Get the free Year 3 Annual Report

Get, Create, Make and Sign year 3 annual report

How to edit year 3 annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out year 3 annual report

How to fill out year 3 annual report

Who needs year 3 annual report?

Your Complete Guide to the Year 3 Annual Report Form

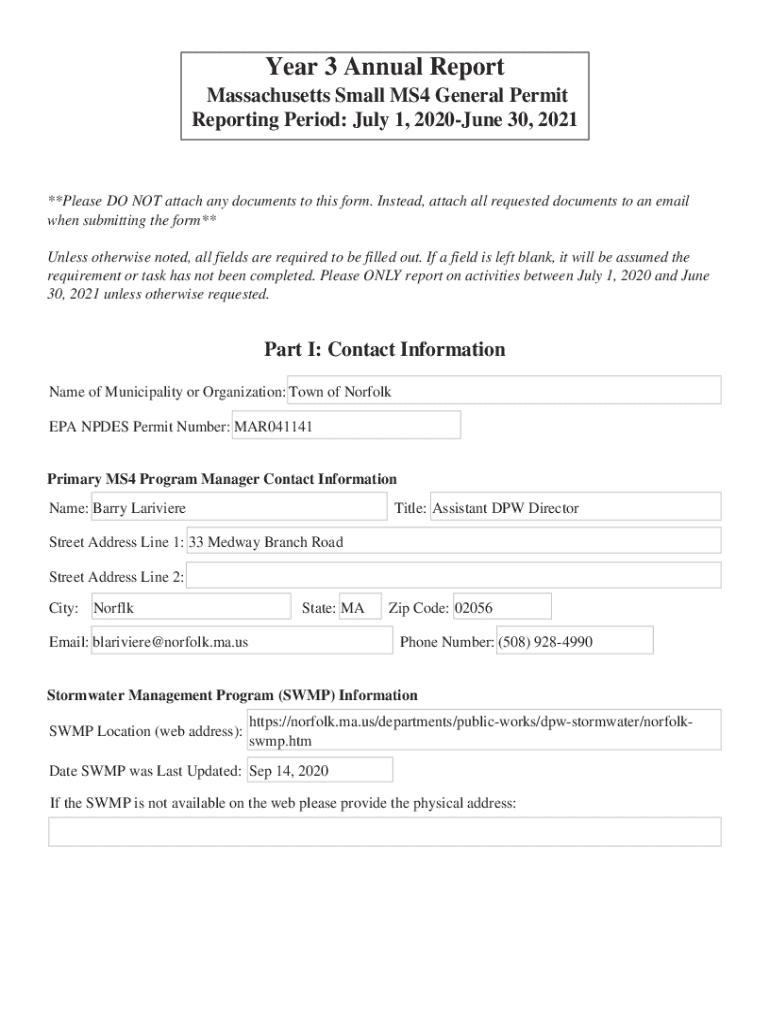

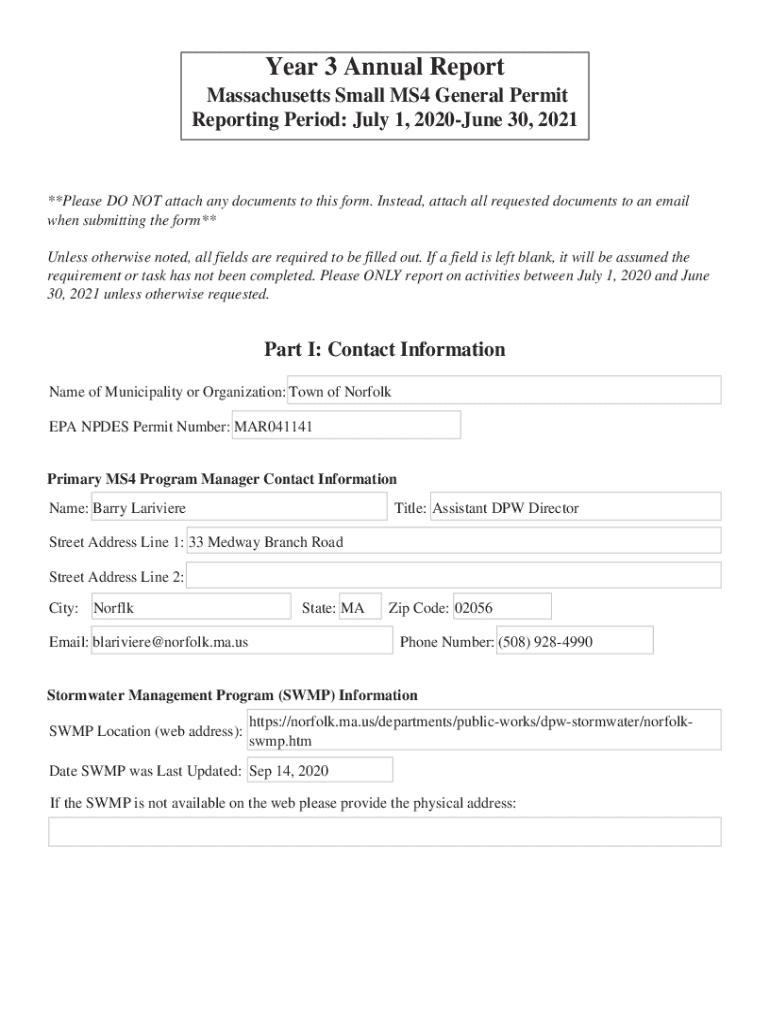

Overview of the Year 3 Annual Report Form

The Year 3 Annual Report Form is a critical document for businesses in their third operational year, serving as a formal record of financial health, governance, and compliance with state regulations. This report provides insights into a company’s year-over-year performance, which is essential for stakeholders, including investors, regulatory bodies, and the company itself.

Preparing for Your Year 3 Annual Report

To effectively prepare for your Year 3 Annual Report, compiling all required documentation is essential. This proactive approach not only facilitates a smoother filing process but also ensures that all reported information aligns with regulatory standards.

Additionally, it's important to understand the reporting requirements of your specific state. Each state has its nuances regarding what must be reported and how, so familiarizing yourself with those distinctions can prevent issues.

Step-by-step guide to completing the Year 3 Annual Report Form

Filling out the Year 3 Annual Report Form involves several straightforward sections. Below, we provide a detailed guide to help you navigate the specific requirements.

Using pdfFiller to complete your Year 3 Annual Report

pdfFiller provides a streamlined platform for completing your Year 3 Annual Report Form. Its user-friendly interface enhances the efficiency of filling out and managing your reports.

