Get the free 2022 Nj-1040-hw

Get, Create, Make and Sign 2022 nj-1040-hw

How to edit 2022 nj-1040-hw online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 nj-1040-hw

How to fill out 2022 nj-1040-hw

Who needs 2022 nj-1040-hw?

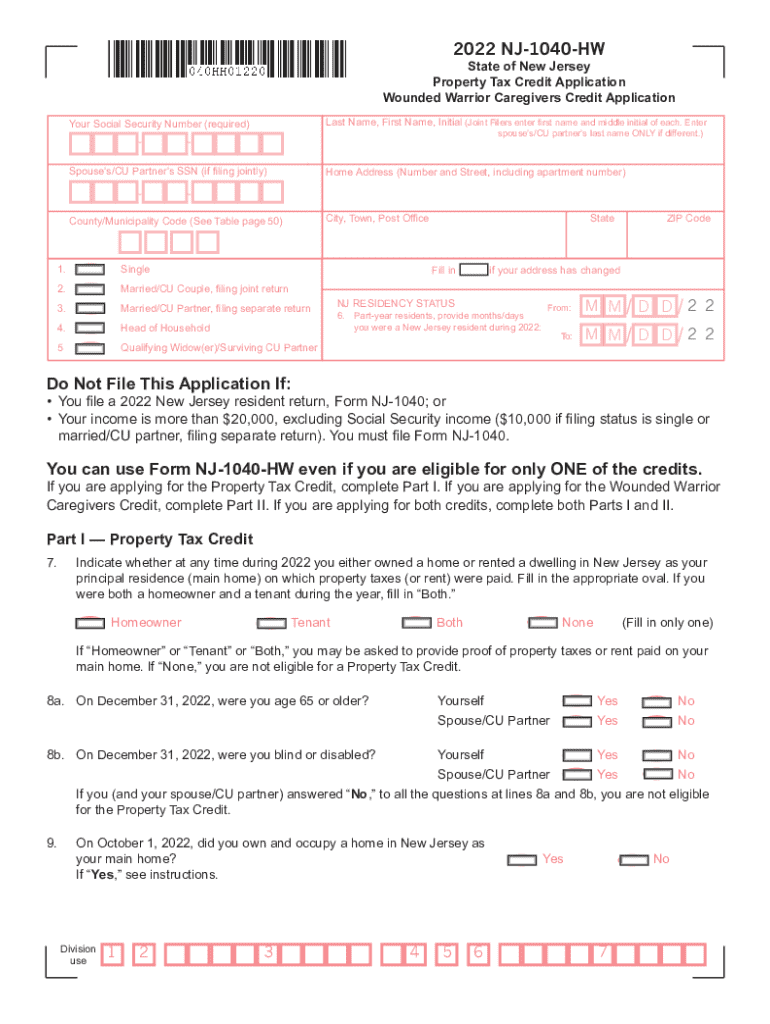

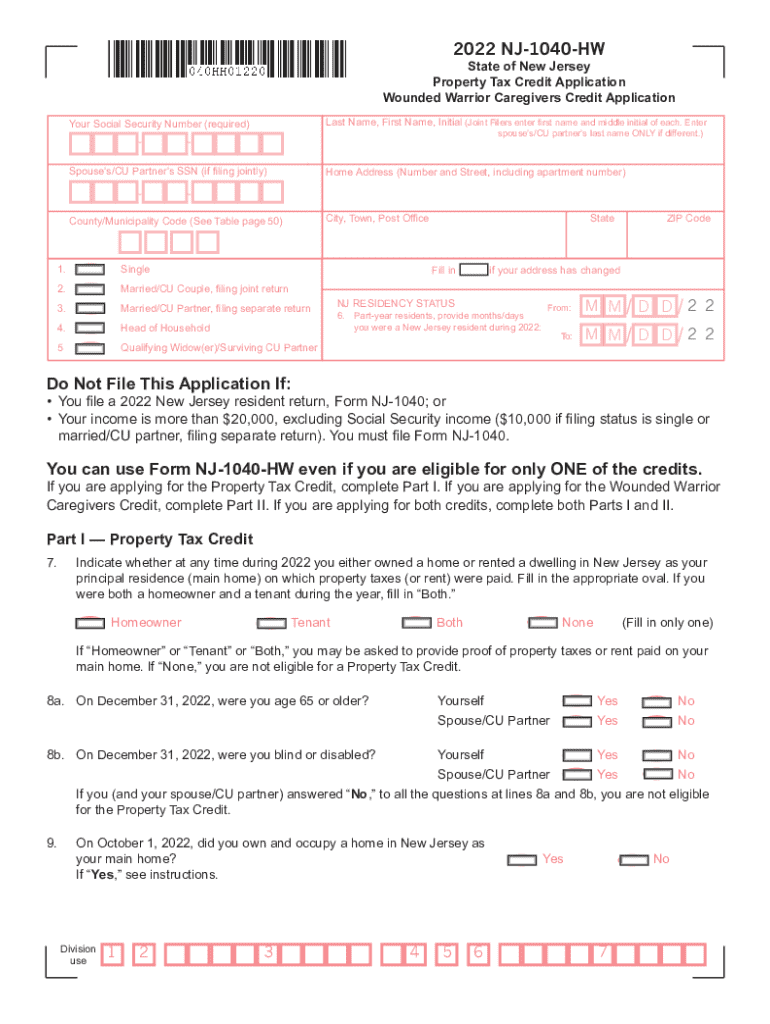

A Comprehensive Guide to the 2022 NJ-1040-HW Form

What is the 2022 NJ-1040-HW Form?

