Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

A Comprehensive Guide to Form 10-K

Understanding Form 10-K

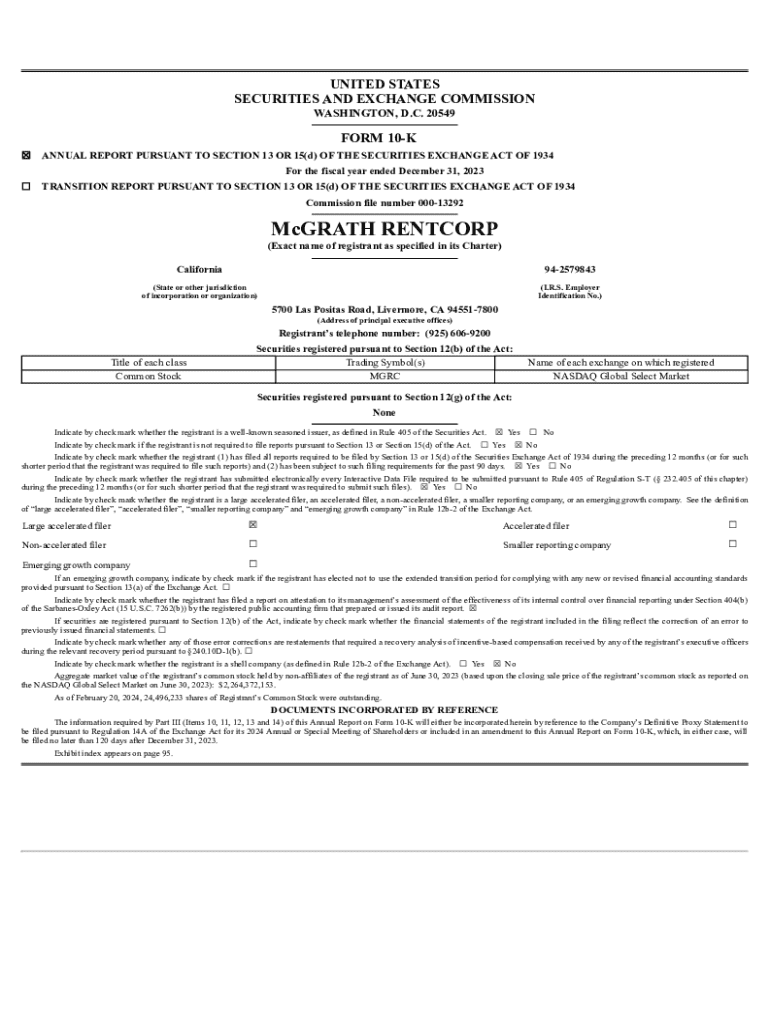

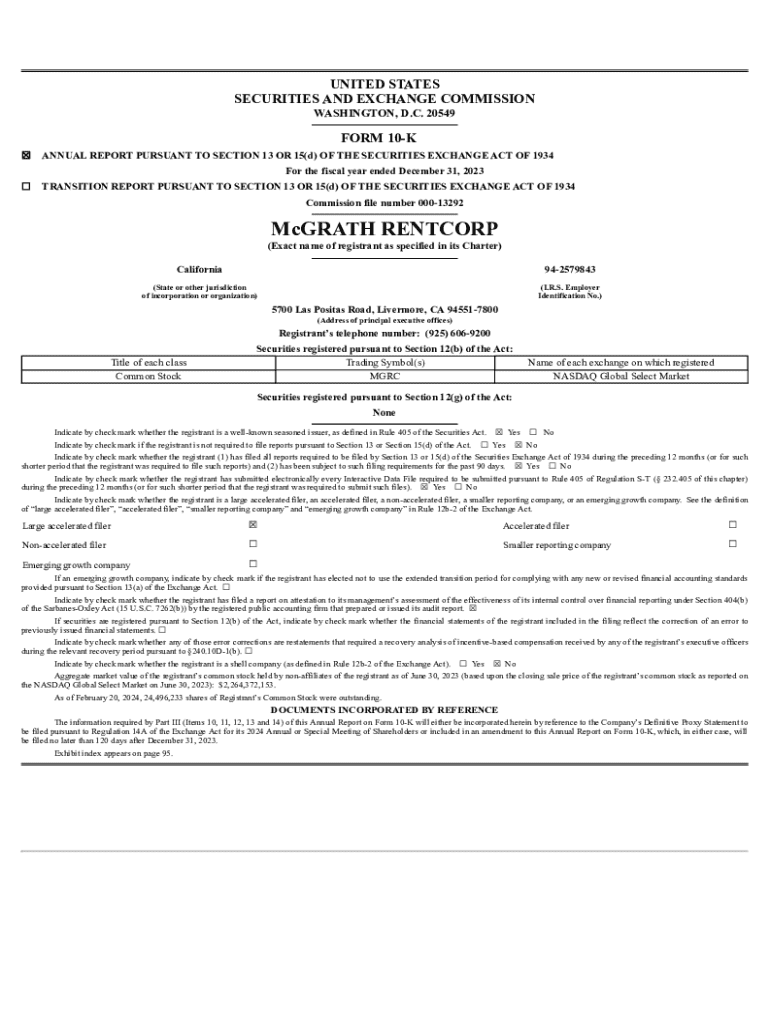

Form 10-K is a comprehensive annual report filed by publicly traded companies with the U.S. Securities and Exchange Commission (SEC). This detailed document offers insights into a company's financial performance and business operations, encompassing key information that investors and stakeholders need to make informed decisions. Unlike quarterly reports, the Form 10-K provides a complete overview of a company's activities over the year, highlighting significant events and operational results.

