entity—be it a corporation, nonprofit organization, or partnership—the specific format and requirements of the annual report can differ significantly.

For businesses and organizations alike, the annual report form is not merely a bureaucratic formality; it is a vital tool for transparency and accountability. Investors, donors, and regulators often scrutinize this document to gauge the organization's performance, strategically aligning expectations for the year ahead. Furthermore, numerous jurisdictions mandate the submission of an annual report form, making it an essential aspect of corporate governance.

Understanding the annual report requirement

An annual report typically contains several key components: a letter from the board of directors, an overview of the company's mission and strategies, detailed financial statements, and information about governance. While corporate annual reports may focus heavily on financial health through audited results and balance sheets, nonprofit annual reports frequently emphasize social impact and fundraising outcomes.

Filing an annual report is not just a suggestion—it is often a legal requirement. Neglecting this obligation can lead to penalties such as fines, loss of good standing, or even the dissolution of the business. Therefore, compliance is essential. One of the primary benefits of staying compliant with annual report regulations is the positive perception it cultivates among stakeholders, which can enhance reputational standing and attract potential investors.

Preparing to file your annual report

Before you begin the filing process for your annual report, gathering all necessary information is crucial. Generally, you will need key data points such as your business name, registered address, ownership structure, and any relevant identification numbers. Depending on the legal structure of your entity, additional information may be required, particularly concerning financial statements and operational activities for the year.

A common pitfall during this phase is inaccuracies in the submitted information. Double-checking all entries, including business details, is essential to ensure compliance. Another frequent mistake businesses encounter is missing the reporting deadlines, which can result in late fees and unwanted complications. Organizing your records and setting alerts for submission deadlines can help mitigate these concerns.

Steps to fill out the annual report form

Once you are ready to fill out your annual report form, the first step is to access the current version. It's vital to download the most updated annual report form, available through your state or regulatory agency’s official website. Using outdated forms can lead to complications or even rejections and delays in processing.

Carefully completing each section is essential for a successful submission. Here is a breakdown of the common sections you will encounter:

Managing and submitting your annual report

After diligently filling out the annual report form, the next step is selecting a filing option. Online filing through platforms like pdfFiller offers convenience and efficiency. Alternatively, traditional mail-in or in-person submissions are also available, yet they might add delay to your processing time.

Utilizing the e-filing service through pdfFiller can enhance your experience. The platform allows for step-by-step guidance through online submission, featuring interactive tools that enable editing and e-signing directly on the form. The intuitive interface can significantly reduce the likelihood of errors and expedite the submission process.

After filing your annual report

Once you have submitted your annual report, tracking your submission is essential. Confirming receipt of your filing ensures you are on the right side of compliance. Many regulatory agencies provide a confirmation receipt or online tracking tools to help you verify that your submission has been received and is being processed.

If you need to make changes after filing, knowing the correct procedures is vital. Most jurisdictions allow amendments to submitted annual reports, but there are specific deadlines and requirements for these adjustments. Typically, you will want to determine if the changes are minor or substantive, as this can impact what steps are necessary for correction.

FAQs about annual report form

Specialized company guidelines

Different types of businesses have unique requirements regarding annual reports. For instance, Limited Liability Companies (LLCs) may have different information compared to corporations or sole proprietorships. Nonprofits must often include details regarding donor contributions, which may not be necessary for for-profit organizations. Thus, it is critical to follow specialized guidelines suited to your business type to ensure compliance.

For partnerships, requirements may vary significantly based on state laws. Thoroughly examining the specific regulations governing your business type will simplify the annual filing process and ensure that you include all mandated information.

Additional considerations

Staying informed about changes in laws and regulations affecting annual reporting is crucial for all entities. Regularly reviewing information from your state’s regulatory agency or subscribing to industry newsletters can keep you on track regarding compliance. Adaptability is key; as regulations evolve, so should your processes for filing and maintaining necessary documentation.

Utilizing tools from pdfFiller can also enhance your document management strategies. The platform offers features that help track deadlines and manage your business documents effectively. Collaboration tools available allow multiple users to work on the same document, fostering a team environment where completion can be swift and efficient.

Practical tips and best practices

Proactive strategies can streamline the filing of your annual report form. For instance, setting reminders in your calendar for annual filing dates helps ensure you don’t miss deadlines. In addition, keeping an organized record of all necessary documents, including financial statements and board meeting minutes, throughout the year simplifies the completion of your annual report.

Leveraging technology can further enhance your management processes. Cloud-based document solutions like pdfFiller not only allow you to access, edit, and submit documents from anywhere, but they also provide an intuitive way to e-sign and store them securely. Utilizing these technologies can significantly enhance your operational efficiency and improve compliance rates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in annual report?

Can I sign the annual report electronically in Chrome?

How do I edit annual report on an iOS device?

What is annual report?

Who is required to file annual report?

How to fill out annual report?

What is the purpose of annual report?

What information must be reported on annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.