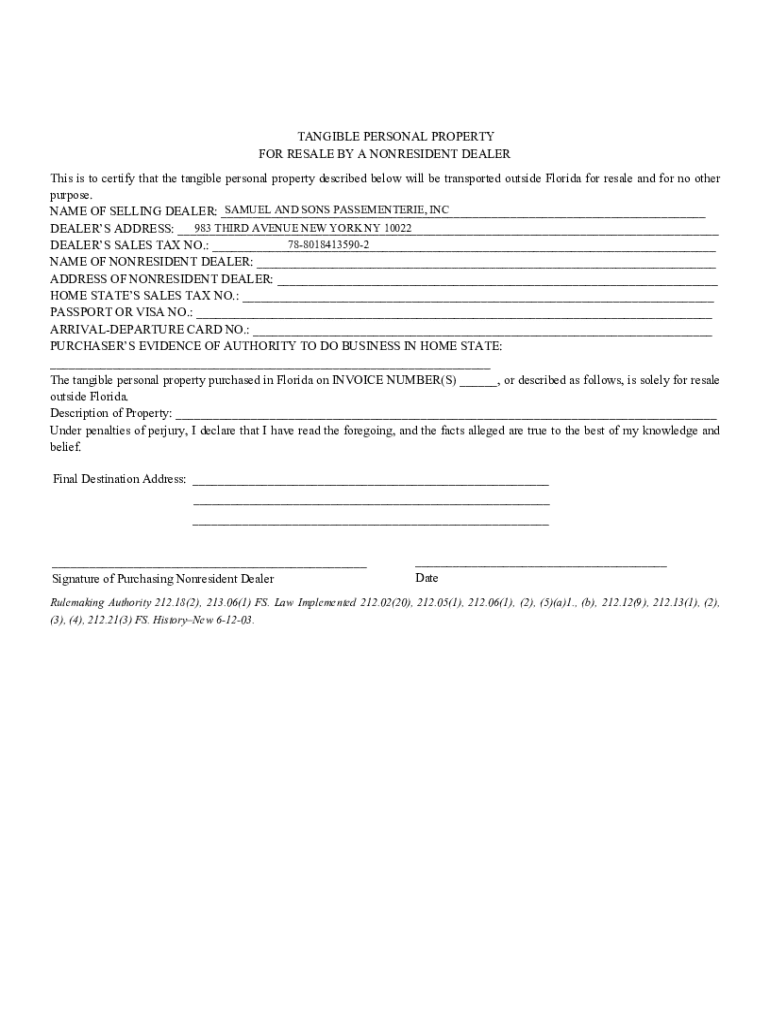

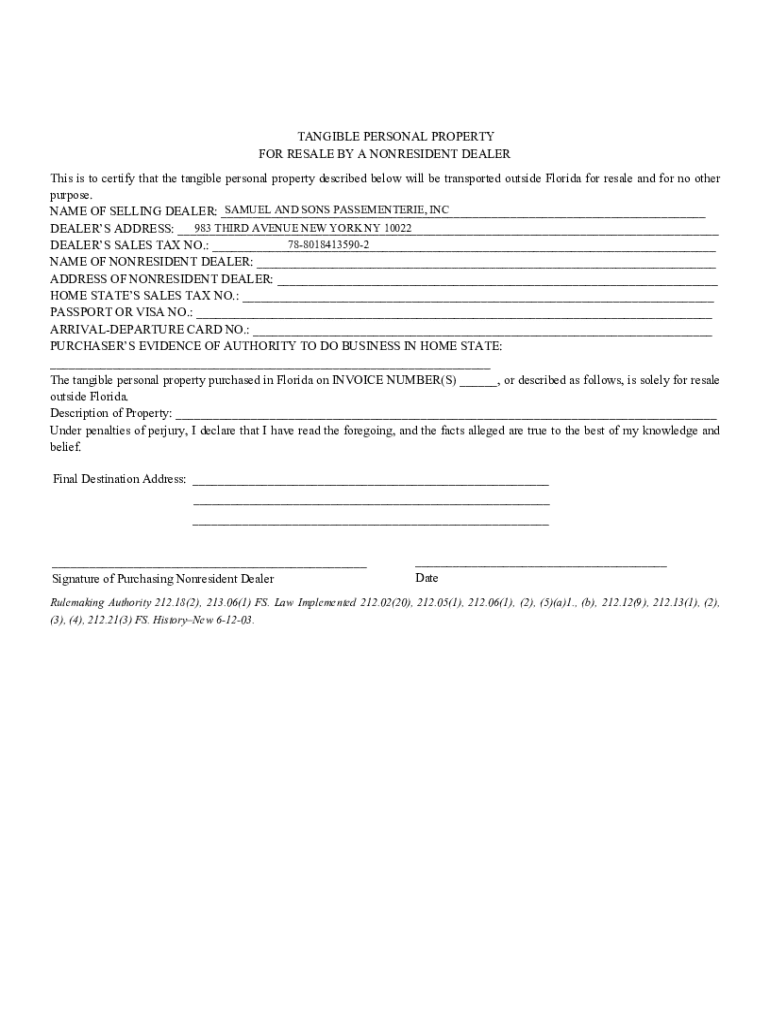

Get the free Tangible Personal Property for Resale by a Nonresident Dealer

Get, Create, Make and Sign tangible personal property for

Editing tangible personal property for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tangible personal property for

How to fill out tangible personal property for

Who needs tangible personal property for?

