Get the free Monthly Lodging Tax and Extended Stay Leisure Fee Return

Get, Create, Make and Sign monthly lodging tax and

Editing monthly lodging tax and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly lodging tax and

How to fill out monthly lodging tax and

Who needs monthly lodging tax and?

Monthly lodging tax and form: A comprehensive guide

Understanding monthly lodging tax

Monthly lodging tax refers to the tax imposed on short-term rental properties, including hotels, motels, and vacation rentals. It is generally levied by local or state governments to generate revenue that can be allocated toward public services, tourism development, and infrastructure maintenance. For short-term rental owners, understanding this tax is critical as it directly impacts profitability and compliance with local laws.

The importance of lodging tax compliance cannot be underestimated. It not only ensures that rental businesses operate within the regulations but also supports the local economy. Property owners must stay abreast of both state and local regulations, as rules can vary significantly from one jurisdiction to another. Failure to comply can result in hefty fines or even the suspension of rental licenses.

Monthly lodging tax reporting process

The process of reporting monthly lodging tax can seem daunting initially, but clarity on the eligibility criteria is essential. Generally, any property owner who rents their property for less than 30 days must file monthly lodging tax forms. This includes individuals renting through platforms such as Airbnb or Vrbo, as well as traditional property owners.

Filing frequency and deadlines depend on local regulations; most areas require submissions monthly. Missing deadlines can result in penalties, so it’s crucial to mark these dates on your calendar. Furthermore, calculating your lodging tax starts with determining your gross receipts, which includes all income earned from rentals before any deductions.

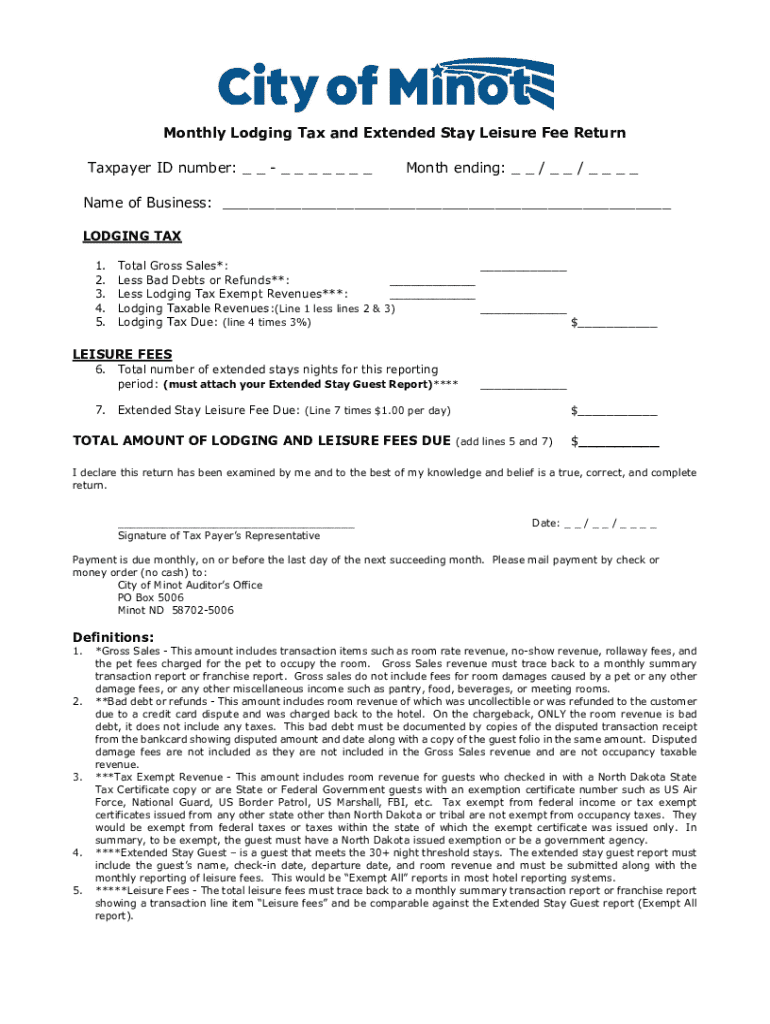

Navigating the monthly lodging tax form

The monthly lodging tax form is structured to capture key details about your rental business and the income generated. Understanding each section of the form is vital to ensure accurate reporting. Typically, the form will require information such as the owner's name, business registration details, property address, and the total gross rental income for the reporting period.

When completing the form, it is crucial to report not only your income but also any deductions or exemptions that may apply, such as services or fees associated with rental operations. Incorrectly completing the form can lead to errors in tax owed, potentially resulting in fines or further scrutiny from tax authorities.

Submitting your monthly lodging tax form

Once the monthly lodging tax form is completed, it's time to submit it. Most jurisdictions offer multiple submission methods, such as online filings and traditional mail. Online submissions are often preferred due to their convenience and speed. Checking the specific requirements for your area will ensure successful and timely submissions.

Regarding payment, you can usually pay the tax due through various methods including credit cards or electronic transfers. It's vital to keep track of your submission status, especially if you opt for postal mail, as processing times can vary significantly depending on the method chosen.