The 2022 NJ-1040-HW Form is a critical document for New Jersey residents who rent or own their homes. It serves as a means for taxpayers to apply for the Homestead Benefit program, which provides financial relief based on property taxes paid or rent incurred. Understanding this form is key for ensuring that eligible individuals receive the tax credits available to them, which can significantly ease financial burdens, particularly for low- to moderate-income households.

For New Jersey residents, filing the NJ-1040-HW form can lead to substantial savings. It is imperative to note that this form must be submitted annually, and staying aware of key deadlines can prevent missed opportunities for tax relief.

Eligibility requirements for filing the NJ-1040-HW

To qualify for the Homestead Benefit under the 2022 NJ-1040-HW Form, residents must meet certain eligibility requirements. This includes being either a homeowner or a renter, and there are specific details that must be considered. For homeowners, the property must be your principal residence, and you should have paid property taxes in the year for which you are applying.

Renters also have specific criteria, primarily related to income limits and rental history. More specifically, applicants must usually be over the age of 65, disabled, or meet income requirements not exceeding set limits to qualify for this benefit.

Navigation through the NJ-1040-HW Form

The NJ-1040-HW Form is organized into several key sections that guide users through the application process. Each part of the form corresponds to specific information required by the New Jersey Department of Treasury. It includes sections for filling in personal information, detailing income, and providing information on property taxes paid or rent incurred.

Understanding the layout of this form is essential for accurate completion. Each section typically includes straightforward prompts, but attention to detail is essential, as errors can lead to delayed processing or denial of benefits.

Required documentation for submission

Submitting the NJ-1040-HW Form requires specific documentation to substantiate the claims made within the application. Proof of property taxes paid or rental payments must be included to ensure eligibility. Additionally, proper identification will be necessary to confirm the applicant's identity.

For homeowners, the documentation may include property tax bills, payment receipts, or any correspondence that shows property taxation. Renters, on the other hand, should gather lease agreements, receipts, or statements from the landlord.

Step-by-step guide to completing the NJ-1040-HW Form

Completing the NJ-1040-HW Form can be made easier with a methodical approach. Start by pre-filing considerations: gather all necessary documentation and understand the terminology used within the form. Familiarity with the structure will simplify the process and lead to a more accurate submission.

As you fill out the form, it's vital to use tools that assist in editing and signing documents, such as the pdfFiller platform. This technology allows users to type directly onto PDF forms, retain copies, and ensure all entries are double-checked for accuracy before submission.

Common mistakes to avoid

Filing the NJ-1040-HW Form is straightforward, but some common mistakes can lead to complications or denial of benefits. Typical errors include providing incorrect personal information or failing to enclose necessary documentation. Moreover, miscalculations in reported income or property taxes can also jeopardize one's application.

To rectify mistakes after submission, taxpayers may need to contact the New Jersey Division of Taxation or submit an amended form. Being proactive in checking all entries can save time and confusion later on.

After filing: what to expect

Once submitted, applicants can expect a timeframe for processing their NJ-1040-HW Form. Typically, the New Jersey Department of Treasury communicates the status of applications, and successful claimants will receive notification about their benefits. However, any discrepancies can lead to further communications or even requests for additional information.

Understanding the processing timeline is important, as applicants may require this information for budgeting purposes or future financial planning. Keeping records of all submitted information allows for efficient follow-up if needed.

Linked topics to enhance understanding

A well-rounded understanding of the 2022 NJ-1040-HW Form may involve familiarizing oneself with related forms such as the NJ-1040 or the NJ-1040NR. Each serves specific purposes and can provide wider benefits to New Jersey residents beyond the Homestead Benefit.

Additionally, there may be other tax benefits available for homeowners and renters. By exploring state tax credits or financial aid opportunities, individuals can identify further financial assistance that may reduce their cost of living or increase their tax refunds.

Resources for further assistance

Access to accurate resources can significantly alleviate the confusion surrounding the NJ-1040-HW Form. The New Jersey Division of Taxation provides online resources, a help desk, and recorded workshops to assist residents. They also ensure taxpayers can submit queries for personalized guidance.

Online tools, like pdfFiller, can radically change how residents manage their tax documentation, allowing for streamlined editing, signing, and collaboration all in one place. Local tax assistance centers also offer in-person help, catering especially to those who may find the forms challenging.

Importance of maintaining document records

Keeping organized records of tax documents, including ones concerning the NJ-1040-HW Form, is crucial for effective tax management. Simple methods such as categorizing documents by year, type, or importance can vastly improve retrieval and clarity during the filing process.

Using tools like pdfFiller facilitates not just the filling out of documents but also the long-term management of stored documents, making it easier to retrieve and examine records when needed. A well-maintained document repository contributes to stress-free tax seasons moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2022 nj-1040-hw online?

How do I make edits in 2022 nj-1040-hw without leaving Chrome?

Can I edit 2022 nj-1040-hw on an Android device?

What is 2022 nj-1040-hw?

Who is required to file 2022 nj-1040-hw?

How to fill out 2022 nj-1040-hw?

What is the purpose of 2022 nj-1040-hw?

What information must be reported on 2022 nj-1040-hw?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.