Get the free New Jersey Corporation Business Tax

Get, Create, Make and Sign new jersey corporation business

Editing new jersey corporation business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey corporation business

How to fill out new jersey corporation business

Who needs new jersey corporation business?

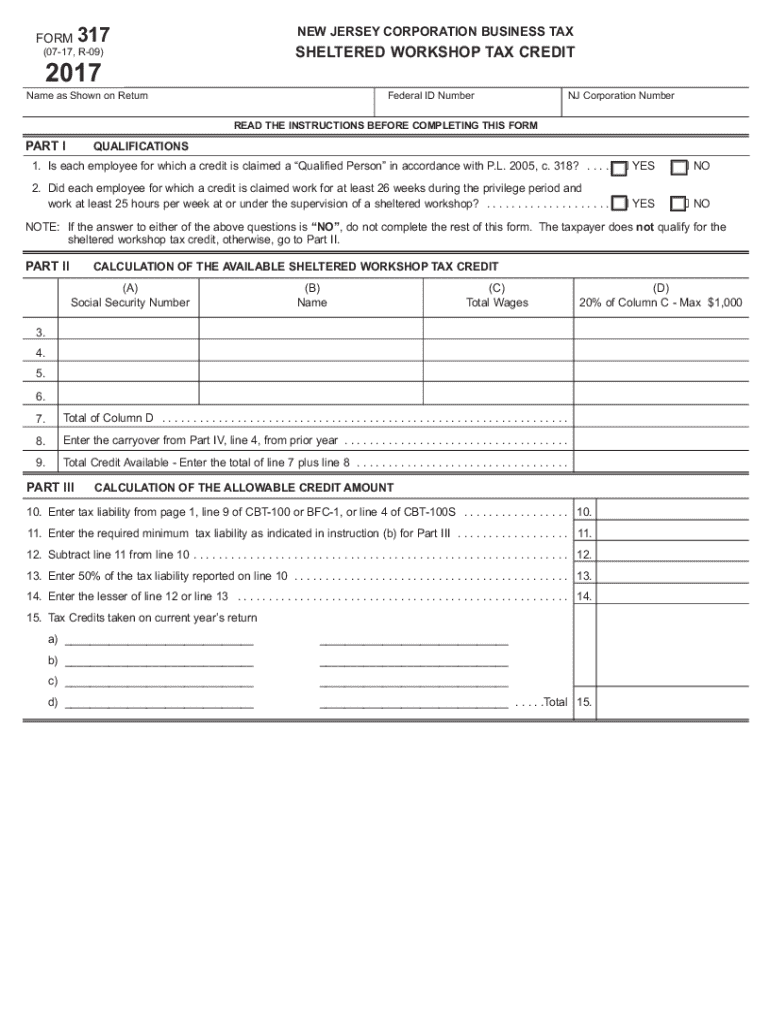

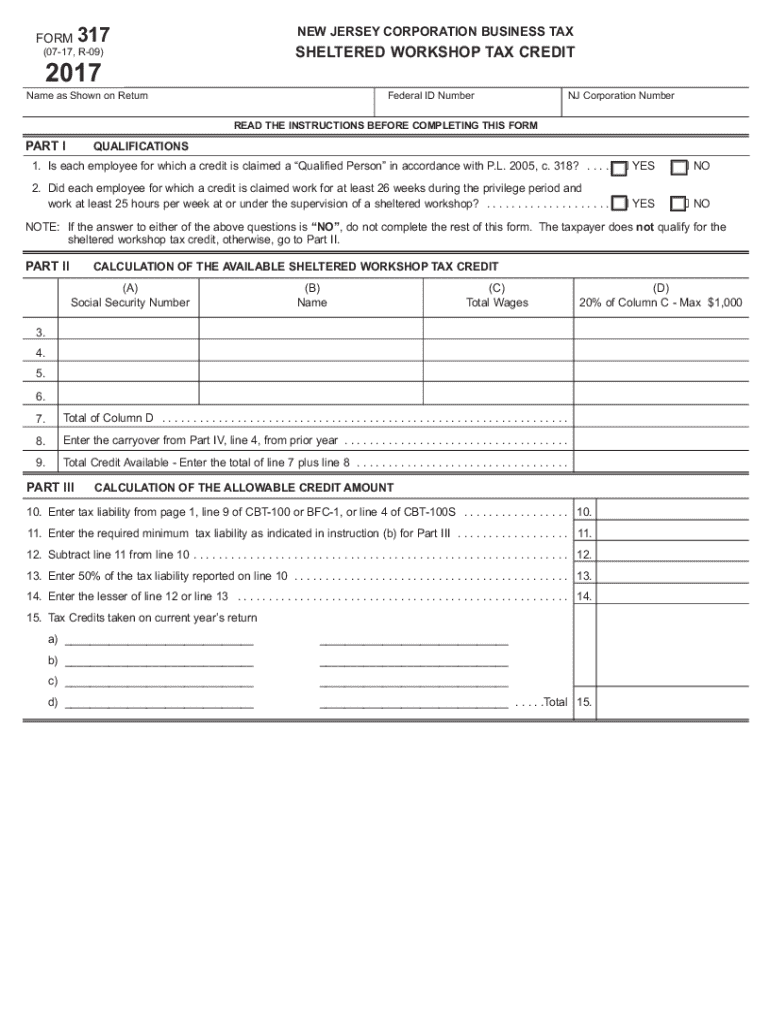

Understanding the New Jersey Corporation Business Form

Overview of New Jersey corporation business form

The New Jersey corporation business form is a formal document that establishes a corporate entity in the state. This form delineates the structure, governance, and operational framework of your business. Registering as a corporation not only legitimizes your business but also offers various benefits, such as legal protection for its owners and potential tax advantages.

