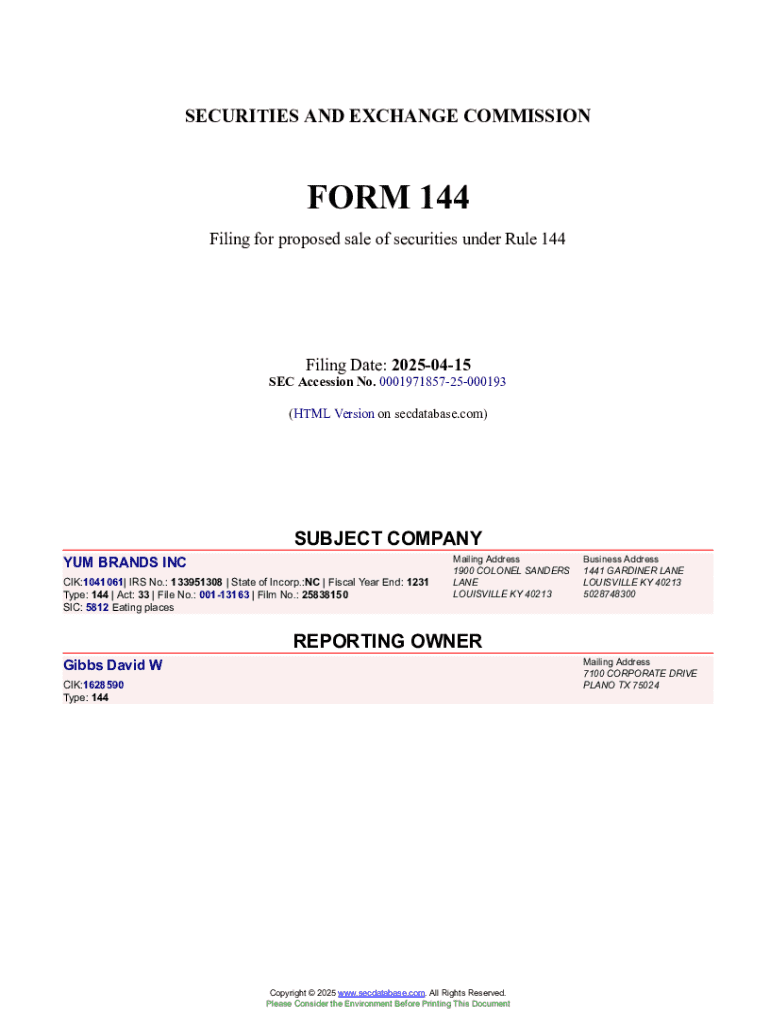

Get the free Form 144

Get, Create, Make and Sign form 144

Editing form 144 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 144

How to fill out form 144

Who needs form 144?

