Get the free Maryland Franchise Tax Return for Telephone Companies

Get, Create, Make and Sign maryland franchise tax return

Editing maryland franchise tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland franchise tax return

How to fill out maryland franchise tax return

Who needs maryland franchise tax return?

A comprehensive guide to the Maryland Franchise Tax Return Form

Overview of the Maryland Franchise Tax

Maryland Franchise Tax is a tax imposed on entities organized under Maryland law, such as corporations and limited liability companies (LLCs). It is a fee that allows these businesses to operate within the state, with the income derived from business activities contributing to the state's revenue.

The purpose of the tax is to ensure that all businesses benefit from the state's infrastructure and services. It applies primarily to corporations and LLCs that are registered or conducting business in Maryland, making it crucial for these entities to understand their obligations.

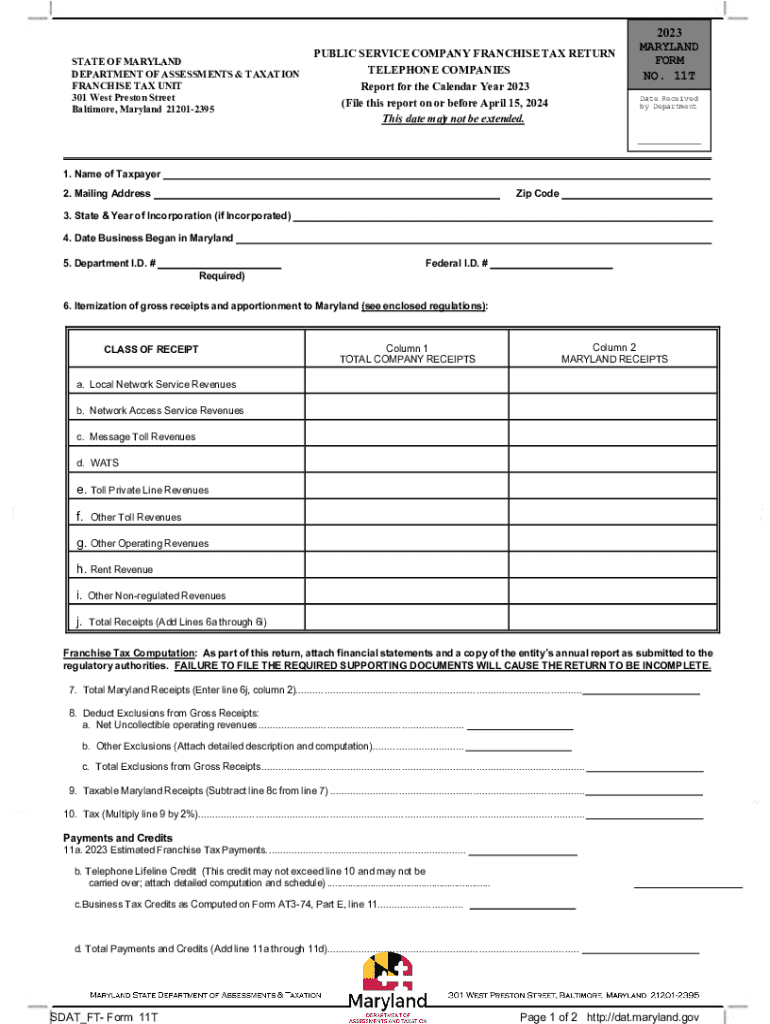

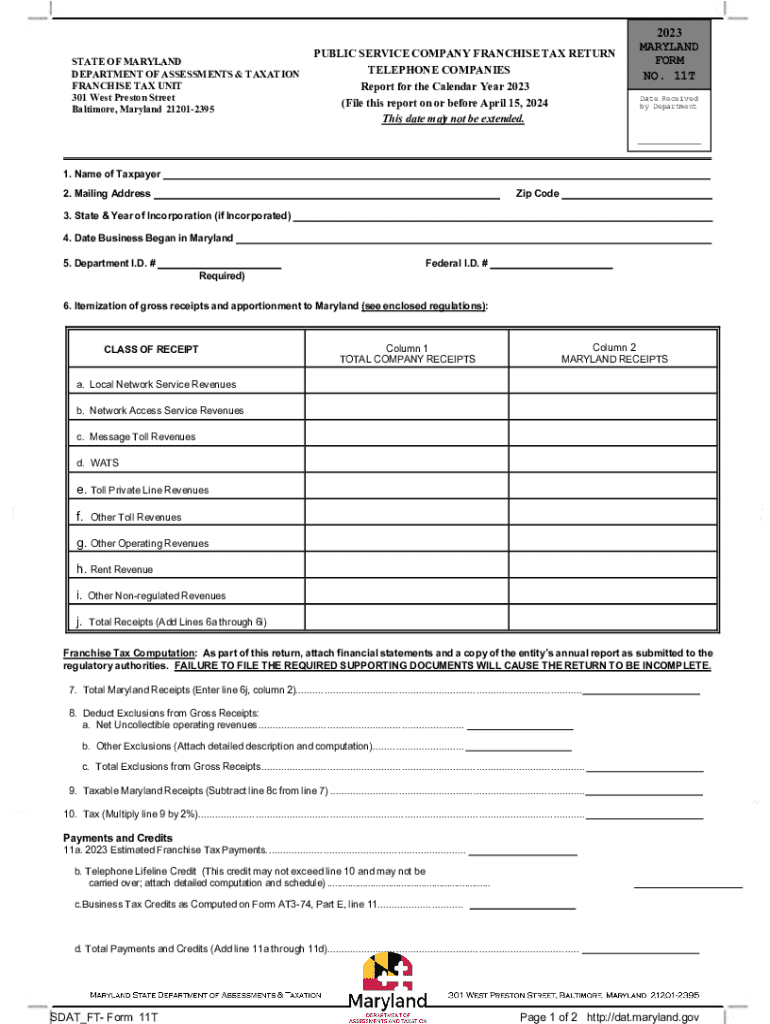

Understanding the Franchise Tax Return Form

The Maryland Franchise Tax Return Form is integral to reporting the necessary financial information about a business. Key components of the form include the name and address of the business, the type of organization, and the financial year’s revenue figures. Collecting this information correctly is paramount for accurate reporting.

Notably, there are different forms tailored for various types of entities; for example, corporations generally utilize Form 1, while LLCs may need to fill out Form 510. Understanding which form to use based on your business entity type helps ensure compliance and avoids potential penalties.

Eligibility criteria

Most businesses organized in Maryland, including both domestic and foreign corporations, are required to file a Franchise Tax Return. However, there are exemptions available; for instance, non-profits may qualify to be exempt from this obligation. It’s important to verify if your business falls under any exemption categories to avoid unnecessary filings.

Missing the filing deadline can lead to substantial penalties, including late fees and interest on any unpaid taxes. Therefore, understanding your business's filing requirements is critical to maintain good standing and compliance.

Steps to prepare your Franchise Tax Return

Preparation of the Maryland Franchise Tax Return requires several methodical steps. The first is to gather all essential information, like your business identification details, financial statements, and specific revenue sources that will be necessary to complete the form accurately.

Once you have the needed information, choose the correct form for your business type. This could be Form 510 for LLCs or Form 1 for corporations. After selecting the appropriate form, fill it out carefully, paying attention to detail. Each section of the form will require specific information, so read the instructions thoroughly. Common mistakes, such as mathematical errors or providing incomplete information, can lead to additional scrutiny or fines.

Filing options

When it comes to filing your Maryland Franchise Tax Return, businesses have two main options: electronic filing or paper filing. Electronic filing is generally more efficient and reduces processing time significantly. There are several platforms available; pdfFiller is an efficient tool that streamlines this process.

To file electronically using pdfFiller, users can easily fill, edit, and submit their forms directly online. For those who prefer paper filing, you must send the completed form to the appropriate state office. Ensuring you send it to the correct address is vital to avoid delays or misfiling.

