Get the free Credit / Debit Card Authorization and Policy Acknowledgment

Get, Create, Make and Sign credit debit card authorization

How to edit credit debit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit debit card authorization

How to fill out credit debit card authorization

Who needs credit debit card authorization?

Comprehensive Guide to Credit Debit Card Authorization Forms

Understanding credit debit card authorization forms

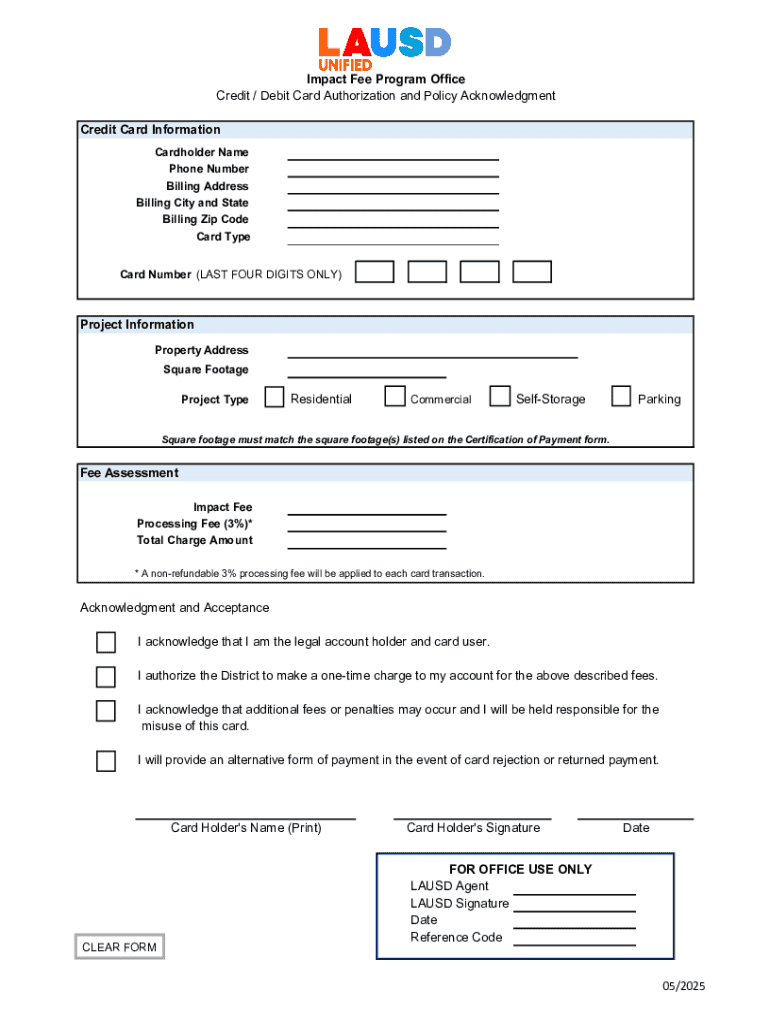

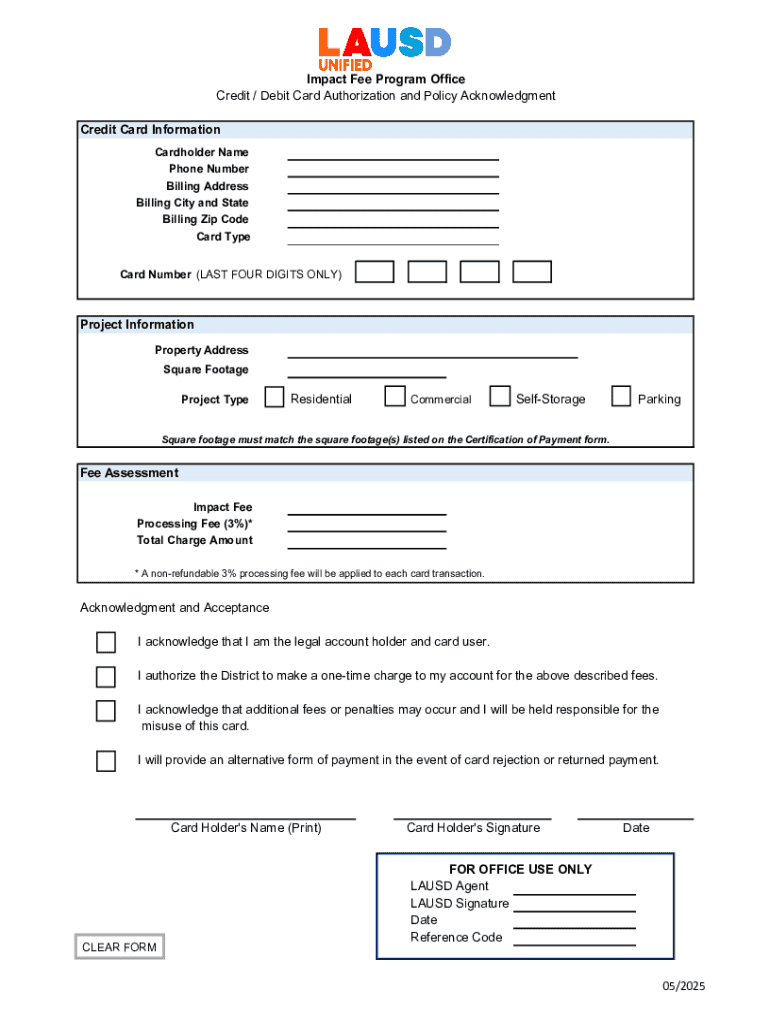

A credit debit card authorization form is a crucial document utilized in financial transactions where the cardholder grants permission to a merchant to charge their card for a specified amount. This form is designed not only to streamline payment processes but also to safeguard both parties involved from potential disputes.

These authorization forms play a pivotal role in today’s transaction environment, ensuring that authorized payments are processed securely and efficiently. Their importance cannot be overstated as they minimize the risk of unauthorized transactions and help maintain the integrity of financial exchanges.

The role of authorization forms in fraud prevention

Credit debit card authorization forms are fundamental in combating chargeback abuse. By having this documented authorization, merchants can contest chargebacks effectively, demonstrating that a consumer approved the transaction. This is essential in reducing fraudulent claims and conserving business revenue.

Moreover, these forms provide legal protection for merchants by clearly outlining the terms under which a transaction is authorized. When disputes arise, having a signed document serves as evidence that the transaction was legitimate, thus instilling a sense of security for the seller.

Components of a credit debit card authorization form

A properly constructed credit debit card authorization form includes several essential elements that ensure clarity and authorization security. These typically encompass critical client information, detailed payment information, and required authorization signatures.

Including optional sections like the CVV and expiry date can enhance security, although these details can also pose additional risks if mismanaged. Businesses should decide based on their specific needs and the nature of the transactions involved, especially when dealing with international clients.

Step-by-step guide to completing a credit debit card authorization form

Completing a credit debit card authorization form requires careful attention to detail. To start, gather relevant information such as the cardholder's name, card number, and the transaction amount. This will ensure a smooth process and prevent potential errors.

When filling out the form, follow these detailed instructions for each section, as accuracy is crucial:

Common mistakes include not providing complete information and using outdated forms. Always double-check for accuracy before submission to avoid issues with payment processing.

When and why sellers should use an authorization form

Sellers should employ credit debit card authorization forms when processing significant transactions or for recurring payments. This practice safeguards the seller and the customer by ensuring there is mutual agreement on payment terms, minimizing misunderstandings.

