Get the free Bills of Exchange Act

Get, Create, Make and Sign bills of exchange act

Editing bills of exchange act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bills of exchange act

How to fill out bills of exchange act

Who needs bills of exchange act?

Bills of Exchange Act Form: A Comprehensive Guide

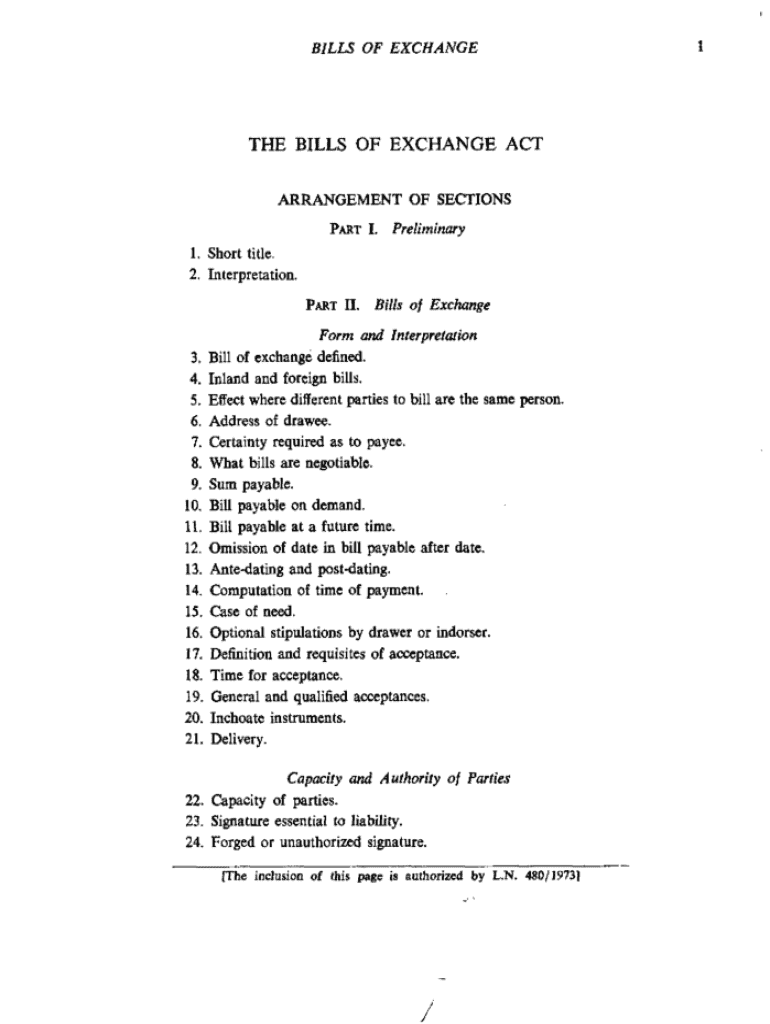

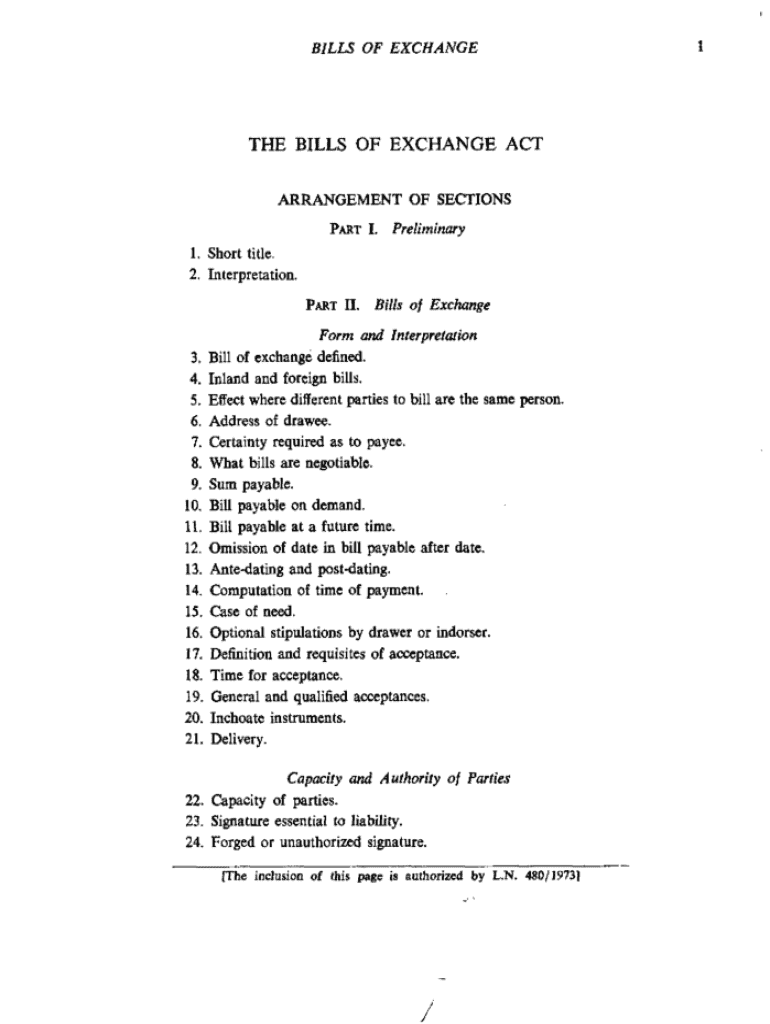

Overview of the Bills of Exchange Act

The Bills of Exchange Act serves as a pivotal legal framework governing the use of negotiable instruments, primarily in trade and commerce. This legislation is crucial in regulating how bills of exchange, promissory notes, and cheques can be used in various financial transactions. Understanding the provisions of this act is vital for anyone involved in commercial practices, as it sets the standards for the validity and enforceability of these instruments.

