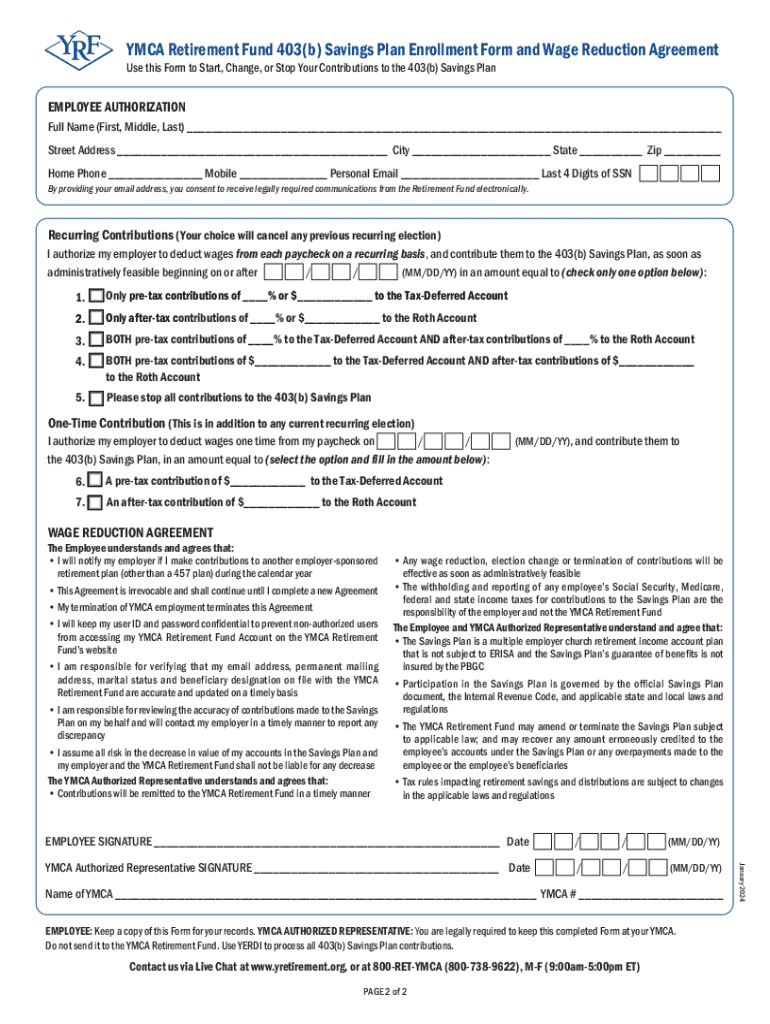

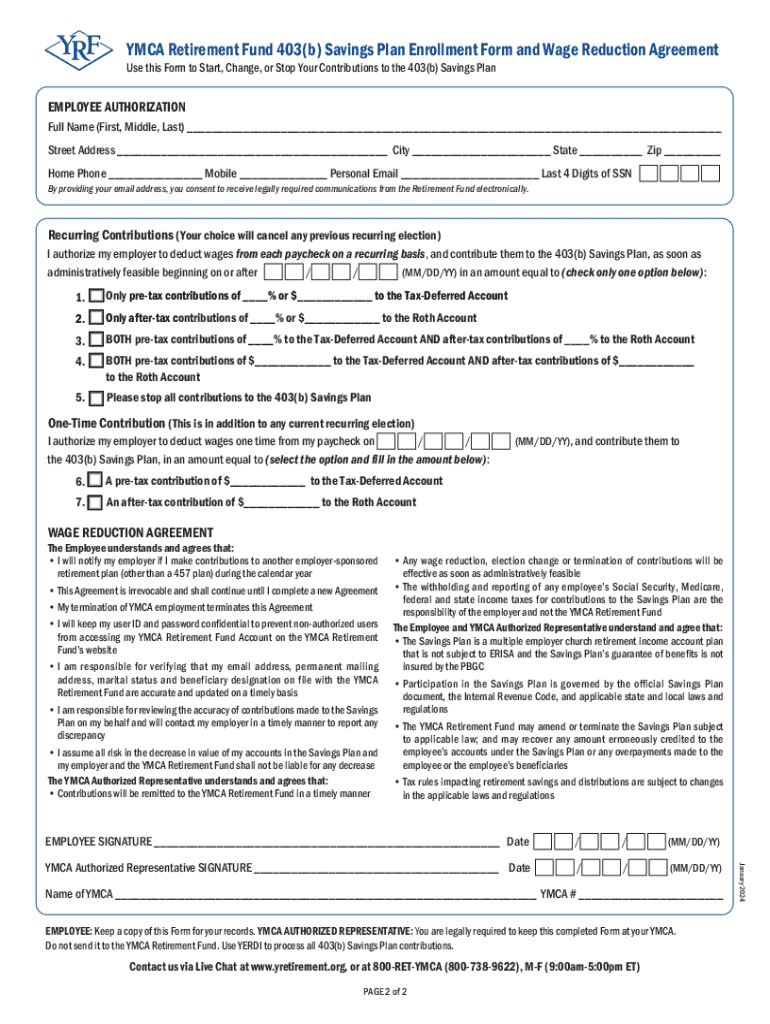

Get the free Ymca Retirement Fund 403(b) Savings Plan Enrollment Form and Wage Reduction Agreement

Get, Create, Make and Sign ymca retirement fund 403b

Editing ymca retirement fund 403b online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ymca retirement fund 403b

How to fill out ymca retirement fund 403b

Who needs ymca retirement fund 403b?

YMCA Retirement Fund 403b Form: A Comprehensive Guide

Understanding the YMCA retirement fund 403b plan

A 403b plan serves as a retirement savings option specifically tailored for employees of non-profit organizations, including the YMCA. This plan allows individuals to save and invest a portion of their paycheck before taxes are deducted, ultimately providing a nest egg for retirement. The YMCA Retirement Fund is an integral part of this process, offering a structured and supportive environment for individuals to grow their retirement savings.

By contributing to a 403b plan, YMCA employees can benefit from tax advantages, professional financial management, and a wide range of investment choices. It's essential for employees to understand the significance of regularly contributing to this plan as it affects their financial security in retirement.

Eligibility requirements for the YMCA retirement fund 403b

Eligibility to participate in the YMCA Retirement Fund 403b plan generally includes employees of the YMCA who are over the age of 21, although specific requirements may vary based on local physical branch policies. Factors like employment status—full-time or part-time—also influence eligibility. To ensure you qualify, it’s important to check the specific guidelines associated with your local YMCA.

