Get the free Business Personal Property Rendition of Taxable Property

Get, Create, Make and Sign business personal property rendition

Editing business personal property rendition online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business personal property rendition

How to fill out business personal property rendition

Who needs business personal property rendition?

Understanding the Business Personal Property Rendition Form

Understanding business personal property renditions

Business personal property refers to movable assets owned by a business that are used to generate income. This includes furniture, machinery, equipment, and leasehold improvements. Accurately reporting these assets through a business personal property rendition form is crucial for tax purposes.

Filing a rendition is important as it communicates the business’s asset holdings to the local tax assessors. The information is pivotal for assessing appropriate property taxes owed. Failure to file can complicate tax calculations and lead to the imposition of penalties.

Business personal property taxes are based on the assessed value of the business’s equipment and inventory. Varying by jurisdiction, these taxes fund essential public services including schools, emergency services, and infrastructure projects.

Who must file a business personal property rendition?

Generally, any business that owns tangible personal property must file a rendition. This includes sole proprietors, partnerships, and corporations. Specific criteria can vary; for instance, businesses with a total value of assets over a certain threshold are typically required to file.

However, some businesses may be exempt. For example, certain small businesses with a minimal asset value may not need to file, and non-profit organizations often qualify for exemptions. Understanding these nuances is essential.

