Get the free Email Credit Application

Get, Create, Make and Sign email credit application

How to edit email credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out email credit application

How to fill out email credit application

Who needs email credit application?

Email Credit Application Form: Your Comprehensive Guide

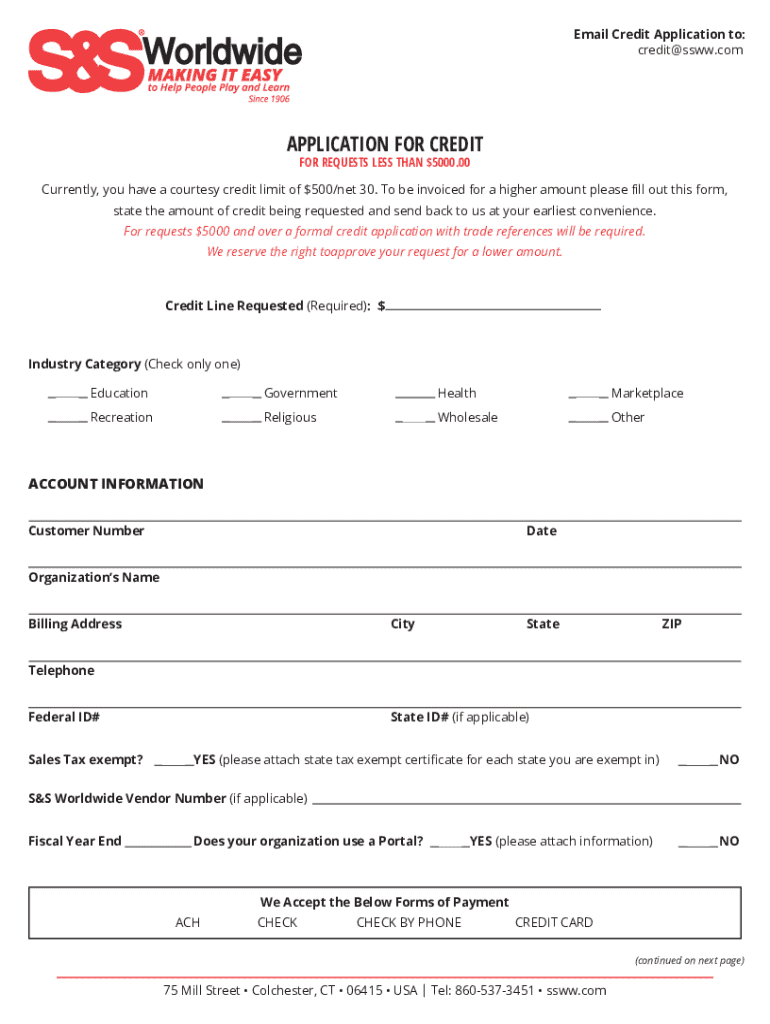

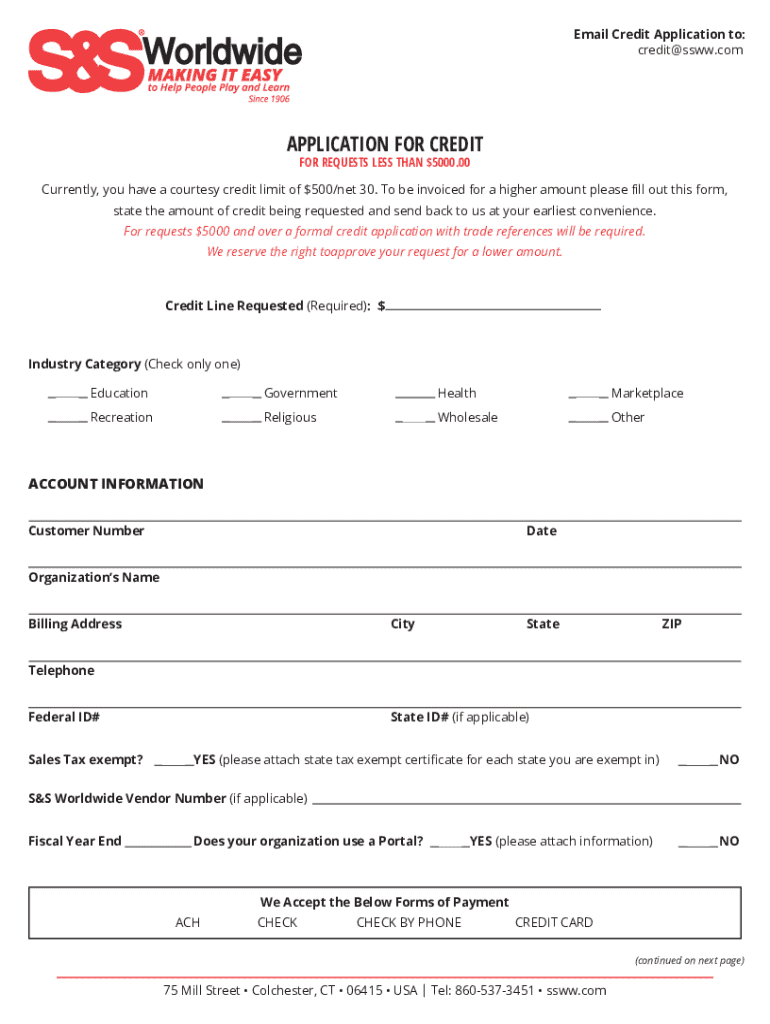

Understanding the email credit application form

An email credit application form is a document that potential borrowers fill out and send via email to financial institutions or lenders to apply for credit. This form serves as a formal request for a loan or line of credit and is crucial because it enables lenders to evaluate the applicant's financial status and creditworthiness. The importance of using an email format for such applications lies in its convenience and speed—applicants can deliver their requests directly to lenders without the need for physical paperwork.

