Get the free Ms8453-pte

Get, Create, Make and Sign ms8453-pte

How to edit ms8453-pte online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ms8453-pte

How to fill out ms8453-pte

Who needs ms8453-pte?

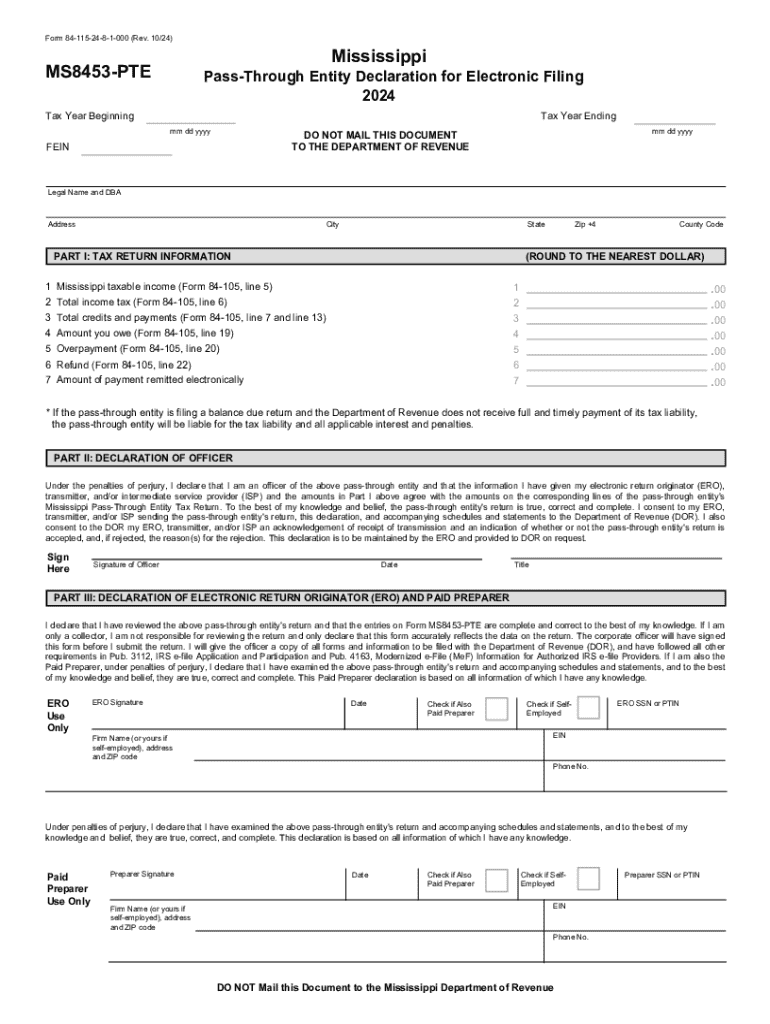

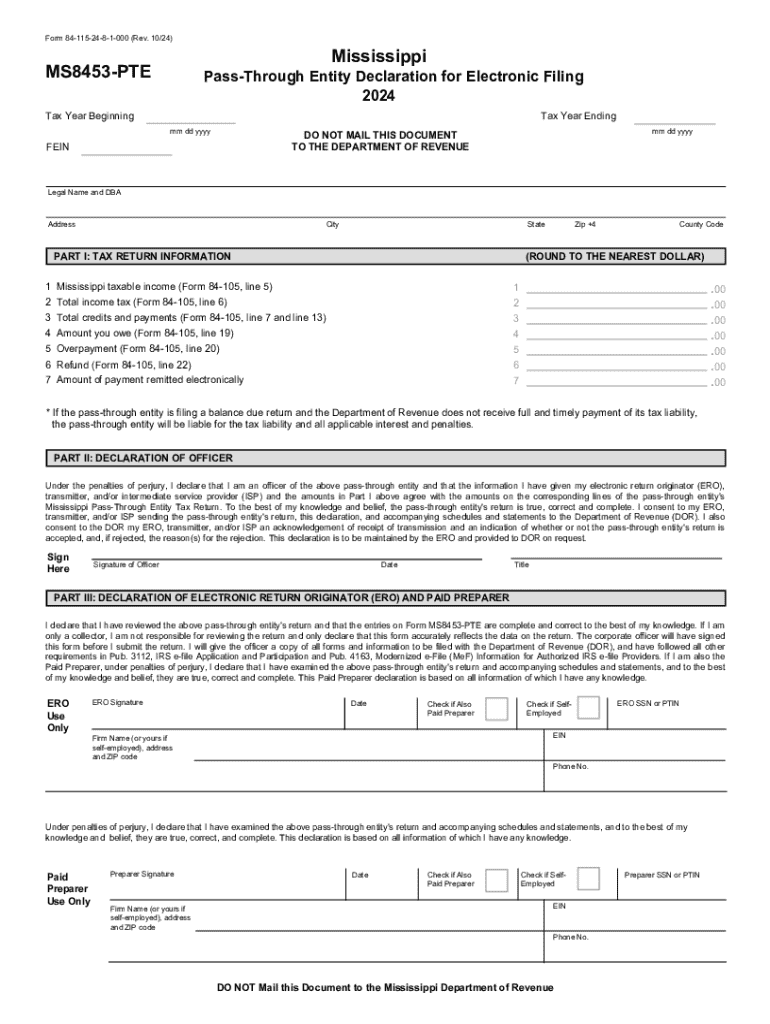

A comprehensive guide to the MS8453-PTE form

Understanding the MS8453-PTE form

The MS8453-PTE form serves a crucial role in the processing and validation of specific applications, typically related to tax matters or certain legal instances. This document is essential for individuals and businesses as it helps gather necessary information for tax processing and compliance.