Submitting the Year 3 Annual Report

Once your Year 3 Annual Report is completed, you must choose how to submit it. Many states offer both electronic and traditional filing methods, each with its pros and cons.

Common challenges and how to overcome them

Despite thorough preparation, businesses may encounter common pitfalls when filing their Year 3 Annual Reports. Understanding these challenges will help you proactively address them.

Managing your Year 3 Annual Report post-submission

After you’ve submitted your Year 3 Annual Report, managing the status and accessibility of your documents is crucial for future reference and compliance.

Frequently asked questions

As you navigate the process of completing your Year 3 Annual Report, you might have some pressing questions. Here are some frequent inquiries.

Additional considerations

Being aware of the fees associated with the Year 3 Annual Report is essential for budgeting. Additionally, maintaining organized records will facilitate smoother future filings.

Conclusion and support resources

The Year 3 Annual Report Form is a vital document that can significantly impact your business's trajectory. Utilizing tools like pdfFiller can streamline the process, allowing for efficient document management and e-signing capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my year 3 annual report in Gmail?

How do I edit year 3 annual report in Chrome?

Can I create an electronic signature for signing my year 3 annual report in Gmail?

What is year 3 annual report?

Who is required to file year 3 annual report?

How to fill out year 3 annual report?

What is the purpose of year 3 annual report?

What information must be reported on year 3 annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.