Payment methods for the Franchise Tax

When filing your Franchise Tax Return, you must also be aware of payment methods for the tax owed. Maryland accepts various forms of payment, including electronic bank transfers, credit cards, and checks. It’s essential to meet all payment deadlines to avoid penalties, which can accumulate quickly.

Understanding the due dates is vital; failing to pay by the deadline results in additional fees and interests. Keep track of important dates to ensure compliance and avoid late payments.

Special considerations for businesses

Businesses operating in multiple states face unique challenges regarding franchise tax. It’s important to understand how Maryland's regulations interact with those of other states where your business might also be liable for franchise taxes. An additional complexity for certain business structures, like S-corporations and LLCs, is understanding specific filing requirements for those entities.

Furthermore, staying updated with changes in state tax law can significantly impact your business. Regularly consult legal counsel or tax professionals to navigate these complexities, ensuring compliance with both state and federal tax laws.

Utilizing pdfFiller for Franchise Tax Returns

pdfFiller enhances the process of completing your Maryland Franchise Tax Return. The platform's editing options allow users to customize PDF forms easily and quickly. It also provides eSigning capabilities, ensuring that all signatures required are completed efficiently.

In addition to editing, pdfFiller offers document storage and management features. This is particularly useful for businesses that need to keep track of multiple filings and forms. A step-by-step guide to using pdfFiller can help users effectively complete their forms, with interactive tools available for easier navigation and collaboration features allowing teams to work on documents together in real-time.

Frequently asked questions

Many individuals have common inquiries about the Maryland Franchise Tax Return. Questions regarding eligibility, how to file, and deadlines often arise. Clarifying these points can significantly ease the concerns many have when dealing with tax obligations.

For those needing further assistance, the Maryland Comptroller's Office can offer the help necessary for understanding filings and compliance. Familiarizing yourself with key contacts will facilitate resolution when questions or issues arise.

Tips for managing your business taxes

Effective record-keeping is vital for managing your business taxes. Maintain organized records of income, expenses, and all documents related to your franchise tax return. This practice not only simplifies filing but helps in case of any audits or inquiries from state officials.

Additionally, resourceful tools are invaluable for ongoing tax compliance. Stay updated about tax law changes in Maryland by subscribing to newsletters from the Maryland Comptroller's Office and utilizing online tax platforms for insights and updates. This proactive approach will help ensure your business maintains great standing with tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my maryland franchise tax return directly from Gmail?

Can I sign the maryland franchise tax return electronically in Chrome?

How do I fill out maryland franchise tax return using my mobile device?

What is maryland franchise tax return?

Who is required to file maryland franchise tax return?

How to fill out maryland franchise tax return?

What is the purpose of maryland franchise tax return?

What information must be reported on maryland franchise tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.