Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

How to edit financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

A Comprehensive Guide to Financial Disclosure Statement Forms

Understanding Financial Disclosure Statements

A financial disclosure statement form is a vital tool used to provide transparency concerning an individual's or an organization's financial interests. Designed to offer a clear snapshot of one's financial situation, this form is essential for compliance in various sectors, especially in government, finance, and nonprofit organizations. The primary function of this document is to disclose potential conflicts of interest, ensuring accountability and fostering trust.

Financial disclosure statements hold importance for individuals as they help keep track of assets and obligations. For teams and organizations, these statements are integral to maintain compliance with legal regulations and internal governance policies. By requiring detailed disclosures, stakeholders can identify and mitigate any potential conflicts of interest.

Who needs to file?

Filing a financial disclosure statement is mandatory for various sectors. For instance, government officials, employees in regulatory bodies, and executives at publicly traded companies must complete these disclosures regularly. The specific requirements can vary by jurisdiction, but typically, anyone in a position that could influence public trust or integrity is included.

Failing to comply with these regulations not only exposes individuals to legal penalties but also harms their reputation and public trust. Understanding who needs to file is crucial in ensuring that all legal obligations are met.

Key components of a financial disclosure statement

A comprehensive financial disclosure statement form typically includes essential information such as income sources, assets, liabilities, and personal gifts. Each of these components plays a pivotal role in establishing a complete picture of an individual's financial landscape. Accurate reporting of income sources includes any salary, investment returns, and other forms of revenue, while a thorough accounting of assets and liabilities ensures that both sides of the financial equation are acknowledged.

Furthermore, the reporting of personal gifts is crucial, particularly for public officials who must adhere to strict limits on the value of gifts they can accept. Commonly required documents that support this information can include pay stubs, bank statements, property deeds, and gift disclosure forms. Collectively, these documents provide a foundation for the information presented in the financial disclosure statement.

Step-by-step guide to completing the form

Successfully completing a financial disclosure statement form involves a systematic approach. Start by gathering all necessary information to ensure accuracy. This may include financial records such as W-2s, 1099 forms, and brokerage statements, along with any relevant documentation supporting claims made in the form.

When filling out the form, take care to complete each section diligently and review it for accuracy. Common mistakes include misreporting income, failing to disclose assets, or leaving sections blank. To ensure compliance, double-check your entries and have a colleague review your form before submitting it.

Interactive tools for effortless completion

Online platforms such as pdfFiller provide a user-friendly interface for filling out financial disclosure statement forms. These platforms streamline the process, allowing users to complete forms electronically without the hassle of physical paperwork. Navigating the form fields is intuitive, enabling individuals to input information quickly and effectively.

Moreover, using templates available on pdfFiller can significantly expedite the process. Users can choose from pre-made templates tailored to various requirements, ensuring that all necessary information is included without starting from scratch. Customization options allow users to adapt templates to their specific needs, ensuring a more accurate submission.

Editing and managing your financial disclosure documentation

Once your financial disclosure statement is completed, managing this document is crucial. pdfFiller offers various editing options, enabling you to make modifications easily. You can update financial records as necessary or integrate comments and notes directly within the document to clarify your entries.

Implementing these document management best practices not only safeguards your information but also enhances overall efficiency in managing financial disclosures.

Signing and submitting your financial disclosure statement

Signing your financial disclosure statement can now be completed electronically, thanks to platforms like pdfFiller, which offer secure eSigning options. The convenience of eSigning eliminates delays associated with traditional methods while ensuring compliance with legal requirements. It’s essential to remember that legitimate signatures contribute to the document's authenticity and its acceptance by relevant authorities.

Regarding submission guidelines, individuals can typically submit their completed forms via electronic channels or traditional mail, depending on the regulatory requirements specific to their sector. After submission, confirmation of receipt can often be requested, providing peace of mind that your financial disclosure has been received and is under review.

