Get the free Crest Savings Bank Disclosure of Account Terms

Get, Create, Make and Sign crest savings bank disclosure

How to edit crest savings bank disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crest savings bank disclosure

How to fill out crest savings bank disclosure

Who needs crest savings bank disclosure?

Crest Savings Bank Disclosure Form: A Comprehensive Guide

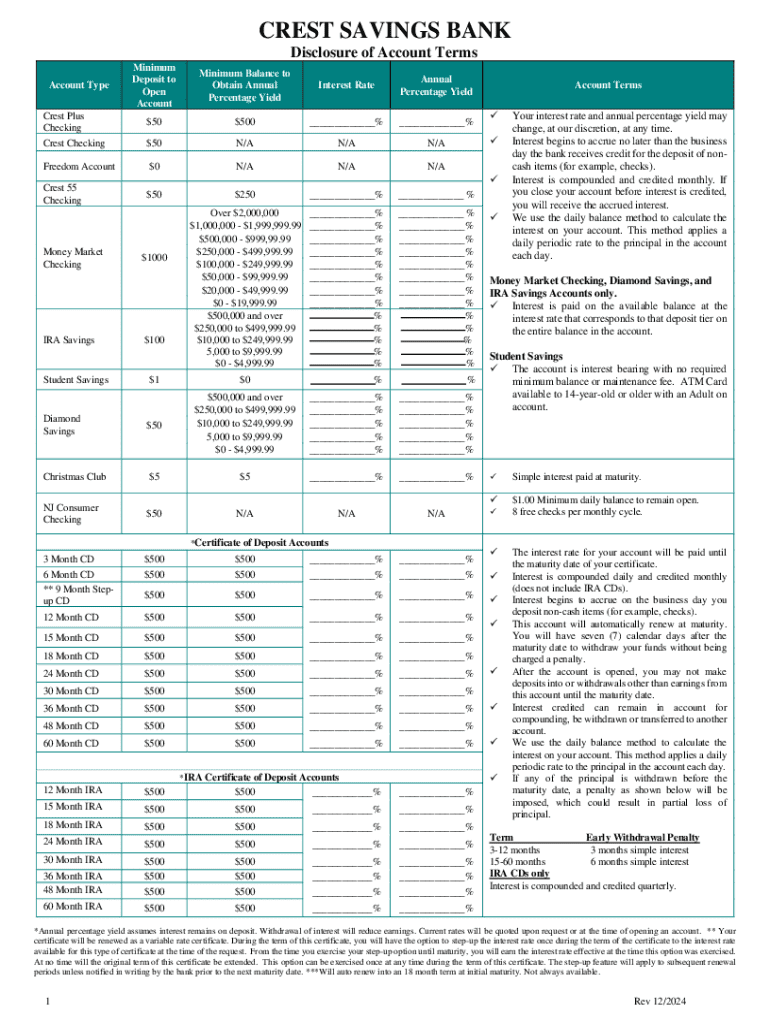

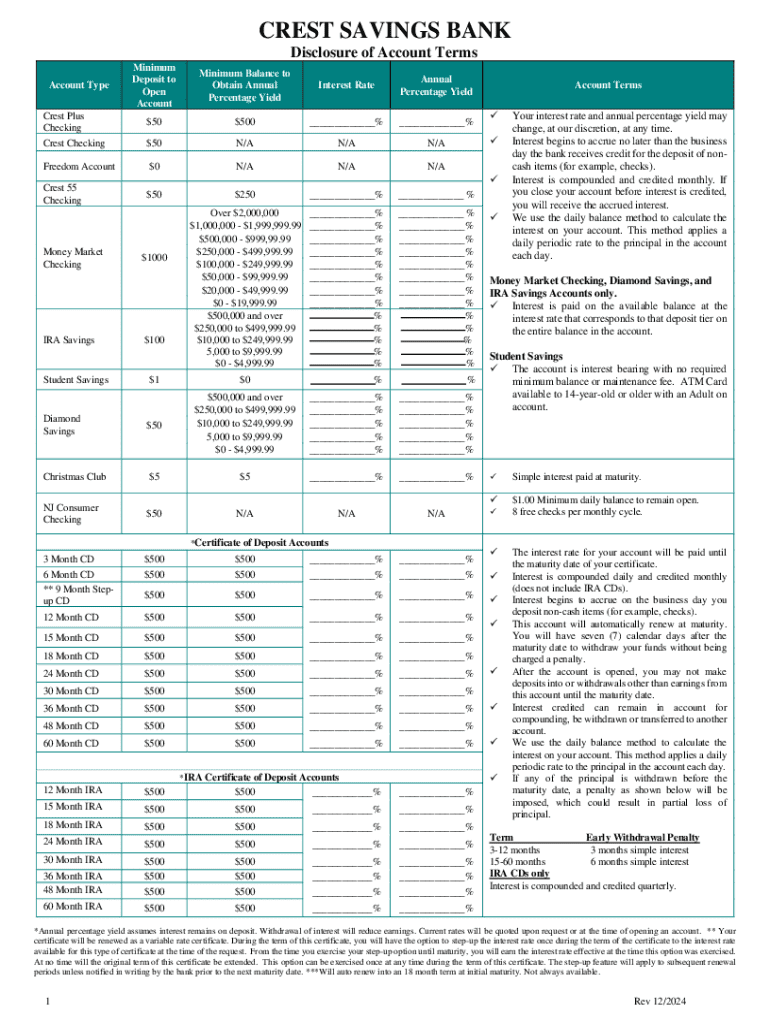

Overview of the Crest Savings Bank Disclosure Form

The Crest Savings Bank disclosure form serves as a vital tool to inform account holders of the bank's policies, fees, and practices. It lays the groundwork for transparency between customers and the financial institution, thus fostering trust and understanding. By outlining the key terms and conditions of banking services, the form helps customers make informed decisions.