Enrollment periods typically coincide with the beginning of the calendar year, and deadlines for submission of forms are strictly enforced to facilitate early participation and maximize contributions. Keeping an eye on these timelines ensures that you don’t miss out on contributing to your retirement savings.

Getting started: filling out the YMCA retirement fund 403b form

Filling out the YMCA retirement fund 403b form is an essential step toward securing your financial future. Begin by gathering necessary documentation such as your social security number, employment identification details, and the names of beneficiaries. This preparation ensures a smooth application process.

Next, fill out your personal information accurately. This includes your contact details and employment status. When it comes to selecting contribution levels and investment options, carefully consider your financial goals and risk tolerance. Once completed, review the form thoroughly to avoid common mistakes like incorrect personal data or missing signatures, which can delay processing.

Options for contributions: understanding your choices

When contributing to the YMCA retirement fund 403b, you can choose between pre-tax contributions, where your taxable income is reduced now but taxed upon withdrawal, or Roth contributions, which are made with after-tax dollars. Understanding the difference is crucial for long-term planning, as each option has distinct implications on your future retirement funds.

Contribution limits are determined by the IRS and can change annually, so it’s important to stay informed. Typically, participants under age 50 can contribute a maximum of $20,500 in 2023, with catch-up contributions available for those over 50. Moreover, employer matching contributions can enhance your savings significantly, so understanding your employer’s matching policy is beneficial.

