Get the free Legacy Giving

Get, Create, Make and Sign legacy giving

How to edit legacy giving online

Uncompromising security for your PDF editing and eSignature needs

How to fill out legacy giving

How to fill out legacy giving

Who needs legacy giving?

Legacy Giving Form: A Comprehensive How-to Guide

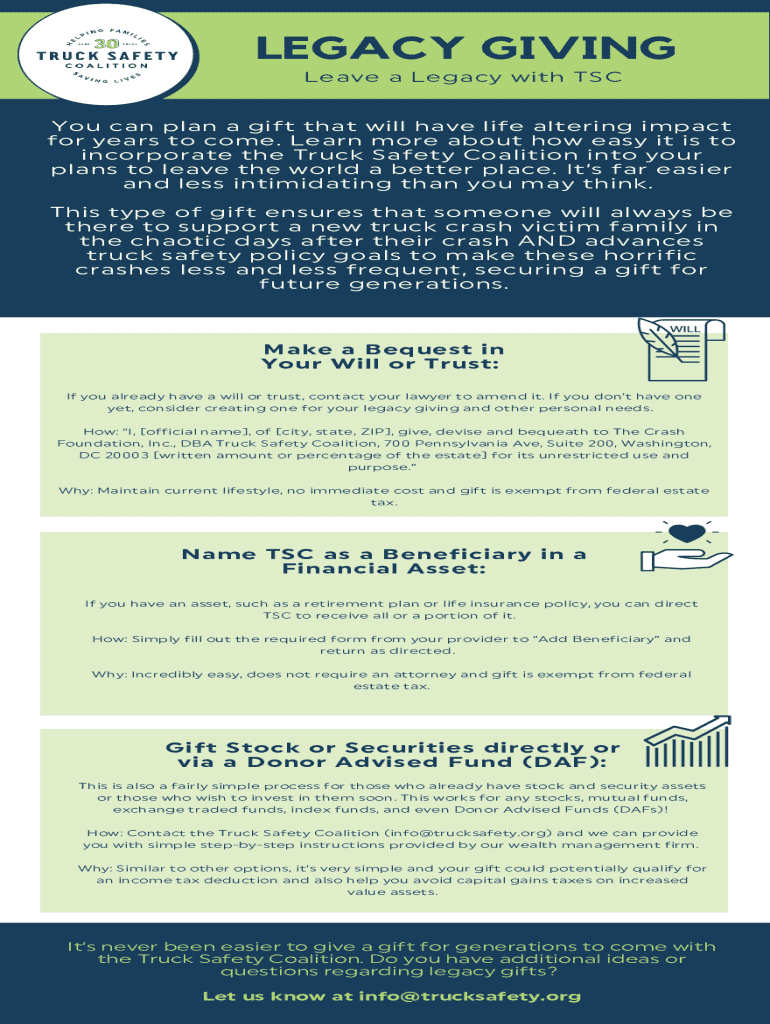

Understanding Legacy Giving

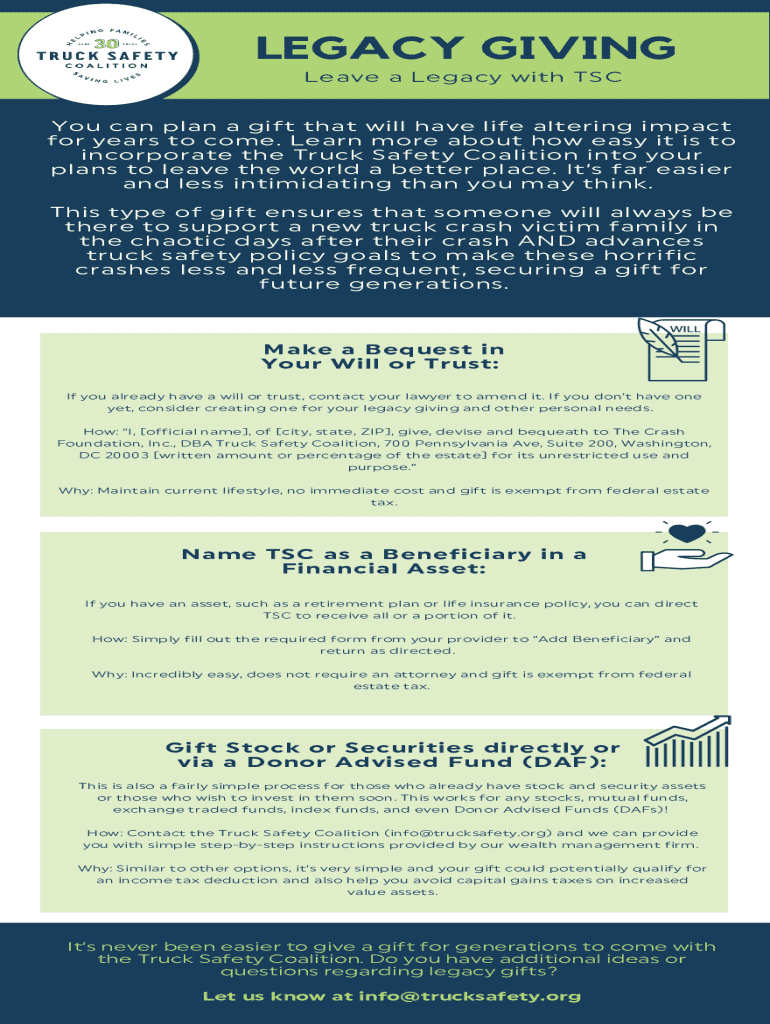

Legacy giving, often referred to as planned giving, allows individuals to make significant contributions to charitable organizations after their demise. This type of giving encompasses various financial arrangements, wherein donors express their intention to leave a portion of their estate or specific assets to a nonprofit, creating a lasting impact. Such gifts can bolster the missions of organizations, ensuring they can continue their work for future generations.

The importance of legacy gifts cannot be overstated; they're vital for nonprofits seeking long-term sustainability. These gifts provide charities with predictable funding streams while allowing donors to leave a lasting mark on causes they care about deeply. Typically, legacy gifts can come in various forms, including bequests, charitable remainder trusts, and insurance policies.

The legacy giving form explained

The legacy giving form serves as the formal document where individuals can outline their charitable intentions regarding planned giving. This form is essential in capturing detailed information about the donor, the type of gift, and the designation of funds to specific programs or projects within the organization. Understanding this form can simplify the process for both the donor and the nonprofit organization.