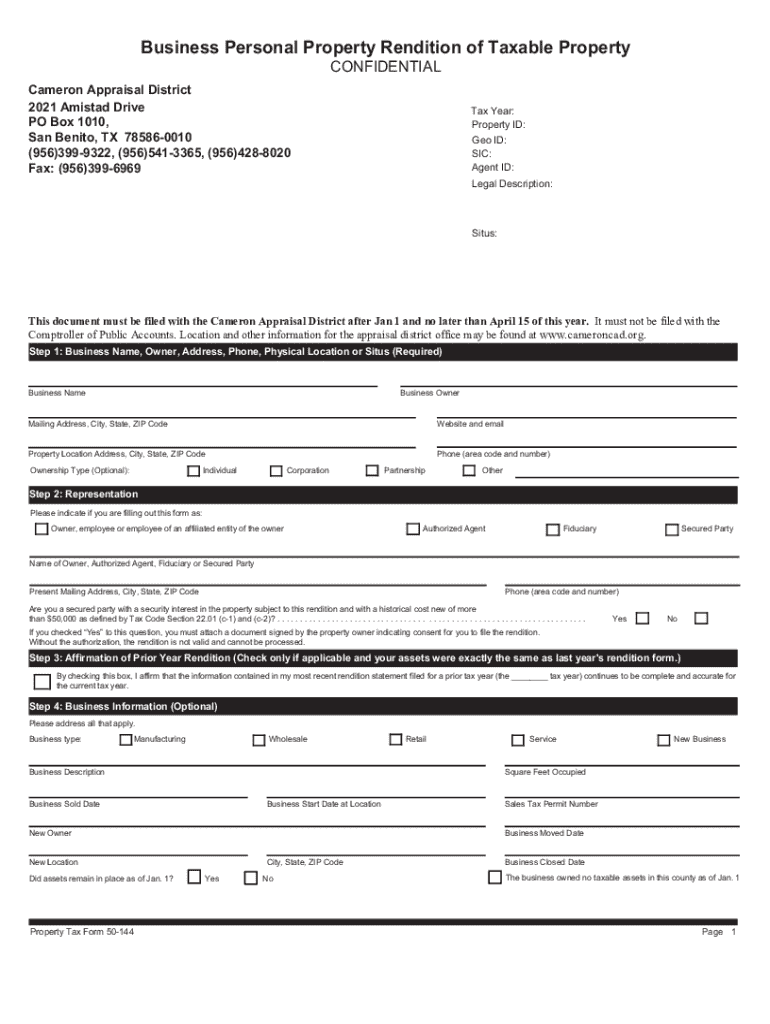

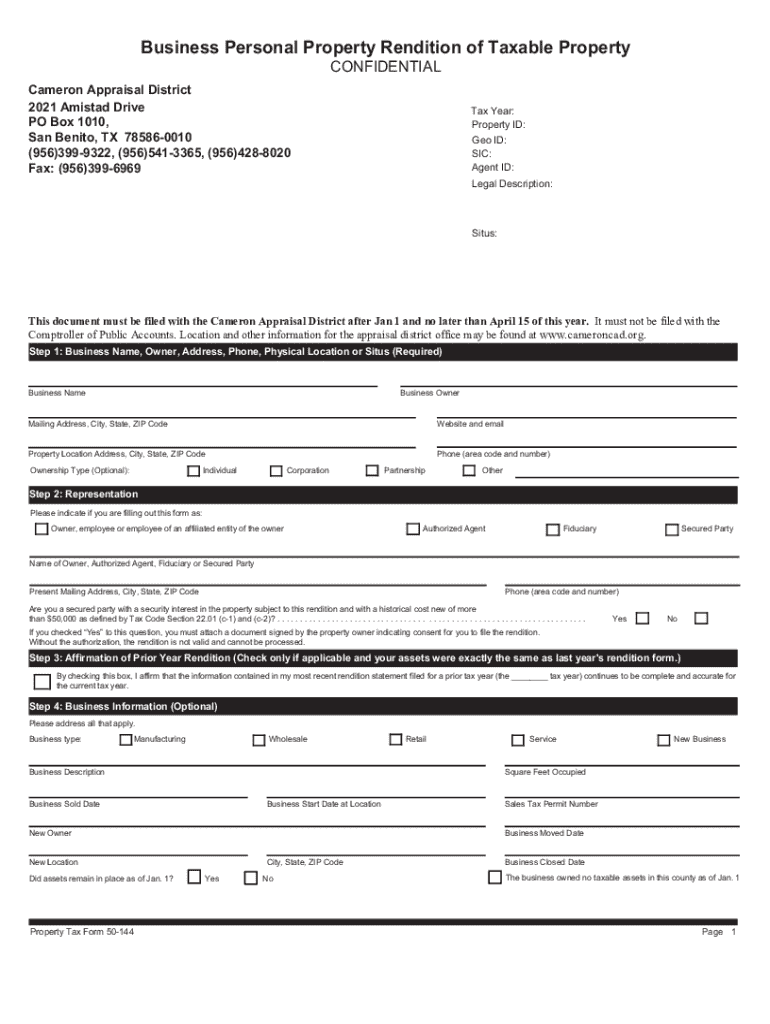

Key components of the business personal property rendition form

The business personal property rendition form typically includes critical information that enables proper asset identification and valuation. The main sections include:

Common mistakes such as undervaluation or omission of assets can lead to complications during the tax assessment process. Ensure all business property is fully accounted for to avoid issues.

Completing the business personal property rendition form

Filling out a rendition form accurately is vital. Follow these step-by-step instructions for completeness:

Ensure all figures are accurate and substantiated with documentation to avoid discrepancies and potential audits. Regularly updating and maintaining records simplifies this process.

How to file the business personal property rendition form

Filing options usually include paper submissions and online filing through local appraisal district websites, which provide a more streamlined process.

Be mindful of important filing deadlines, as late submissions can lead to penalties. These deadlines can vary significantly across different regions, so check local requirements.

Frequently asked questions (FAQs)

The role of appraisers in business personal property taxation

Appraisers play a crucial role in the assessment of business personal property. They determine the value of assets for tax purposes based on methodology that may consider market value, reproduction costs, or income potential.

Preparing for an appraisal visit involves organizing records and being transparent about business operations. Having detailed accounts of all personal property can smooth the process and support accurate evaluations.

Managing business personal property taxes annually

Maintaining accurate records is essential for managing business personal property taxes. Regularly update the asset inventory and valuation reports to reflect any changes accurately.

Establishing strong record-keeping practices will help ensure compliance and readiness for any future assessments or audits.

Understanding tax revenue and its allocation

The revenue generated from business personal property taxes plays a significant role in funding local services. This includes public education, road maintenance, and emergency services that enhance community welfare.

Understanding where tax dollars go can help business owners appreciate the importance of timely and accurate filing, reinforcing the connection between their business and community investment.

Special considerations and additional forms

In addition to the standard rendition form, various jurisdictions may have special inventory forms for specific industries or property types. Becoming familiar with these additional requirements can ensure full compliance.

Check with your local appraisal district for any other required filings that may pertain to your business, which may include industrial or agricultural property forms.

Contact information for assistance with renditions

For assistance, business owners can reach out to their local appraisal district. These offices typically provide guidance on filing procedures and deadlines.

Interactive tools and resources for filing

Utilizing interactive tools such as pdfFiller can streamline the document management process. Users can easily edit, sign, and manage their rendition forms digitally from any location.

By utilizing these resources and tools, businesses can enhance their filing accuracy and manage their tax responsibilities more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business personal property rendition for eSignature?

Where do I find business personal property rendition?

Can I create an eSignature for the business personal property rendition in Gmail?

What is business personal property rendition?

Who is required to file business personal property rendition?

How to fill out business personal property rendition?

What is the purpose of business personal property rendition?

What information must be reported on business personal property rendition?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.