Get the free Schedule Cp

Get, Create, Make and Sign schedule cp

Editing schedule cp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule cp

How to fill out schedule cp

Who needs schedule cp?

Schedule CP Form: A Comprehensive How-to Guide

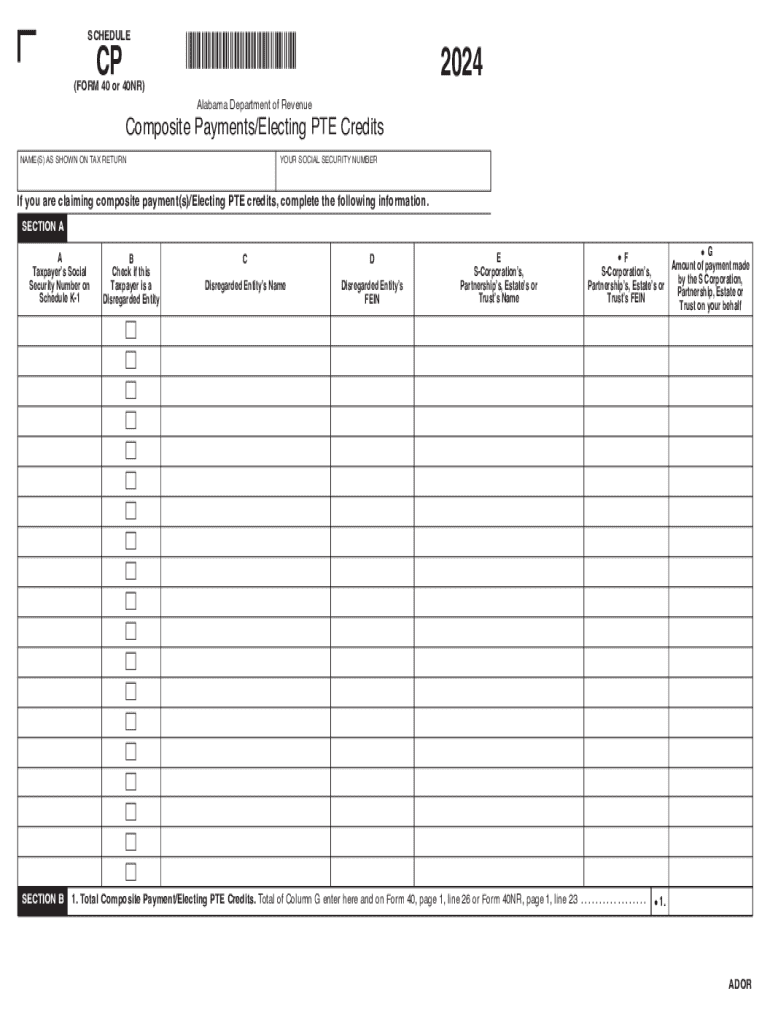

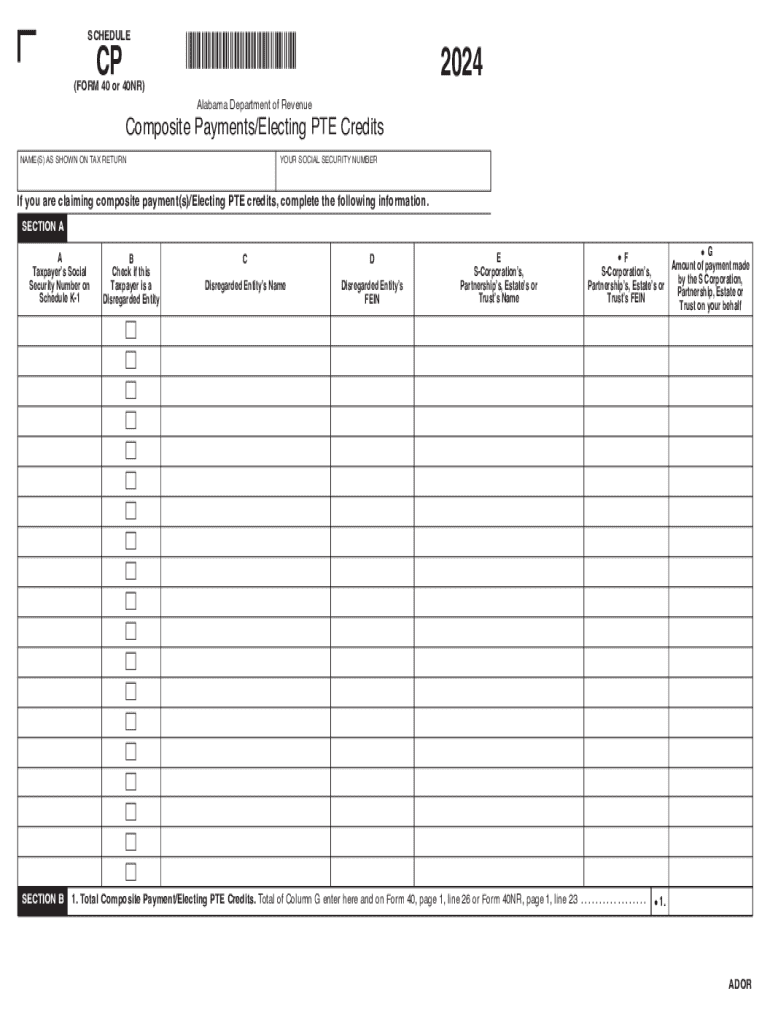

Understanding the Schedule CP Form

The Schedule CP Form is a crucial document used by taxpayers to report specific tax information to the IRS. It is primarily utilized in cases where the IRS needs additional clarification or correction regarding a taxpayer's submitted returns. Understanding the nuances of this form can significantly impact the accuracy of your tax submissions and ensure compliance.

The Schedule CP Form serves a vital purpose as a communication tool between taxpayers and the IRS. It allows taxpayers to clarify discrepancies that may arise from their initial filings, ensuring a more streamlined review process and reducing the chances of lengthy audits. Its correct completion is essential, as inaccuracies can lead to penalties or delays.

Individuals required to complete the Schedule CP Form typically include those who have received a CP letter—a notice from the IRS stipulating the need for further clarification on their tax status. Understanding who needs to fill it out is essential for compliance and avoiding more significant issues with the IRS down the line.

Tax implications related to the Schedule CP Form include potential adjustments to refund amounts and taxable income. Failure to address the issues raised in the CP letter may result in additional taxes owed, so it’s critical to approach the Schedule CP Form with care and diligence.

Key components of the Schedule CP Form

The Schedule CP Form consists of several distinct sections, each designed to collect specific information from the taxpayer. Understanding these sections is key to ensuring accurate completion and avoiding mistakes that could lead to inflated taxes or penalties.

Familiarizing yourself with common terminology used in the Schedule CP Form is equally important. Knowing terms such as 'Taxable Income,' 'Adjusted Gross Income,' and 'Credits' will empower you to accurately fill out the form and identify information that may require further documentation or clarification.

Preparing to fill out the Schedule CP Form

Before diving into filling out the Schedule CP Form, it is essential to gather all the necessary documentation and information. This preparation phase can save you time and ensure that your form is completed accurately.

Efficiently gathering this data involves creating a checklist and allocating time specifically for this purpose. Ensuring that you have everything at hand before you start filling out the form can minimize distractions and help you focus more on accuracy.

