Get the free Billing Practices / Financial Agreement

Get, Create, Make and Sign billing practices financial agreement

Editing billing practices financial agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out billing practices financial agreement

How to fill out billing practices financial agreement

Who needs billing practices financial agreement?

Billing practices financial agreement form: A comprehensive guide

Understanding billing practices in financial agreements

Billing practices encompass the methods and procedures used to charge clients for services rendered or goods provided. These practices are critical in establishing transparency and maintaining healthy financial relationships between service providers and clients. In diverse industries ranging from healthcare to consulting, clear financial agreements can prevent disputes and build trust. A well-constructed billing agreement serves not only as a contract but also as a roadmap for the expected services, payment processes, and consequences of non-compliance.

Typically, financial agreements include essential components such as the parties involved, a breakdown of services or products offered, payment schedules, and any terms related to late payments or cancellations. By detailing these elements upfront, businesses help clients understand their commitments, leading to smoother financial transactions.

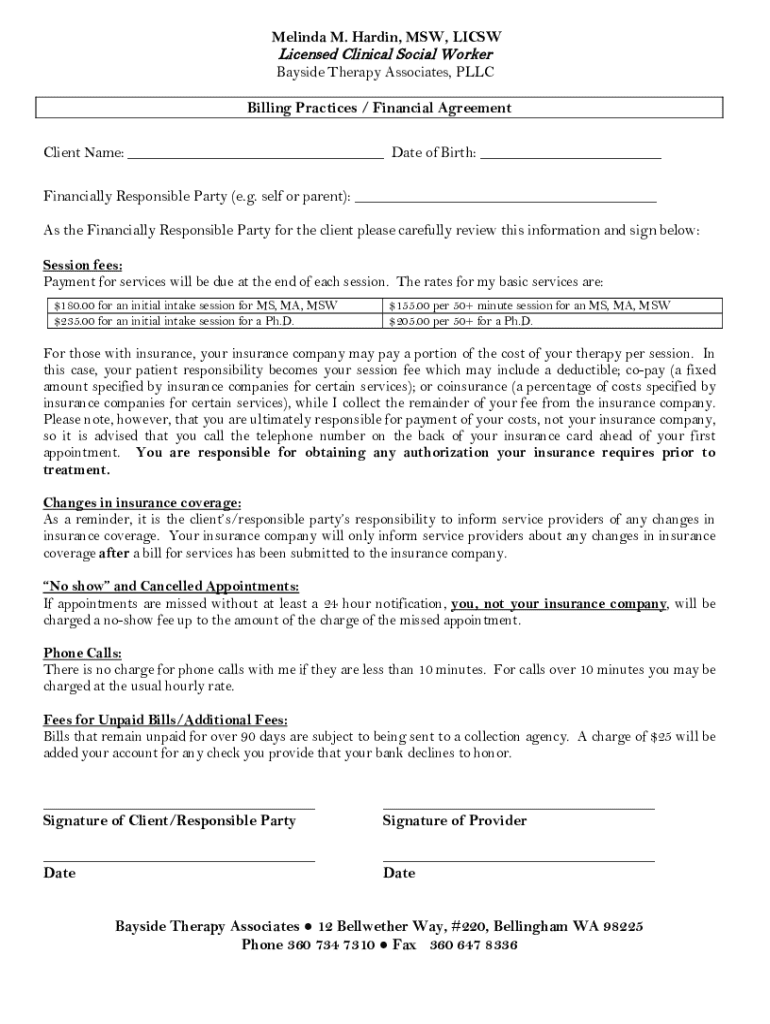

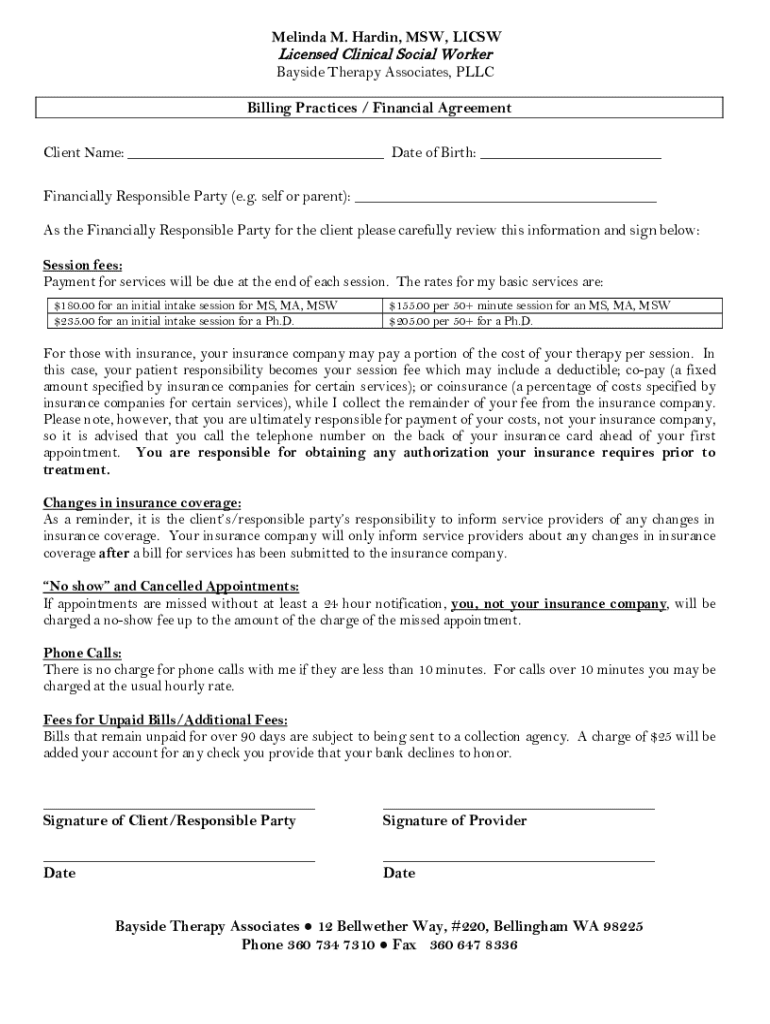

What is a billing practices financial agreement form?

A billing practices financial agreement form is a structured document that outlines the financial terms and conditions between a service provider and a client. This form acts as a mutual understanding of expectations and responsibilities surrounding payment for services provided. Key elements of the form include the parties involved in the agreement, which typically identifies the service provider (the billing party) and the client (the payer).