Understanding the significance of the disclosure form is crucial for anyone holding an account at Crest Savings Bank. It not only provides details about fees and charges but also outlines how customer data is handled, thus playing an essential role in customer protection and compliance with financial regulations.

Accessing the Disclosure Form

To locate the Crest Savings Bank disclosure form, you can visit the official Crest Savings Bank website. Typically, financial institutions make their disclosure forms readily accessible within their website’s customer service or resources section. Look for links labeled 'Account Disclosures' or 'Customer Policies.'

Another useful resource is pdfFiller, where users can typically find an easy-to-navigate interface for forms. Simply search for 'Crest Savings Bank Disclosure Form' within the platform, and you should find options to view or download the document directly. The intuitive layout of pdfFiller is ideal for users seeking various banking forms quickly.

Step-by-step instructions to fill out the form

Before starting to fill out the Crest Savings Bank disclosure form, it’s advisable to gather specific information to ensure accuracy. This might include your account number, personal identification, and any other relevant information that verifies your identity and account status.

Filling out the form can be broken down into manageable sections, ensuring that nothing is overlooked. Below is a detailed walkthrough of each required section.

While filling out the form, be cautious of common mistakes. Ensure that all information is accurate and legible and double-check for typographical errors before submission.

Editing and customizing your disclosure form

Using pdfFiller to edit the Crest Savings Bank disclosure form streamlines the process of ensuring that your information is accurate. Once you’ve accessed the form in pdfFiller, you can navigate through its user-friendly editing options. These allow you to modify text, delete unnecessary information, and rearrange content as needed.

Furthermore, pdfFiller offers advanced features to enhance your form's functionality. Users can seamlessly add digital signatures or include comments for additional clarity, ensuring that every aspect of your form is tailored to your needs.

Signing the disclosure form

Electronic signatures have become a standard practice for signing forms, especially in banking and finance. An electronic signature, or eSignature, is a secure and legal way to confirm the authenticity of a document. Many online platforms, including pdfFiller, comply with legal standards for eSignatures, ensuring that your submitted forms are binding.

To sign your Crest Savings Bank disclosure form via pdfFiller, follow these straightforward steps: First, locate the signature section on the form. Next, use the eSignature tool to draw or upload your signature. Finally, confirm your signature placement and save your changes to ensure compliance.

Managing completed disclosure forms

Once you've duly completed and signed your Crest Savings Bank disclosure form, managing it effectively ensures you can access it when needed. PdfFiller gives you multiple options for saving your completed form. You can opt to save it in various formats, such as PDF or DOCX, depending on your preference.

Moreover, leveraging cloud storage options available through pdfFiller not only helps in organizing your documents but also provides added security. You can share your forms directly from the platform, which guarantees that sensitive information remains protected.

FAQs about the Crest Savings Bank disclosure form

When dealing with banking documentation like the Crest Savings Bank disclosure form, questions may arise. For instance, if you lose access to the form, you can easily recover it by visiting the official website or accessing it through your pdfFiller account. If you need to update information on a previously submitted form, reaching out to customer service will guide you through the amendment process.

For further inquiries or assistance, Crest Savings Bank provides multiple avenues for customer support. Users can also benefit from pdfFiller’s extensive help resources to resolve form-related queries efficiently.

Importance of document management in banking

Effective document management is paramount within the banking sector as it ensures compliance with specific regulations and enhances operational efficiency. By maintaining accurate documentation, banks can safeguard client information and provide better service experiences. For individuals and teams, digital document management simplifies processes and allows for better tracking of important banking documents.

On that note, pdfFiller stands out as a powerful tool for enhancing document management strategies. It combines intuitive document creation with powerful editing features in a cloud-based platform, making it easier for users to collaborate and manage their documents thoroughly.

Additional resources and tools

Aside from the Crest Savings Bank disclosure form, users can explore various other banking forms and templates available on pdfFiller. This includes forms related to loan applications, account changes, and other financial documents. Accessing these forms can provide a comprehensive toolkit for managing your banking needs effectively.

To assist in your financial journey, pdfFiller also features informative articles and guides that cover banking best practices and document security tips. They offer a mobile app, ensuring that you can manage your documents from your phone or tablet, giving you the flexibility to access your accounts from anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute crest savings bank disclosure online?

How do I edit crest savings bank disclosure in Chrome?

Can I sign the crest savings bank disclosure electronically in Chrome?

What is crest savings bank disclosure?

Who is required to file crest savings bank disclosure?

How to fill out crest savings bank disclosure?

What is the purpose of crest savings bank disclosure?

What information must be reported on crest savings bank disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.