Best practices indicate that authorization forms are particularly necessary in high-risk industries, such as travel or eCommerce, where chargeback rates are typically elevated. Using them when conducting transactions that involve larger sums is also advisable.

Managing and storing signed authorization forms

Proper management and storage of signed credit debit card authorization forms is essential for both security and compliance. When storing these forms digitally, it's crucial to implement high-grade security measures such as encryption and secure access protocols to protect sensitive customer information.

Additionally, legal guidelines often dictate how long signed forms should be retained. Businesses typically need to keep these records for a minimum duration to address potential disputes effectively and must have a clear access strategy for future transactions.

Frequently asked questions (FAQ)

Many people wonder if there is a legal obligation to use credit debit card authorization forms. While it’s not universally mandated, many businesses find it essential for protecting against fraud and chargebacks.

Another common inquiry is why certain authorization forms might not include a space for the CVV code. This can be due to security protocols or preferences; however, it’s important to understand the implications of not collecting this information.

Downloadable templates and tools

To streamline your process, download our customizable credit debit card authorization form template designed for flexibility and ease of use. This adaptable format allows you to tailor the document according to your business needs, ensuring all essential elements are included.

Utilize interactive tools that allow for online editing and signing of forms. Platforms like pdfFiller can dramatically enhance document management efficiency, guiding you through the customization and approval process effortlessly.

Additional resources and further reading

For businesses seeking to improve their understanding of payment processes, numerous resources are available. Explore articles on best practices for accepting credit card payments and insights on chargeback management and prevention to fortify your financial acumen.

Guides focusing on the setup of secure payment systems can also provide invaluable information to improve your transaction security, ensuring compliance with current standards.

Combining security with accessibility

pdfFiller offers innovative features that enhance document security while maintaining ease of collaboration. This platform allows businesses to access their documents from anywhere, ensuring that security measures do not compromise accessibility.

With a cloud-based document management platform, pdfFiller simplifies the process of creating, editing, and storing credit debit card authorization forms. Its standout features promote streamlined workflows and efficient authorization processes, making it ideal for modern businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit debit card authorization in Gmail?

How can I edit credit debit card authorization from Google Drive?

How do I complete credit debit card authorization on an iOS device?

What is credit debit card authorization?

Who is required to file credit debit card authorization?

How to fill out credit debit card authorization?

What is the purpose of credit debit card authorization?

What information must be reported on credit debit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.