Key components of an email credit application form

When filling out an email credit application form, several key components are essential to ensure that lenders have all necessary information to make an informed decision. First, applicants need to provide personal details, such as their full name, address, and contact information, allowing lenders to verify identity and reach out if needed. Following this, financial details such as income, expenses, and a concise credit history are crucial, as they give lenders insight into the applicant's financial behavior.

Additionally, employment information like the employer's name, job title, and a possible income verification document can further strengthen the application. Optional additional information might include references or co-signers, as well as any specific requests related to the credit being sought, which can help tailor the lender’s decision-making process.

Best practices for structuring your email attachment

To ensure your email credit application is received positively, adherence to proper formatting guidelines is paramount. It's recommended to use widely accepted file formats like PDF when sending documents. This format preserves the layout and ensures all information is easily readable. When organizing your information, structure it in a logical flow—starting with personal details, then financials, followed by employment data, which allows for quick comprehension by the recipient.

Including necessary attachments, such as identification documents or income verification, enhances your application’s credibility. When attaching these files, ensure they are secure and submit them alongside your application to avoid delays. A well-organized email with clear, labeled attachments significantly increases your chances for approval.

Crafting the perfect email message

The email itself is just as important as the attached application form. Start with a clear and concise subject line, such as ‘Credit Application for [Your Name].’ This makes it easier for the recipient to understand the purpose of the email immediately. The body of the email should begin with a professional greeting and a brief introduction about yourself and your purpose for applying. Clearly articulate your intent for seeking credit and provide a short overview of the documents attached to the email.

Closing the email politely is also crucial. Express gratitude towards the recipient for considering your application, as this sets a positive tone and shows respect for their time and effort. An email that is friendly yet professional leaves a lasting impression.

Sending and managing your application

When sending your email, it’s essential to utilize a professional email account to maintain a formal tone. Additionally, after sending the application, confirm delivery by checking if there are tools available to request read receipts. Following up a few days after sending is a good practice; a polite inquiry asking if the application has been received demonstrates your interest and keeps the lines of communication open.

Tracking the status of your application allows you to respond promptly if further information is needed from the lender. If you do not receive a response within the expected timeframe, don’t hesitate to reach out again, providing your application details, which can help in locating it within their system and reduce the chances of your application being overlooked.

Editing and revising your application form

Before submitting your email credit application form, meticulous review is critical. Common errors in credit applications include inaccuracies in personal data or missing financial details that could hinder approval. Utilizing platforms like pdfFiller enhances this process; its editing tools let you collaborate seamlessly, allowing others, such as financial advisors, to offer feedback or confirm the accuracy of your submission.

Moreover, the eSignature feature on pdfFiller provides a quick and legally binding way to sign your application, which could expedite the approval process. Additionally, collaboration tools ensure that everyone involved can make necessary inputs and revisions, making the application solid and error-free.

Troubleshooting common issues

Miscommunication regarding the receipt of your application can sometimes lead to frustration. If your application seems to be lost or overlooked, kindly reach out to the lender, referencing the date you submitted and details included in the original email. A gentle reminder may prompt a review of your application.

In case of a denied application, it's important to understand common reasons such as insufficient credit history or high debt-to-income ratios. In such cases, requesting feedback from the lender can provide insight into what could be improved for future applications, enabling you to better prepare and improve your financial standing for next time.

Advantages of using pdfFiller for your email credit application

Choosing pdfFiller for your email credit application form maximizes the benefits of an online document solution. The platform offers cloud-based access that allows you to manage your documents from virtually anywhere, ensuring that you can complete your applications on the go. Its real-time editing and collaboration features enable multiple users to work together efficiently, allowing for immediate updates and shared input.

User testimonials highlight numerous success stories that demonstrate the effectiveness of pdfFiller in streamlining the credit application process. By opting for pdfFiller, you're not only enhancing your documentation efficiency but also increasing your chances for a successful credit application.

Frequently asked questions (FAQs)

Many applicants wonder about the legality of submitting an email credit application. Generally, this method is entirely accepted as long as the forms comply with legal requirements and all necessary information is included. Additionally, you should handle sensitive information with care, ensuring that any documents sent via email are encrypted or password-protected to prevent unauthorized access.

For further support, pdfFiller offers resources and customer support dedicated to helping users navigate the intricacies of creating and submitting their forms. This includes guidance on securing their information and handling paperwork effectively.

Interactive section

To assist you in applying for credit, we provide a fillable email credit application template that you can access on pdfFiller. This interactive template offers you a step-by-step guide on filling it out accurately, ensuring you don’t miss any important information. Making use of this template simplifies the process and enhances your chances of approval.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit email credit application from Google Drive?

Can I create an electronic signature for signing my email credit application in Gmail?

How can I fill out email credit application on an iOS device?

What is email credit application?

Who is required to file email credit application?

How to fill out email credit application?

What is the purpose of email credit application?

What information must be reported on email credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.