The act comprises a multitude of defined terms and obligations that protect the interests of parties involved. From the definition of a bill of exchange to the rights of holders in due course, these elements foster trust and security in business dealings. Therefore, knowing the key definitions encapsulated in this act enhances comprehension and proficient utilization of negotiable instruments.

The applicability and scope of the Act extend beyond mere definitions. It outlines the rights and liabilities of all parties involved, the procedures for acceptance and payment, and mechanisms for addressing non-compliance. Familiarity with these provisions is essential to navigating the complexities of financial transactions involving these instruments.

Understanding bills of exchange

The instrument known as a bill of exchange is fundamentally a financial document that involves three parties: the drawer, the drawee, and the payee. This instrument legally binds the drawer to instruct the drawee to pay a specified amount to the payee. The legal framework surrounding bills encompasses both statutory regulations and common law principles, providing a comprehensive understanding of how these documents operate.

Within this context, it is essential to differentiate between the various types of bills. Demand bills require payment upon presentation, while time bills specify a future date for payment. Understanding these distinctions is crucial in determining obligations, rights, and conditions for both parties involved.

All parties involved in a bill of exchange carry specific roles. The drawer initiates the transaction, the drawee is typically a bank or individual who will pay the bill, and the payee is the recipient of the payment. Understanding the dynamics between these parties helps clarify responsibilities and the overall flow of the transaction.

Forms under the Bills of Exchange Act

Having the appropriate forms in order is paramount to effectively applying the Bills of Exchange Act. Official forms streamline shared understanding and compliance with legal requirements. Each form serves a specific function, whether it is documenting non-acceptance, a protest for non-payment, or any other essential process outlined by the Act.

The following list details some of the most relevant forms under the Bills of Exchange Act that individuals and businesses should be aware of:

By familiarizing oneself with these forms and their purposes, parties can navigate the intricacies of bill transactions and ensure adherence to legal frameworks.

Detailed instructions for filling out bills of exchange forms

Accurate completion of bills of exchange forms is vital in ensuring compliance and legal enforcement. Each form has common fields and information that must be filled out with precision to avoid disputes or misunderstandings.

The following key components must be addressed when filling out the forms:

To enhance accuracy and compliance during form completion, utilizing tools like pdfFiller can streamline the process. This platform allows for easy access and editing of forms, ensuring all necessary fields are correctly filled out.

pdfFiller also facilitates eSignature options and collaboration tools for team members to review forms together before finalizing them. This ensures that every document meets legal standards and protects the interests of all parties involved.

Managing and filing your bills of exchange

A well-organized document management system is crucial for anyone handling bills of exchange. Best practices in this regard incorporate digital storage solutions to facilitate access and filing, alongside compliance with relevant legal standards to maintain both current and archival documents.

When adopting a digital storage system, consider the following best practices:

Utilizing interactive tools provided by online platforms like pdfFiller can also enhance document management. Features such as document tracking and collaborative review tools are invaluable for maintaining organization and transparency during the transaction process.

Legal considerations and protecting your interests

Being aware of the legal implications when dealing with bills of exchange is crucial for safeguarding your interests. Understanding liability and responsibilities helps clarify the obligations each party has, especially in instances of non-payment or conflict.

Rights and powers of holders must also be understood. The following aspects are key to navigating these complexities:

Moreover, understanding how conflicts of laws affect transactions involving bills of exchange can provide clarity and aid in effective dispute resolution, ensuring that your rights are upheld across jurisdictions.

Additional information

For those looking to deepen their understanding of bills of exchange forms, several common queries can arise. Addressing frequently asked questions helps demystify complex concepts and provides clarity on the practical application of the relevant regulations.

Common terms defined in this context include:

A glossary of relevant legal terms will also assist users in understanding the intricacies of bills of exchange and ensure a knowledge base from which they can operate confidently.

Conclusion

Understanding the bills of exchange act form and its associated requirements is crucial for engaging successfully in financial transactions. By leveraging tools like pdfFiller for document creation and management, users are empowered to streamline their workflows while ensuring compliance with legal standards.

Cloud-based document solutions allow for accessibility and collaboration, permitting teams and individuals to operate efficiently in preparing, filing, and managing their negotiable instruments. Thus, establishing a robust knowledge base and utilizing effective document management solutions lays the groundwork for successful financial interactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bills of exchange act on a smartphone?

How do I fill out the bills of exchange act form on my smartphone?

How do I edit bills of exchange act on an iOS device?

What is bills of exchange act?

Who is required to file bills of exchange act?

How to fill out bills of exchange act?

What is the purpose of bills of exchange act?

What information must be reported on bills of exchange act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.