The importance of Form 10-K in financial reporting cannot be overstated. It serves as a vital tool for public companies to communicate with shareholders and potential investors, establishing transparency and trust. By requiring detailed disclosures, the SEC ensures that companies cannot misrepresent their financial conditions, fostering an environment of accountability in the markets.

All public companies, regardless of size, are required to file Form 10-K annually. This requirement applies to domestic and foreign companies trading on U.S. exchanges, ensuring that all publicly available information follows the same rigorous standards across various sectors.

Key components of Form 10-K

Form 10-K consists of several key components structured to provide a thorough understanding of a company's operations and financial health. The document is divided into four main parts, each containing specific items that detail various aspects of the company.

The table of contents typically guides readers through the document, allowing easy navigation between sections. Within each part, the following items are essential:

Understanding these components is critical for anyone involved in financial reporting or investment analysis, as they encapsulate key metrics and narratives that shape an organization's performance.

Preparing to file Form 10-K

Organizing a Form 10-K filing requires meticulous preparation and attention to detail. Companies must gather essential documents reflecting their financial position, operational pursuits, and other requisite data. The following steps outline how entities can effectively prepare their Form 10-K:

It is also crucial to be aware of common pitfalls during preparation. Overlooking details or misreporting data can lead to severe consequences, including penalties and damage to corporate reputation. Diligently reviewing each section and obtaining necessary approvals before submission is advised.

Filing deadlines and requirements

Filing Form 10-K is time-sensitive, with strict deadlines established by the SEC. Understanding the filing calendar is essential for compliance. Public companies typically fall into three categories based on their public float, which affects their specific filing dates:

Late filings can lead to penalties, increased scrutiny from regulators, and loss of investor trust. Companies should establish a timeline to ensure timely preparation and filing to uphold their commitment to transparency.

Tips for completing Form 10-K

Completing a Form 10-K requires accuracy and thoroughness. Adopting best practices in reporting will not only aid in compliance but will also improve the quality of the filing. Some key tips include ensuring that all financial statements are reconciled, utilizing clear language for management's discussion, and backing up claims with data.

Using tools such as pdfFiller can simplify the process of editing, signing, and collaborating on Form 10-K filings. With features like document collaboration, electronic signatures, and security options, pdfFiller allows companies to manage their document workflow from any location seamlessly. Here’s how to maximize its effectiveness:

Implementing these strategies can dramatically enhance the quality of your filing and cut down on potential re-filing and errors.

Insights into industry practices

Different industries approach the Form 10-K filing process in varying ways, often reflecting the unique challenges and opportunities they face. For example, technology firms might spend considerable time discussing cybersecurity risks in Item 1A due to the sector's vulnerability, while financial institutions would delve deeper into regulatory compliance issues and market risks.

High-quality Form 10-K filings can serve as case studies for best practices. Reviewing exemplary filings can provide insights into how leading companies articulate their operational narratives, address risks, and present financial data. Investors and analysts benefit from understanding differing strategies across industries, enhancing their analysis of potential investments.

Resources for further learning

A wealth of resources exists for individuals and teams looking to enhance their understanding and efficiency when preparing Form 10-K. Several recommended tools can support filers in navigating regulatory requirements and streamlining their documentation processes.

Leveraging these resources can help ensure that companies stay ahead of compliance requirements and adopt emerging best practices.

Frequently asked questions (FAQs)

As you navigate the complexities of Form 10-K filing, queries may arise that need clarification. Here are some common questions that may help clarify any lingering uncertainties:

Addressing these questions can enhance your filing strategy and ensure compliance with SEC regulations.

Conclusion: The importance of staying compliant

Form 10-K plays a crucial role in corporate transparency, providing stakeholders with a detailed assessment of a company's fiscal health and operational strategies. The increasing complexity of financial markets only heightens the importance of meticulous compliance and reporting. Companies should not underestimate the significance of submitting accurate and timely filings, as they directly influence investor trust.

pdfFiller is committed to assisting users in navigating the complexities of document management efficiently. By using tools that facilitate the creation, editing, and sharing of Form 10-K and other important documents, businesses can focus on their core operations while ensuring top-notch compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 10-k?

Can I create an electronic signature for signing my form 10-k in Gmail?

How do I fill out form 10-k using my mobile device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.