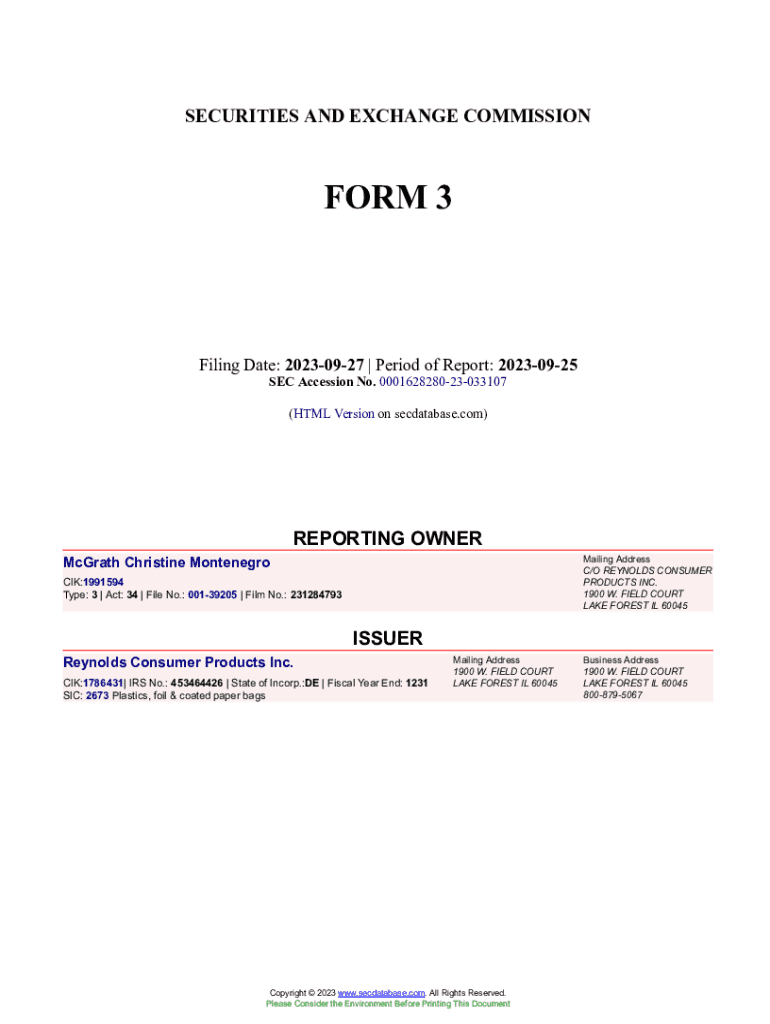

Get the free Form 3

Get, Create, Make and Sign form 3

Editing form 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 3

How to fill out form 3

Who needs form 3?

