Get the free Business Income & Expenses (sole Proprietorship)

Get, Create, Make and Sign business income expenses sole

How to edit business income expenses sole online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business income expenses sole

How to fill out business income expenses sole

Who needs business income expenses sole?

Comprehensive Guide to Business Income Expenses Sole Form for Sole Proprietors

Understanding business income and expenses

Business income comprises all the revenue generated from a sole proprietor’s operations, including sales from products or services. It’s the lifeblood of any business and is vital for sustaining operations, paying expenses, and ensuring profitability. On the other hand, business expenses are the costs incurred in the process of earning that income. These can range from operational costs to administrative fees, which are essential for the day-to-day functioning of a business. For sole proprietors, understanding the intricacies of tracking both income and expenses is crucial, not only for marketing and growth strategies but also for accurate tax reporting and compliance.

Overview of the sole proprietorship

A sole proprietorship is a straightforward business model where an individual owns and operates the business independently. This form is popular among freelancers, consultants, and small business owners due to its simplicity and ease of establishment. The primary benefit of operating as a sole proprietor is the direct control the owner has over business decisions, along with minimal regulatory burdens compared to other business structures such as corporations or partnerships. However, this structure also comes with its challenges, including personal liability for business debts and the potential for greater financial risk.

Key components of the sole proprietor’s financial records

To maintain a successful sole proprietorship, it’s critical to organize and categorize financial records effectively. The primary components include income categories and expense categories. Understanding where your revenue is coming from—whether it’s from sales, service provision, or additional income sources—is essential for assessing business performance. Similarly, categorizing expenses helps in identifying where money is being spent and can reveal opportunities for cost-cutting and efficiency improvements.

Allowable and disallowable business expenses

Navigating the landscape of allowable versus disallowable expenses is crucial for sole proprietors to prevent costly mistakes during tax filing. Allowable expenses are those that can be deducted from your income for tax purposes, significantly lowering taxable income and tax liability. Examples include travel expenses, meals related to business, and home office deductions. On the contrary, disallowable expenses, which cannot be deducted, typically include personal expenses and fines. Understanding these distinctions can help sole proprietors maximize their tax returns while ensuring compliance with tax regulations.