Comprehensive Guide to Form 144

Overview of Form 144

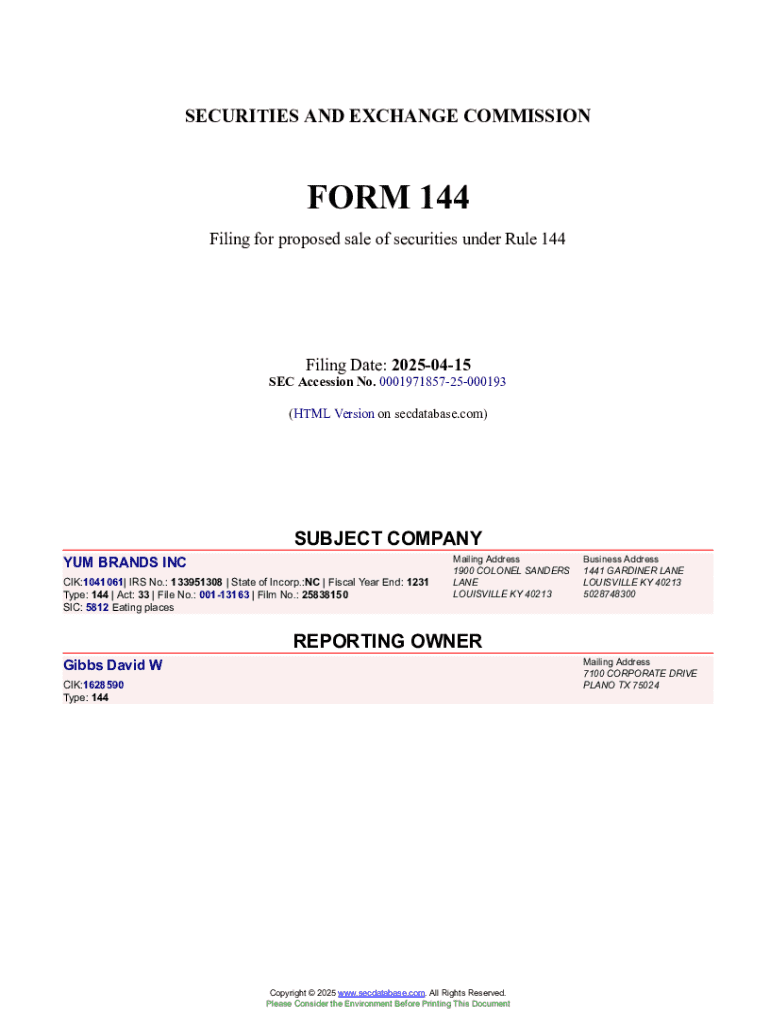

Form 144 is a notice of proposed sale of securities under Rule 144, primarily concerning the resale of restricted securities and control securities. This form identifies to the Securities and Exchange Commission (SEC) that an individual or entity plans to sell their owned securities, which are not freely tradable. The purpose of Form 144 is to disclose significant transactions to the SEC, thereby promoting transparency in capital markets and protecting against potential market manipulation.

The significance of Form 144 arises particularly in relation to restricted securities. These are typically shares acquired through private investment that cannot be sold for public trading until certain conditions are met. By filing Form 144, the stakeholders ensure compliance with SEC regulations, thereby safeguarding the integrity of the financial markets.

Key stakeholders in Form 144 submissions include individual investors, institutional investors, company insiders, and entities that hold restricted securities. Proper filings can help maintain an orderly market while giving stakeholders the necessary legal framework to sell their securities efficiently.

Understanding the context

Historically, Form 144 has evolved following various regulations concerning restricted securities dating back to the 1930s, when the SEC was established to regulate securities markets. The initial framework required transparency for securities transactions, and over the decades, modifications and refinements have taken place to adapt to marketplace innovations and investment practices.

In modern capital markets, Form 144 continues to play a vital role. With the rise of private equity, hedge funds, and venture capital—each often dealing heavily in restricted securities—the need for a clear resale process has grown. However, some misconceptions linger around Form 144, particularly around the belief that it only applies to insiders of a company.

Who needs to file Form 144?

Identifying eligibility criteria for Form 144 filing includes recognizing who must comply with its requirements. Primarily, individuals or entities that hold restricted securities or control securities must file if they plan to resell. Control securities are held by individuals who have a connection to the issuing company, such as officers, directors, or significant shareholders. Meanwhile, restricted securities are often acquired through private placements and need regulatory approval to ensure compliance.

Common triggers for Form 144 filing include:

Form 144 filing triggers

Filing Form 144 becomes necessary under certain conditions. Typically, individuals must submit this form when they intend to sell more than 5,000 shares or the total sales price exceeds $50,000, which helps to track significant transactions. The rationale behind this threshold is to balance privacy for smaller transactions with regulatory needs for larger sales.

Statistical data shows that the frequency of Form 144 filings peaks during significant market events, reflecting how often insiders choose to liquidate portions of their holdings. For instance, a sharp increase was noted during market recoveries post-economic downturns—often interpreted as indicators for broader market confidence.

Case studies reveal that successful filings often enable quicker conversion of restricted securities into cash, illustrating the form's practical efficacy. For example, a technology company executive filed Form 144 prior to a significant stock spike, successfully aligning their sale to maximize returns while remaining compliant.

Step-by-step instructions for completing Form 144

Completing Form 144 involves several straightforward steps. Initially, filers must provide their name, address, and the name of the issuer whose securities they are selling. The next crucial section includes the information regarding the type of securities, the number of shares, and the proposed sale dates.

To ensure accuracy while filling out Form 144, it is vital to:

Common mistakes filers make include failing to file within the required time frame, neglecting to disclose all necessary transactions, or mistakenly miscalculating sale values. Avoiding these pitfalls is essential for maintaining compliance with SEC regulations.

Amendments to conditions for resale of restricted securities

Regulatory changes periodically affect the conditions under which restricted securities can be resold and thus influence Form 144 filing procedures. Amendments can introduce new rules relating to the frequency of filings, volume limitations, and circumstances under which filings may be amended or withdrawn. Recognition of these changes can lead to better strategies for asset liquidation.

The implications of these changes may extend to secondary market transactions, impacting how quickly and efficiently securities can be turned into cash. It's essential for filers to stay updated with these amendments through SEC announcements, financial news, or legal advisories to ensure compliance.

