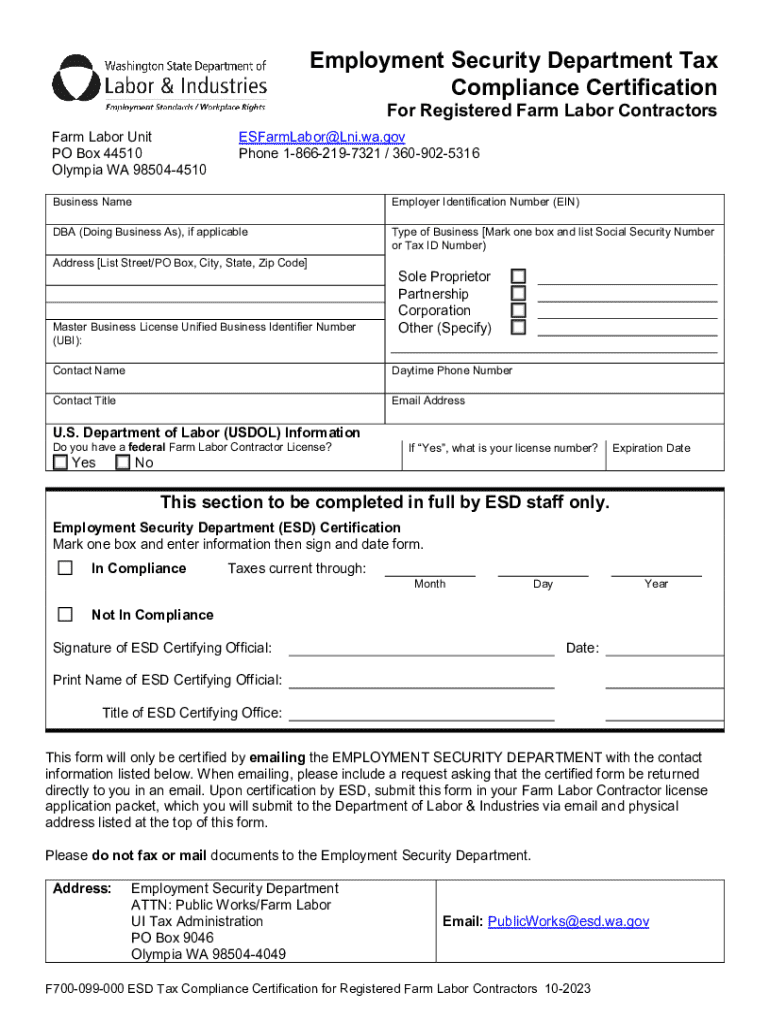

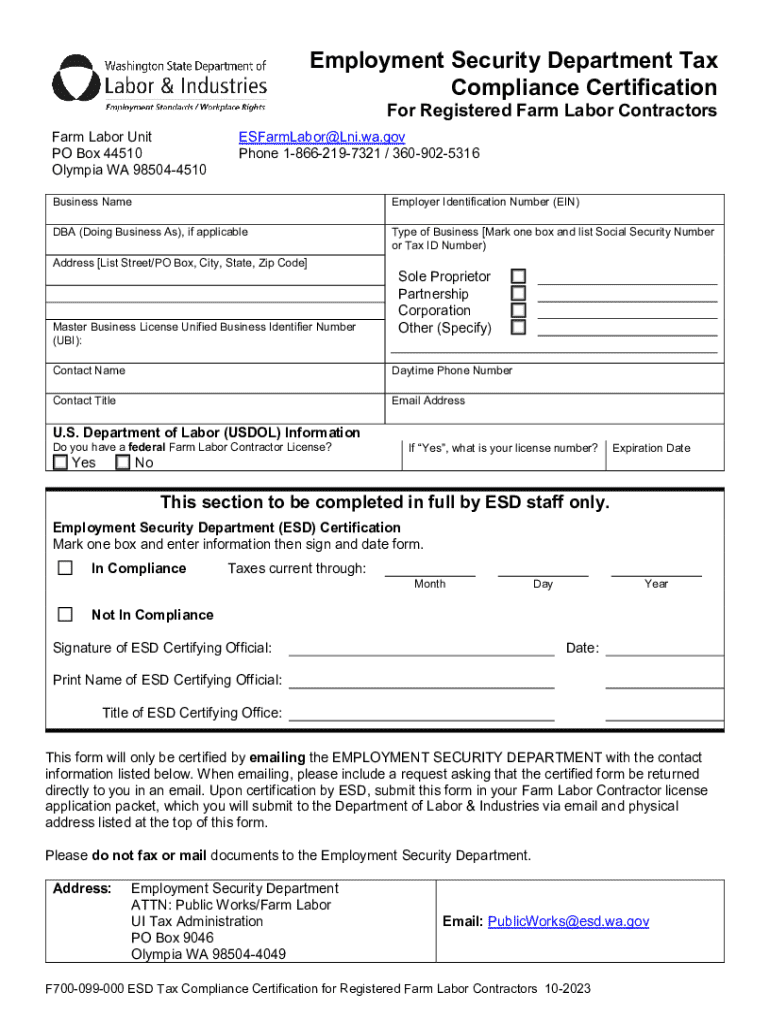

Get the free F700-099-000 Esd Tax Compliance Certification for Registered Farm Labor Contractors

Get, Create, Make and Sign f700-099-000 esd tax compliance

Editing f700-099-000 esd tax compliance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f700-099-000 esd tax compliance

How to fill out f700-099-000 esd tax compliance

Who needs f700-099-000 esd tax compliance?

