Get the free Non-resident Alien (nra) Additional Information Form

Get, Create, Make and Sign non-resident alien nra additional

Editing non-resident alien nra additional online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-resident alien nra additional

How to fill out non-resident alien nra additional

Who needs non-resident alien nra additional?

Non-Resident Alien (NRA) Additional Form: A Comprehensive Guide

Understanding Non-Resident Alien (NRA) status

A Non-Resident Alien (NRA) is an individual who is not a U.S. citizen and does not meet the green card or substantial presence test, which are two primary criteria for determining residency in the United States for tax purposes. Understanding what constitutes NRA status is essential for compliance with IRS regulations regarding income and withholding tax obligations.

In contrast, a Resident Alien (RA) meets either the green card test or the substantial presence test, meaning they can be taxed on their worldwide income like a U.S. citizen. The importance of determining the correct tax residency status is particularly crucial for NRAs, as different regulations apply, impacting their taxation on income earned both within and outside the U.S.

Overview of additional forms required for NRAs

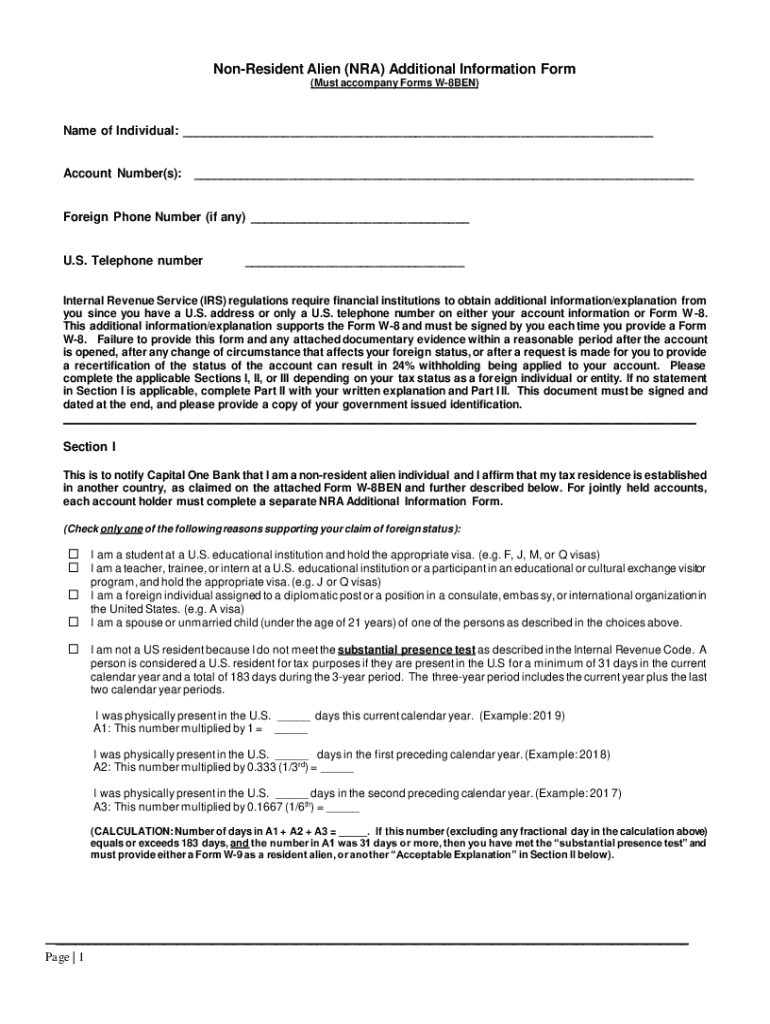

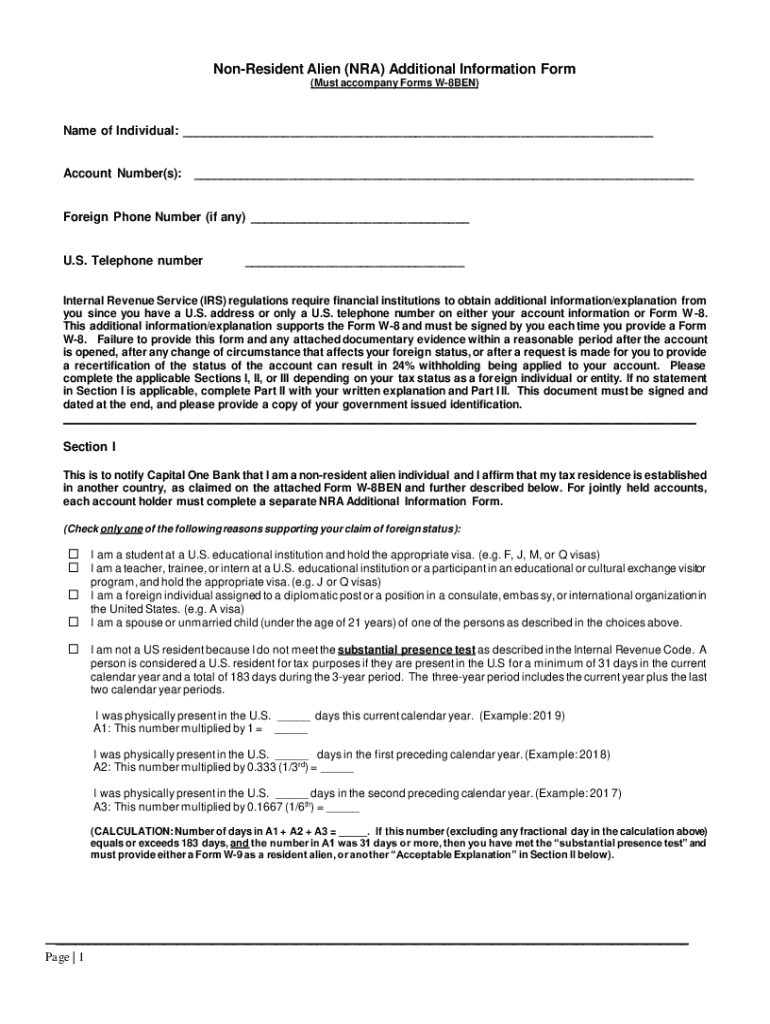

Non-Resident Aliens typically need to submit specific forms to report income and manage tax obligations in the United States. Among the essential forms is Form W-8BEN, which certifies the individual's foreign status for U.S. tax withholding purposes and is often required by financial institutions or brokers. In addition, Form 1040-NR, the U.S. Nonresident Alien Income Tax Return, is necessary for reporting income effectively and claiming any applicable tax treaties.

These forms serve distinct purposes: while Form W-8BEN helps NRAs prevent over-withholding on specific income types, such as dividends or royalties, Form 1040-NR is utilized to report overall income for tax assessment. Understanding the circumstances that necessitate additional documentation is critical; for instance, having income sourced from various channels may require multiple submissions to ensure compliance.

Step-by-step guide to completing additional forms

Completing Form W-8BEN requires careful attention to detail: Start with filling out your name, country of citizenship, and status as a beneficial owner. Common mistakes include omitting the U.S. Taxpayer Identification Number (if applicable) or leaving out signature and date. Submit your completed W-8BEN form to the withholding agent or financial institution; direct submissions to the IRS are not required unless explicitly instructed.

Form 1040-NR is more comprehensive, requiring income figures, deductions, and tax treaty benefits where applicable. NRAs must ensure they are eligible to file this form, typically evidenced by income earned in the U.S. and compliance with IRS regulations. The standard deadline for filing is June 15 for NRAs living abroad, although extensions can be requested if more time is needed.

Tax withholding considerations for NRAs

Understanding tax withholding obligations is pivotal for NRAs. Generally, the entity making payments to NRAs is responsible for withholding the appropriate tax rate as dictated by IRS guidelines. This rate can vary based on types of income received; for instance, wages and scholarships might have different treatments under tax treaties, illustrating why documentation such as Form W-8BEN is essential.

For NRA students or employees, specific examples of withholding may include reduced withholding rates on scholarships that are exempt from taxation or different withholding rates on wages depending on the individual's resident status. Therefore, keeping abreast of potential impacts and using resources to clarify any issues around withholding can be highly beneficial.