Frequently asked questions (FAQ)

One common inquiry revolves around the implications of missing a filing deadline. Typically, individuals may face penalties or fines if their submission is late; however, specific consequences may differ by jurisdiction. It’s crucial to familiarize yourself with your area's regulations to avoid these potential pitfalls. Additionally, many users express concern about the privacy and sharing of data in these statements.

Access support and resources

For individuals requiring assistance with their financial disclosure statement forms, support is readily available. pdfFiller offers reliable customer support, making it easy to reach out for help via email or chat. Additionally, users can benefit from comprehensive user guides and video tutorials that walk through each step of the form-filling process, ensuring users have the tools they need to succeed.

Engaging with community forums and support groups adds another layer of resources, allowing individuals to share experiences and solutions. Utilizing these channels can significantly enhance your understanding of financial disclosure requirements and improve accuracy in future submissions.

Current trends in financial disclosure

Staying updated on the regulatory landscape is essential for individuals and organizations using financial disclosure statement forms. Recent changes in regulations often influence what must be disclosed and the formats that are accepted. Increasing digitization has resulted in streamlined processes and enhanced transparency in how finances are reported.

Digital transformation is enabling organizations to manage disclosures more efficiently through cloud-based solutions, allowing real-time updates and collaboration. As technology advances, the future of financial documentation is likely to become even more integrated and user-friendly, driving further compliance and accuracy.