Step-by-step instructions for completing the Schedule CP Form

To successfully complete the Schedule CP Form, follow these structured steps meticulously to avoid unnecessary errors.

Editing and signing the Schedule CP Form

Once you have completed the Schedule CP Form, editing and signing it properly is crucial. Digital tools have simplified this process significantly.

The ease of digital editing and signing offered by pdfFiller not only minimizes human error but also fosters a more efficient workflow. You can access your documents from anywhere, making the process more convenient.

Submitting the Schedule CP Form

After completing your Schedule CP Form, the next crucial step is submission. Understanding your options will help streamline this process.

Prioritizing efficient submission is integral to keeping your tax matters in good standing. Utilizing pdfFiller’s tools can simplify this step in the process.

Managing your Schedule CP Form post-submission

After submitting your Schedule CP Form, it’s essential to manage the next steps effectively. Knowing how to track your submission and resolve any issues that arise can save you a lot of stress.

Successful management of your Schedule CP Form post-submission is vital for ensuring that any issues are dealt with efficiently, preventing future complications.

Frequently asked questions (FAQs) about the Schedule CP Form

Addressing common concerns regarding the Schedule CP Form can alleviate the stress of navigating tax responsibilities and improve confidence in completing the form correctly.

Understanding the intricacies of potential concerns related to the Schedule CP Form will empower users to take proactive steps in managing their tax obligations effectively.

Interactive tools and resources for Schedule CP Form users

Utilizing tools and resources can greatly enhance your experience while working with the Schedule CP Form.

The interconnected resources provided by pdfFiller enhance your overall experience, leading to more efficient completion and management of important tax documents.

Best practices for future Schedule CP Form filings

Implementing best practices for future filings will contribute to a smoother process each tax season and minimize the hassle associated with tax documentation.

By adhering to these best practices, both individuals and teams can foster an efficient approach to tax documentation, ultimately leading to improved accuracy and compliance over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my schedule cp in Gmail?

How do I edit schedule cp straight from my smartphone?

How do I complete schedule cp on an iOS device?

What is schedule cp?

Who is required to file schedule cp?

How to fill out schedule cp?

What is the purpose of schedule cp?

What information must be reported on schedule cp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.