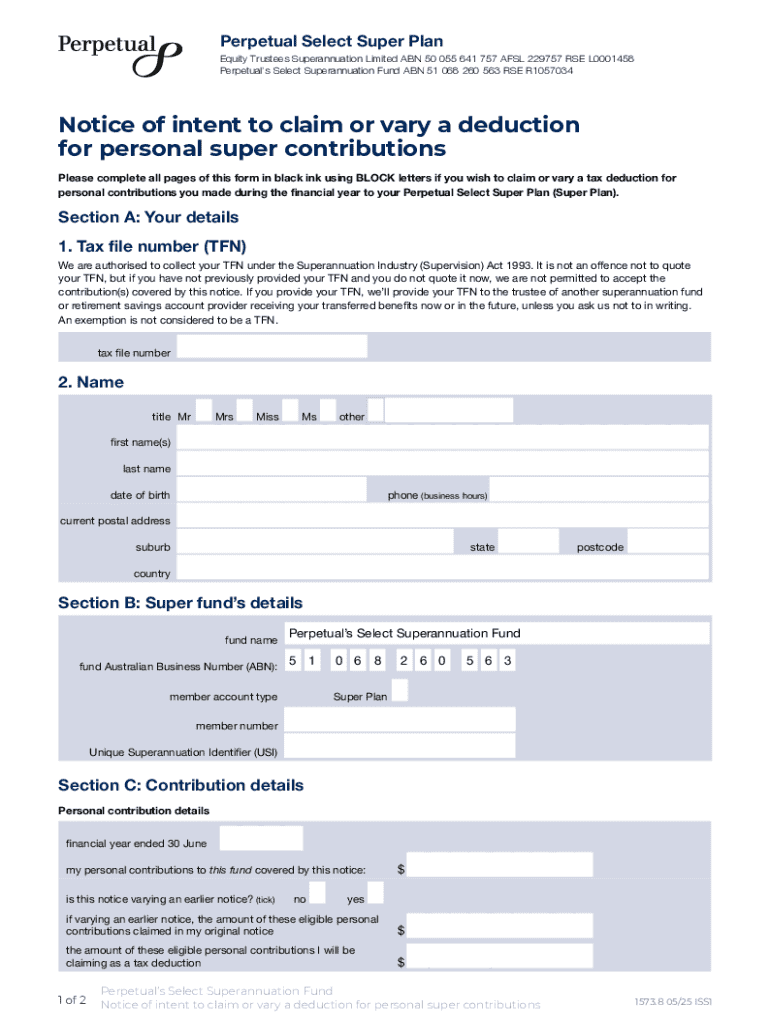

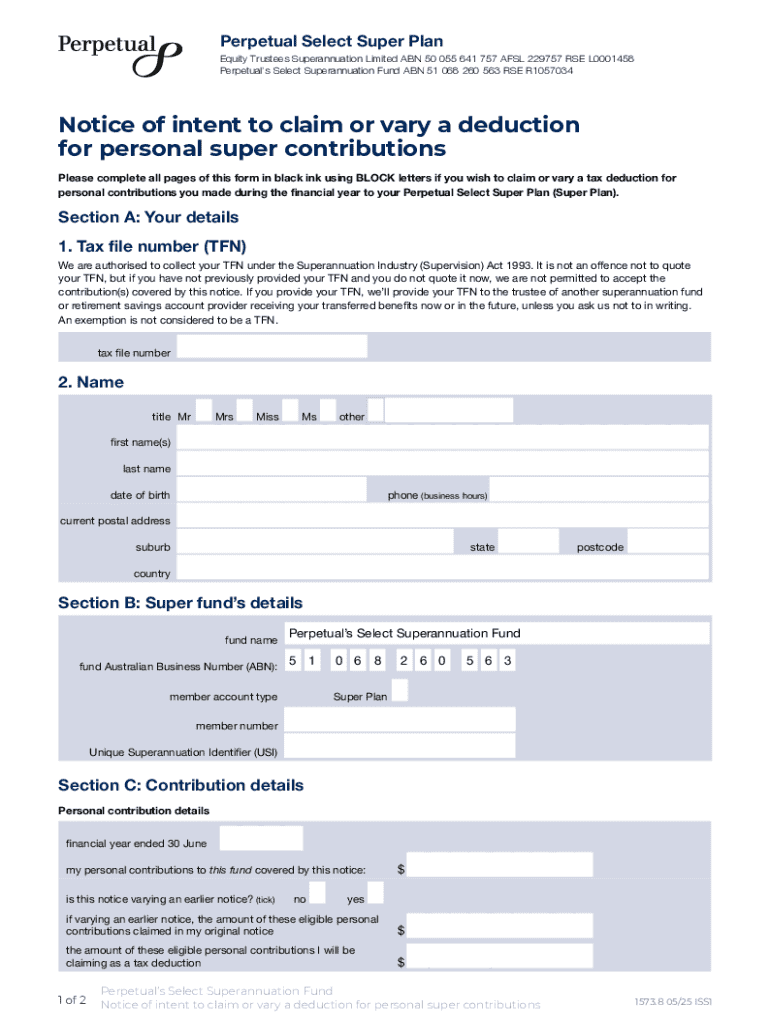

Get the free Notice of Intent to Claim or Vary a Deduction for Personal Super Contributions

Get, Create, Make and Sign notice of intent to

Editing notice of intent to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of intent to

How to fill out notice of intent to

Who needs notice of intent to?

Understanding and Managing the Notice of Intent to Form

Understanding the notice of intent to form

A notice of intent to form is a legal document that declares the intention to establish a particular type of business entity, such as a corporation or a partnership. This notice is generally filed with the applicable government authority and serves as a preliminary step in the formation process. It is critical for legal compliance and ensures that the state is aware of your entity’s establishment, which subsequently aids in fulfilling further administrative requirements.

The importance of this notice cannot be overstated. It lays down the groundwork for transparency and legal propriety, signifying intent to operate within regulatory frameworks. Particularly in an environment where businesses must adhere to strict compliance laws, the notice provides necessary protective measures to both the organization and its stakeholders. Key components typically include the entity's name, purpose, registered agent details, and the proposed date of formation.

Types of notices of intent to form

Notices of intent can differ greatly depending on whether the entity is public or private. Public organizations generally have more stringent requirements due to needing to meet accountability standards to the public and government bodies. This can include detailed disclosures about funding sources and operational structures, making the process more involved.