Tangible personal property for form: A comprehensive guide

Overview of tangible personal property (TPP)

Tangible personal property (TPP) refers to physical items that are movable and not fixed to any one location. Examples include furniture, machinery, vehicles, equipment, and inventory. Understanding TPP is essential for businesses and individuals alike as it plays a significant role in business operations and financial reporting. These assets contribute to a company's balance sheet and can impact tax liabilities. In legal terms, the classification of TPP can affect ownership rights, transferability, and taxation obligations.

The importance of TPP extends beyond its physical presence. Businesses need to accurately report TPP to comply with tax requirements and to present an accurate financial picture to investors and stakeholders. Failing to do so can lead to penalties or misrepresentations in financial statements, which could undermine trust in the business.

Application of TPP taxation

TPP taxation is the responsibility of various stakeholders depending on their ownership and operational status. Generally, anyone who owns tangible personal property utilized in a business context is required to pay TPP taxes. This requirement can extend to property owners with TPP spread across multiple locations or to new business owners establishing their operations.

Specific cases can complicate TPP obligations. For instance, new business owners often need to familiarize themselves with local regulations for TPP taxation, while those who cease operations must ensure that their tax responsibilities are finalized. Additionally, businesses operating in multiple jurisdictions may face differing regulations and tax implications depending on where the TPP is located.

Understanding the TPP return process

Filing a TPP return may seem daunting, but it can be managed with a clear step-by-step approach. First, you must gather necessary information such as property type, purchase date, current value, and location. It's important to keep documentation like receipts and previous filings for reference.

Once you have collected the necessary information, familiarize yourself with the TPP return form specific to your jurisdiction. Key dates and deadlines for filing vary, so mark your calendar to ensure timely submissions. For those filing for the first time, obtaining a TPP account number will be essential for tracking and managing your TPP assessments.

Special cases and considerations with TPP

In managing TPP, certain special cases warrant highlighting. Non-usable or depreciated TPP must be reported accurately to reflect its status on your financial statements. Depending on your jurisdiction, regulations can change on how to handle these assets, highlighting the importance of keeping updated with local laws.

Additionally, if you rent TPP to third parties, there are unique reporting obligations to consider. These may require different tax assessments altogether based on the nature of the rental. Exemptions can also apply, often depending on the type of TPP or its usage. Understanding what constitutes a business site can further complicate TPP reporting, necessitating careful examination of your situation.

Addressing common concerns and questions

As you navigate TPP filing, you may have several concerns. One common question is whether you need to file every year. Generally, TPP returns are annual filings; however, certain jurisdictions may have different files depending on the local laws. Missing a deadline can lead to penalties or fines, so it’s critical to be punctual.

Non-compliance with TPP regulations can yield severe consequences, such as audits or excessive penalties. Understanding exemptions becomes equally essential, as some jurisdictions may offer benefits for specific types of TPP. Compliance becomes not just about meeting obligations but also understanding the potential advantages available under state laws.

Valuation of tangible personal property

Valuing TPP accurately is crucial for reporting and tax purposes. Various methods and resources are available to assist in determining the worth of your assets. Common valuation methods include the cost approach, market approach, and income approach, along with specific valuation tables that may be provided by your local tax authority.

Utilizing reliable online tools can streamline the valuation process, helping you avoid common pitfalls and ensuring accuracy. Comparable sales analysis can also serve as a beneficial method, leveraging recent sales data of similar assets to assert a fair value.

Tools and resources for TPP management

Managing TPP effectively often involves using specialized tools to aid in filing and documentation. Interactive tools for creating and managing TPP returns can streamline the process and minimize errors. pdfFiller offers a suite of cloud-based services tailored for TPP documentation, allowing users to create, edit, sign, and share TPP forms seamlessly.

With pdfFiller’s user-friendly interface, individuals and teams can easily collaborate on documents and track any changes in real-time. Furthermore, accessing public records related to TPP becomes straightforward, ensuring that all relevant information is at your fingertips.

Specialized assistance and professional support

In certain circumstances, seeking assistance from property appraisers can be invaluable, particularly when dealing with complex TPP assessments. These professionals can help clarify the valuation process and provide insight on potential adjustments to reported values based on local regulations.

There are also specialized services related to TPP assessments that can provide critical support. When working with these professionals, be sure to prepare relevant documentation and articulate your needs clearly to maximize the benefits of their expertise.

Important dates and compliance calendars

Staying organized with compliance calendars can greatly assist in managing TPP responsibilities effectively. An annual filing calendar designated specifically for TPP can help track deadlines for both tax reporting and any exemption applications required. It's vital to stay updated on these dates to avoid unnecessary penalties.

Implementing strategies for timely compliance, such as reminders or dedicated software, can contribute to smoother management of TPP obligations. Regularly reviewing upcoming deadlines should become a routine to avoid last-minute rushes or oversights.

Conclusion: Mastering your TPP responsibilities

Managing tangible personal property effectively is crucial for businesses and individuals alike. By understanding your obligations and utilizing the right tools, such as those offered by pdfFiller, you can simplify your TPP reporting and maximize compliance. Staying informed and proactive in TPP matters ultimately leads to better asset management and smoother operations.

Engaging with cloud-based tools not only makes document management easier but enhances overall productivity. Utilize pdfFiller’s capabilities to ensure ease in editing, signing, and collaborating on your TPP forms and related documentation. With proper guidance, resource management, and compliance awareness, you can master your TPP responsibilities successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tangible personal property for online?

How do I fill out the tangible personal property for form on my smartphone?

Can I edit tangible personal property for on an Android device?

What is tangible personal property for?

Who is required to file tangible personal property for?

How to fill out tangible personal property for?

What is the purpose of tangible personal property for?

What information must be reported on tangible personal property for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.