Additional resources for NRAs

Accessing IRS publications, specifically those pertaining to NRAs, is invaluable for individuals navigating their tax obligations. Key publications like Publication 519 and the instructions for Form 1040-NR provide detailed guidance and examples that help clarify tax responsibilities. Utilizing these resources effectively can empower NRAs to make informed decisions.

Moreover, numerous community resources, including tax assistance programs specifically targeting non-residents, can provide personalized guidance. Organizations such as the Volunteer Income Tax Assistance (VITA) program often assist international students and NRAs with their tax-related inquiries, enhancing accessibility to necessary support.

Interactive tools for managing forms

Managing tax-related forms, such as the non-resident alien NRA additional form, can be streamlined through tools like pdfFiller. This platform enables you to edit and fill out PDFs easily, ensuring that all information is accurately captured. To get started, users can simply upload their forms to the pdfFiller platform and begin editing using the intuitive online interface.

Additionally, pdfFiller offers electronic signature functionality, allowing users to securely sign documents from anywhere. Collaboration features mean that users can share forms with team members, facilitating communication and ensuring that all necessary inputs are collected efficiently. Finally, users can securely store their completed forms in the cloud, ensuring easy access and maintaining comprehensive records.

FAQs about Non-Resident Alien (NRA) additional form

NRAs often have numerous questions regarding their tax obligations and the completion of IRS Forms. Common concerns include how to properly fill out the forms, what to do in case of missing information, and clarifications surrounding specific line items. Troubleshooting common issues—like failed submissions or unexpected rejections—can also be daunting and require careful attention to IRS guidelines.

Positioning oneself for success involves familiarizing with IRS resources and reaching out to professionals when needed. If confusion arises, NRAs should investigate pathways for assistance, such as contacting a tax professional experienced in non-resident taxation or leveraging community support services for guidance.

Best practices for Non-Resident Alien compliance

Ensuring compliance with IRS standards involves staying informed about tax regulations, particularly regarding NRAs—these can change based on policy shifts or updates in tax treaty agreements. Establishing a routine for monitoring tax obligations and filing deadlines, such as maintaining a calendar of due dates, can also be advantageous.

Additionally, keeping meticulous records and securely storing documents will aid in case of an audit or discrepancies. Utilizing platforms like pdfFiller to manage and organize documents effectively can simplify this process, ensuring that NRAs are always prepared and compliant with required provisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-resident alien nra additional for eSignature?

How do I edit non-resident alien nra additional online?

How do I complete non-resident alien nra additional on an Android device?

What is non-resident alien nra additional?

Who is required to file non-resident alien nra additional?

How to fill out non-resident alien nra additional?

What is the purpose of non-resident alien nra additional?

What information must be reported on non-resident alien nra additional?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.