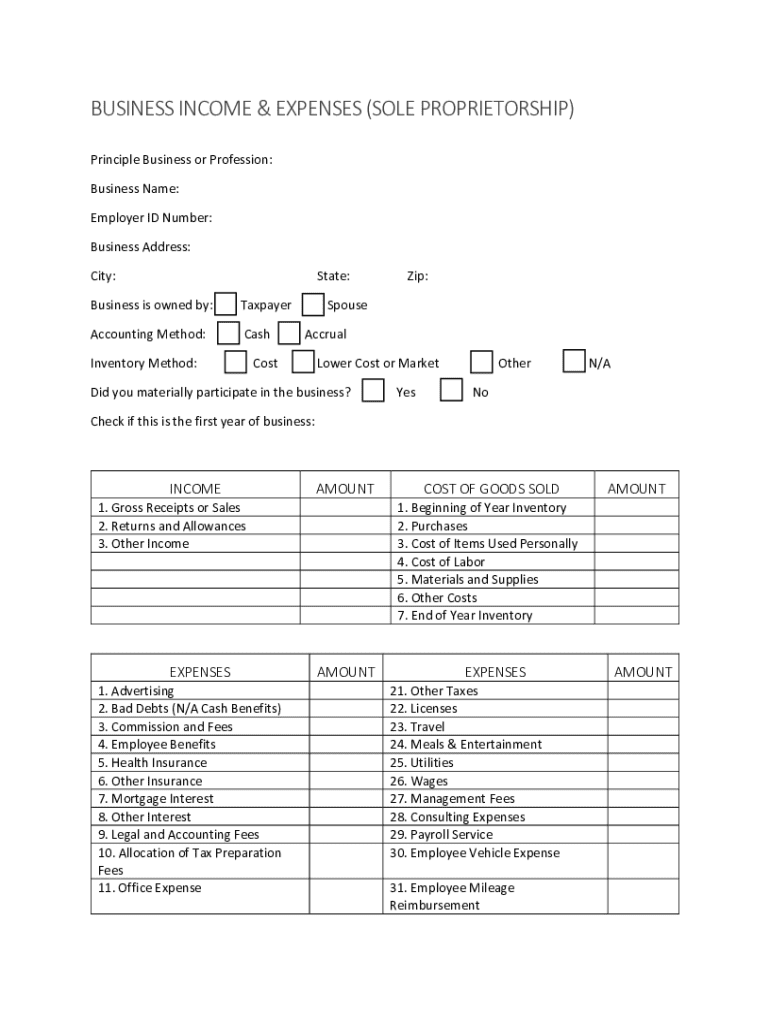

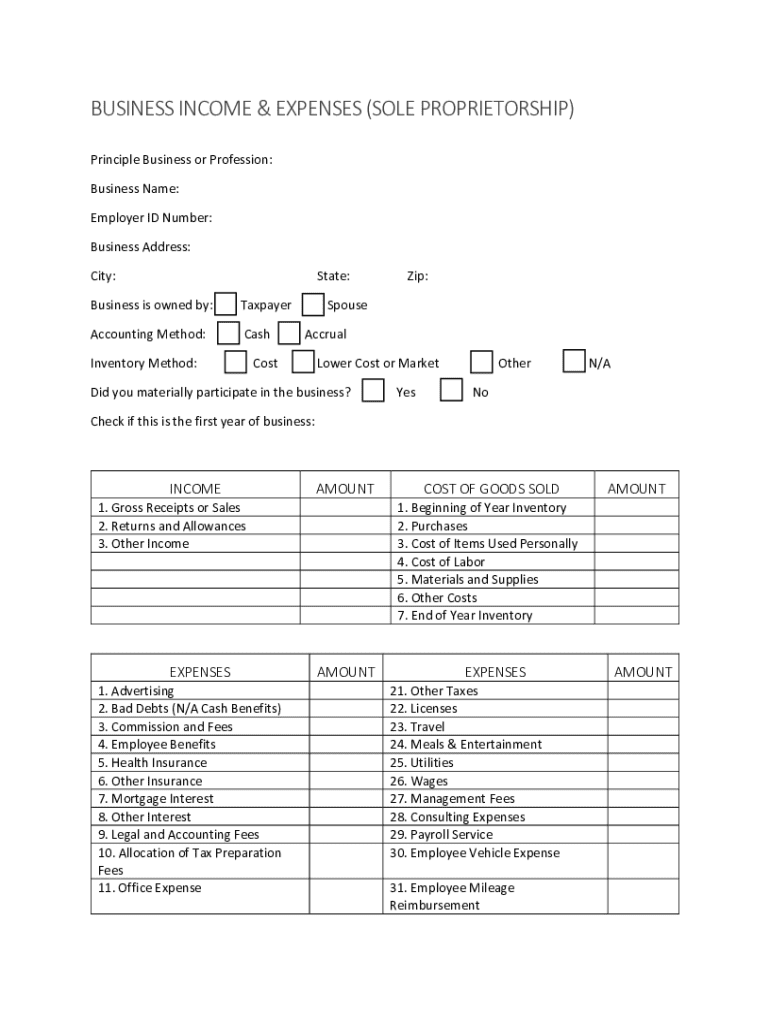

Preparing the business income expenses sole form

Filling out the business income expenses sole form accurately is pivotal to ensure proper tax reporting. The first step is gathering all necessary documentation, including receipts, invoices, and bank statements, which serve as evidence of income and expenses. The next step involves a detailed breakdown of income and expenses in the specified sections of the form. By following a methodical approach to filling out this form, sole proprietors can avoid common pitfalls that may lead to audits or penalties, including misclassification of expenses or omitted income.

Illustrative example: Completing the form

To provide clarity, let’s consider a case study of a freelance graphic designer operating as a sole proprietor. In one month, they earned $4,000 from client projects and incurred $1,200 in operational costs, including software subscriptions and office supplies. When completing the business income expenses sole form, the designer would record the $4,000 in income and categorize expenses like subscriptions and supplies, ensuring the totals align with bank statements and receipts. This practical example illustrates how to properly document incoming profits and outgoing expenses.

Tax implications of business income and expenses

Understanding the tax implications of income and expenses is crucial for sole proprietors. Proper documentation facilitates more accurate tax returns, maximizing potential deductions and minimizing liabilities. Tax deductions for allowable expenses can liberate significant capital, enabling reinvestment into the business. It’s important for sole proprietors to be aware of shifting tax laws and reporting requirements, which can differ from year to year, to keep abreast of legal obligations and benefits.

Utilizing pdfFiller for business documents

Managing documents as a sole proprietor becomes significantly easier with pdfFiller. This cloud-based solution enables users to edit PDFs, e-sign documents, and collaborate effectively from anywhere. With pdfFiller, uploading and managing your business income expenses sole form is straightforward. The platform offers access to templates and resources, helping users fill out forms accurately and efficiently while minimizing human error. Features like cloud-based edits and collaborative tools enhance workflow and productivity.

Best practices for managing business income and expenses

Effective management of business income and expenses requires a systematic approach. Regularly updating financial records is a fundamental practice, ensuring accuracy and completeness throughout the year. Setting up a robust tracking system categorized by type of expense or income source helps streamline the accounting process. Additionally, leveraging financial software to automate tasks can save time and reduce the risk of human error, thereby enhancing the overall efficiency of business operations.

Frequently asked questions (FAQs)

When navigating the realm of business income expenses sole form, it's common to have questions. For instance, what should you do if you miss an expense? Staying organized and maintaining an accurate record becomes crucial, as it may still be claimed in the following year if properly documented. Additionally, financial records should generally be retained for at least seven years, depending on local regulations. Failure to fill out the sole form accurately can attract scrutiny, resulting in potential audits from tax authorities.

Interactive tools for sole proprietors

In the digital age, numerous tools are available to facilitate the management of business income and expenses. Calculators specifically designed for estimating allowable expenses can help ensure that you are claiming all eligible deductions. Additionally, tools for tracking income trends and patterns are invaluable for strategic business planning. Resources detailing tax obligations in your local area can further enhance your understanding, ensuring compliance and financial optimization for your sole proprietorship.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business income expenses sole?

Can I edit business income expenses sole on an iOS device?

How do I fill out business income expenses sole on an Android device?

What is business income expenses sole?

Who is required to file business income expenses sole?

How to fill out business income expenses sole?

What is the purpose of business income expenses sole?

What information must be reported on business income expenses sole?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.