Analyzing SEC staff interpretations

Analyzing SEC staff interpretations provides essential insights for filers. The SEC frequently issues guidance on how Form 144 should be interpreted in the context of particular transactions. Understanding these interpretations can help avoid misfiling and lead to more successful compliance with SEC regulations.

Practically, these interpretations affect filing methods, necessary disclosures, and the SEC's expectations from filers. These interpretations may differ at state levels, leading to additional considerations for those operating in multiple jurisdictions. Thus, professionals must familiarize themselves with both federal and state regulations to comply thoroughly.

Collaboration and communication: Working with analysts

Collaboration with financial analysts is crucial when it comes to handling Form 144 filings. Analysts use this data to gauge the activity of insiders within a company, creating insights that can influence investment strategies. By effectively communicating the intent behind Form 144 filings, filers can manage perceptions and reduce speculation in the markets.

Effective communication strategies include timely notifications to analysts about upcoming sales, clarification of the nature of securities being sold, and the strategic alignment of sales with overall financial reporting. Engaging in transparent and structured dialogues can bolster analyst confidence and enrich market analysis.

Utilizing interactive tools for Form 144 management

Utilizing interactive tools can streamline the management of Form 144 submissions. Resources such as pdfFiller provide comprehensive options for filling out, editing, and securely submitting forms, making the entire process more efficient. Features like e-signing, collaboration, and secure storage can help ensure that documents are handled accurately and expediently.

Adopting cloud-based solutions for document management not only facilitates real-time collaboration but also improves record-keeping for compliance. By leveraging these tools, filers minimize the likelihood of errors, contribute to streamlined processes, and enhance overall document management when navigating the complexities of Form 144.

Common FAQs and troubleshooting tips

Addressing common questions surrounding Form 144 is important for both novice and experienced filers. This form can evoke confusion, especially concerning deadlines, required disclosures, and the implications of late filings. Being proactive about these common queries can significantly ease the filing process.

Solutions to common filing issues include:

For additional assistance, filers can refer to the SEC’s official website or reach out to securities regulatory bodies.

Real-world examples and case studies

Real-world examples provide context for Form 144's effectiveness. Successful filings, such as those conducted by prominent corporate executives during favorable market conditions, often result in optimal financial outcomes. Case studies illustrate how timely filings allowed for strategic liquidations to capitalize on surges in stock prices.

Furthermore, analyses of these filings demonstrate how they can impact individual and market performance. For example, a tech firm’s executive liquidating a portion of shares prior to a product launch highight the anticipation that drives market price adjustments. Taking lessons from these past filings can equip future filers with insights into strategic timing and compliance.

Regulatory compliance and best practices

Ensuring compliance with SEC regulations surrounding Form 144 is paramount. Establishing a robust understanding of both the foundational and evolving requirements protects filers from potential legal repercussions. Best practices emphasize maintaining immaculate records and documentation throughout the filing process, as well as developing a clear timeframe for submissions.

Consequences of non-compliance with Form 144 can include hefty fines, legal ramifications, and damage to professional reputation. Hence, filers should establish proactive monitoring of compliance and consider engaging legal counsels for consultation on all significant transactions.

Further exploration: Related forms and documents

Engaging with additional forms and documents can broaden understanding surrounding Form 144. Key forms often linked to Form 144 include Form S-1 for registration of new securities and Form 10-K for annual reporting. A cohesive understanding of these forms and their interrelations can offer filers enhanced clarity on the broader regulatory landscape.

Exploring these documents in tandem can create a well-rounded approach towards understanding all required disclosures and filings in the context of securities. To better navigate these regulations, individuals should familiarize themselves with related frameworks and best practices.

Expert perspectives on future trends in Form 144 filings

Industry experts predict that Form 144 filings will evolve alongside technological advancements and regulatory shifts. As transparency requirements tighten and investor demands grow, the landscape surrounding restricted securities will continue to transform. Analysts anticipate that streamlined digital platforms will enable more efficient filing processes while maintaining compliance.

The future may also see an increased focus on automated compliance checks, which can help filers navigate complex regulations with ease, ultimately democratizing access to equity markets. Embracing technology and adapting to regulatory changes will be paramount for stakeholders looking to succeed in the evolving landscape surrounding Form 144.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 144 without leaving Google Drive?

How do I execute form 144 online?

How do I edit form 144 online?

What is form 144?

Who is required to file form 144?

How to fill out form 144?

What is the purpose of form 144?

What information must be reported on form 144?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.