In addition to party details, the form encompasses critical sections on payment terms and conditions, such as due dates, accepted payment methods, late fee policies, and service descriptions. This clarity is essential for both parties, as it lays down the groundwork for a professional relationship characterized by trust and accountability.

Practical steps to complete your billing practices financial agreement form

To ensure that your billing practices financial agreement form is completed accurately, follow these straightforward steps. First, gather all necessary information encompassing personal or organizational details, as well as key financial and service information.

Next, begin filling out the form. Complete each section carefully, paying attention to detail. Common mistakes to avoid include mislabeling payment terms, failing to specify due dates, and not adequately describing the services provided. Lastly, review your completed agreement for any errors. A thorough review is especially important as it can save you from potential disputes or misunderstandings later on. In situations that seem complex or unclear, seeking legal counsel ensures that your agreement meets all necessary legal standards.

Editing and customizing your financial agreement form

Customizing your billing practices financial agreement form to reflect your unique brand can enhance its professionalism and effectiveness. Using tools offered by pdfFiller, you can easily edit and modify templates to fit your specific needs. For example, adding your organization’s logo fosters brand recognition and can instill confidence in clients.

Additionally, taking the time to incorporate personal touches makes the document more engaging. Collaborating with team members can lead to a more refined document; gathering input allows for a comprehensive agreement that represents all stakeholders’ interests. Consider setting up team brainstorming sessions to ensure that everyone’s perspective is included.