The importance of the MS8453-PTE form cannot be overstated; it aids in the accurate calculation of liabilities and ensures that all necessary information is disclosed to the relevant authorities. Furthermore, this form is a vital step in ensuring taxpayers meet compliance standards, helping to avoid potential penalties or legal issues.

Key components of the MS8453-PTE form

The MS8453-PTE form is divided into several sections designed to collect specific information. Notable sections include personal information, employment details, and financial information. Each section requires attention to detail to ensure accuracy and completeness.

The personal information section will typically require your name, address, and contact information, while employment details focus on job title, employer, and duration of employment. Lastly, financial information will gather income details, deductions, and other relevant financial data necessary for a comprehensive review.

Mandatory fields on the form require particular attention as missing information can delay processing. Conversely, optional fields, while not compulsory, might provide additional context or aid in your submission.

Step-by-step guide to completing the MS8453-PTE form

Before diving into the completion of the MS8453-PTE form, gather essential documents such as identification, proof of income, and employment verification. Having these documents on hand will streamline the process and ensure accuracy throughout.

To successfully fill out the form, proceed as follows: First, begin with filling out your personal information. Be careful to double-check your name and social security number for accuracy. Next, complete the employment details, ensuring that your employer's name and your job title are correctly entered.

Finally, provide detailed financial information regarding income and owed taxes. Take a moment to review your completed form; errors at this stage could lead to significant delays or issues with processing.

Editing and making changes to the MS8453-PTE form

Editing a completed MS8453-PTE form can be efficiently accomplished using pdfFiller. First, you can upload your previously completed form onto the platform, which allows you to access it easily for any changes required.

Once uploaded, pdfFiller offers interactive editing features that enable you to modify any section of the form with ease. Suite options include text edits, adding new sections, or removing unnecessary information seamlessly.

Signing the MS8453-PTE form electronically

As many documents are moving toward digital formats, the eSignature requirements for the MS8453-PTE form allow for greater flexibility and efficiency in processing. An electronic signature can be legally binding and valid for most legal purposes.

To eSign the MS8453-PTE form using pdfFiller, follow this straightforward step-by-step process: After completing your form, proceed to the signature section. Use pdfFiller's built-in eSignature feature, which allows you to create a signature from scratch or upload an existing one. Once satisfied, place the signature in the designated area, ensuring it's compliant with your local laws regarding electronic signatures.

Managing your MS8453-PTE form with pdfFiller

Saving and storing your completed MS8453-PTE form can be done effortlessly through pdfFiller’s cloud storage options. This feature ensures your documents are accessible from anywhere and at any time, making it easier to manage submissions and follow-up tasks.

For organized access, consider marking your documents and creating folders based on specific criteria, like date or project type. Additionally, pdfFiller offers collaboration features allowing you to share forms with colleagues and track edits made, fostering teamwork while working on important documents.

Common challenges and FAQs related to the MS8453-PTE form

Mistakes can happen at any stage of the form completion. If you find an error after submission, the first step is to determine whether your submission has been processed. If not yet processed, you may have the opportunity to make adjustments directly; if processed, follow the outlined procedures to formally update your information.

Common pitfalls to avoid include overlooking mandatory fields, failing to provide correct signatures, or submitting incomplete information. Staying organized, double-checking filled information, and utilizing the editing features of pdfFiller can significantly mitigate these risks.

Benefits of using pdfFiller for the MS8453-PTE form

Utilizing pdfFiller for managing the MS8453-PTE form streamlines the process significantly. Its document management system integrates various critical features, enabling users to edit, eSign, and collaborate on documents all within one platform. This integration enhances efficiency and reduces the likelihood of errors.

Moreover, the cloud-based solutions provided by pdfFiller mean that users can access their forms from anywhere and at any time, making it easy for individuals and teams to work remotely or on-the-go. In a world where collaboration is increasingly essential, pdfFiller excels in providing tools that foster teamwork while enhancing individual productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ms8453-pte online?

Can I create an electronic signature for the ms8453-pte in Chrome?

How can I edit ms8453-pte on a smartphone?

What is ms8453-pte?

Who is required to file ms8453-pte?

How to fill out ms8453-pte?

What is the purpose of ms8453-pte?

What information must be reported on ms8453-pte?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.