In contrast, private businesses may have more flexibility in how they formulate their notice, but they still must abide by specific legal requirements. For instance, non-profits must include their charitable purpose, while corporations must highlight their governance structure in greater detail. Partnerships have unique considerations as well; they should note the nature of their partnership, alongside the roles and responsibilities of each partner. Understanding these differences will better equip you for the formation process.

Preparing the notice of intent to form

Drafting a notice of intent to form requires attention to detail and compliance with local regulations. Begin with a clear header that states your intent to form a specific entity type. Include essential information such as the name of the entity, its address, the purpose of the organization, and the registered agent responsible for receiving legal documents. Additionally, consider incorporating optional components for clarity, such as details regarding the planned ownership structure or financial management strategies.

Clarity is key—avoid jargon and use straightforward language. To achieve this, you may want to draft in a collaborative environment, utilizing tools that allow for real-time editing and feedback. Common pitfalls include omitting required information, using ambiguous terms, or failing to check for legal compliance with local statutes. Each of these can delay the formation process, adding time and possibly costs that can be avoided with careful planning.

Filing the notice of intent

The filing process for your notice of intent can vary by state. Typically, you will need to submit the completed document to a state-specific office, often the Secretary of State or a similar regulatory body. Be prepared to incur filing fees that can range widely depending on the state and type of business entity. Having a clear understanding of these costs helps in budgeting and ensures there are no surprises during the filing.