Signing and securing your agreement

Once the billing practices financial agreement form is complete, the next step is securing it through signing. eSigning has become an integral part of the document management process as it provides a convenient and legally recognized way to finalize agreements. With whatsapp, stakeholders can quickly review and approve the document, saving significant time.

Security is paramount when it comes to financial agreements. pdfFiller offers comprehensive encryption and data protection measures to ensure that your sensitive information remains private. You may also consider including witnesses or third-party signatures where necessary, enhancing the authenticity of the agreement and ensuring higher levels of trust among parties.

Managing your financial agreement documents

Effective document management is essential for maintaining organized records of your billing practices financial agreements. Cloud-based solutions provide accessibility, allowing you to access agreements from anywhere, which is particularly beneficial for remote teams or businesses with multiple locations. Organizing documents in easily searchable folders also enhances workflow efficiency.

Additionally, keeping track of changes and versions is vital in dynamic business environments. Understanding the evolution of agreements can help with compliance and provide insights for future negotiations. pdfFiller’s features simplify document management, enhancing the organization of financial agreements and ensuring you can respond rapidly to client needs.

Enhancing your billing practices with effective communication

The role of communication in executing billing practices cannot be underestimated. Effectively discussing financial agreements with clients and stakeholders ensures clarity and minimizes misunderstandings regarding payment policies and expectations. It is beneficial to anticipate common objections or concerns during these discussions, which can vary based on individual client situations.

Offering clear payment options and policies upfront can also alleviate concerns. This proactive approach helps position your organization as transparent and considerate, which can improve client relationships significantly. Use confident language and remain open to feedback, helping clients feel comfortable expressing any worries they may have before finalizing agreements.

The role of billing practices in maximizing client relationships

Transparent financial agreements are fundamental in building trust and credibility with clients. When clients feel confident in their understanding of billing practices, it strengthens their overall relationship with your business. Establishing open lines of communication centered around billing not only prevents disputes but can also nurture long-term partnerships.

Real-world examples demonstrate how organizations that adopt transparent practices experience improved client satisfaction. For instance, a consulting firm that clearly outlines billing processes in their financial agreement saw a considerable decrease in payment questions, resulting in more time for consultant-client interactions, ultimately creating a positive feedback loop.

Conclusion: Streamlining your processes with pdfFiller

Implementing effective billing practices financial agreements can streamline workflow and enhance business operations. The right tools, like pdfFiller, simplify the entire process, allowing users to create, manage, edit, and eSign financial documents conveniently. Embracing these solutions not only improves organizational efficiency but also fosters stronger client relationships through transparent billing practices.

As you navigate your own practices, consider experimenting with pdfFiller's functionalities to address your document management needs. By sharing your experiences and seeking feedback, you can refine your billing practices to help your clients better understand their commitments, ultimately leading to mutually beneficial partnerships.

Interactive tools section

As part of our commitment to enhancing your experience with billing practices, pdfFiller offers interactive tools to help you navigate financial agreements smoothly. Utilize calculators for payment plans to assist clients in understanding their financial commitments better. Additionally, our FAQ section is available to address common queries about billing practices and financial agreements.

Top links

Main navigation

Explore other useful forms and templates for document management on pdfFiller to streamline all aspects of your business operations. Addressing your document needs can be achieved seamlessly with our intuitive interface and broad range of templates.

Social section

We invite you to share your experiences with billing practices on social media! Engaging with your community and sharing insights can not only reinforce your knowledge but also help others navigate financial agreements confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the billing practices financial agreement in Chrome?

How do I fill out the billing practices financial agreement form on my smartphone?

Can I edit billing practices financial agreement on an Android device?

What is billing practices financial agreement?

Who is required to file billing practices financial agreement?

How to fill out billing practices financial agreement?

What is the purpose of billing practices financial agreement?

What information must be reported on billing practices financial agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.