Key sections of the legacy giving form typically include three main areas: donor information, gift details, and fund designation. Each section serves its specific purpose, capturing everything necessary to ensure the donation is executed smoothly and accurately.

Benefits of using the legacy giving form

Using a legacy giving form presents numerous benefits, streamlining the process for donors and ensuring accuracy for the organization. Firstly, it simplifies the act of giving, enabling donors to communicate their wishes clearly. Having a structured form reduces the likelihood of misunderstandings and errors that could arise from verbal communication.

Moreover, the legacy giving form ensures that all necessary information is collected upfront, allowing nonprofits to plan properly and integrate these gifts into future funding strategies. Furthermore, it aids in ensuring compliance with legal and tax requirements related to donations. Accurate information helps organizations report on fundraising effectiveness and maintain relationships with their donors.

Step-by-step guide to completing the legacy giving form

Completing the legacy giving form can feel daunting, but breaking it down into manageable steps can simplify the process. Here's a step-by-step guide to help you navigate through the form:

Tips for editing and signing your legacy giving form

After completing your legacy giving form, ensuring accuracy is paramount. Using tools like pdfFiller can elevate your editing experience. The platform offers user-friendly text editing tools that allow you to make adjustments without needing extensive technical skills or reprinting the form.

Additionally, pdfFiller allows you to easily add fields for signatures and dates. When ready to sign, consider utilizing the eSignature platform, which simplifies the signing process. This feature enables you to sign from anywhere, making the finalization of your legacy giving form convenient and efficient.