Comprehensive Guide to the Form 3 Form

Overview of the Form 3 Form

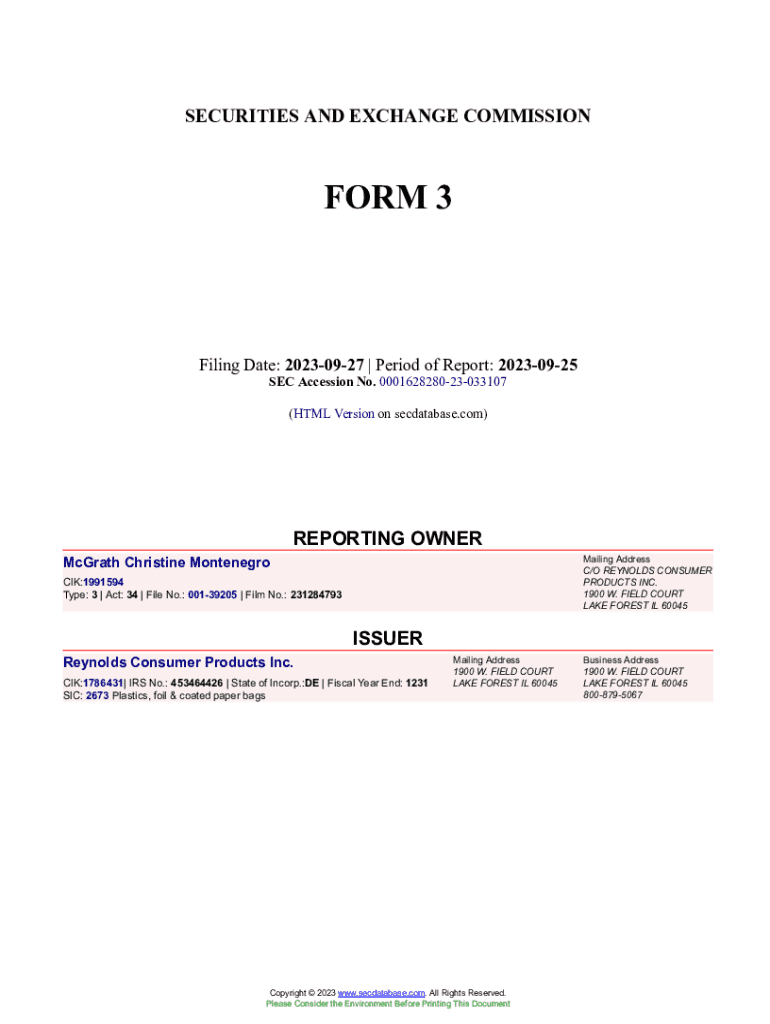

The Form 3 form is a critical document within the ecosystem of regulatory compliance that serves to report specific organizational information to regulatory authorities. Primarily, it is utilized by investment advisors, broker-dealers, and companies offering securities, providing essential disclosures pertaining to audit reports, results of proceedings, and relationships that impact stakeholders. Understanding the definition and purpose of Form 3 is paramount for compliance and maintaining transparency in business practices.

The importance of Form 3 cannot be overstated as it directly correlates with regulatory compliance. Timely filing and accurate reporting via this form helps organizations avoid penalties and ensures adherence to statutory obligations. This form is essential for providing stakeholders with relevant information and maintaining the integrity of the financial markets.

Typically, firms that operate in a regulated capacity, such as publicly traded companies, investment firms, and certain nonprofits, are required to file Form 3. Anyone who has a role in influencing or managing these organizations must understand when and how to complete this document responsibly.

General instructions for completing Form 3

Before beginning to fill out the Form 3 form, there are critical considerations to keep in mind. Understanding the required information is vital: each section of the form necessitates specific details related to the firm's structure, leadership, and any ongoing proceedings. Identifying these requirements in advance reduces the likelihood of errors and delays in filing.

Accuracy remains paramount when reporting information. It is advisable to cross-verify details against official documents such as audit reports, licensing records, and internal records to avoid discrepancies. A small error can lead to compliance issues or reports being deemed invalid.

Detailed breakdown of Form 3 sections

Understanding the Form 3 form requires a detailed look into its various sections, each meticulously designed to gather critical information.

A. Identity of the firm (Part )

The first part of the Form 3 requests the identification of the firm, requiring essential data including the firm's official name, physical address, and contact information. Documentation such as proof of registration may be necessary to verify this information.

B. Reason for filing this report (Part )

This section clarifies the specific reasons behind submitting Form 3. There are multiple circumstances that could necessitate its filing, including changes in management, significant shifts in operational strategies, or certain transactions mandated by law. Each of these instances will have its documentation and reporting requirements that need to be fulfilled.

. Withdrawn audit reports and changes in issuer auditors (Part )

In Part III, firms must disclose any withdrawn audit reports and changes in their auditing firm. Understanding the implications of withdrawn audits is crucial; reflecting such changes accurately affects investor confidence and perceived reliability of the financial reporting.

. Certain proceedings (Part )

This section focuses on any legal proceedings involving the firm or its key executives. The types of proceedings required for disclosure include lawsuits, bankruptcy filings, or regulatory penalties. Documentation to substantiate these proceedings should be prepared.

E. Certain relationships (Part )

Here, firms must disclose relationships that may impact their operations or reporting. This could include information about relationships with auditors, key shareholders, or significant partners. Clear delineation between relevant and irrelevant relationships is crucial for compliance.

