Get the free Notice of Lca Filing

Get, Create, Make and Sign notice of lca filing

Editing notice of lca filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of lca filing

How to fill out notice of lca filing

Who needs notice of lca filing?

Notice of LCA Filing Form: A Comprehensive Guide

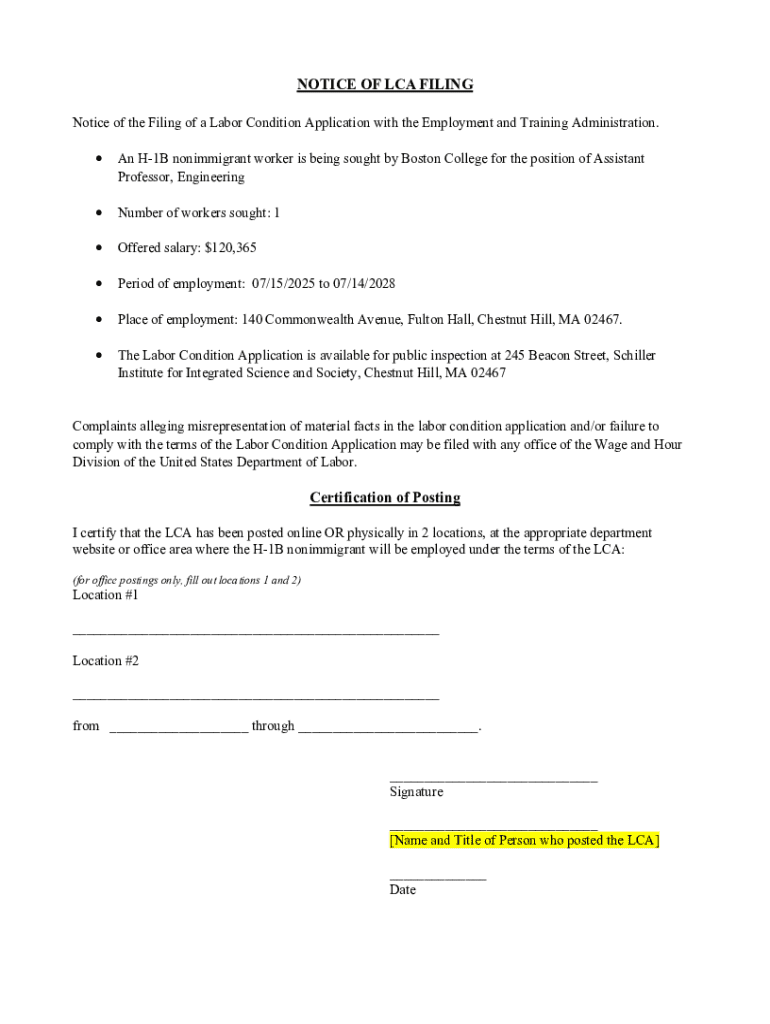

Understanding the Notice of LCA Filing Form

The Labor Condition Application (LCA) Filing Form is a crucial document for employers seeking to hire foreign workers under various visa categories, including the H-1B visa. This form, which is submitted to the Department of Labor (DOL), details certain labor conditions that must be met to ensure fair treatment of both foreign and domestic workers. The LCA contains information about job offers, wage terms, and conditions of employment to protect the rights of U.S workers.

Filing an LCA is not merely a bureaucratic step; it represents a commitment to uphold labor laws and standards. For employers, a properly filed LCA ensures compliance with regulations, while employees gain the assurance that their rights are protected.

Who needs to file an LCA?

Primarily, employers who intend to hire foreign workers are required to file a Notice of LCA Filing Form. This includes companies sponsoring H-1B visa applicants, who come from various sectors, including technology, healthcare, and education, among others. In addition, employers who wish to employ workers on other non-immigrant visas, such as E-3 or H-1B1, may also need to submit an LCA.

Understanding which visa category applies is essential because each has specific requirements that need to be adhered to. Employers should familiarize themselves with these categories to determine their obligations correctly.

Key components of the Notice of LCA Filing Form

The LCA Filing Form consists of several key sections that require detailed and accurate information. Some of the main components include:

Other essential terms often addressed in the LCA include the prevailing wage—the average wage for similar positions in the employment area, working conditions to ensure employee rights, and a statement about not displacing U.S. workers.

Step-by-step process to complete the Notice of LCA Filing Form

Completing the Notice of LCA Filing Form requires careful preparation and attention to detail. The following steps provide a comprehensive overview of the process.

Filing and submitting the Notice of LCA

The final step in this process involves the actual filing of the Notice of LCA. Employers can choose between electronic filing or paper submission. Electronic filing is generally faster, and it allows for immediate confirmation of submission.

Once submitted, employers should track the status of their LCA filing. This typically includes a review period by the DOL, which may take anywhere from 7 to 10 business days for approval or denial.

Frequently asked questions (FAQs) about the Notice of LCA Filing

Several common inquiries arise concerning the Notice of LCA Filing Form. For instance, many individuals often want to know the potential consequences of errors or omissions in the filing process. Such mistakes can delay approval and, in some cases, lead to denials.

In the case of an LCA denial, applicants can review feedback provided by the DOL which will guide them in addressing the issues before reapplying.

Utilizing pdfFiller for your LCA filing needs

pdfFiller simplifies the LCA filing process with its user-friendly platform, allowing users to edit PDFs, sign documents electronically, and collaborate on submissions effortlessly. With pdfFiller's cloud-based solutions, users can access their documents from anywhere, making the filing process convenient and efficient.

By using pdfFiller's features, individuals can ensure their submissions meet all necessary requirements while maintaining document security and integrity throughout the filing process.

Success stories: Effective use of the Notice of LCA Filing Form

Many organizations have successfully navigated the complexities of LCA filings using pdfFiller. Users have reported smooth experiences with document management and an easier overall filing process.

Testimonials highlight the benefits of using pdfFiller to streamline the process, with particular praise for the platform's collaborative capabilities that allow teams to work together on the same document.

Best practices for future LCA filings

Maintaining compliance with labor laws is crucial. Employers should always ensure that their LCA filings accurately reflect the position's requirements and compensation to prevent potential issues. Keeping detailed records of job classifications and prevailing wage determinations also contributes to successful filings.

It's important to stay updated on changes to regulations surrounding LCA filings. Resources such as the U.S. Department of Labor's website provide insights into ongoing updates and ensure that employers remain informed about their obligations.

Feedback and contribution

User experiences with the Notice of LCA Filing Form can provide valuable insights for others navigating this process. Sharing feedback enhances the pdfFiller community and allows for continual improvements in the platform's functionality.

Encouraging others to contribute their stories ensures that the document management process becomes streamlined and user-friendly, ultimately benefitting all users engaged in this important filing procedure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send notice of lca filing for eSignature?

How can I fill out notice of lca filing on an iOS device?

How do I fill out notice of lca filing on an Android device?

What is notice of lca filing?

Who is required to file notice of lca filing?

How to fill out notice of lca filing?

What is the purpose of notice of lca filing?

What information must be reported on notice of lca filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.