After filing, a processing timeline will come into play, which may be anywhere from a few days to a few weeks, depending on the volume of applications the office is handling. It's advisable to track the filing status regularly to ensure that there are no issues. Be proactive in responding to any requests from the agency for additional information, as delays or lack of communication can complicate the process.

Interactive tools for form management

Leveraging tools like pdfFiller can greatly simplify the process of creating and managing your notice of intent. With pdfFiller, users can create and edit their documents seamlessly, enjoying features that facilitate collaboration and enhance document accuracy. You can share the document with colleagues, receive real-time feedback, and make necessary adjustments efficiently.

The platform also allows for eSigning, which accelerates the approval process, making it easier to get necessary signatures without the hassle of physical paperwork. Additionally, pdfFiller equips users with a library of customizable templates tailored specifically for various notice of intent forms, ensuring a straightforward approach to filling out important documents without risking compliance.

FAQs about the notice of intent to form

Common questions surround the purpose of the notice, such as why filing it is necessary and what can happen if it's omitted. It primarily serves as a formal declaration of intent and protects you legally by keeping the appropriate authorities informed. Additionally, potential pitfalls, such as incorrect filing or misunderstanding requirements, can lead to complications and unnecessary delays. It's wise to proactively address these issues by consulting available resources or legal experts.

Clarity on legal obligations is also essential. Not filing the notice or submitting incorrect information could result in penalties or denial of your entity formation. Therefore, understanding your obligations can significantly impact your business's overall compliance and success.

Special circumstances and considerations

Sometimes, modification of your notice may be necessary due to changing laws. Staying informed about recent legislative updates can save you from non-compliance, which could jeopardize your business establishment efforts. Frequent review of the legal landscape should become part of your routine, particularly around the time of filing.

Handling disputes arising from the notice is another critical aspect. If disputes do occur, having proper documentation and a proactive approach to responsible communication can aid in resolving issues quickly. Alternatives, such as seeking advice from legal professionals, may also help navigate complex situations that might arise in the filing process.

Exploring related topics

The notice of intent to form is just one step in a larger series of actions required to officially establish a business. Understanding the subsequent steps, such as filing Articles of Incorporation or other formal notices, will clarify the entire process for you. Additionally, recognizing other forms and notices pertinent to business setup, such as the Notice of Intent to Lien, will further streamline the communication with regulatory bodies.

Utilizing focused resources can enhance your understanding and effectiveness, ensuring that every step is executed flawlessly. The interconnected nature of these documentation processes underlines the importance of thorough preparation and continuous learning about business formation.

Insights from experts

Gathering insights from attorneys or business formation specialists can provide valuable context and guidance during your formation process. Real-world examples illustrate how proper filing has successfully led to business opportunities and compliance. User testimonials affirm the efficiency and ease provided by document management tools like pdfFiller in their experiences navigating the complexities of business formation.

The wisdom gleaned from these experts reinforces the need for diligence in documenting your intent while ensuring clarity and legal adherence. Engaging with community or professional networks can expose you to a wealth of knowledge that can streamline your own processes.

Next steps after filing your notice

Once the notice of intent to form is filed, understanding your obligations is paramount. Legal responsibilities extend beyond simply filing to include maintaining compliance with state regulations, paying taxes promptly, and addressing any ongoing operational requirements dictated by your business's nature and structure. Regular reviews of these obligations can prevent issues down the line.

Continuing to utilize tools like pdfFiller can facilitate ongoing document management, ensuring your filings and agreements remain organized. Staying proactive about maintaining compliance not only protects your business but also fosters trust with stakeholders and customers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notice of intent to online?

Can I edit notice of intent to on an iOS device?

How do I complete notice of intent to on an Android device?

What is notice of intent to?

Who is required to file notice of intent to?

How to fill out notice of intent to?

What is the purpose of notice of intent to?

What information must be reported on notice of intent to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.