F. Licenses and certifications (Part )

Accurate reporting of licenses and certifications held by the firm showcases its legitimacy and operational capabilities. Firms should ensure that they renew and correctly document licenses to prevent operational disputes and challenges.

G. Changes in the firm or the firm's board contact person (Part )

Updating the firm's information, such as the business address or board members, is critical to keep stakeholders informed. An organization must establish a process for reporting these changes promptly and accurately.

H. Certification of the firm (Part )

The final certification ensures the accuracy of the information provided. This process often requires affirmation from responsible officers, reinforcing accountability within the organization.

. Exhibits (Part )

Exhibits can include various supplementary documents that validate the information reported in the form. Familiarizing oneself with the correct formats and types of exhibits to include enhances the overall submission.

Interactive tools for Form 3 compliance

Utilizing interactive tools like those available at pdfFiller can significantly streamline the process of completing Form 3. The platform's PDF editing features allow users to modify forms directly, ensuring that essential fields are completed accurately before submission.

Additionally, the eSignature capabilities facilitate quick submission, ensuring essential documentation is signed and submitted efficiently. Collaborative tools available within the platform enable multiple team members to review entries and provide real-time feedback, enhancing the accuracy of the final submission.

How to submit Form 3

Submitting the Form 3 form can be done through various methods depending on the regulatory authority's guidelines. Common submission methods include electronic submission via dedicated regulatory portals or traditional mail. It’s essential to be aware of the deadlines imposed by regulatory bodies, as late submissions can incur penalties.

After submission, firms can expect confirmation of receipt from the relevant authority. This confirmation is critical for record-keeping and compliance verification. Knowing what to expect helps firms prepare better for any follow-up actions required.

Managing your Form 3 submissions

Effective management of Form 3 submissions is vital for maintaining compliance over time. Tracking submission status can be easily accomplished through platforms like pdfFiller, which provides real-time updates on your document's status. This ensures that you can always stay informed about where your submission stands in the review process.

If changes or errors are discovered post-submission, the process for editing or revising your submission must be understood. Keeping meticulous records of all filed documents enhances compliance and provides a strong audit trail for future reference.

FAQs on Form 3

FAQs about filling out Form 3 often revolve around procedural clarifications and troubleshooting common issues. Understanding the frequently asked questions allows organizations to preemptively address concerns about the filing process, documentation requirements, and submission methods.

For further assistance, firms should have clear contact information readily available for regulatory authorities or compliance experts, ensuring access to help when needed.

Leveraging pdfFiller for seamless document management

Access to a cloud-based platform like pdfFiller for document creation and management streamlines the entire process of handling Form 3. With its robust features, users are empowered to edit documents, ensure proper eSigning, and collaborate effectively with team members from anywhere.

Success stories from users emphasize the platform's impact on improving workflow efficiency. Testimonials often highlight how timely document management leads to enhanced regulatory compliance, thus enabling firms to focus on core operational tasks without being bogged down by administrative burdens.

Ensuring compliance with follow-up actions

After filing Form 3, several follow-up actions can ensure continuing compliance. This includes regularly reviewing the firm's regulatory obligations to stay informed about any changes or updates that may affect future filings. Remaining proactive is crucial to maintaining compliance and fostering a culture of transparency and responsibility.

Establishing a routine for compliance checks and updates can significantly help in managing any changes in firm operations or regulatory requirements, ensuring that your firm remains compliant while mitigating potential risks.

Conclusion and final tips for success

In summary, mastering the nuances of the Form 3 form can be instrumental for firms seeking to comply with regulatory requirements. By understanding its various sections, adhering to submission guidelines, and utilizing available resources like pdfFiller, organizations can streamline their compliance efforts effectively.

Best practices for future filings include maintaining organized records, staying updated on regulatory changes, and seeking assistance when necessary. Utilize the available resources to ensure that your firm not only meets its obligations but does so in a way that enhances trust and accountability in its operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 3?

How do I edit form 3 in Chrome?

Can I sign the form 3 electronically in Chrome?

What is form 3?

Who is required to file form 3?

How to fill out form 3?

What is the purpose of form 3?

What information must be reported on form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.