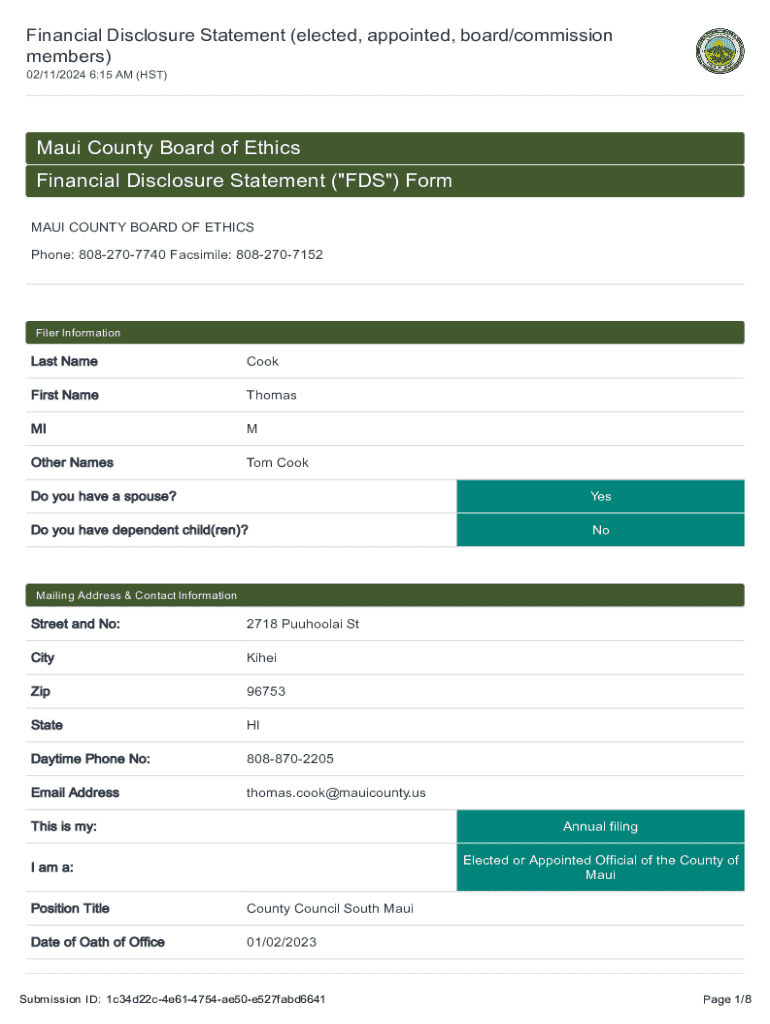

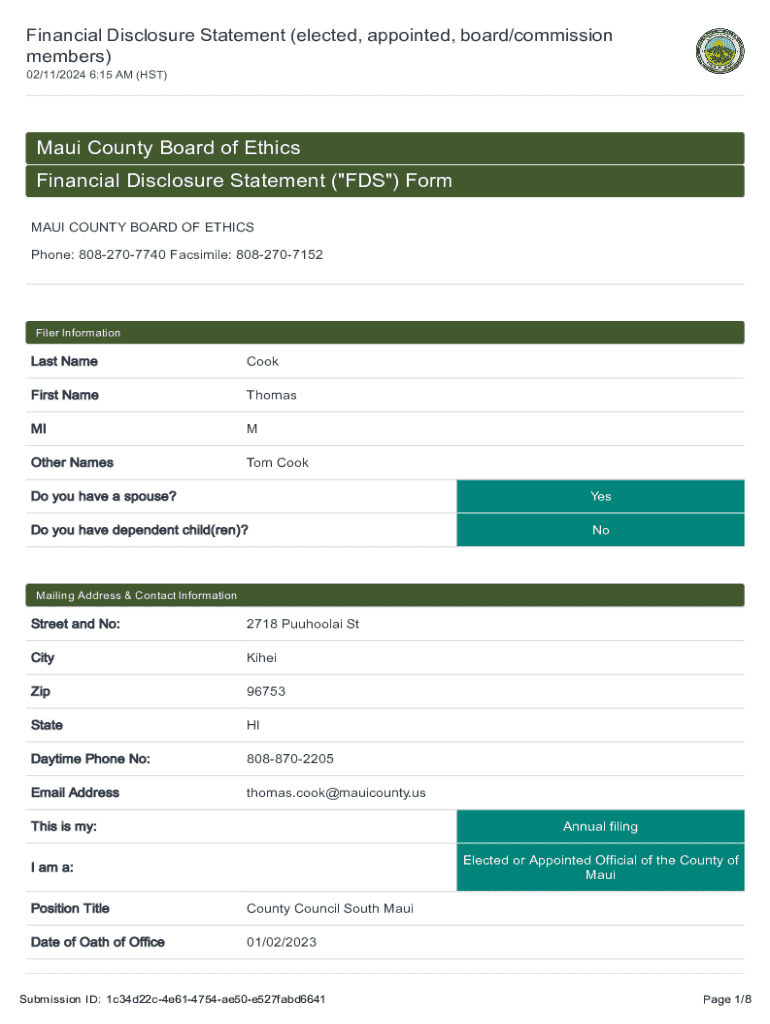

Sample financial disclosure statement forms

For users seeking to navigate their financial disclosure statement forms effectively, reviewing real-world examples can be extremely beneficial. Sample forms illustrate what a completed disclosure looks like, highlighting key areas to include and common formats for presenting information. Analyzing these samples provides insight into best practices and helps users understand what to expect when filling out their own forms.

Learning from completed forms can enhance accuracy and confidence, preventing errors that can result from misinterpretation of form requirements. Users are encouraged to utilize sample disclosures as a reference point, ensuring they meet all requirements specific to their sector.

Publishing updates and notifications

To stay informed about changes in financial disclosure regulations and submission processes, subscribing to notifications is highly beneficial. Keep abreast of new compliance requirements and forms by following official channels and utilizing resources provided on platforms like pdfFiller.

Accessing a library of publications and guides ensures individuals can continuously learn about best practices and avoid common mistakes in their financial disclosure submissions. Remaining engaged with updated information fosters proactive compliance and fortifies the integrity of financial reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial disclosure statement in Gmail?

How can I get financial disclosure statement?

Can I sign the financial disclosure statement electronically in Chrome?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.