Managing your YMCA retirement fund 403b account

Once you have established your account, managing it effectively is crucial. Available investment choices typically range from conservative bonds to high-risk stocks, catering to various risk tolerances and investment strategies. It’s vital to regularly monitor your investments and make adjustments based on market performance and your personal financial goals.

Additionally, be aware of any associated fees and charges, as these can eat into your retirement savings over time. Reviewing your account statements regularly will help you gain insights into your growth and understand any costs involved.

Loan and withdrawal options from your 403b plan

In certain situations, you may require access to your retirement funds prior to retirement age. The YMCA Retirement Fund 403b plan allows for short-term and long-term loans, but specific eligibility requirements must be met. Understanding when you can withdraw funds is also crucial; hardship withdrawals are permissible, but they come with specific conditions and limitations.

It’s important to consider the tax implications of early withdrawals carefully. Accessing your funds inappropriately can lead to penalties, so consulting with a financial advisor prior to making such decisions is strongly recommended.

Rolling over your YMCA retirement fund 403b

When changing jobs or retiring, you may consider rolling over your YMCA Retirement Fund 403b into another retirement plan. Understanding the rollover process is key; this typically involves transferring funds directly to an IRA or a new employer's plan to maintain tax advantages.

It's critical to assess whether a rollover is the right choice for you, as the features and benefits of your current 403b plan might exceed those of prospective plans. The key steps for initiating a rollover include contacting your current plan administrator and the new plan you wish to transfer to and completing designated paperwork.

The tax benefits of a 403b retirement plan

The YMCA Retirement Fund 403b plan offers significant tax benefits, one of the primary advantages being tax-deferred growth. This means that earnings on your investment compounds over time without being taxed until withdrawal. For many individuals, this can lead to substantial growth compared to a taxable account.

Distinction between taxable and non-taxable income is essential for strategic planning. Proper understanding of tax forms, such as the IRS Form 5500, and any reporting requirements associated with 403b plans can help ensure compliance and maximization of benefits.

Staying informed: tracking your retirement progress

Monitoring your retirement progress involves regularly reviewing your account statements and understanding the various metrics presented, such as your total account balance, investment performance, and contribution breakdown. Familiarizing yourself with these statements can help you make informed adjustments to your investment strategies.

You should also track your annual contributions to adhere to IRS limits, adjusting them as needed based on changes in income or retirement objectives. Setting retirement milestones and goals will keep you focused and motivated throughout your retirement saving journey.

Interactive tools for managing your YMCA retirement fund 403b

Utilizing online tools is key for effective retirement planning. pdfFiller offers a suite of interactive calculators specifically designed to help you estimate your retirement needs. These calculators can provide tailored estimates based on your current savings and projections of future contributions.

Moreover, pdfFiller includes advanced document management features, allowing you to easily edit, sign, and store your YMCA retirement fund 403b form and related documents. Users can conveniently manage their paperwork from anywhere, enhancing their overall experience.

Connecting with financial advisors and support services

The YMCA offers a variety of resources to assist participants in navigating their retirement planning. Financial counseling services can provide personalized insights tailored to your financial situation, helping you make informed decisions about your 403b contributions and investments.

Additionally, the YMCA community often hosts educational programs and networking opportunities, connecting you with peers facing similar retirement planning challenges. Engaging with these resources can significantly enhance your understanding and capabilities in managing your retirement fund.

Real-world examples and testimonials

To better understand the impact of the YMCA retirement fund 403b plan, consider reviewing case studies and testimonials from members who have successfully navigated their retirement planning. These narratives often illustrate common pathways to success, including how participants overcame challenges and capitalized on available resources.

Hearing from fellow YMCA members can provide valuable insights and actionable lessons learned, fostering a community of support as individuals work toward their financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ymca retirement fund 403b?

Can I sign the ymca retirement fund 403b electronically in Chrome?

How do I complete ymca retirement fund 403b on an Android device?

What is ymca retirement fund 403b?

Who is required to file ymca retirement fund 403b?

How to fill out ymca retirement fund 403b?

What is the purpose of ymca retirement fund 403b?

What information must be reported on ymca retirement fund 403b?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.