Managing your legacy gift: Post-submission steps

Once the legacy giving form has been submitted, it's crucial to understand what follows. The organization will typically acknowledge receipt of your gift and might even provide updates regarding your overall impact. Retaining copies of all submitted documents is vital for your records and future reference.

Following up with the nonprofit you’ve supported is a best practice. Not only does this demonstrate your ongoing interest, but it also lays the foundation for a strong relationship. Regular communication can help ensure you stay informed on how your legacy gift is making a difference in the community.

Best practices for engaging donors in legacy giving

To cultivate a culture of legacy giving within your organization, building strong relationships with potential legacy donors is essential. This involves not just asking for their support but actively engaging them in your mission. Regularly informing them about the organization’s work and how their contributions can make a difference can foster goodwill and commitment.

Crafting a compelling legacy giving message is key. Focus on the emotional aspect of legacy gifts - the enduring impact they can have and how they contribute to a meaningful future. Organizing informational sessions or workshops tailored to prospective donors can also be beneficial, addressing common concerns and providing valuable insights into planned giving options.

Tools and resources for legacy giving programs

Today’s digital tools can enhance legacy giving programs significantly. Utilizing features from platforms like pdfFiller can help streamline document management for non-profit organizations, allowing them to focus on building relationships with donors. Similarly, additional online resources can provide templates, guides, and best practices to elevate legacy giving efforts.

Highlighting successful legacy giving campaigns can inspire others. Providing concrete examples of impactful gifts showcases the potential of planned giving, encouraging prospective donors to consider legacy gifts seriously. Sharing testimonials or case studies can be highly persuasive.

Frequently asked questions about legacy giving

When making a legacy gift, donors often have questions regarding commitments, the legal implications, and the overall impact of their donations. Addressing common concerns upfront can significantly assist in alleviating donor anxiety. For instance, educating donors about the potential tax benefits of various gift types can encourage them to proceed with their plans.

Additionally, clarifying how the donation will be used and the impact it will have on the organization can establish trust and reassurance in the donor's decision. Providing accessible resources or Q&A sessions can further empower potential donors to make informed choices.

Case studies: Successful legacy gifts and their impact

Examining real-life success stories of legacy gifts offers valuable insight into their power. For instance, one nonprofit organization may have received a substantial bequest that enabled them to expand their services dramatically. By highlighting case studies like this, organizations can illustrate how legacy gifts have led to significant transformations and improvements in their community.

Analyzing the outcomes for both the donors and the beneficiaries can also provide lessons learned for future giving initiatives. Such narratives humanize the concept of legacy giving and demonstrate the personal connection donors can forge with the organization’s mission.

Engaging your community: Promoting legacy giving initiatives

Your organization can raise awareness about legacy giving through various community engagement strategies. Hosting community events allows potential donors to learn more about your work while fostering a sense of solidarity around a cause. Thoughtful storytelling about past contributions can inspire others to consider similar giving.

Moreover, leveraging social media to share your mission and the stories of those your organization has helped can expand your reach. Use these platforms as a funnel to engage potential legacy donors while educating them about the impact of their gifts.

Continuing your legacy: Next steps after completing the form

Once your legacy giving form is successfully submitted, setting up regular communication with the organization is vital. Keeping abreast of the various projects your donation supports can enhance your connection and commitment. Encourage the organization to send updates about the impact of legacy gifts, fostering a deeper relationship.

Additionally, consider discussing legacy gifts as part of your organization’s broader vision. Emphasizing planned giving in communications can instill confidence in potential donors, ensuring a sustainable source of funding and a reliable way to continue making a difference in the community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in legacy giving without leaving Chrome?

Can I sign the legacy giving electronically in Chrome?

How can I fill out legacy giving on an iOS device?

What is legacy giving?

Who is required to file legacy giving?

How to fill out legacy giving?

What is the purpose of legacy giving?

What information must be reported on legacy giving?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.