A comprehensive guide to the f700-099-000 esd tax compliance form

Understanding the f700-099-000 esd tax compliance form

The f700-099-000 esd tax compliance form plays an essential role in ensuring that businesses and individuals comply with state economic development mandates. Created to facilitate tax compliance, this form is indispensable for those seeking to benefit from various economic incentives and tax credits. Understanding its purpose not only helps taxpayers fulfill their obligations but also aids in maximizing their financial advantages through careful reporting.

The importance of the f700-099-000 form extends beyond mere compliance; it is a key instrument for fostering economic growth within communities. Often, economic development organizations leverage this information to determine the effectiveness of programs aimed at stimulating business activities. Therefore, awareness of key terms like 'tax credits,' 'incentives,' and 'eligibility' becomes crucial as they significantly impact the filing process and potential benefits.

Eligibility requirements

Not every individual or business is required to fill out the f700-099-000 esd tax compliance form. Generally, it is mandated for businesses that engage in specific economic activities or participate in development programs facilitated by local or state authorities. For instance, companies benefitting from tax incentives related to job creation or capital investment typically must submit this form to confirm their compliance with stipulated guidelines.

Additionally, certain criteria may exempt organizations from this requirement. For example, small businesses with minimal revenue may not be obligated to file if they do not meet specific thresholds set by state agencies. Understanding your classification and the associated responsibilities is vital to prevent potential penalties.

Step-by-step instructions for completing the f700-099-000

Successfully completing the f700-099-000 esd tax compliance form requires careful attention to detail. Follow these steps to ensure all relevant information is accurately reported.

Gather required information

Before diving into the actual filling of the form, gather all necessary documents. This includes income statements such as W-2s, 1099s, and any other documentation that provides insights into financial operations over the reporting period. Maintaining organized records supports a smoother filing process and can simplify any future adjustments.

Filling out the form

Now, it’s time to fill out the form section by section:

Common mistakes include omitting critical information or misunderstanding the categories of income. To avoid these pitfalls, double-check entries and, if available, consult a tax professional for clarification.

Editing and modifying the f700-099-000 form

Once you've filled out the f700-099-000 esd tax compliance form, you might find the need to edit or modify your entries. pdfFiller provides an intuitive platform for making such adjustments. Using their tools, you can easily add notes, annotations, and other modifications without hassle.

Utilizing pdfFiller’s editing functions ensures your form remains compliant after changes. It’s essential to verify that any modifications align with legal requirements to maintain the integrity of your submission.

eSigning the f700-099-000

Electronic signatures (eSignatures) provide a streamlined approach to finalize the f700-099-000 tax compliance form. This modern method not only expedites the filing process but also enhances security and authenticity. pdfFiller’s eSigning features make this process straightforward, ensuring that your signature is valid and legally recognized.

To eSign using pdfFiller, simply follow these steps: upload your completed form, select 'eSign,' choose your signing method, and confirm. The platform employs robust security measures to protect your identity and ensure that all signatures are encrypted.

Submitting the f700-099-000 form

After completing the f700-099-000 esd tax compliance form, several submission options are available. You can opt for online submission via state tax portals or mail a hard copy, depending on your jurisdiction’s guidelines.

Be aware of critical deadlines to ensure timely submissions. Missing deadlines can lead to penalties or loss of benefits. Once your form is submitted, it’s wise to keep a record of your submission confirmation for future reference.

Tracking and managing your submission

Using pdfFiller enables you to manage your submitted f700-099-000 forms effectively. With its tracking features, you can easily monitor the status of your submission, ensuring that any potential issues are addressed promptly.

If any problems arise after submission, reach out to your tax authority with the documentation provided during your submission process. Keeping communication lines open is crucial for resolving issues that may surface.

FAQs about the f700-099-000 esd tax compliance form

Common questions about the f700-099-000 form often revolve around eligibility, deadlines, and issues that may arise during the completion process. Many users wonder whether they need to consult a tax professional, or how to best manage supporting documents. A thorough understanding of these elements can significantly ease the filing experience.

Utilizing resources from tax authorities and pdfFiller’s support page can provide additional clarity and assistance for those navigating complexities associated with this form.

Case studies: success stories with the f700-099-000

Many individuals and businesses have successfully utilized the f700-099-000 esd tax compliance form to achieve various benefits, from securing tax credits to advancing their economic viability. Case studies reveal that those who approach the filing process with careful attention to detail and utilize resources like pdfFiller often enjoy a smoother completion process.

Best practices shared by successful users include maintaining organized records, seeking professional insights when necessary, and familiarizing oneself with each section of the form prior to submission.

Interactive tools for enhanced document management

pdfFiller offers a suite of features designed for effective document management, particularly useful for those navigating the f700-099-000 esd tax compliance form. Users can collaborate on documents, share with team members, and utilize templates tailored to specific needs.

The platform’s collaborative tools optimize tax compliance processes, allowing users to invite colleagues for joint editing and provide feedback seamlessly. By leveraging these tools, you can enhance the accuracy and completeness of your submissions while saving time and reducing stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute f700-099-000 esd tax compliance online?

How do I edit f700-099-000 esd tax compliance straight from my smartphone?

How do I fill out the f700-099-000 esd tax compliance form on my smartphone?

What is f700-099-000 esd tax compliance?

Who is required to file f700-099-000 esd tax compliance?

How to fill out f700-099-000 esd tax compliance?

What is the purpose of f700-099-000 esd tax compliance?

What information must be reported on f700-099-000 esd tax compliance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.