Understanding additional fees and charges

In addition to the monthly lodging tax, many jurisdictions impose related fees that may apply to short-term rentals. These can include license fees, processing fees, or other charges aimed at supporting tourism and public services. Understanding these additional fees helps rental owners prepare their budgets more accurately.

Certain exemptions may apply, depending on local laws and the nature of the rental operation. For instance, non-profit entities or properties used for specific charitable purposes may not be subjected to all standard fees. It's essential to check with local authorities or tax agencies to determine the specific fees that may apply to your situation.

Managing your lodging tax responsibilities

Accurate record-keeping is essential for successful lodging tax management. Keeping thorough and organized documentation of your rental activities will simplify not only the tax reporting process but also any audits that may occur. Recommended practices include logging all rental transactions, retaining receipts for expenses, and ensuring communication with guests is documented.

In the unfortunate event of an audit or inquiry from tax authorities, having organized and comprehensive records at your disposal can make the process smoother. Furthermore, it’s beneficial to know whom to contact for assistance, whether it’s a tax office, a property management service, or an accountant specializing in rental properties.

Changes and updates to lodging tax regulations

Lodging tax regulations are subject to change, often influenced by local government decisions and economic factors. It's essential for property owners to stay informed about recent changes that may affect tax rates and reporting procedures. For example, a city may raise its lodging tax rate during budget re-evaluations, impacting rental income.

Keeping abreast of upcoming changes can mitigate surprises and plan for future financial implications. Subscribing to local government newsletters or following relevant online forums and communities can provide timely updates about lodging tax developments.

Special considerations for unique situations

Certain unique situations may require special considerations when it comes to monthly lodging tax. For instance, individuals who manage short-term rentals through third-party platforms like Airbnb or Booking.com must understand their local tax obligations, particularly because some platforms may handle tax collection and remittance on behalf of property owners, leading to different compliance requirements.

Additionally, federal employees traveling for business may be exempt from lodging tax charges under specific conditions, so it's important for property owners to be aware of these scenarios. Utilizing exemption certificates when applicable can further streamline the process, avoiding tax liabilities that should not apply.

Frequently asked questions (FAQs)

Questions often arise regarding the nuances of lodging tax obligations. A common inquiry is whether rental owners must file if their rental period extends over 30 days. Generally, properties rented for a month or longer may fall under different tax regulations, possibly exempting owners from lodging tax altogether.

Another frequent concern involves properties managed by Transient Lodging Intermediaries. In this case, property owners should confirm whether the intermediary is responsible for tax collection. Reporting income from multiple properties can often involve summarizing gross income per property on a single lodging tax form; understanding these subtleties can streamline tax reporting.

Utilizing pdfFiller for your lodging tax needs

pdfFiller provides an invaluable resource for property owners managing their monthly lodging tax. With its cloud-based document management capabilities, pdfFiller empowers users to create, edit, and eSign their lodging tax forms seamlessly. This platform's accessibility means you can manage your tax obligations from anywhere, ensuring you stay compliant and organized.

Accessing your forms on pdfFiller is user-friendly—you can edit the lodging tax form directly within the platform and collaborate with team members if needed. This convenience is especially useful during busy rental seasons when efficient tax management becomes paramount. Even eSigning is simple, allowing for fast approvals on important documents.

Staying compliant and updated

Compliance with local lodging tax laws is not only crucial for avoiding fines but also for contributing to community services and infrastructure that benefit everyone. Regularly educating yourself on local tax laws and regulations will keep you compliant and informed. Subscribing to newsletters from local tax departments or government websites can help you stay updated regarding changes in tax codes or filing requirements.

Finding local support is equally important, whether you connect with tax professionals, attend local tax workshops, or join online forums focused on short-term rental businesses. Networking with other property owners in your area can provide insights and shared experiences that can benefit your lodging tax management.

Contact information for tax departments

As you navigate the complexities of the monthly lodging tax and form completion, having access to the right resources is essential. Reach out to your local tax department for any inquiries or concerns regarding the lodging tax. Established tax agencies are invaluable resources for clarifying regulations, understanding tax obligations, and resolving any issues that may arise.

Links to official government websites

Besides contacting local tax offices, it is prudent to familiarize yourself with official government websites related to lodging tax. These platforms often provide downloadable forms, FAQs, and comprehensive guidelines for lodging tax filings in your jurisdiction, which can prove immensely helpful as you prepare to submit your taxes.

Staying connected with local lodging tax updates

Engaging with local lodging tax updates means being proactive about your responsibilities as a rental property owner. Many local governments have regular meetings or forums where tax laws and regulations are discussed. By attending these sessions, you can gain first-hand knowledge while networking with other local business owners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit monthly lodging tax and on a smartphone?

How do I complete monthly lodging tax and on an iOS device?

Can I edit monthly lodging tax and on an Android device?

What is monthly lodging tax?

Who is required to file monthly lodging tax?

How to fill out monthly lodging tax?

What is the purpose of monthly lodging tax?

What information must be reported on monthly lodging tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.