Formalizing your business structure through the New Jersey corporation business form is crucial for maintaining compliance with state laws. It ensures that your business is recognized by the state, which can open doors to opportunities like securing funding and establishing a formal business credit profile.

Starting a New Jersey corporation

Embarking on the journey to establish a corporation in New Jersey involves several critical steps. The first step is to name your corporation, which must reflect your business's identity and comply with state regulations. You need to choose a unique business name that is not already in use by another corporation in New Jersey.

Next, you must designate a registered agent. This individual or business entity is responsible for receiving official correspondence and legal documents on behalf of your corporation. In New Jersey, a registered agent must have a physical address within the state and be available during normal business hours.

Filing the New Jersey certificate of incorporation

The next step in the incorporation process is preparing and submitting the New Jersey certificate of incorporation. This form is essential for creating your corporation legally and requires several key pieces of information, including the corporation's name, registered agent details, and the number of shares the corporation is authorized to issue.

Once submitted, the filing process typically takes several days to complete. After submission, you will receive confirmation of your corporation's status, along with any required documents. It’s essential to keep these records safe for future reference.

Post-incorporation responsibilities

After successfully filing your certificate of incorporation, your next tasks involve important post-incorporation responsibilities. Holding an initial board meeting is crucial for executing foundational agreements, such as the election of directors and corporate officers. During this meeting, establish the corporation's policies and procedures, including setting dates for annual meetings.

Additionally, creating corporate bylaws is an essential step. Bylaws outline the internal governance structure of your corporation and provide guidance on operations, decisions, and roles within the corporate framework. Include critical components such as meeting procedures, voting rights, and the process for amending bylaws.

Compliance and regulatory requirements

To ensure your corporation remains operational, compliance with various regulatory requirements is vital. One of the first steps is applying for an Employer Identification Number (EIN) through the Internal Revenue Service (IRS), which is critical for tax purposes, hiring employees, and opening a corporate bank account.

Additionally, ensure that you acquire any necessary business licenses or permits required by state or local agencies. The requirements can vary depending on your business type and location, so thorough research is essential.

Maintaining good standing in New Jersey

Once your corporation is established, maintaining good standing is paramount. One of the key requirements is filing annual reports with the New Jersey Division of Revenue and Enterprise Services. These reports update your business status and ensure compliance with state regulations.

Unique considerations for foreign entities

Foreign entities wishing to do business in New Jersey must register their out-of-state corporation with the New Jersey Division of Revenue. This process requires submitting a certificate of authority along with necessary documents showing that your business is in good standing in its home state.

Incorporating locally has distinct advantages, such as familiarity with state laws and regulations, while foreign incorporation may offer tax insights from your native state. Weigh these benefits carefully to determine the best approach for your business.

Advantages of incorporating in New Jersey

Incorporating in New Jersey comes with several advantages that make it a viable option for many businesses. The state offers various tax incentives designed to attract and retain companies in areas such as technology, manufacturing, and research.

In short, these factors provide a strong foundation for growth and stability, contributing to the appeal of forming a corporation in New Jersey.

FAQs about New Jersey corporation business forms

Navigating the incorporation process can raise questions. Common inquiries often revolve around the specific steps involved in the incorporation process and the distinctions between the New Jersey corporate business tax and other tax obligations.

Addressing these questions proactively can streamline your journey and ensure that your business foundation is set up for long-term success.

Useful tools and resources

There are a variety of tools readily available to assist you in the documentation process associated with the New Jersey corporation business form. Interactive platforms such as pdfFiller provide users with essential guides for creating, managing, and filing necessary documents effectively.

Leveraging such resources can not only save you time but also enhance the efficiency of your documentation processes.

The role of pdfFiller in your incorporation process

pdfFiller plays a significant role in your journey toward establishing a corporation in New Jersey. By offering cloud-based solutions, pdfFiller empowers users to edit, eSign, and collaborate on essential corporate documents from anywhere.

This integration of technology into the incorporation process simplifies document management, enabling you to focus on what truly matters: growing your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new jersey corporation business directly from Gmail?

How can I edit new jersey corporation business from Google Drive?

How can I fill out new jersey corporation business on an iOS device?

What is new jersey corporation business?

Who is required to file new jersey corporation business?

How to fill out new jersey corporation business?

What is the purpose of new jersey corporation business?

What information must be reported on new jersey corporation business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.